One Of The Best Tips About Gross Margin Income Statement Draw The Format Of Balance Sheet Illustrative Financial Statements

These three balance sheet segments.

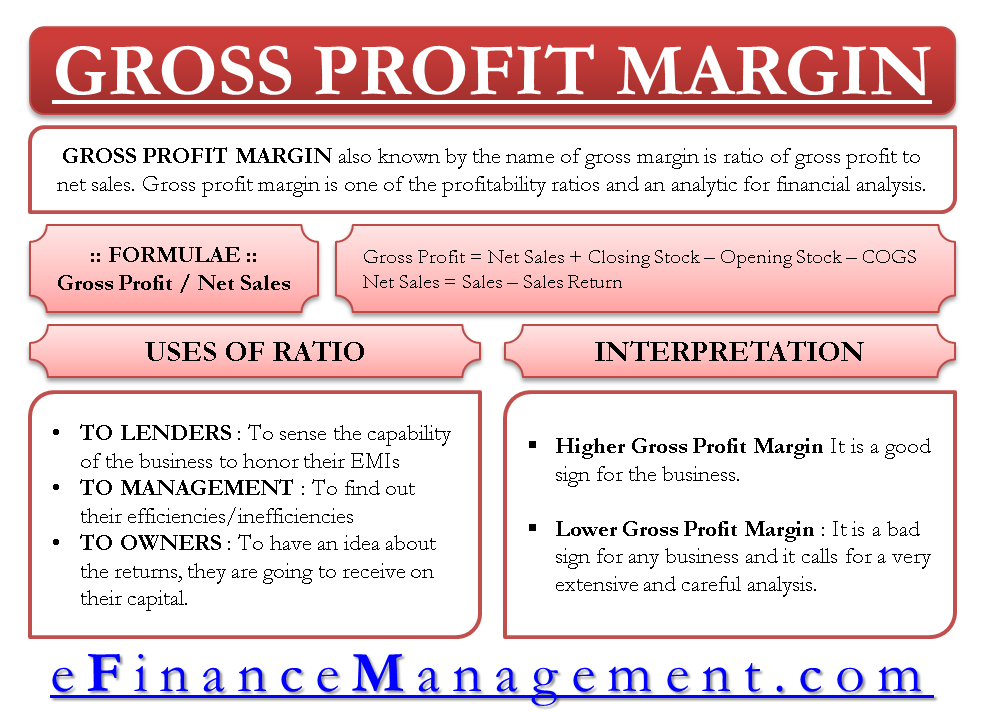

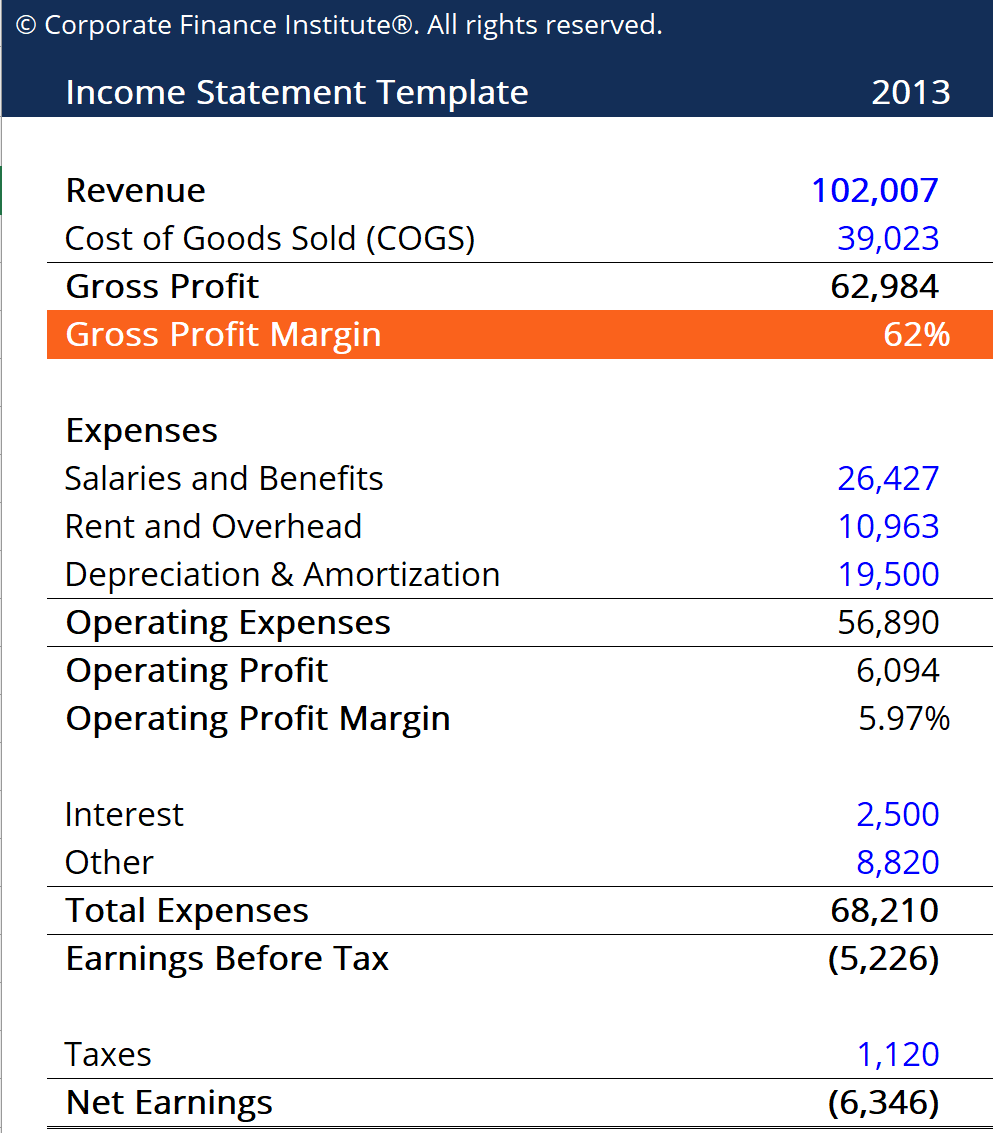

