One Of The Best Info About Financial Statements Of Small Companies Mcdonalds

Small businesses may also put out an annual report that includes financial statements and more detailed information about their year, including key business goals and achievements.

Financial statements of small companies. Presented in a structured format, these reports are usually prepared by your accountant or finance team. Example reflects full set of illustrative financial statements with the notes block as well as detail tagged. 16, 2024, against donald trump, imposing a $364 million penalty over what the judge ruled was a yearslong scheme to dupe banks and others with financial.

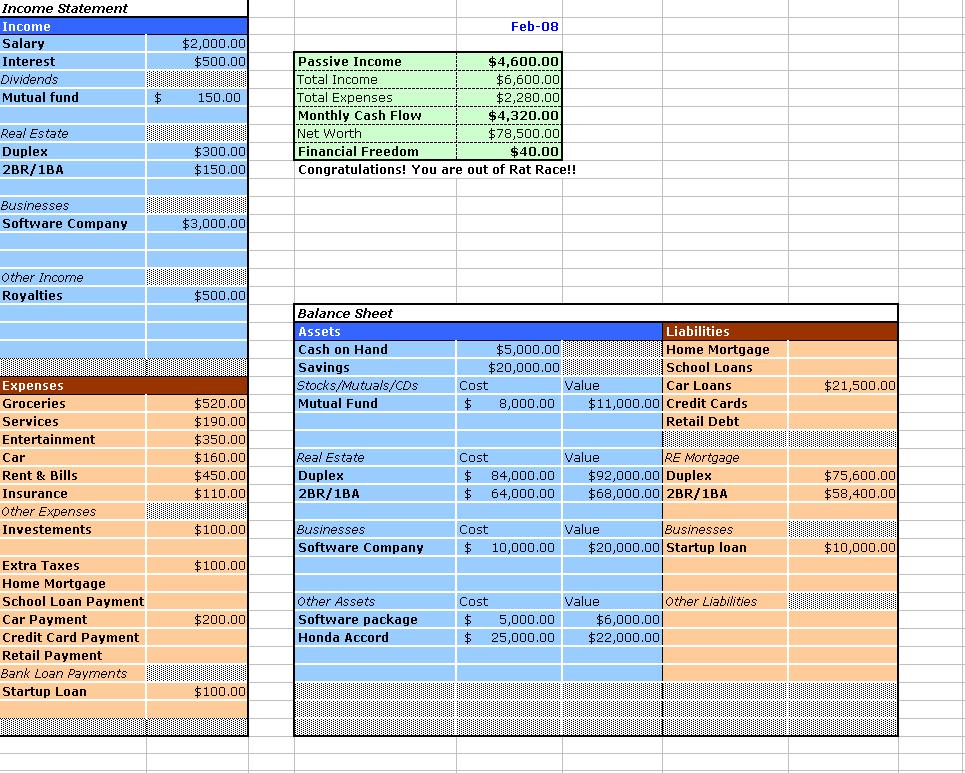

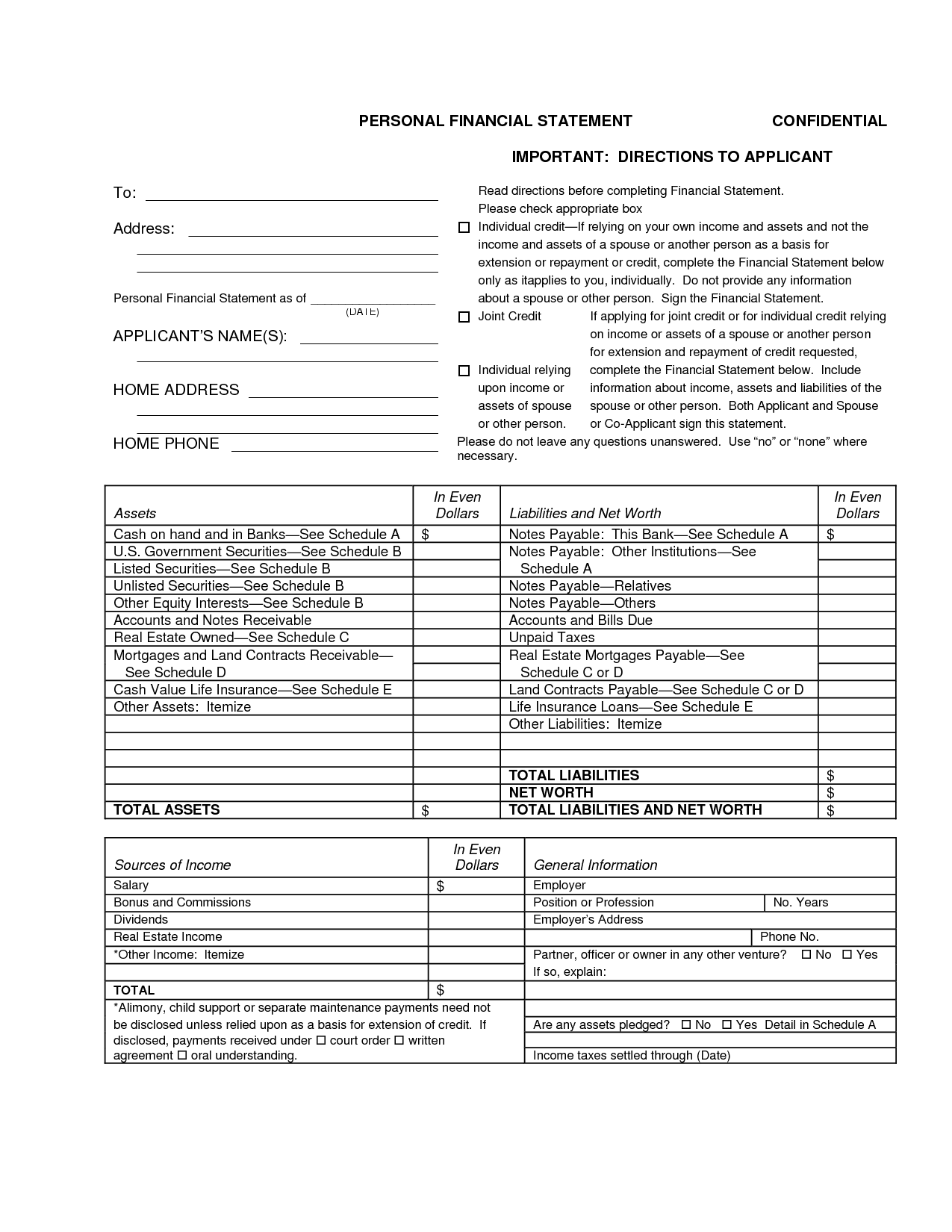

These topics will show you the connection between financial statements and offer a sample balance sheet and income statement for small businesses: 21 feb 2024, 5:30 am. The most critical financial statements include the income statement, balance sheet and cash flow statement , plus accounts receivable reports, accounts payable reports and inventory reports.

