Who Else Wants Info About Accounting Ratios Pdf Report Form Balance Sheet Lululemon

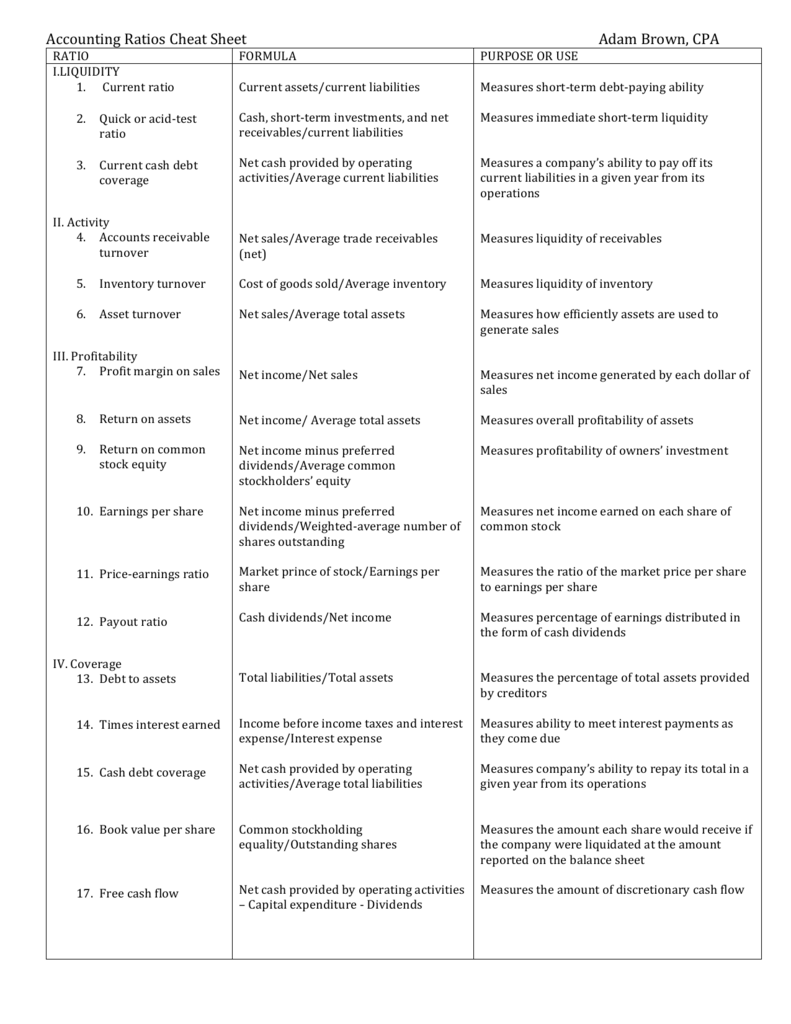

Ratio analysis can also be used as a diagnostic tool to.

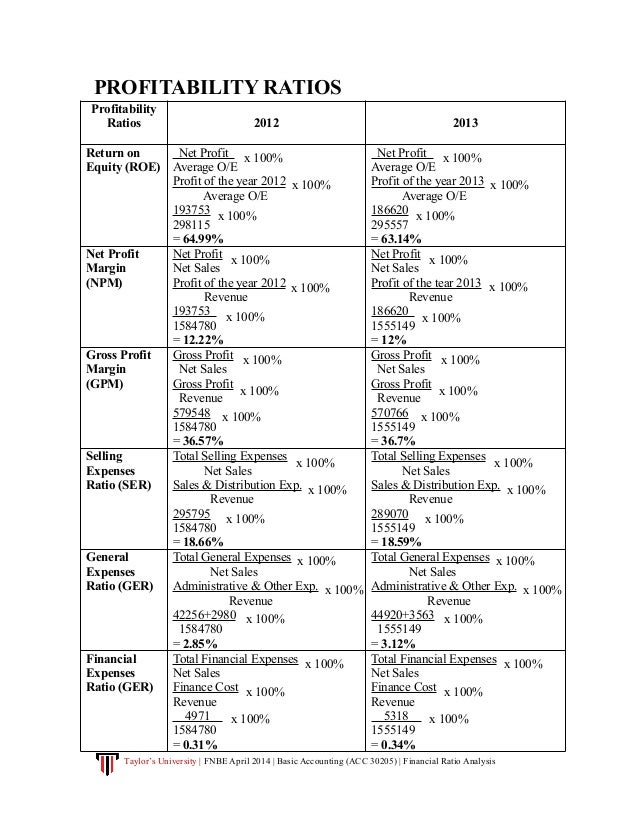

Accounting ratios pdf report form balance sheet. Specifically, we will discuss the. The ratios are also used in comparing to the. In this section, we will discuss five financial ratios which use an amount from the balance sheet and an amount from the income statement.

