Sensational Info About Other Payables In Balance Sheet Md&a Meaning

There is, however, a slight difference.

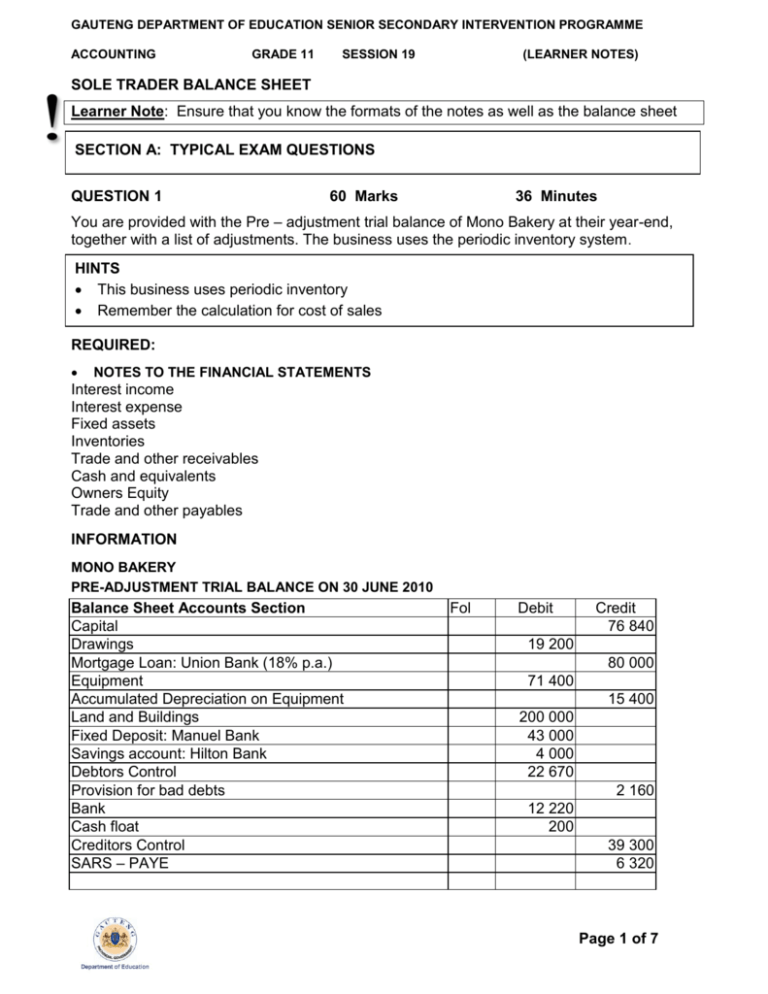

Other payables in balance sheet. Payables appear on a company's balance. Within one year) showing separately amounts payable to trade suppliers, payable to related parties, deferred income and accruals (with for example corporate income tax and social securities as separate reporting lines based on local gaap or reporting habits). Classification accounts payable is classified as a current liability on the balance sheet.

These three balance sheet segments. Accounts payable (ap) and trade payables (tp) are interchangeable accounting terms. Income taxes to be paid in a future year are reported as deferred income.

Accounts payables turnover is a key metric used in calculating the liquidity of a company, as well as in analyzing and planning its cash cycle. The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. A related metric is ap days (accounts payable days).

This is the number of days it takes a. By adam hayes updated april 29, 2023 reviewed by charlene rhinehart fact checked by kirsten rohrs schmitt accrued. Other payables are rarely recorded in the financial statements.

What is the definition of accounts payable? A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. Accounting accrued expenses vs.

Trade and other payables are liabilities (in general payable short term i.e. The liability must be reduced to the extent of the payment by cash or the transfer of other assets. Accounts payable refers to the money your business owes to its vendors for providing goods or services to you on credit.

What is the balance sheet? What are accounts payable on a balance sheet? Other payables are characterized as uncommon or insignificant.

What are other current liabilities? This account includes the payments due to investment suppliers as well as other payments that the company is due, such as payment to employees that have been awarded but are only due in the future. The payment of liability results in the discharge of contractual obligation.

Under accrual accounting, the accounts payable (a/p) line item on the balance sheet records the cumulative payments due to 3rd parties, such as suppliers and vendors. It is represented as the amount of outstanding balances that have to be paid to the suppliers at the end of the given period. The balance sheet displays the company’s total assets and how the assets are.

Example john borrowed $100,000 from michelle on january 1, 2022. Hence, the net balance in the other payables accounts is typically small. John signs the note and agrees to pay michelle $100,000 six months later (january 1 through june 30).