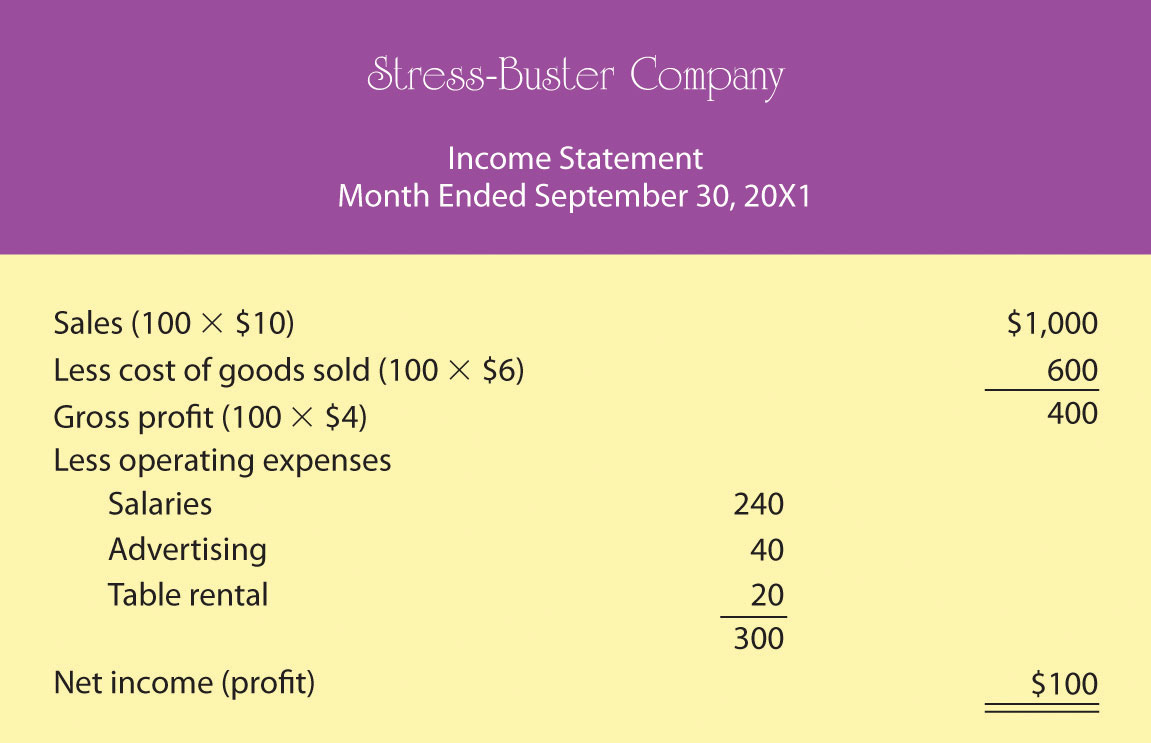

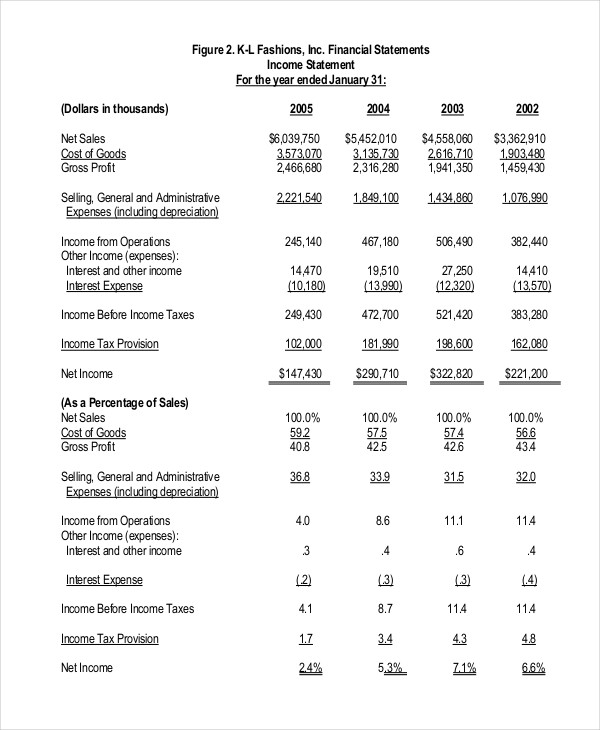

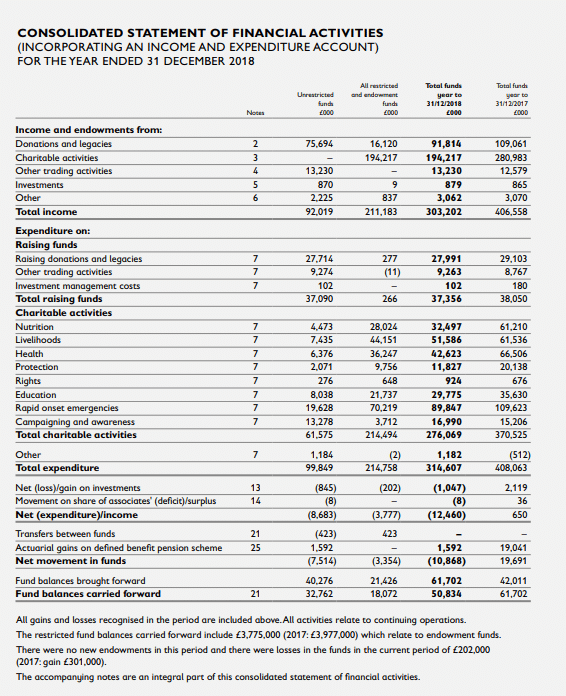

The following are the two types of financial statements: Income statement (profit and loss statement) Financial statements summarize a company's financial performance over a specific period, such as a quarter or a year.

The financial futures association of japan; Judge orders trump and his companies to pay over $350 million in fraud case. We have started adding the annual reports to this page.

Here’s a look at each and the purpose it serves: Small sized companies may be exempted from the full extent of the requirements relating to annual financial statements in respect of any financial year if in respect of that year and the financial year immediately preceding that year the company satisfies two of the three following conditions: These statements include three direct reports:

