Brilliant Strategies Of Tips About Income Tax Expense On Balance Sheet Limited Liability Partnership Format P&l Restaurant Template

Efiling income tax returns(itr) is made easy with clear platform.

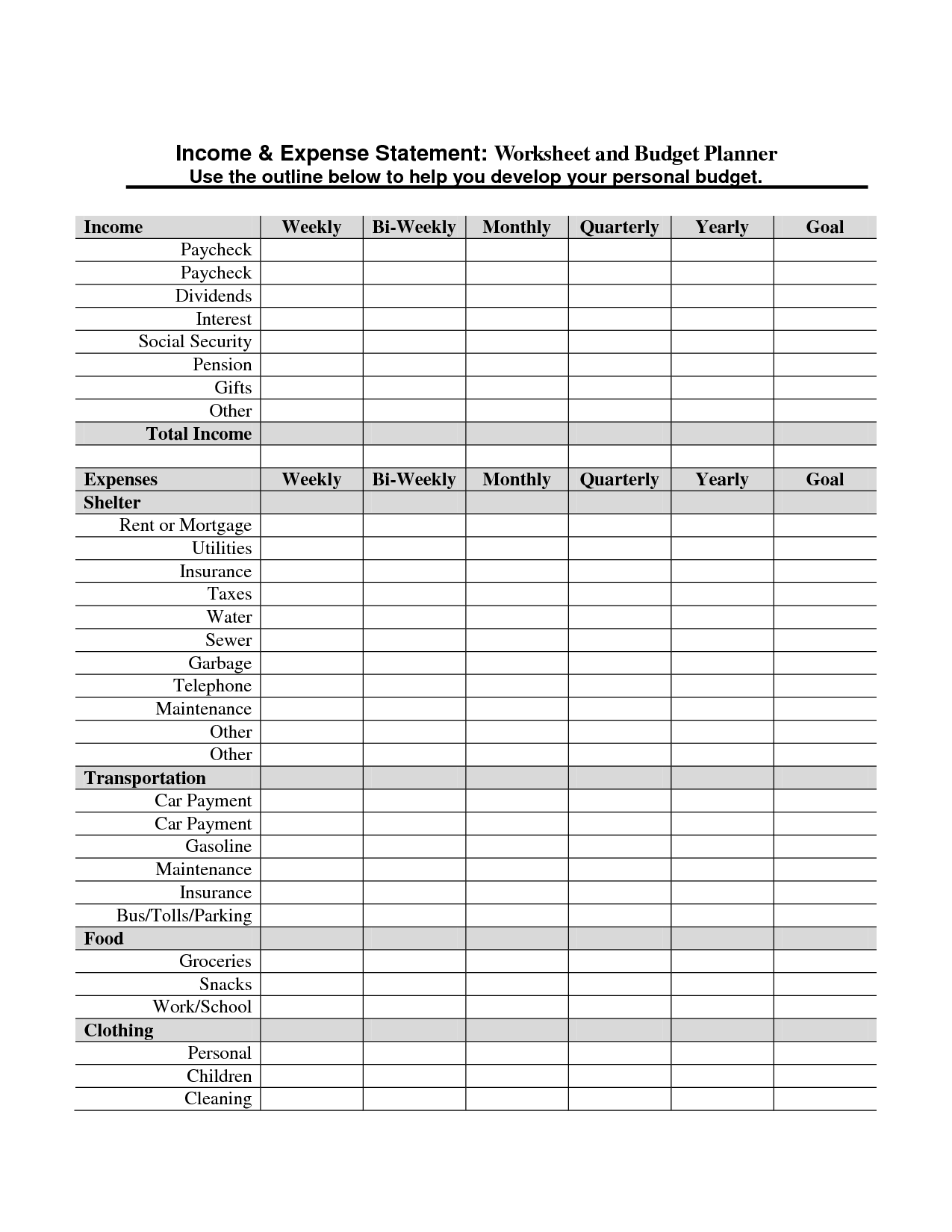

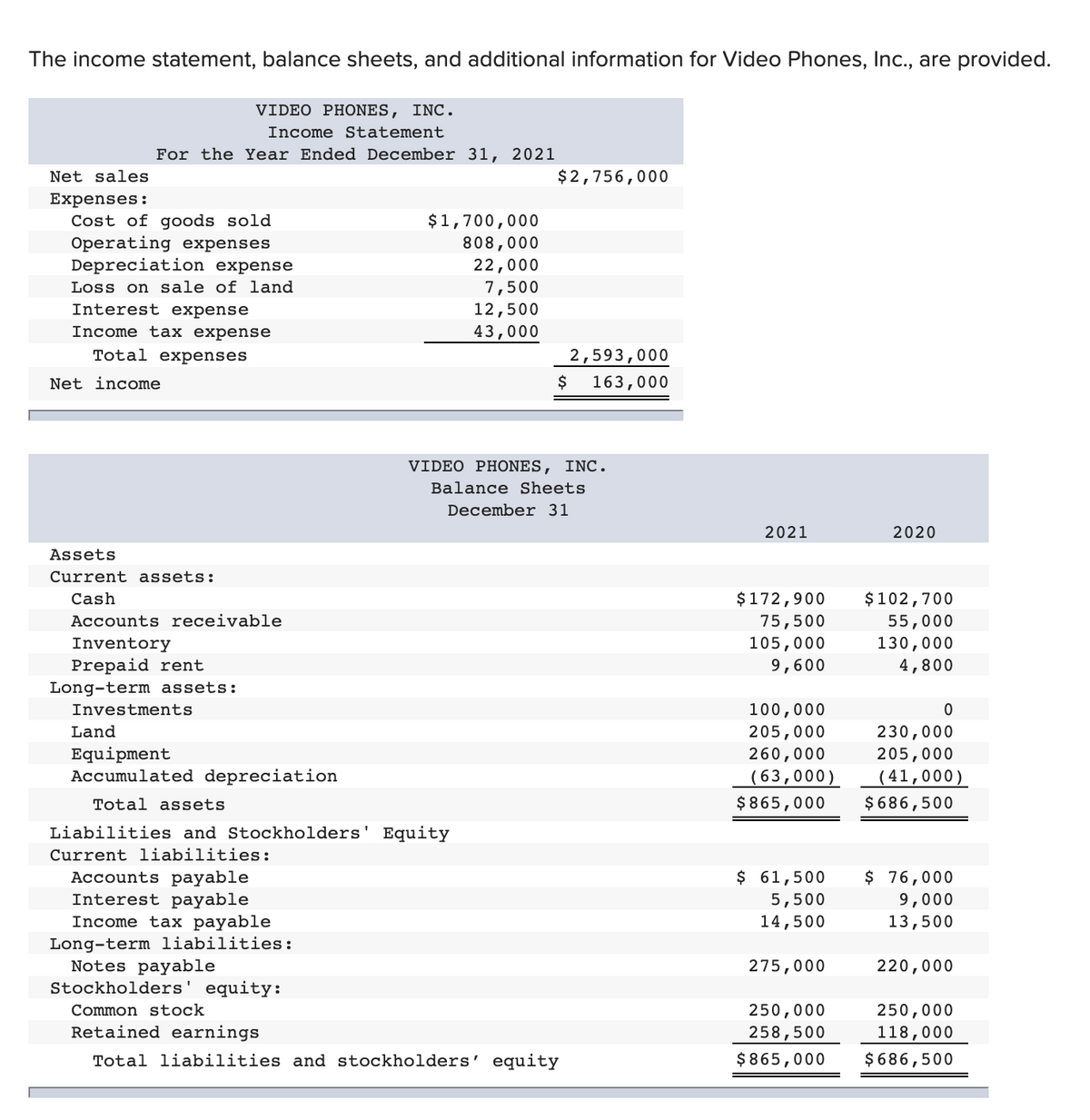

