Glory Tips About Net Income Excel Template Profit And Loss Account In Tally

Use the freshbooks income and expense template to get started.

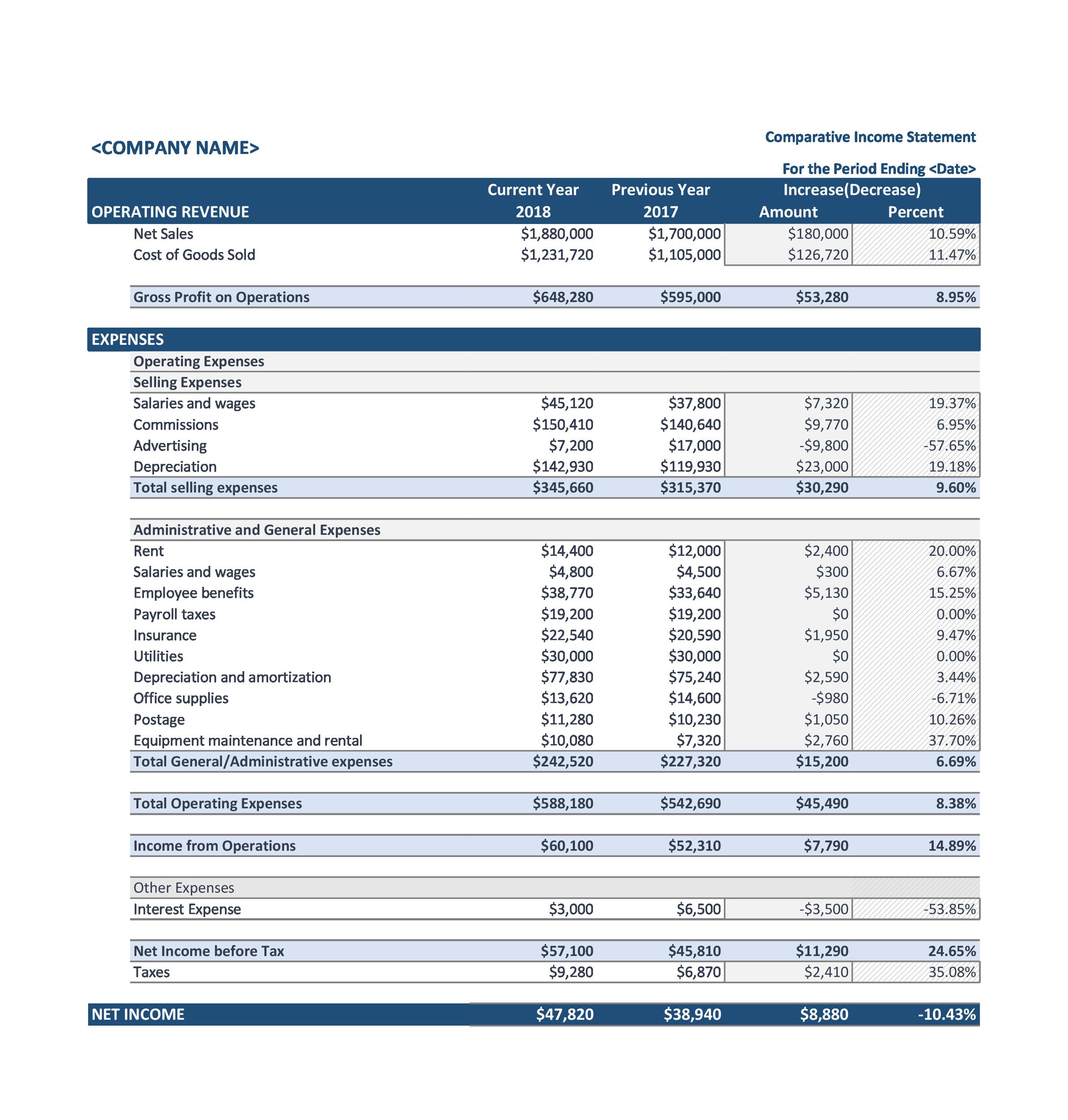

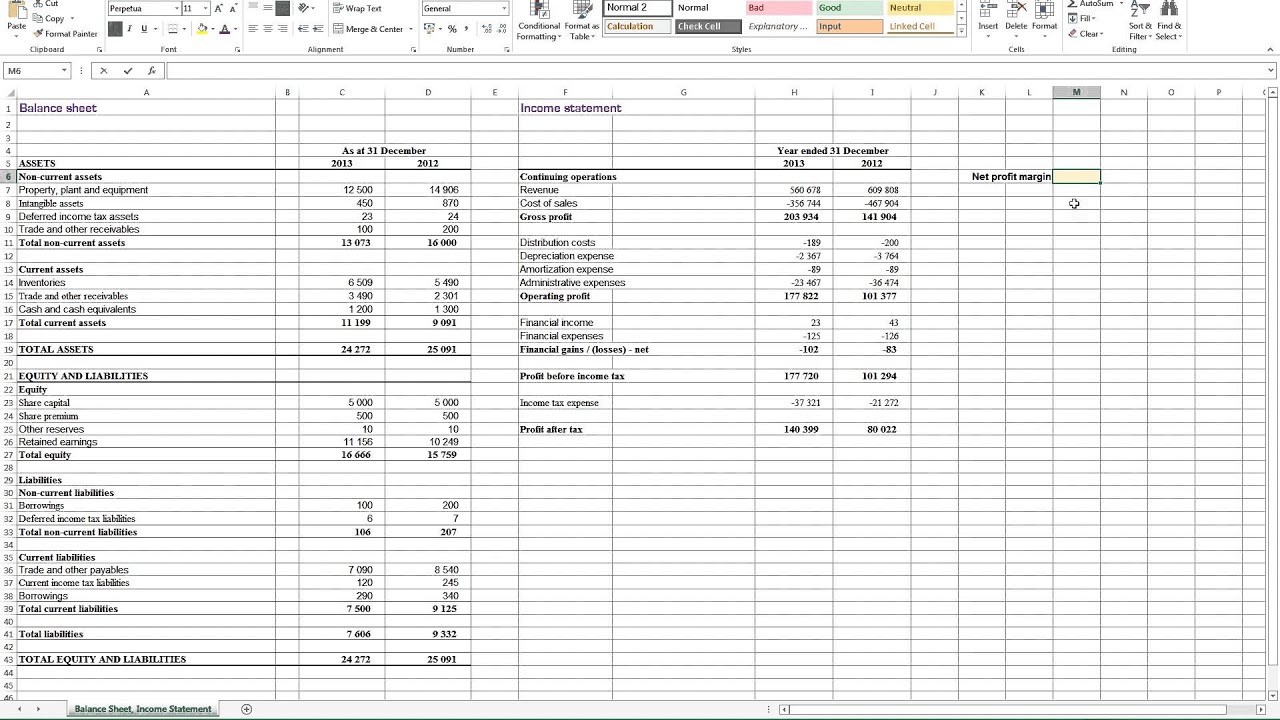

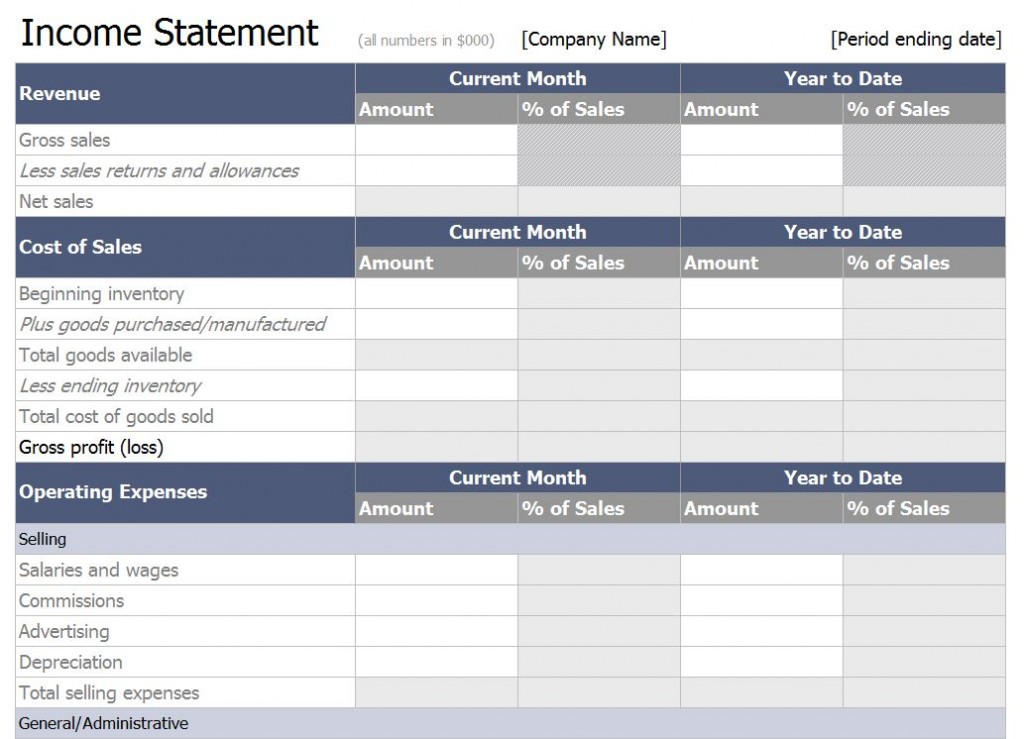

Net income excel template. An income statement or profit and loss statement is an essential financial statement where. The income statement (also called a profit and loss statement) summarizes a business’ revenues and operating expenses over a time period to calculate the net income for the period. There are three formulas to calculate income from operations:

