Breathtaking Tips About Accounting Treatment For Prepaid Expenses Trial Balance Prepared

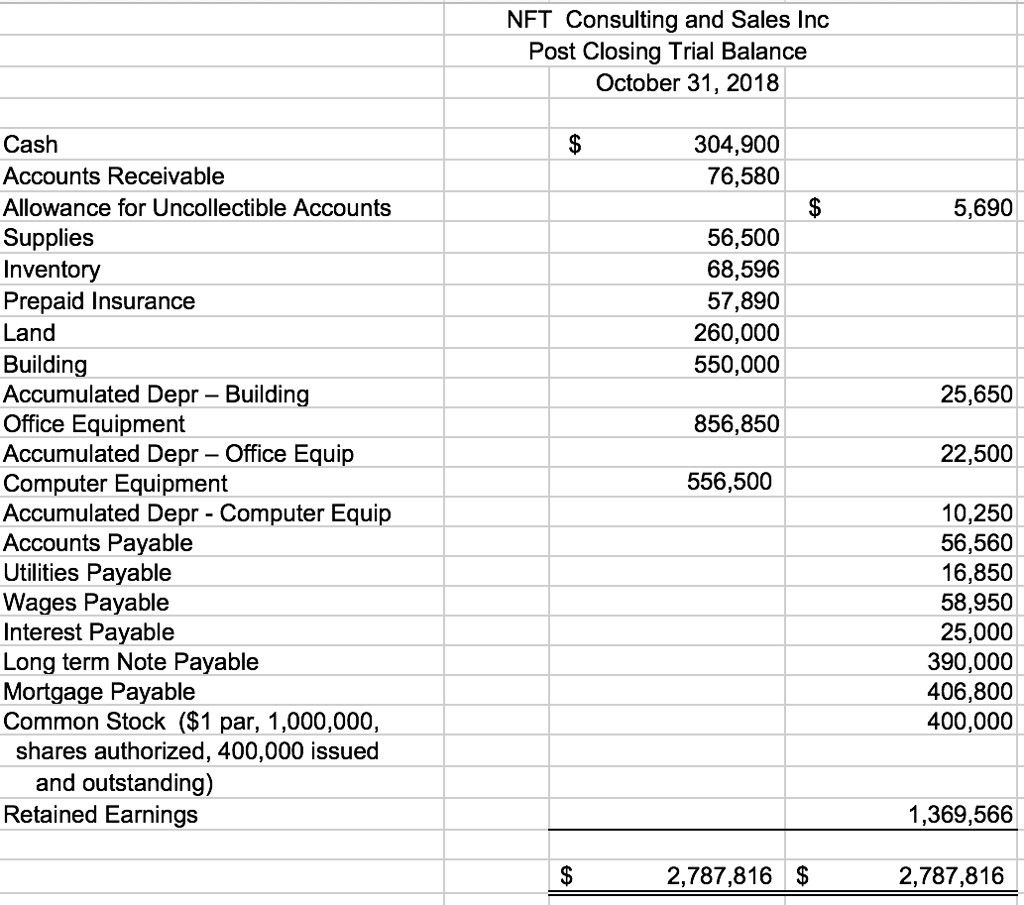

Accurate financial statements correctly accounting for prepaid expenses ensures that financial statements reflect the company’s actual financial.