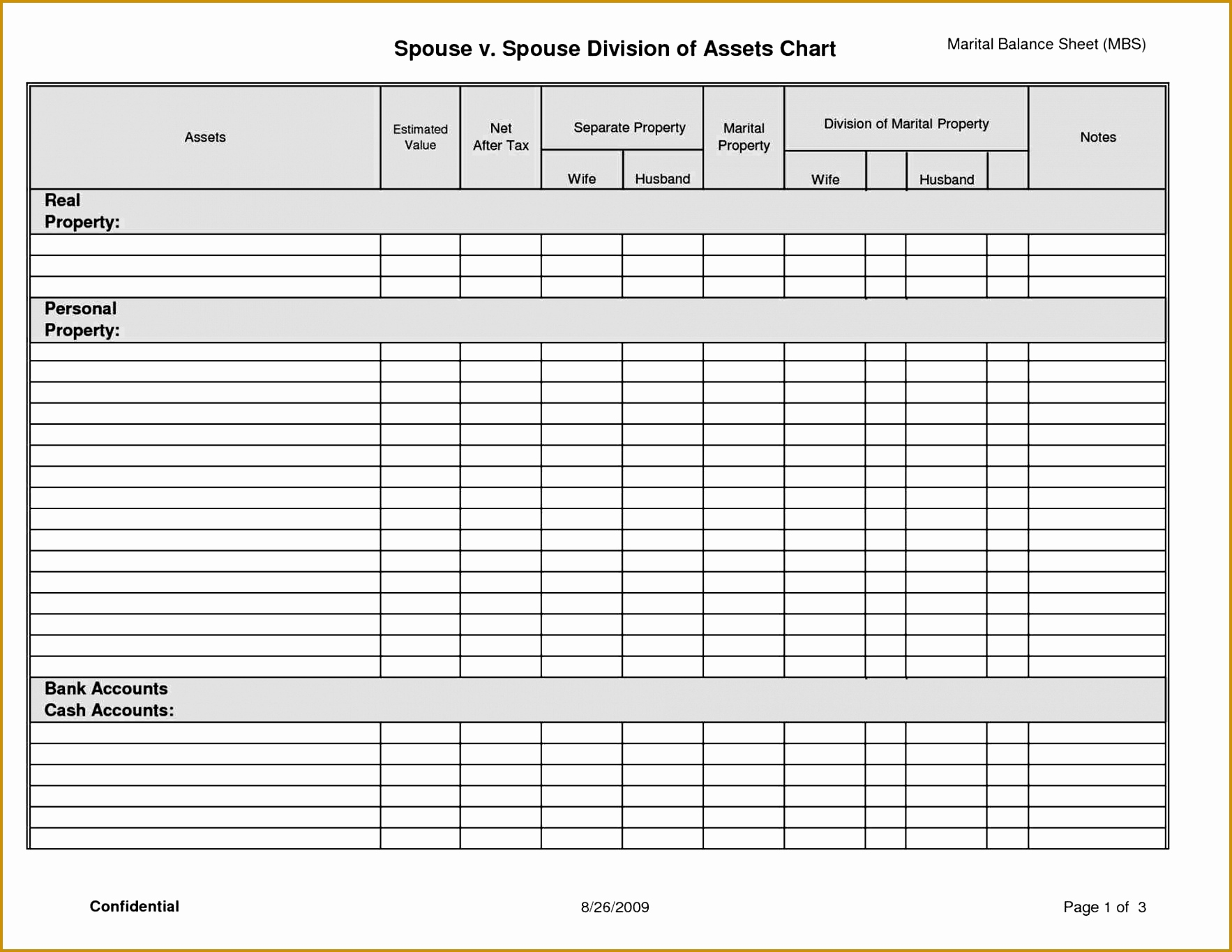

Income tax expense on balance sheet limited liability partnership balance sheet format. Investors scrutinize the balance sheet for. Balance sheet (a) there is a separate capital account for each partner instead of just the one required for a sole trader (b) we often maintain a separate current account for each. The income statements of partnerships should be presented in a manner which clearly shows the aggregate amount of net income (loss) allocated to the general partners and.