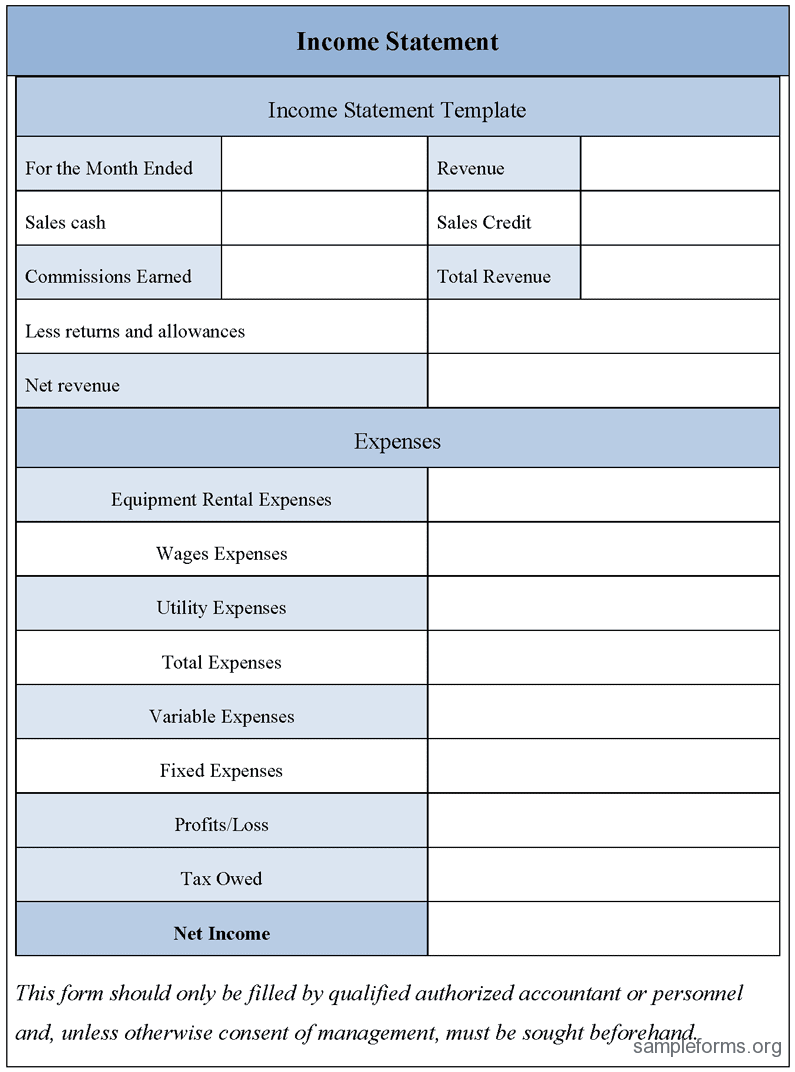

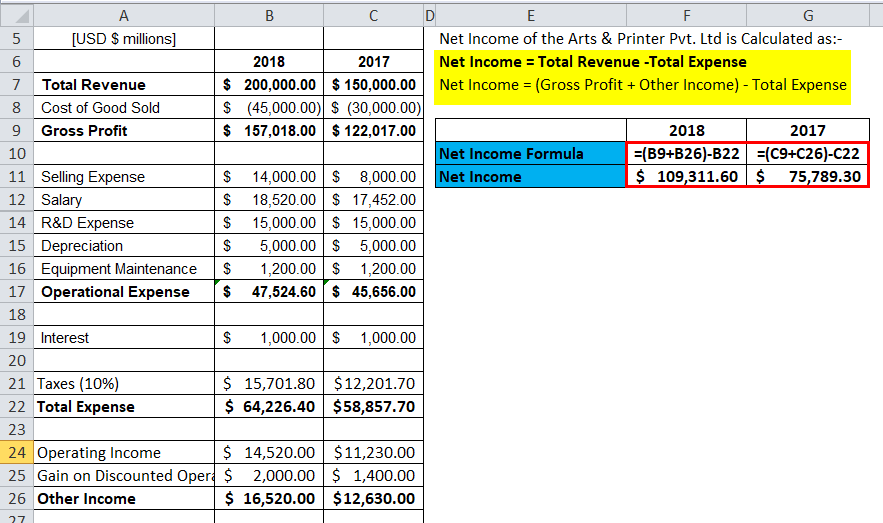

The net income is calculated by subtracting total expenses from total revenues. This number will tell you whether or not your business has earned a net profit or incurred a loss in the given period of time. Net income can be positive or negative.

