Have A Tips About Non Current Liabilities Examples Balance Sheet Distinguish Between Cash Flow And Fund Statement

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

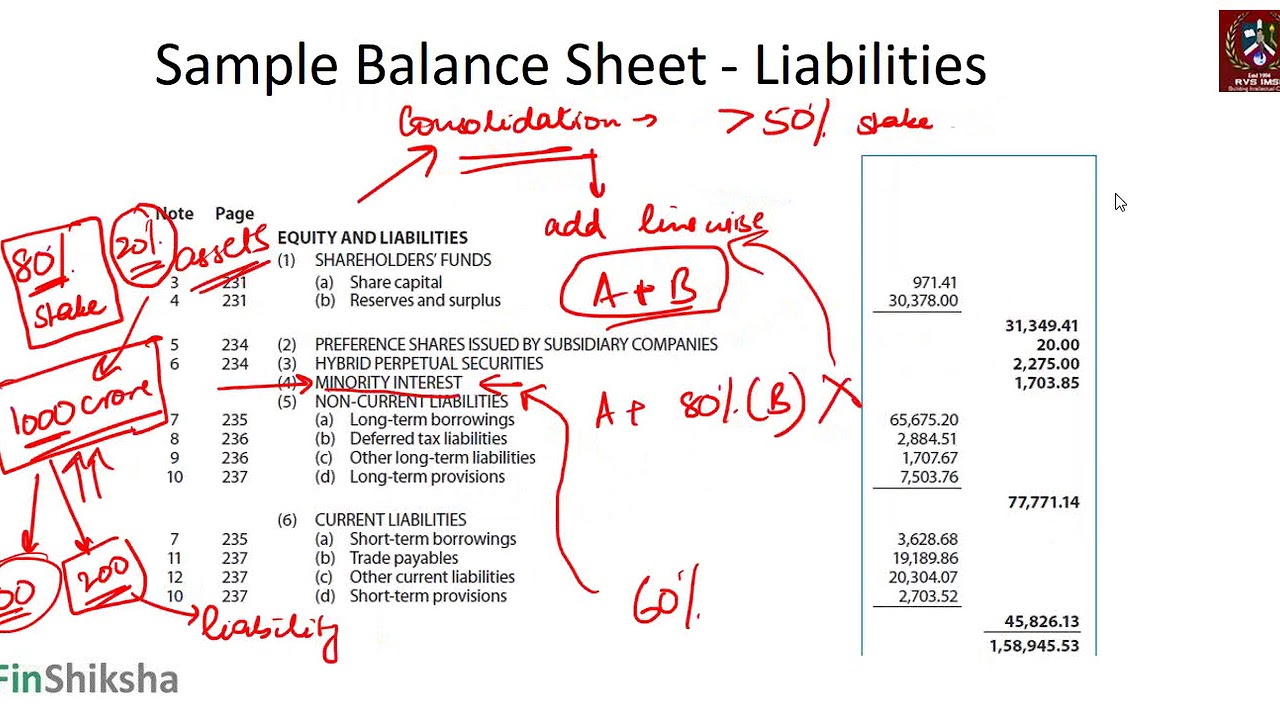

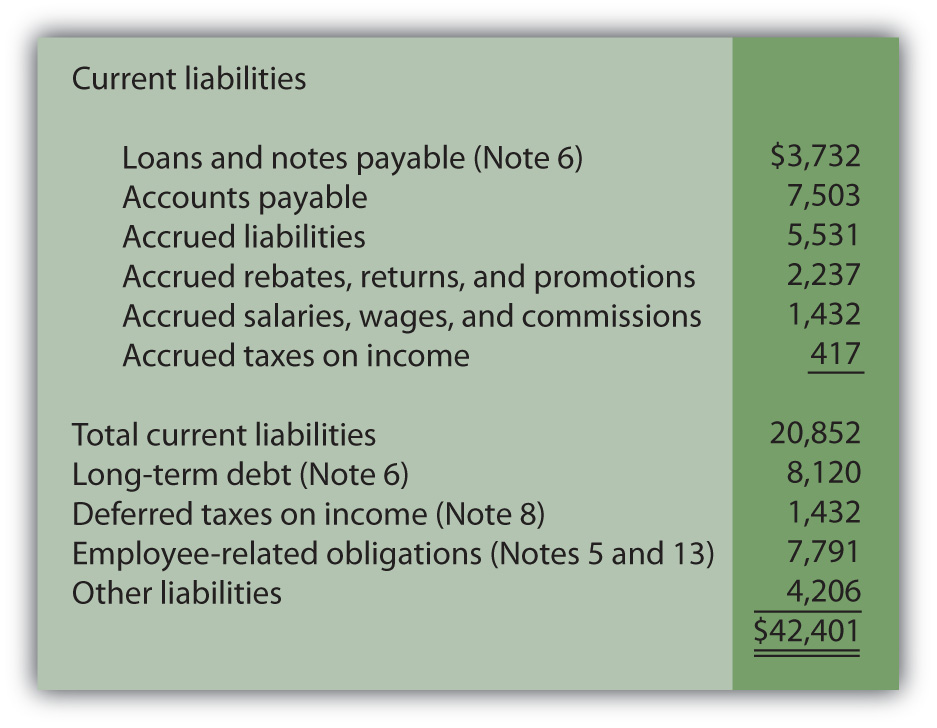

On the balance sheet, the liabilities section can be split into two components:

Non current liabilities examples balance sheet. These include lines of credit with repayment periods lasting for longer than one year. Mentioned below are few non current liabilities examples : That's because a company has to pay for all the things.

A few examples of these assets include unutilized cash and assets, marketable instruments like stocks, bonds, spare parts, vacant land, excess cash, loan receivables, and others. Here are some examples. The examples assist analysts in understanding the liquidity of a company and its future cash requirements.

Company xyz expanded its business last year. Current liabilities — coming due within one year (e.g. Capital the capital of a business is the amount which the owner or owners of the business contribute.

One way to own a more expensive asset is by taking out a loan to pay for it, which would increase a firm’s liabilities. Thus, owners can contribute capital at the time of starting the business or even later as per the requirements of funds. \text {assets} = \text {liabilities} + \text {shareholders' equity} assets = liabilities +shareholders’ equity this formula is intuitive.

These liabilities are a key component of a balance sheet, representing the debts and obligations that extend beyond the current financial year. Current liabilities are owed within a year and might include: For example, a business with $500 in assets and $800 in liabilities has net assets of ($300).

Because the timing of receiving cash and paying cash is critical for businesses, a balance sheet that shows both current assets and current liabilities is useful. Michael schmidt updated december 20, 2023 reviewed by david kindness of all the financial statements issued by companies, the balance sheet is one of the most effective tools in evaluating. Such assets can not be sold/bought easily at a reasonable price.

If this is the case, net assets can and should be reported as a negative number on the balance sheet. Cash and equivalents, including your business checking account balance. Liabilities are amounts a company owes to someone else, either immediately or over a long period.

The payment terms of these liabilities exceed 12 months. They appear on multiple balance sheets as they are obligations that are paid over multiple years. Net assets, or equity, represents the value of business assets.

Inventory including goods for sale, raw materials and items being made. If total assets are less than total liabilities, the business has negative net assets.

/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

:max_bytes(150000):strip_icc()/Exxon-265fb0cef5f04c359ca78ad24048d312.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)