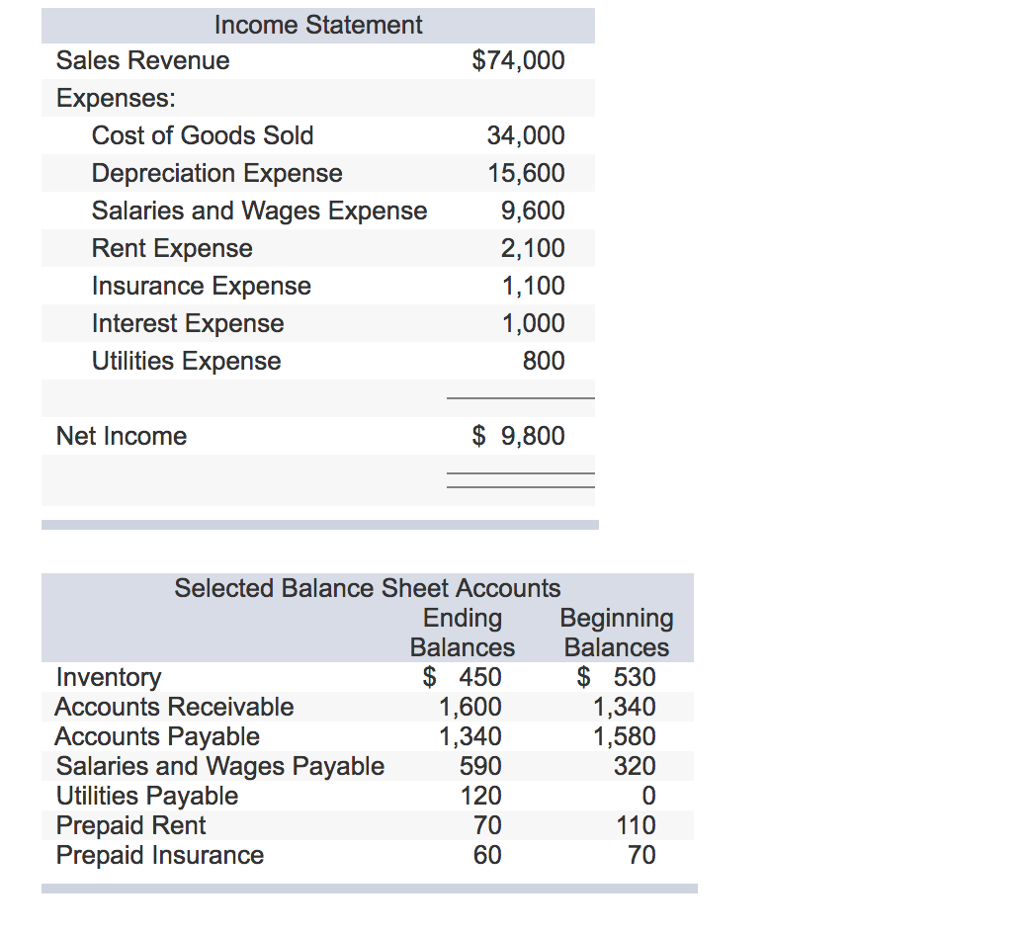

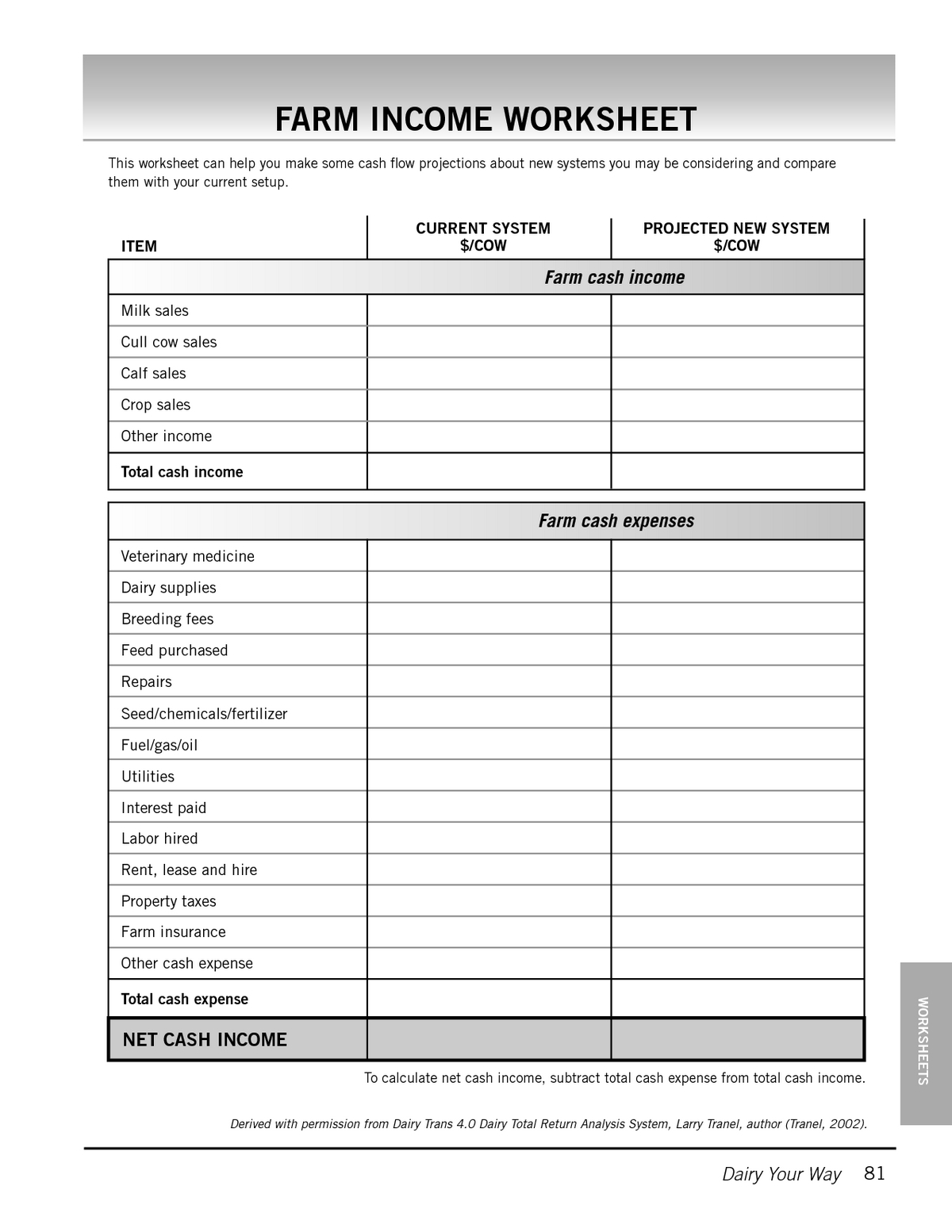

Like a proprietorship, the income statement of a partnership or proprietorship is similar to that of a corporation, except that there is no income taxes. Prepare the partnership's trading and income statement and statement of. The balance sheet is based on the fundamental equation:

Learn why it matters for businesses. The balance sheet is one of the three financial statements businesses use to measure their financial performance. Using dee's consultants net income of $60,000 and a partnership agreement that says net income is shared 50%, 40%, and 10% by its partners, the portion of net income.

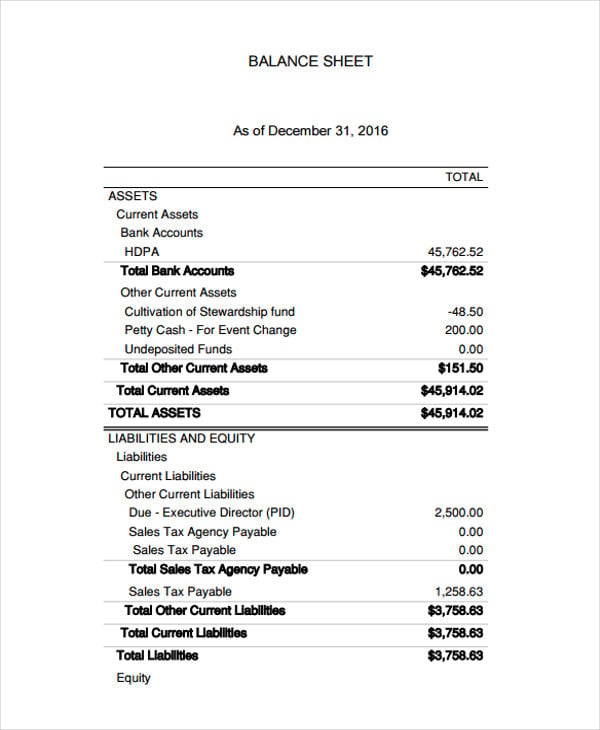

Categorization of current tax liability. A balance sheet is commonly called a “snapshot of a company’s financial condition”. A balance sheet consists of all the liabilities and assets of a company.

Balance sheet and profit and loss; Income tax payable is the line in a balance sheet's current liability section for income taxes due to the irs within 12 months. Division of profit for the year ended 31.

15 points for preparation income tax return: A limited liability company (llc) with more than one owner (called members) is usually taxed as a partnership because the irs does not recognize. Assets = liabilities + equity.

It is a statement of the company regarding its financial position or its net worth. Income tax return : Tax liability shown in the company’s balance sheet is the sum of different types of direct and indirect taxes a company has to pay.

Cfi’s financial analysis course as such, the balance sheet is divided into two. Insurance paid in advance amounted to $1,500. The other two are the profit and loss statement and cash flow.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)