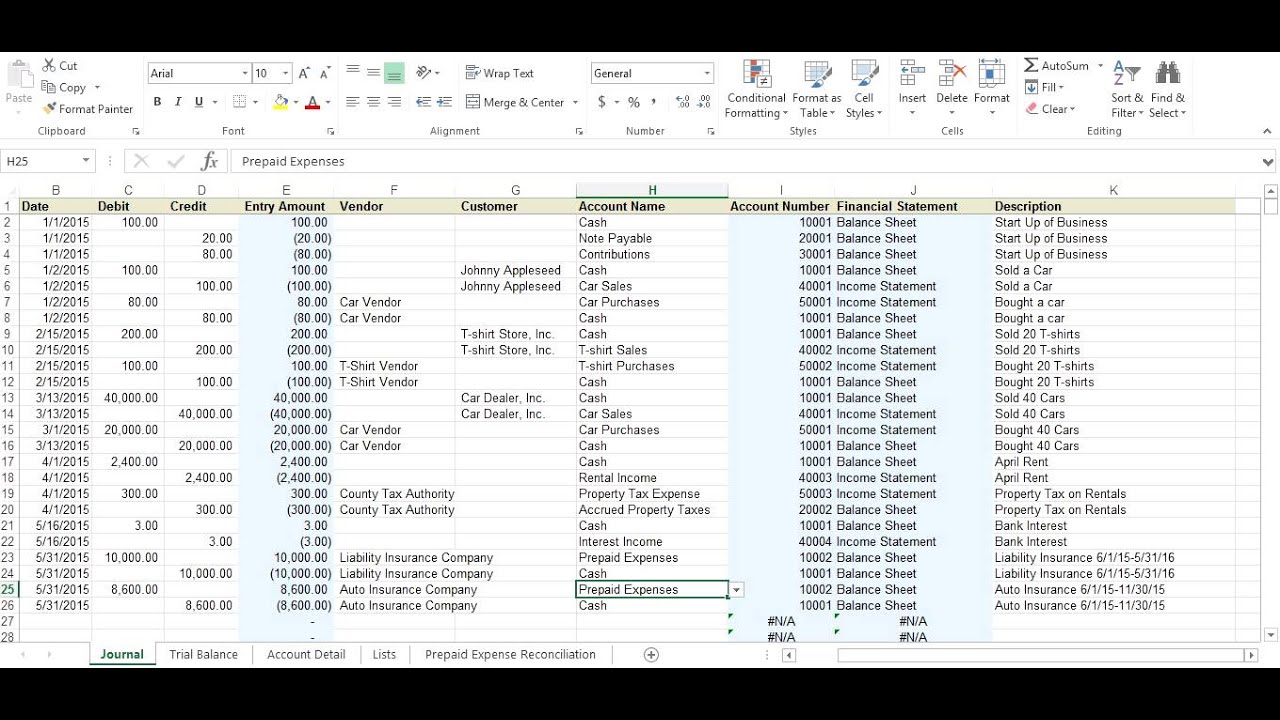

Accounting treatment for prepaid expenses. The guidelines by gaap (generally accepted accounting principles). While often straightforward, their complexity and how they fit into your. The initial journal entry for a prepaid expense does not affect a company’s financial statements.