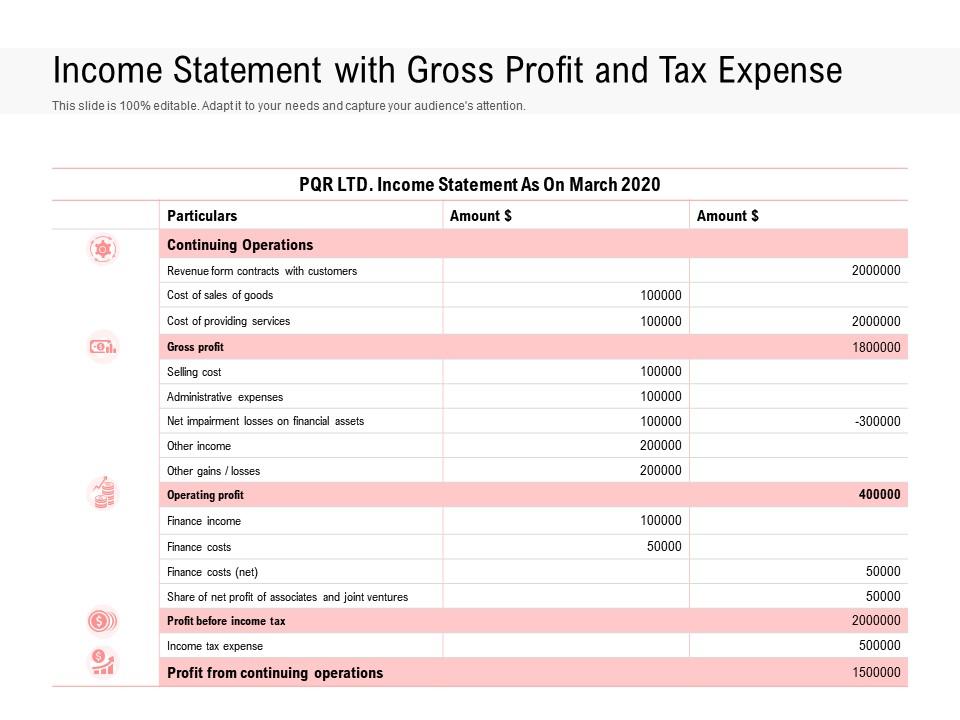

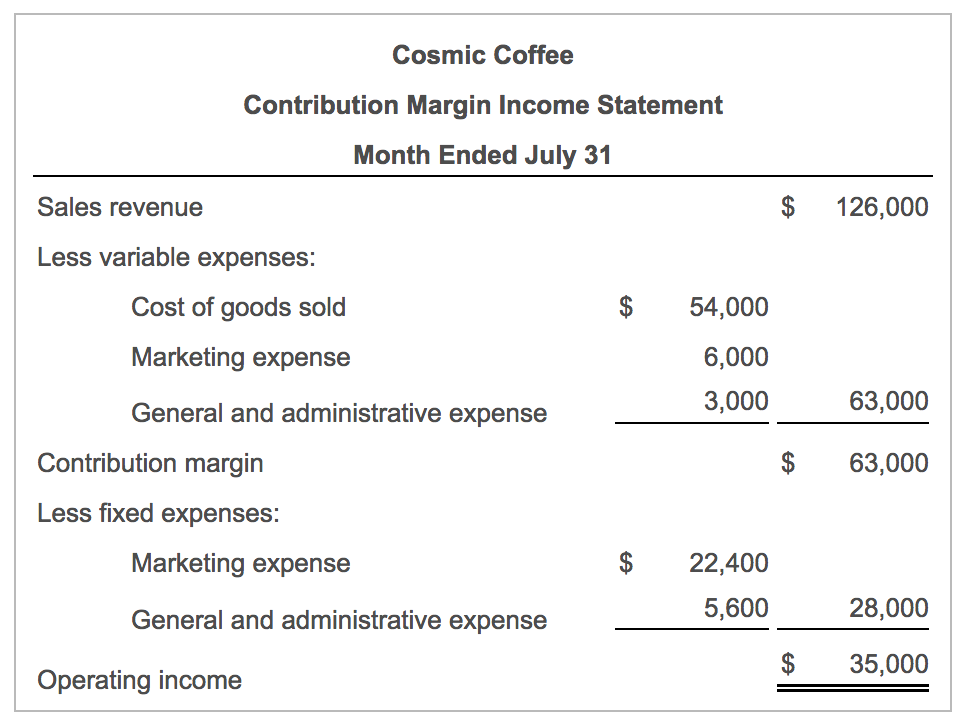

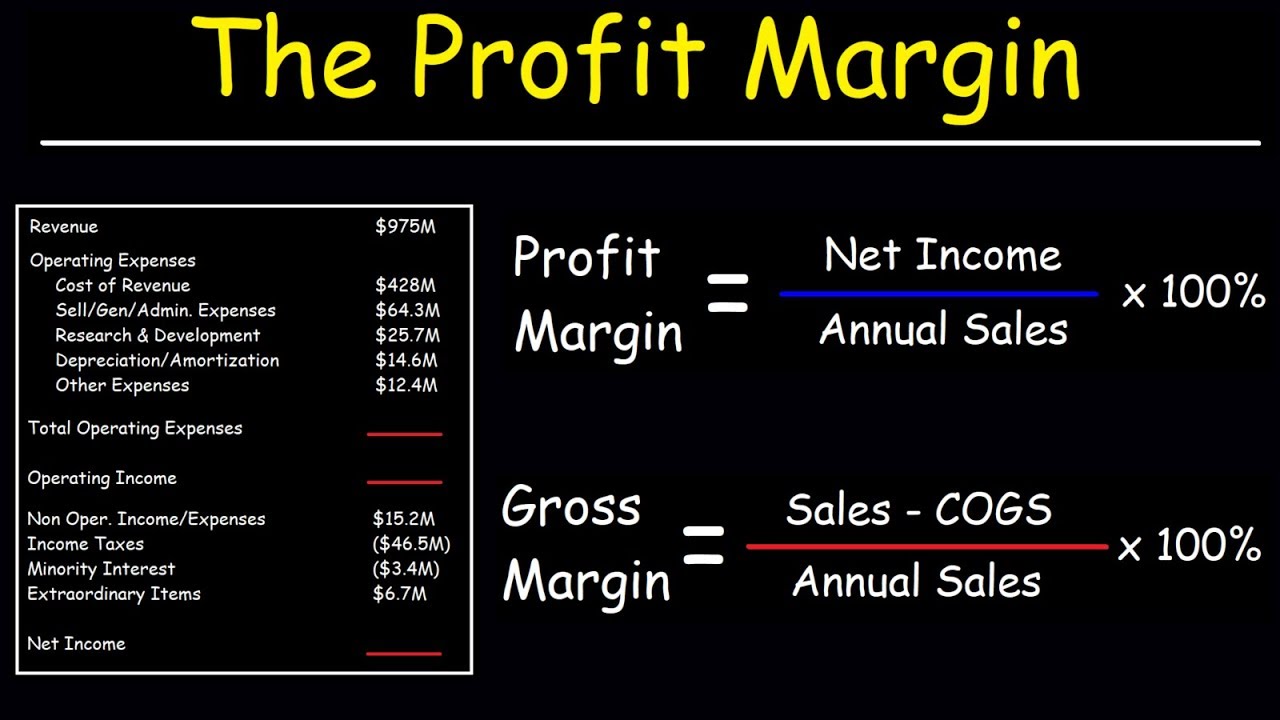

Gross margin income statement draw the format of balance sheet. You may heard about comparative income statement and balance sheet or comparative financial statement. Gross margin is a required income statement entry that reflects total revenue minus cost of goods sold (cogs). For companies, gross income is interchangeable with gross margin or gross profit.

