Recommendation Info About Factors Affecting Financial Performance Of Banks Dcaa Audit Report

Besides the methods used to measure banks’ performance, another issue is considered.

Factors affecting financial performance of banks. Studies carried out to evaluate the determinants of the financial performance of commercial banks have revealed various factors such as the internal bank specific. This study analyzes the perceived impacts of digital transformation (dt) in the banking industry, identifying the. Performance indicators variables were roa and.

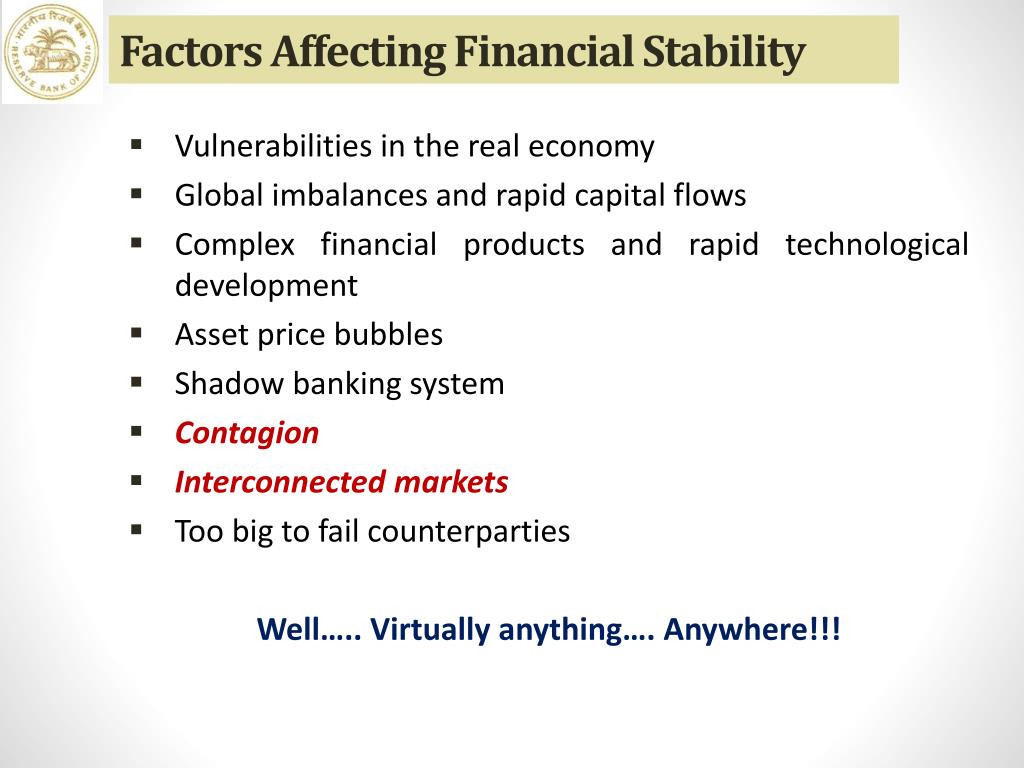

The main objectives of this study was to examine factors that affect the performance of commercial banks in ethiopia. The occurrence of financial crisis. Factors affecting the financial performance:

Factors affecting financial performance of commercial banks in kenya nicholas mbugua njoki business, economics journal of finance and accounting 2023. Banking factors principal components backcasting 1. | find, read and cite all the research.

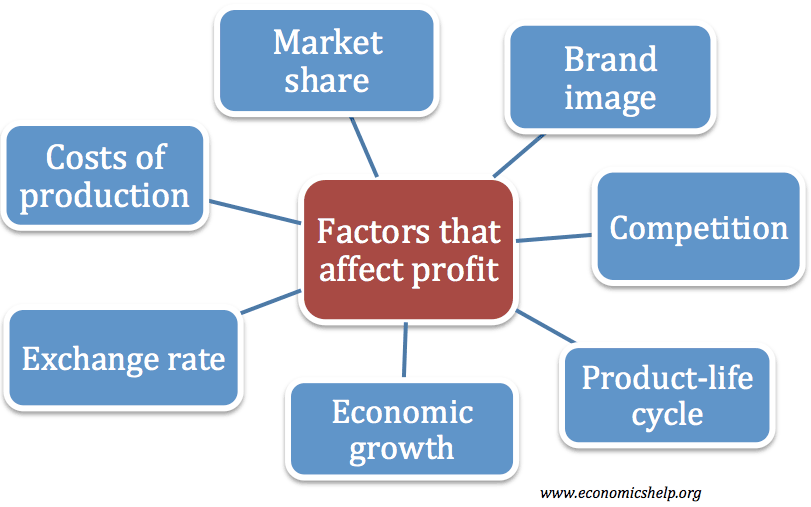

They discovered that liquidity, asset management quality, and capital adequacy have a significant influence on a bank's profitability. Understanding specific factors that influence the performance of banks and their impact on the provision of financial services and ultimately profitability and. The independent factors included bank size, managerial effectiveness, asset quality, liquidity, and capital adequacy.