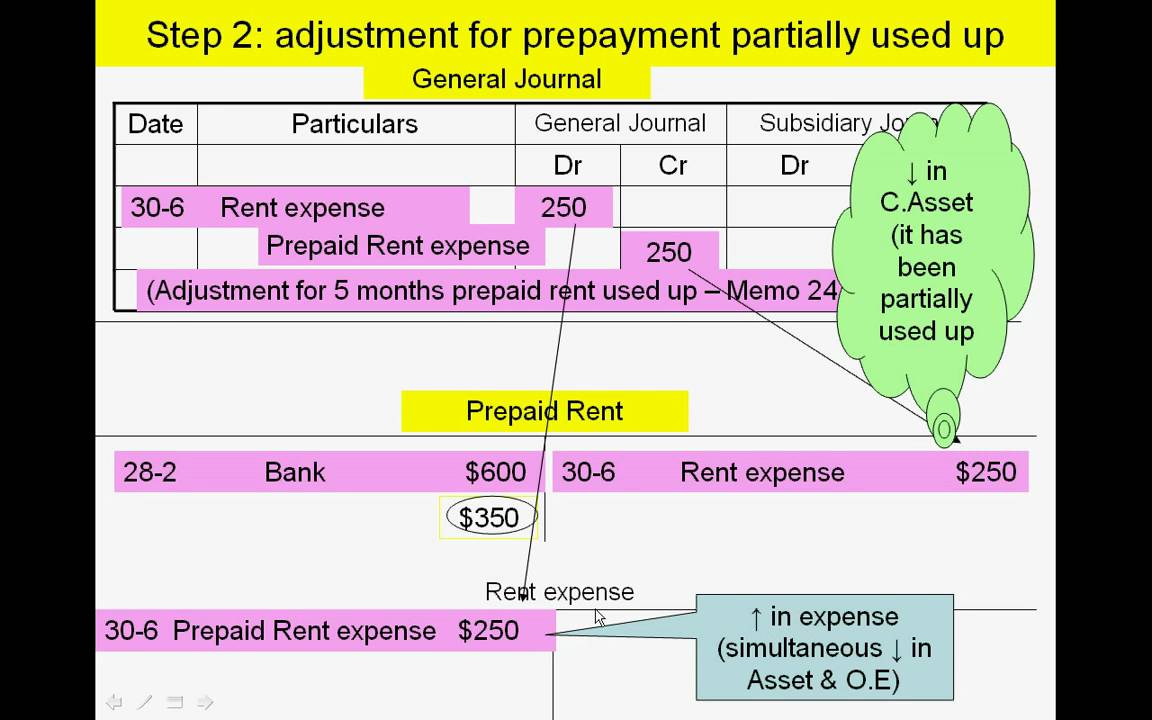

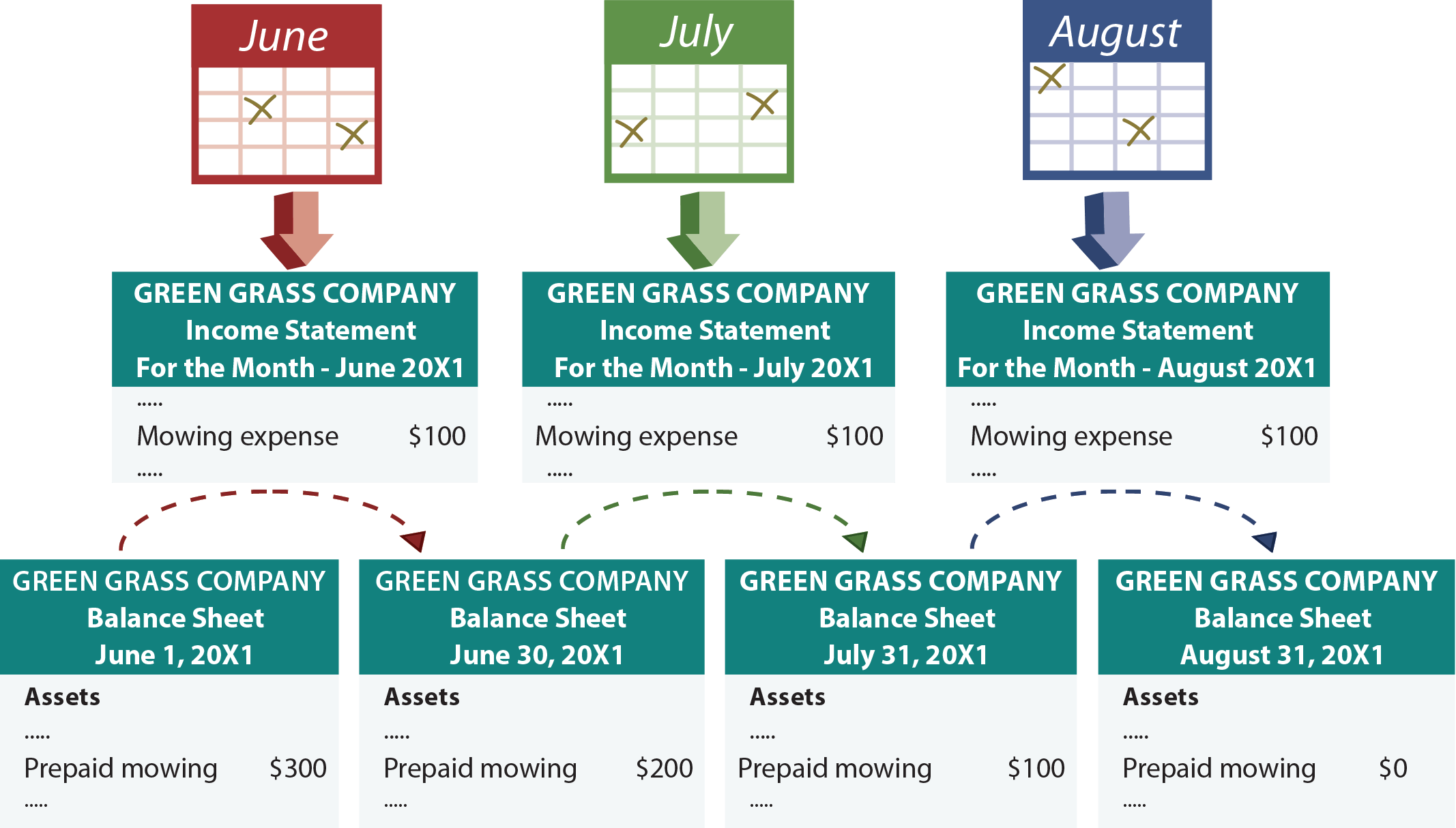

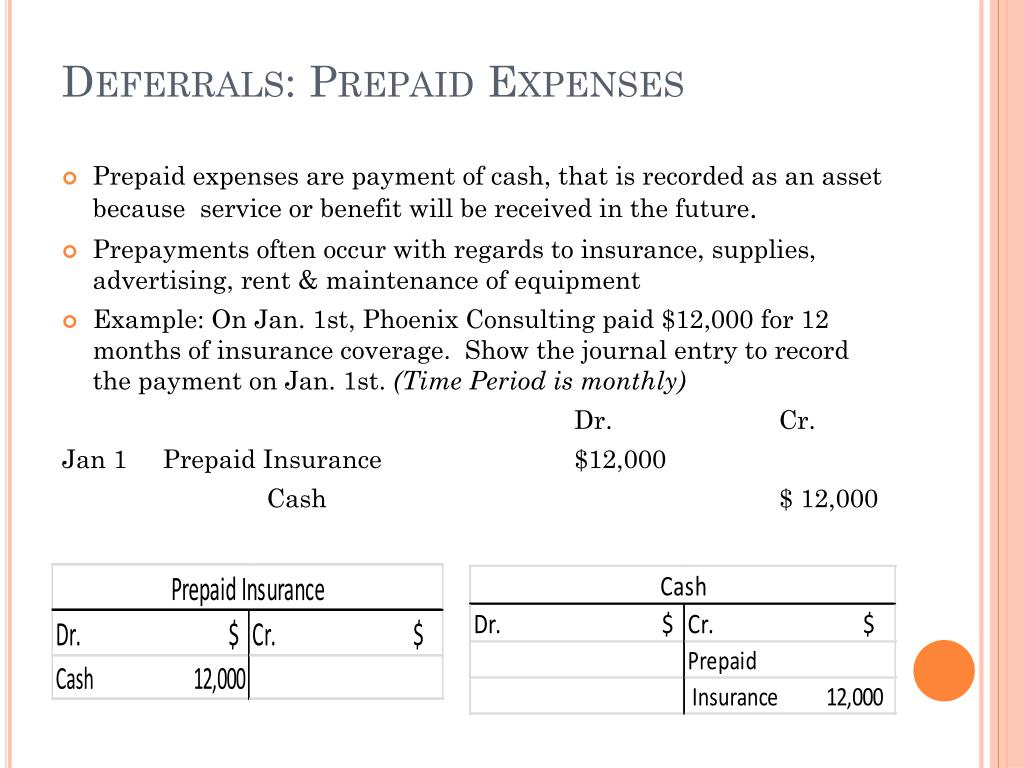

As you use the prepaid item, decrease your prepaid expense. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. When a company pays for an expense in advance, it doesn’t immediately record it as an expense.

