Beautiful Info About Included In The Retained Earnings Statement Are Retail Store Financial Statements

Why is profit and retained earnings not included in the direct method of the cash flow statement?

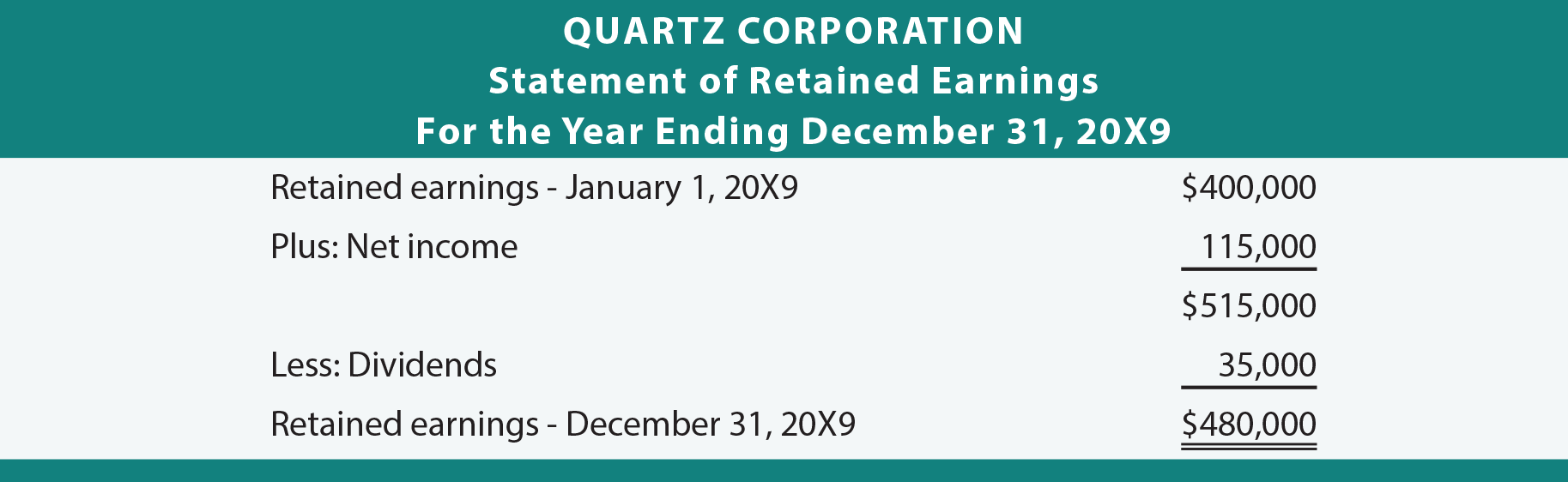

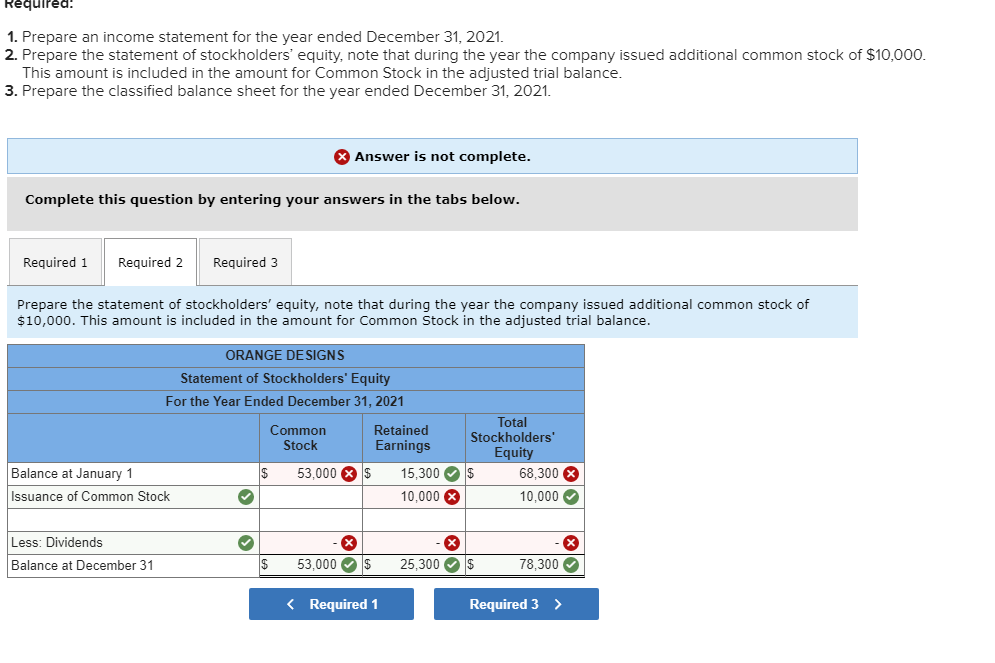

Included in the retained earnings statement are. This amount will be carried over to the new. A statement of retained earnings shows changes