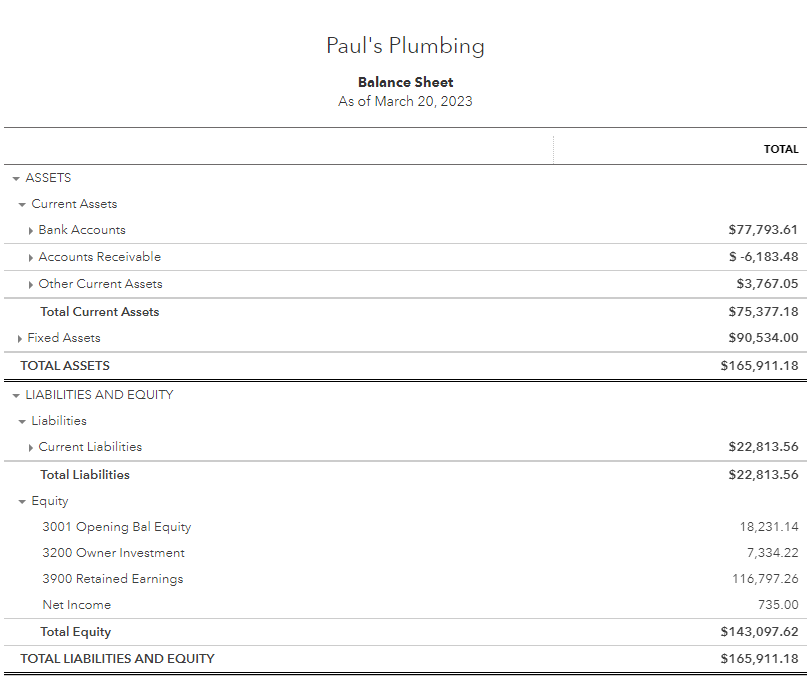

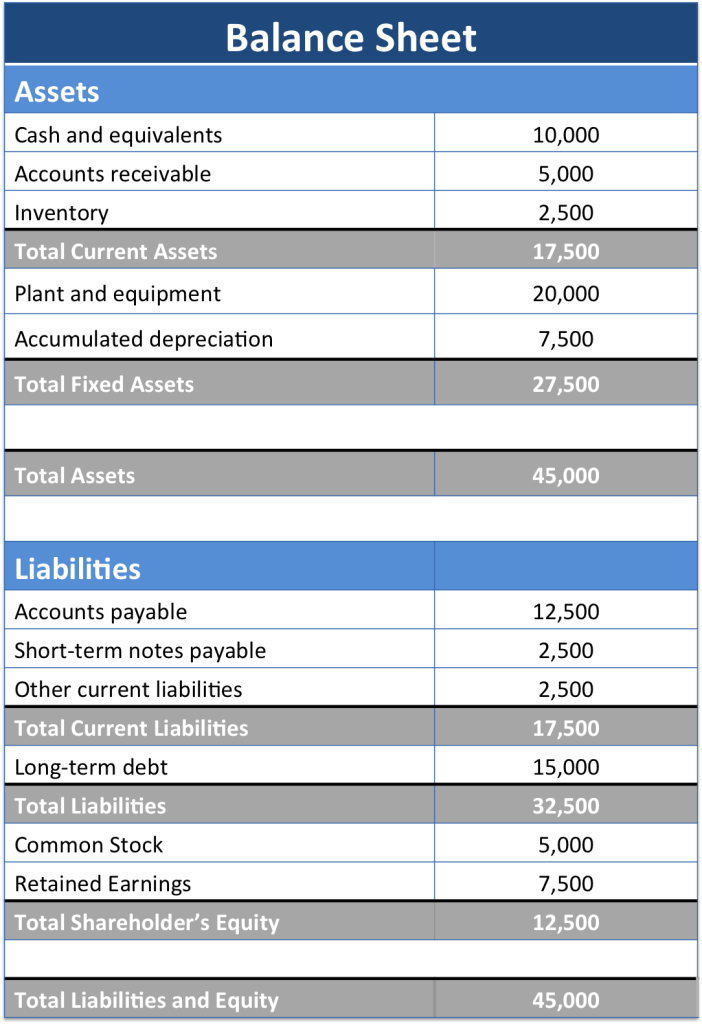

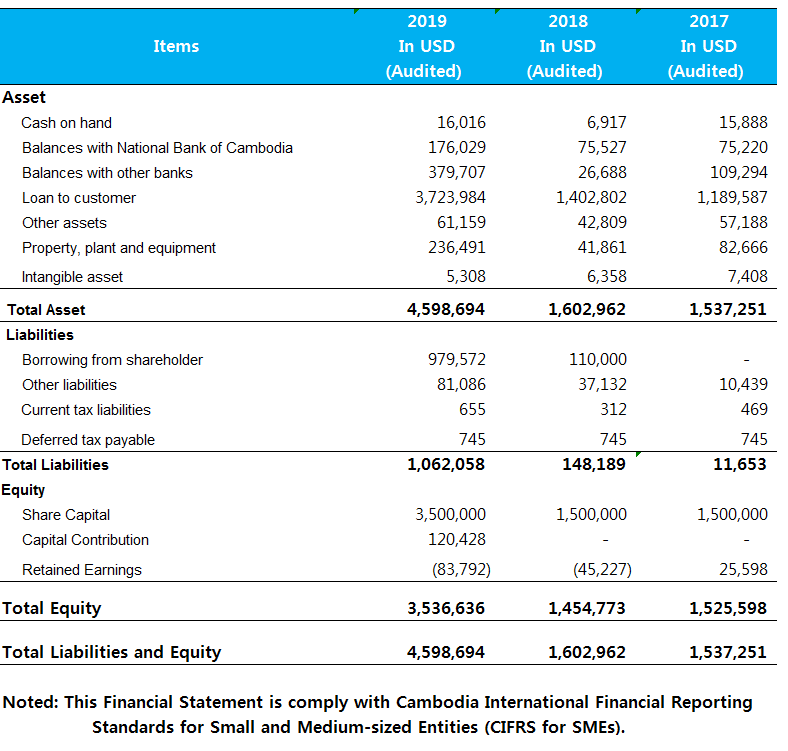

We’ll calculate this ratio using the averages of the balance sheet. An analyst can generally use the balance sheet to calculate a lot of financial ratios that help determine how well a company is performing, how liquid or solvent a company is,. Our business forms package offers 80+ different business forms including the following balance sheet templates in excel and.

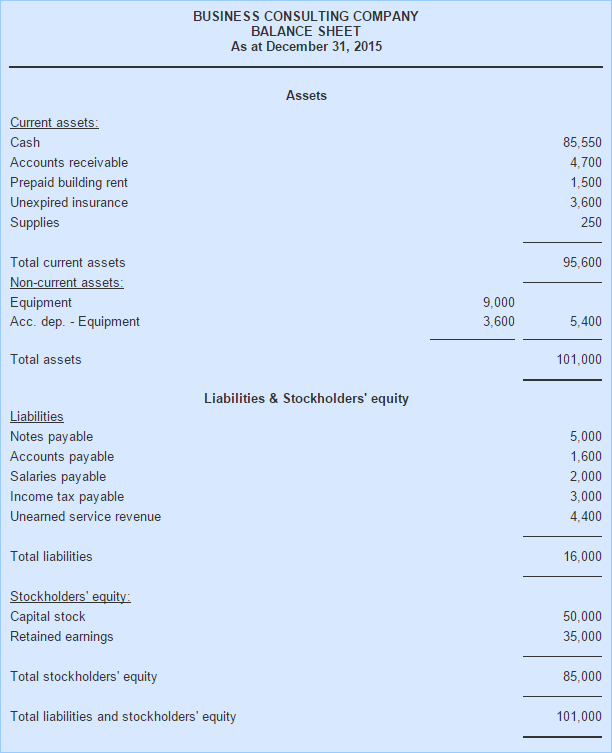

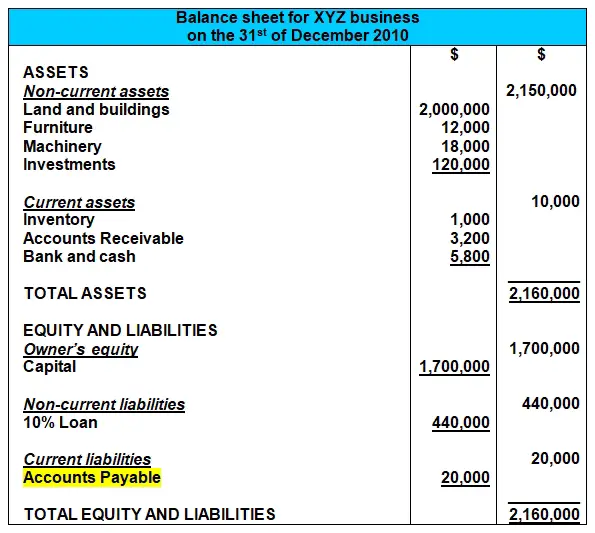

List the types of accounts presented on a balance sheet. What are accounting ratios? Explain the difference between current assets and liabilities and noncurrent assets and liabilities.

Learningobjectives after studying this chapter , you will be able to : These ratios usually measure the strength of the company comparing to its peers in the same industry. Comparisons, industry and group comparisons, and detailed ratio analysis reports for all standard ratios or for selected ratio types.

Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income (profit) relative to. The uses of accounting statements section 3: Cash flow statements (nssch) section 1 ratios by the end of this section you should be able to:.

These include income, balance sheet, and cash flow statements. Account form and report form balance sheets a company’s balance sheet can be presented in one of two ways, account form and report form, depending. Balance sheet ratios are the ratios that analyze the company’s balance sheetwhich indicate how good the company’s condition in the market.

A report form balance sheet is a balance sheet that presents asset, liability, and equity accounts in a vertical format. It is possible to look at the financial health of a corporation by looking at some of its key financial ratios. These techniques and methods compare different.

The detailed ratio analysis reports include. Total (average) shareholders’ equity. Plus, find tips for using a balance sheet.

Degree to which enterprise uses owners’ capital to finance assets. Current ratio is calculated using the formula given below current ratio = current assets / current liabilities current ratio = 1,00,000 / 78,000 current.

Cash in the current year is $110,000 and total. In financial reporting, there are two general.