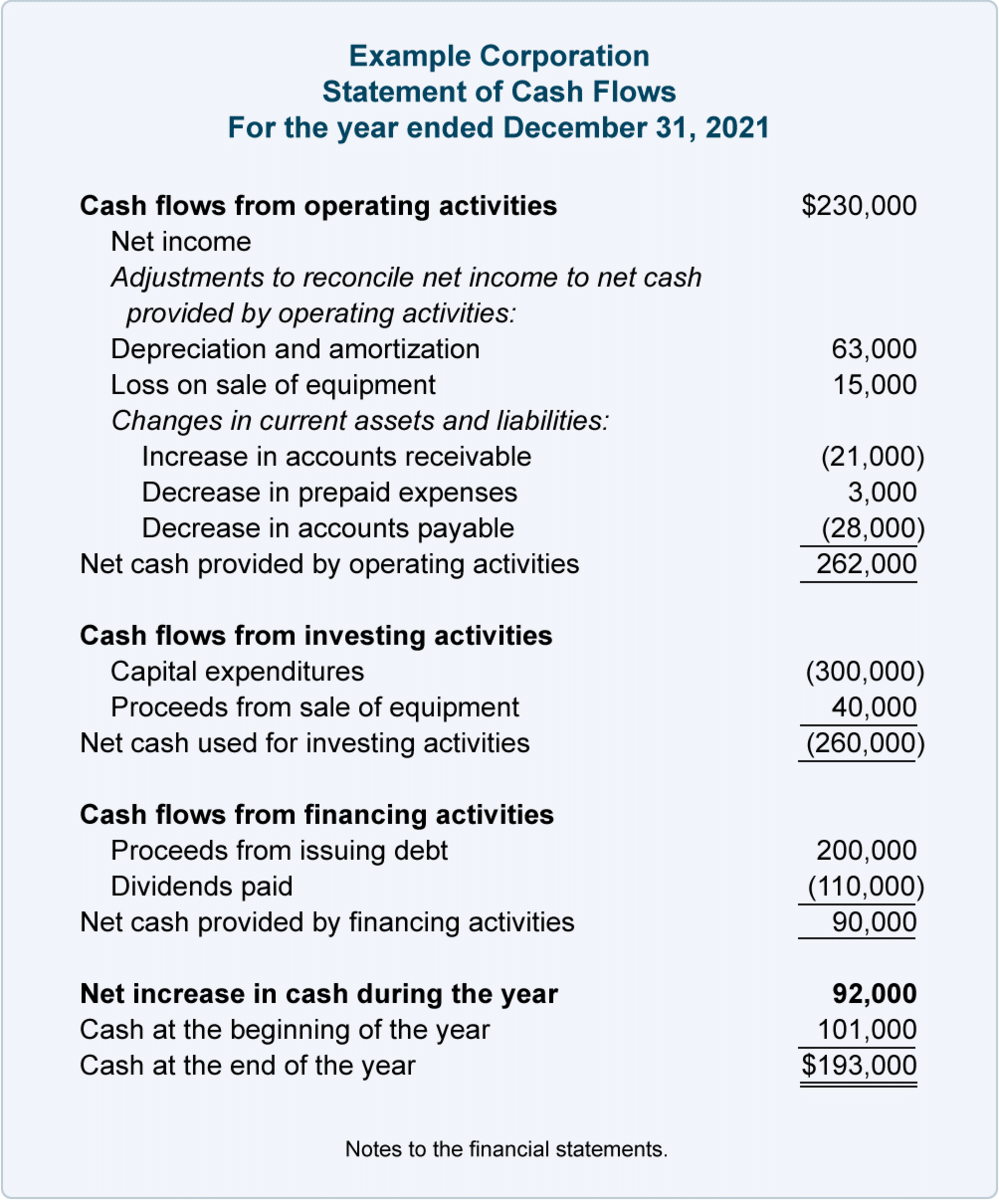

The business income statement also referred to as a profit and loss (p&l) statement, is a useful tool for providing an overview of how your business is doing overtime. These are prepared by listed companies on quarterly basis as per sebi requirements. Balance sheet income statement cash flow statement let’s look at each one in more detail.

A statement of cash flow on any balance sheet should be positive. Together, they provide an understanding of profits and a basis on which to make predictions about the company’s financial future. Annual reports for 10,198 international companies.

Maintaining consistency in recording and reporting practices. There are three basic financial statements: For small businesses, financial reporting always includes the balance sheet, income statement (also called the profit and loss statement) and the cash flow statement.

The income statement, the balance sheet , and the cash flow statement. In this article, you’ll learn about the 3 principal financial statements—income statements, balance sheets, and cash flow statements—and how to interpret them. And eric, liable for a host of civil fraud counts in new york, including issuing false financial statements, falsifying business records.

Balance sheet think of the balance sheet as a snapshot of your business’s financial health at a specific point in time. How do you prepare a balance sheet from an income statement? A current balance sheet, a profit and loss (p&l) statement, and a cash flow statement.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)