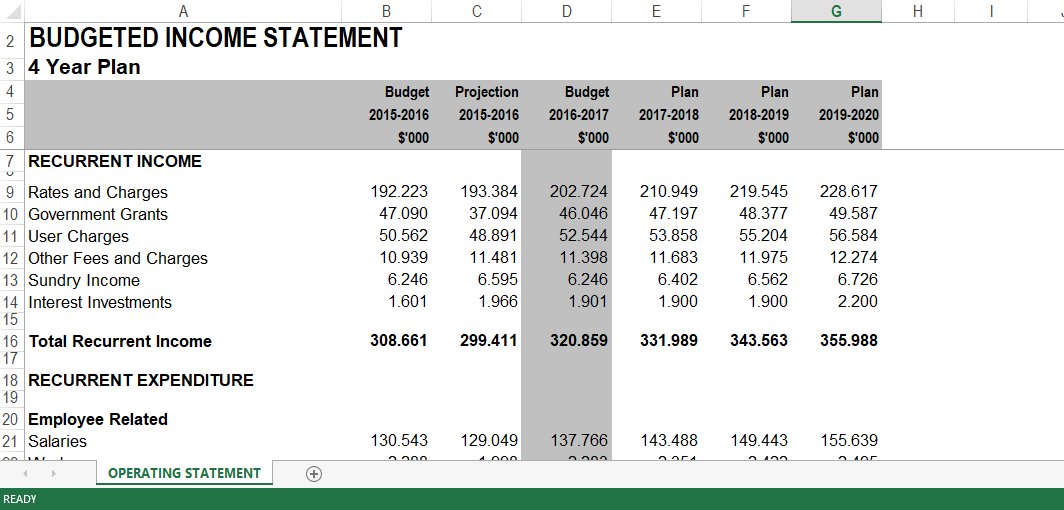

Generated a net operating income of $119,437m in 2022. Open excel and set up your template by inputting all the factors that affect your monthly salary. An income statement compares company revenue against expenses to determine the net income of the business.