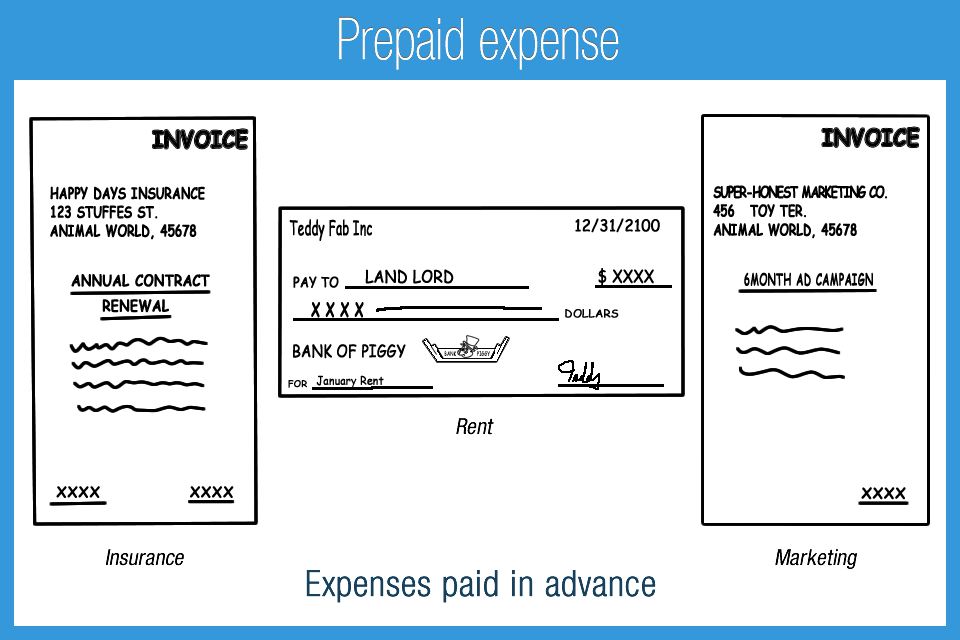

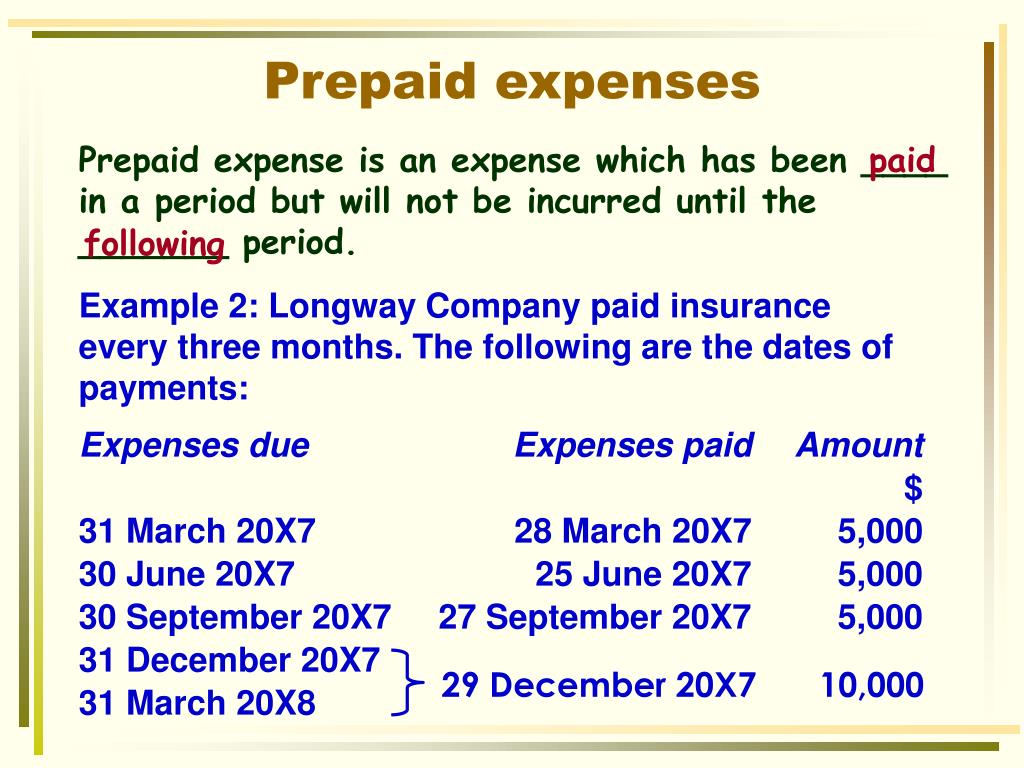

Prepaid expenses refer to payments made in advance for products or services expected to be. Prepaid expenses are a fundamental accounting treatment that every accounting team must manage. Prepaid expenses may need to be adjusted at the end of the accounting period.

Accounting for prepaid expenses accrual basis vs. Key takeaways prepaid expenses are incurred for assets that will be received at a later time. Expense must be recorded in the accounting period in which it is incurred.

Prepaid expenses are only recorded on the accrual basis of accounting because this method uses the matching principle, which indicates that revenues and expenses get. Last updated december 6, 2023 learn online now what are prepaid expenses? Prepaid expenses are those expenses which are paid in advance for a benefit yet to be received.

Journal entry for prepaid expenses. Cash basis it is important to consider what basis of accounting an organization is operating under when. To recognize prepaid expenses that become actual expenses, use adjusting entries.

Prepaid expenses are a fundamental concept in accounting that involves the payment of costs in advance for goods or services that will be consumed or utilized. They also impact the accuracy of. Prepaid expense is expense paid in advance but which has not yet been incurred.

Their primary purpose is to allocate. These are both asset accounts and do not increase or decrease a company’s. The accounting treatment of prepaid expense entries involves recognising them as assets initially, with subsequent recognition as expenses over time.

A prepaid expense incurred is represented on the balance sheet and the income statement. Instead, it’s recorded as an asset on the. The adjusting entry for prepaid expense depends upon the journal entry made when it was.

Prepaid expenses refer to payments made in advance for goods or services that a company will receive or use in the future.