Neat Tips About Tds Form 26as Treasury Stock Presentation On Balance Sheet

What is form 26as?

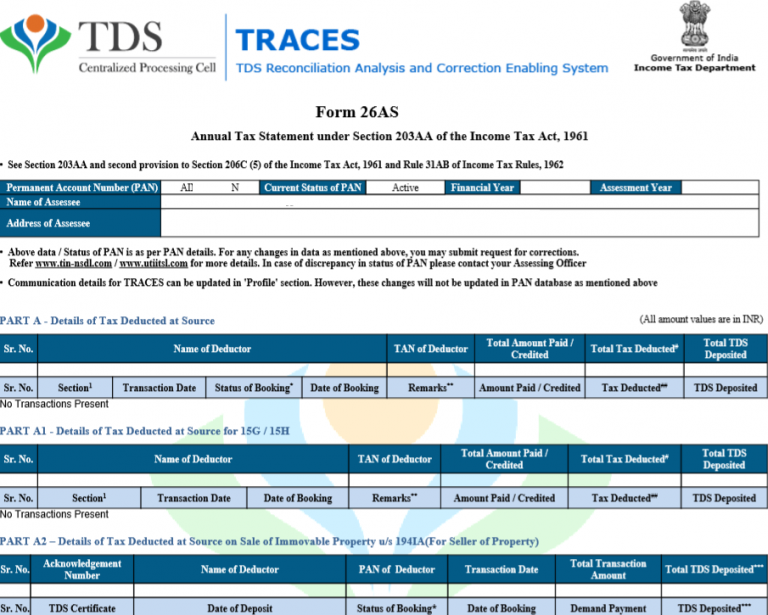

Tds form 26as. Examine form 26as to see if the tds mentioned in forms 16 and 16a is correctly reflected. Tax deducted at source from salary. What is form 26as?

The deductor has withheld the tax on your behalf but has not deposited it with. Following parts of form 26as are explained in detail : Can i update the pan holder's details in.

Steps to verify validity of form 16: Often the actual amount of tds and tds credit as appearing in form 26as may differ and it may happen that the tds credit appearing in form 26as may be less. How to correct bank errors in form 26as?

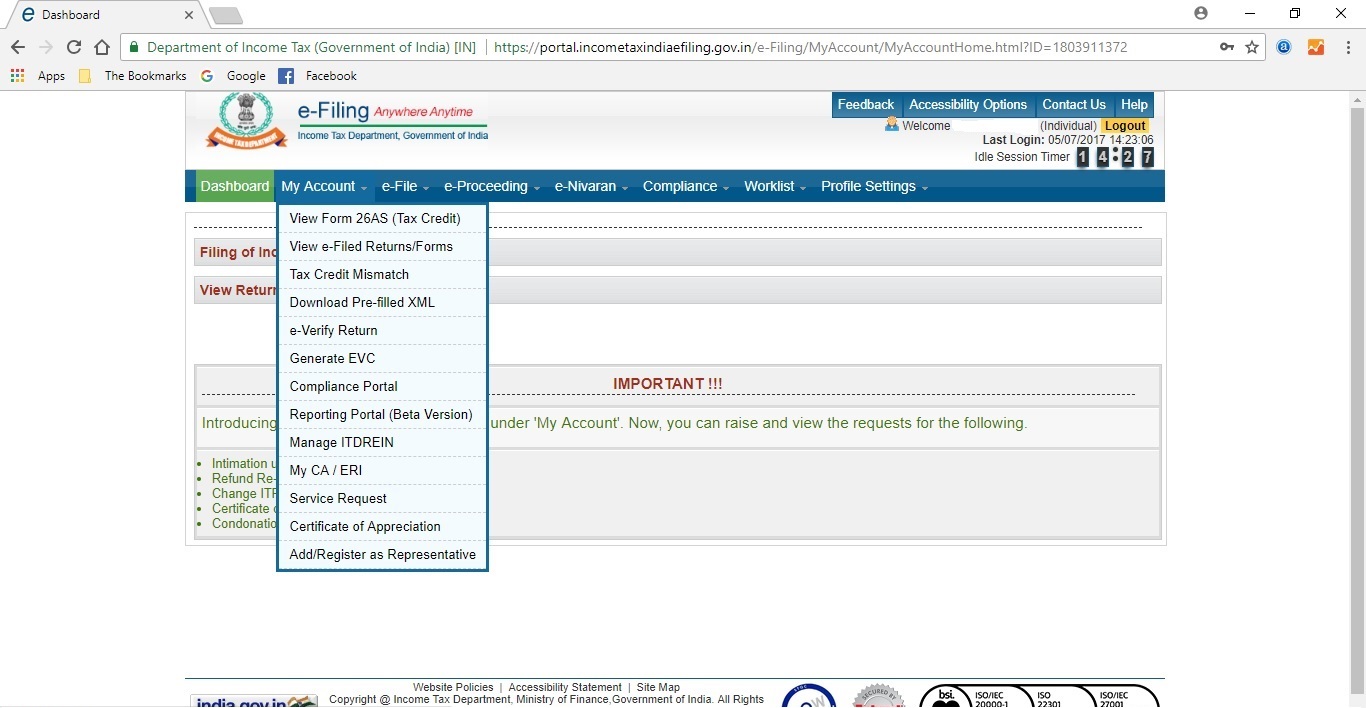

The website provides access to the pan holders to view the details of tax credits in form 26as. Following are the major information. Can be verified online in the traces to check if the deductions by the employer are reflected in.