in retained earnings over time, typically one year. Movements in a company's equity balances are shown in a company's.

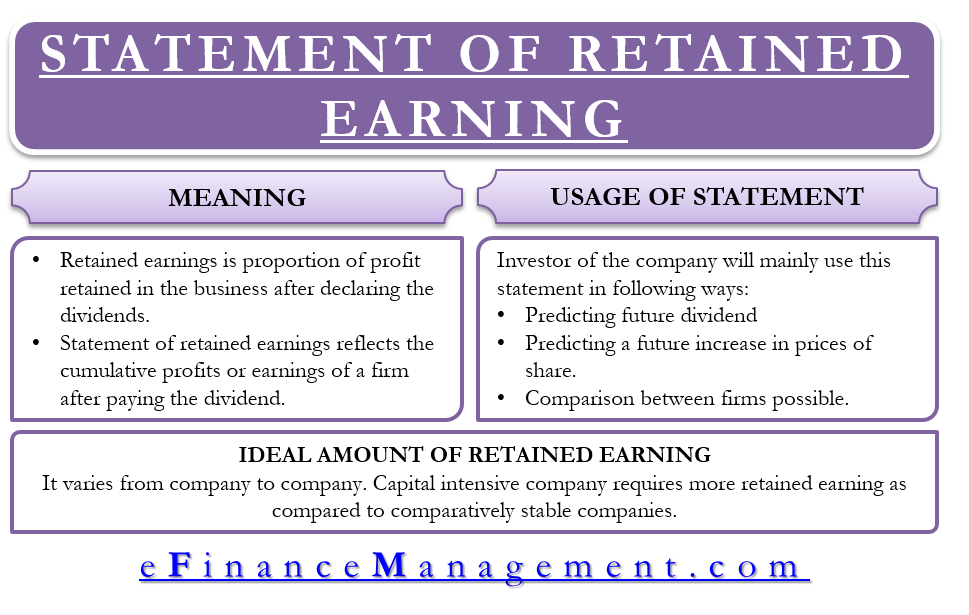

What is a statement of retained earnings? The decision to retain the earnings or distribute them. The purpose of retaining these earnings can be varied and includes buying new equipment and machines, spending on research and development, or other activities that.