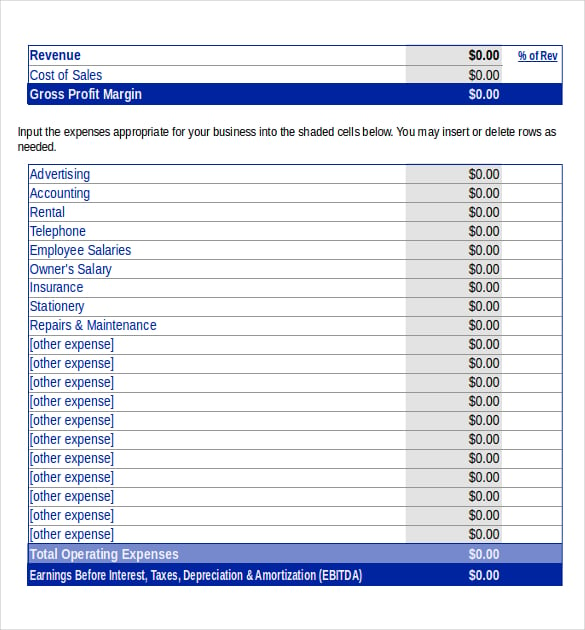

Select revenue columns, then set series overlap and gap with. Enter your name and email in the form below and download the free template now! Track your costs in the customizable expenses column, and enter your revenue and expenses to determine your net income.

Use these templates to add in pie charts and bar graphs so that you can visualize how your finances change over time. Use the formula =sum() for adding up total revenue and expenses, and =sum() or =sumif() to calculate net income. Another way to calculate income from operations is to.

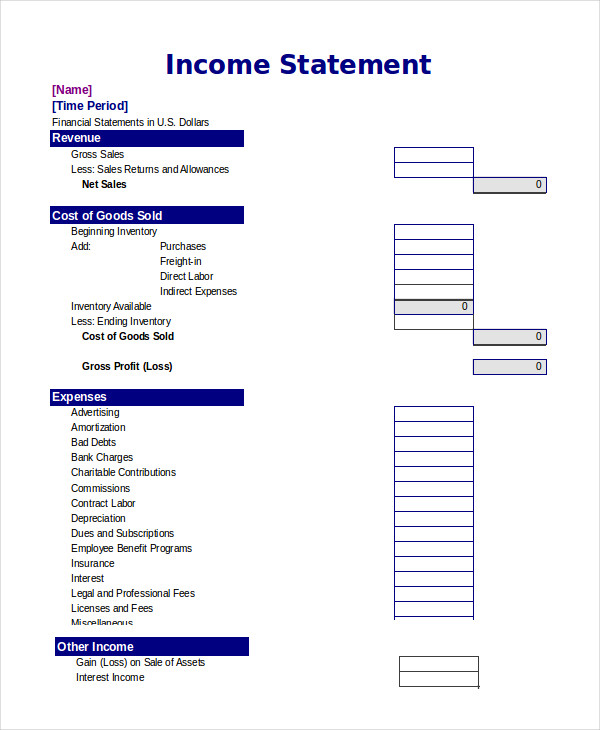

Manage your finances using excel templates. The header can be made to outline the title “income statement,” company details, and date. Rental income & expense worksheet template.

Or, if you really want to simplify things, you can express the net income formula as: The income statement is generally a record of income received and expenses incurred over that period. Calculating this income means subtracting the expenses, operating costs, and taxes from the previous revenue of the company.

The resources below provide expert advice on tricky tax topics and can help you start your. As you navigate the 2024 tax season, use our cheat sheet to help you find all the answers you need. The initial chart looks like this:

Net income = $28,800. The net income is the clean and final profit of the company. These factors can vary depending on your employment contract, but usually this includes a fixed salary, overtime wages (can vary on different days), working hours and tax deductions.

The net income is a simple formula that measures excess revenue above total expense. The single step income statement formula is: A list of some of the software solutions we offer.