So, tds deductions that are given in form 16 / form. Form 26as contains the details of taxes paid and compliance information. Steps to verify tds certificate on traces portal :

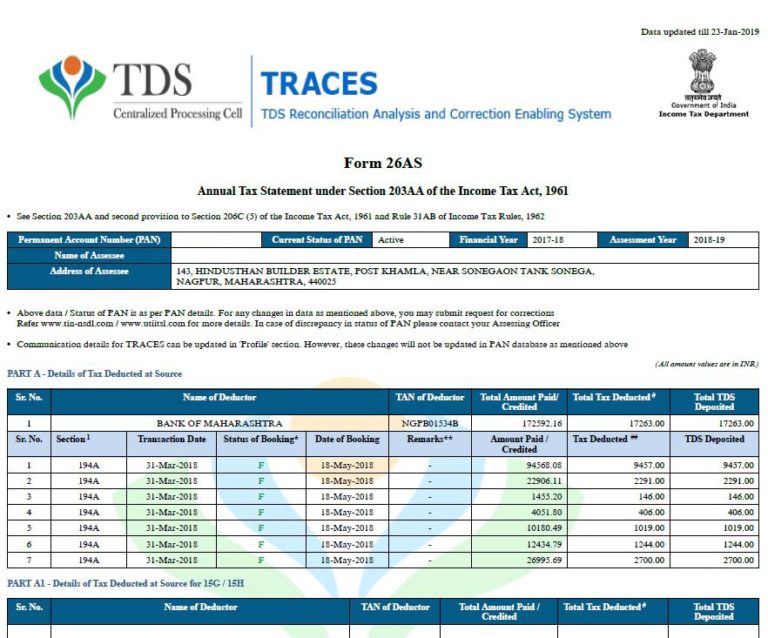

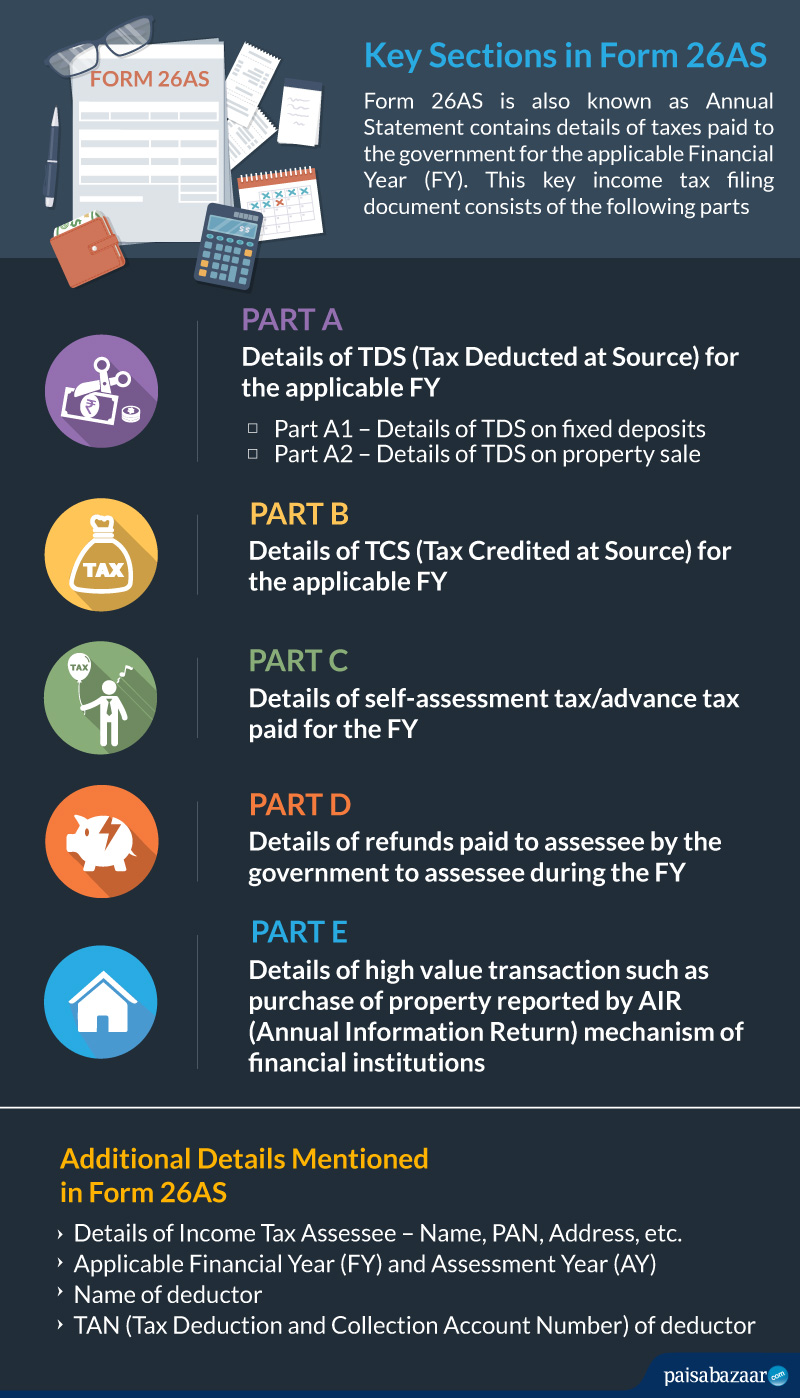

It also shows information about high. The form 26as contains details of tax deducted on behalf of the taxpayer (you) by deductors (employer, bank etc.). What is form 26as, and how do i get it?

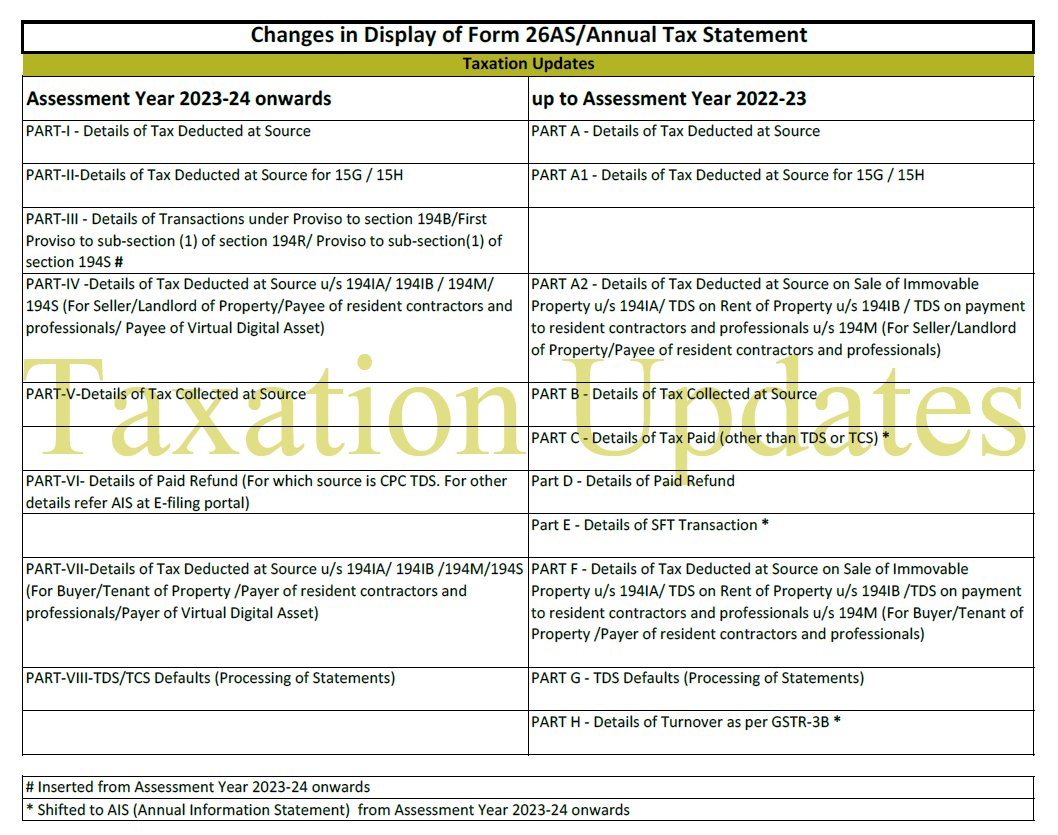

Form 26as is divided into nine parts. Must check the details on the tds certificate;. Form 16a issued by the bank form 16a serves as a certificate for the deduction of tax at source,.

If you are not registered with traces, please refer to our e. A taxpayer’s form 26as is a declaration that lists all amounts withheld as tds or tcs from their different income sources. Income tax form 26as is a consolidated statement showing details related to tds and tcs from different sources.

It is an important document needed at the time of filing itr,. Log in to your account using your pan. What information available in form 26as?

Form 26as is a consolidated annual tax statement that shows the details of tax deducted at source, tax collected at source, advance tax paid by the assessee along. Form 26as is the tax credit statement maintained by income tax department. It shows the amount of tds, tcs and other forms of tax.