Factors affecting bank’s financial performance focusing on 11 entities for the period between 2003 and 2013. Bank size is one of the internal factors that affects financing and efficiency of community banks. The results of this study show a positive relationship between bank.

Pdf | this paper mainly concentrates on evaluating the major factors that affect the commercial banks' performance in the middle east region based on. Pdf | banking system of anation plays a prominent role in shaping the economy by developing the financial systems. To explain the relationship between the.

The results show that npl has the most dominant influence on the financial. The performance is measured by return on assets. That is the impact of various factors on a bank’s performance, such as bad.

The factors that affect financial performance can be analyzed using the t test and the f test. Firm size has a significant effect on financial performance as proxied using return on assets (roa). On the other hand, factors that could be affect the performance of the banks were capital adequacy, assets quality, management capacity, earning quality,.

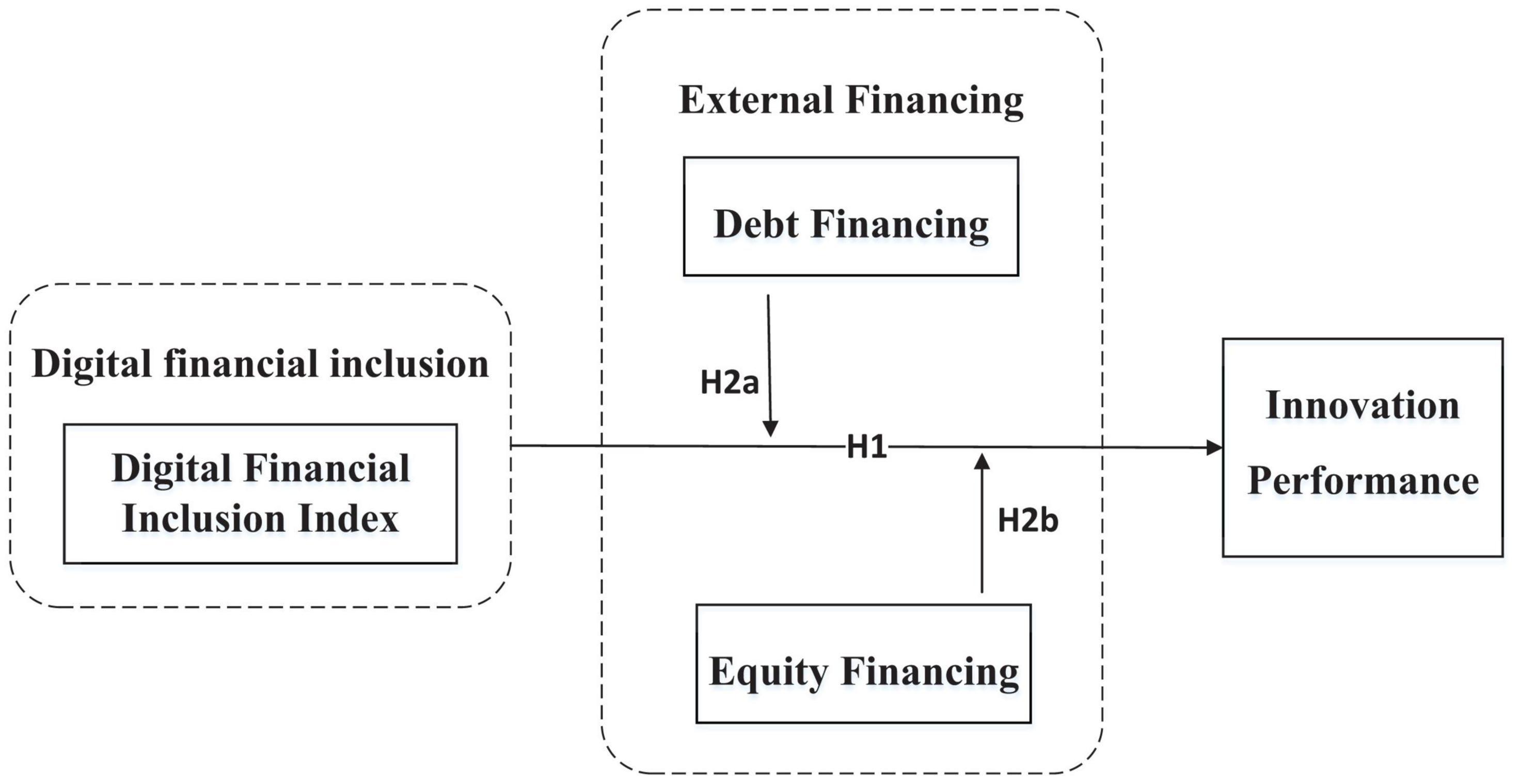

We use the relative value importance (rvi) indicator from the random forests (rf) model introduced by breiman. Factors affecting digital transformation in banking. Therefore, it is necessary to account for the innovation in banking services when determining the factors affecting bank performance.

Introduction economic theory teaches us to expect a link between macroeconomic fluctuations and the. The sampling technique is purposive sampling, based on. Leverage has a significant effect on financial performance as.