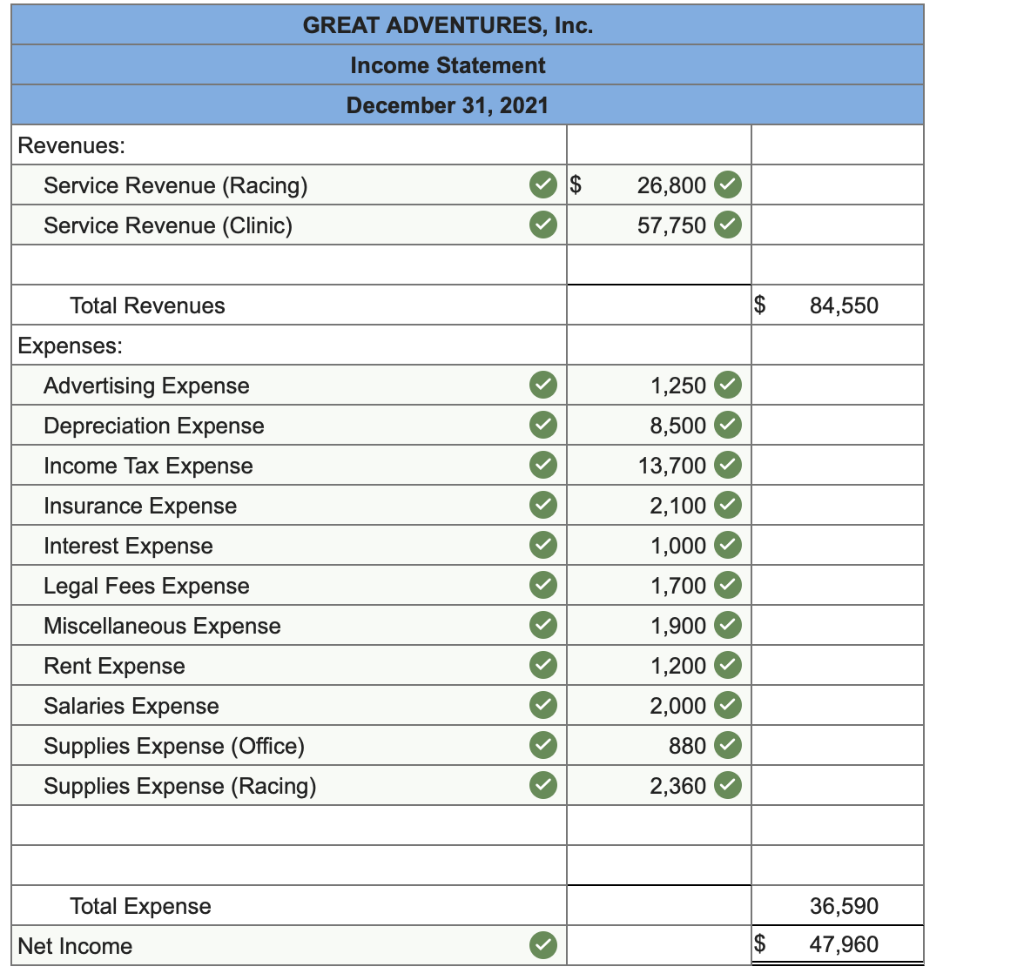

The statement is a financial document that includes information regarding a firm’s retained earnings, along with the net income and amounts distributed to stockholders in the form of dividends. Learn the components and complexities of the statement of retained earnings in this post, optimized for google and statement retained earnings. The retained earnings portion of stockholders’ equity typically results from accumulated earnings, reduced by net losses and dividends.

The statement of retained earnings reconciles changes in the retained earnings account during a reporting period. Investors as shareholders of the company, investors are looking to benefit from increased dividends or a rising share. A statement of retained earnings shows the changes in a company's retained earnings over a set period.

The statement of retained earnings provide details of the starting balance, adds profits and subtracts losses, account for dividends paid to shareholders, and amount of profit that is reinvested in the company. Retained earnings is the investment by the stockholders. Broadly, a company’s retained earnings are the profits left over after paying out dividends to shareholders.

A statement of retained earnings may appear as a separate document, or it can be included on a company’s balance sheet or income statement. 5.0 annual fee $0 read review learn more what is a statement of retained earnings? Retained earnings are calculated by adding the current year’s net profit (if it’s a net loss, then subtracting the current period net loss) to (or from) the previous year’s retained earnings (which is the current year’s retained earnings at the beginning) and then subtracting dividends paid in the current year from the same.

Remember that profit equals income minus expenses. This statement is primarily for the use of outside parties such as investors in the firm or the firm's creditors. Statement of retained earnings definition — accountingtools statement of retained earnings definition september 08, 2023 what is the statement of retained earnings?

Retained earnings are the profits or net income that a company chooses to keep rather than distribute it to the shareholders. Know your financials inside and out! The statement of retained earnings starts with the beginning balance in the retained earnings account, then:

Retained earnings statement provides details of the earnings, net income, dividend aid, and the ending balance of the it. The formula for the company's retained earnings at the end of the accounting period would be: These earnings can be retained and reinvested into the business.

What does the statement of retained earnings include? The following are the two main users of the statement of retained earnings: Ending retained earnings = $230,000.

:max_bytes(150000):strip_icc()/statement-of-retained-earnings-final-8500839aff40433dba054ce0af9f9f42.png)