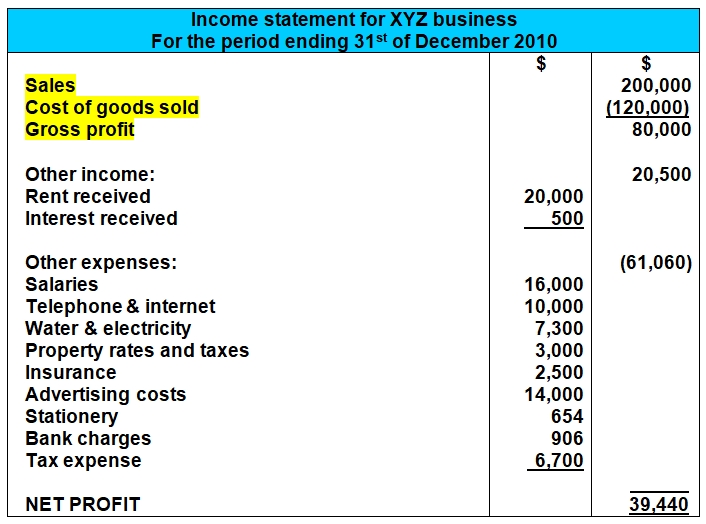

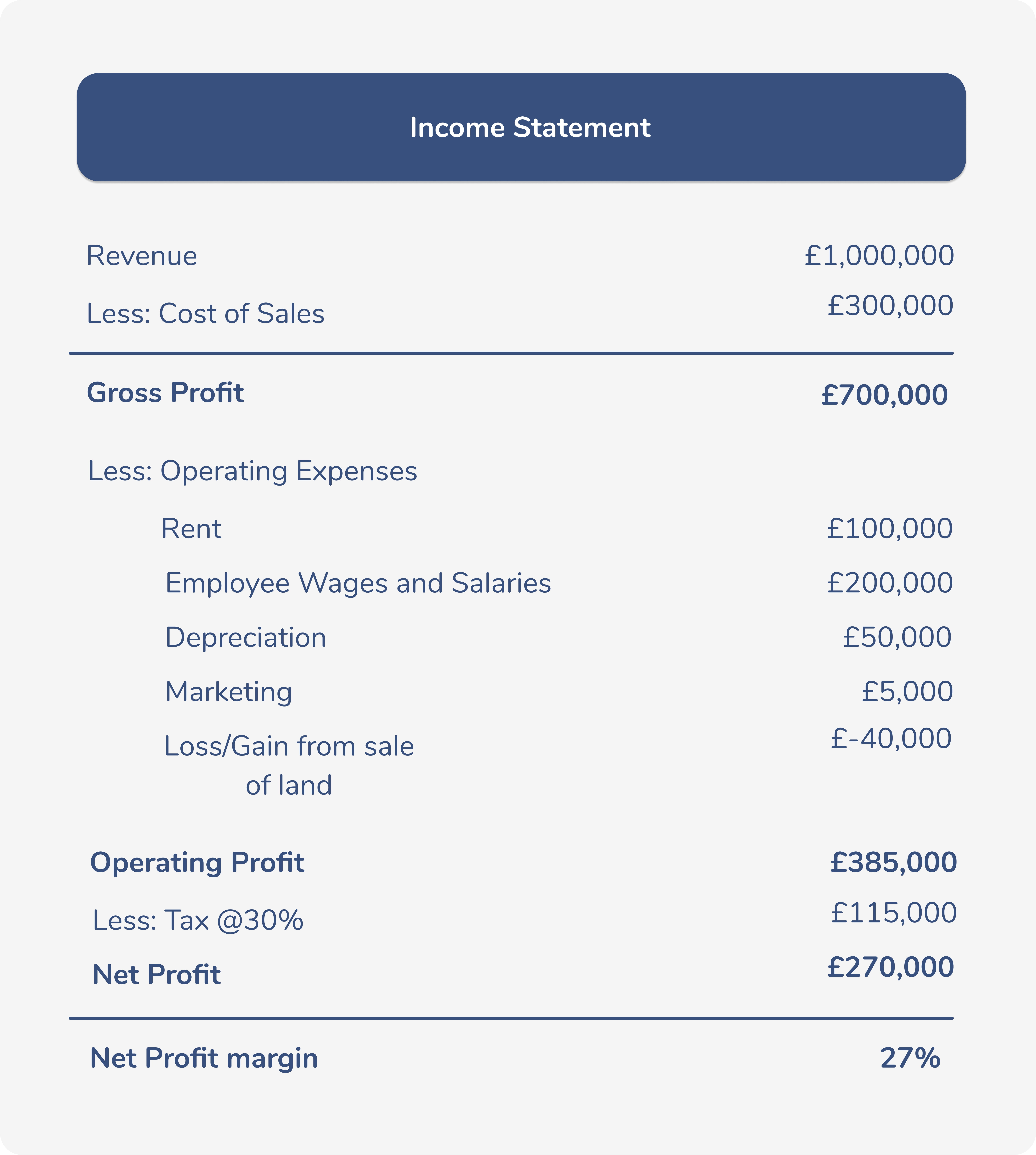

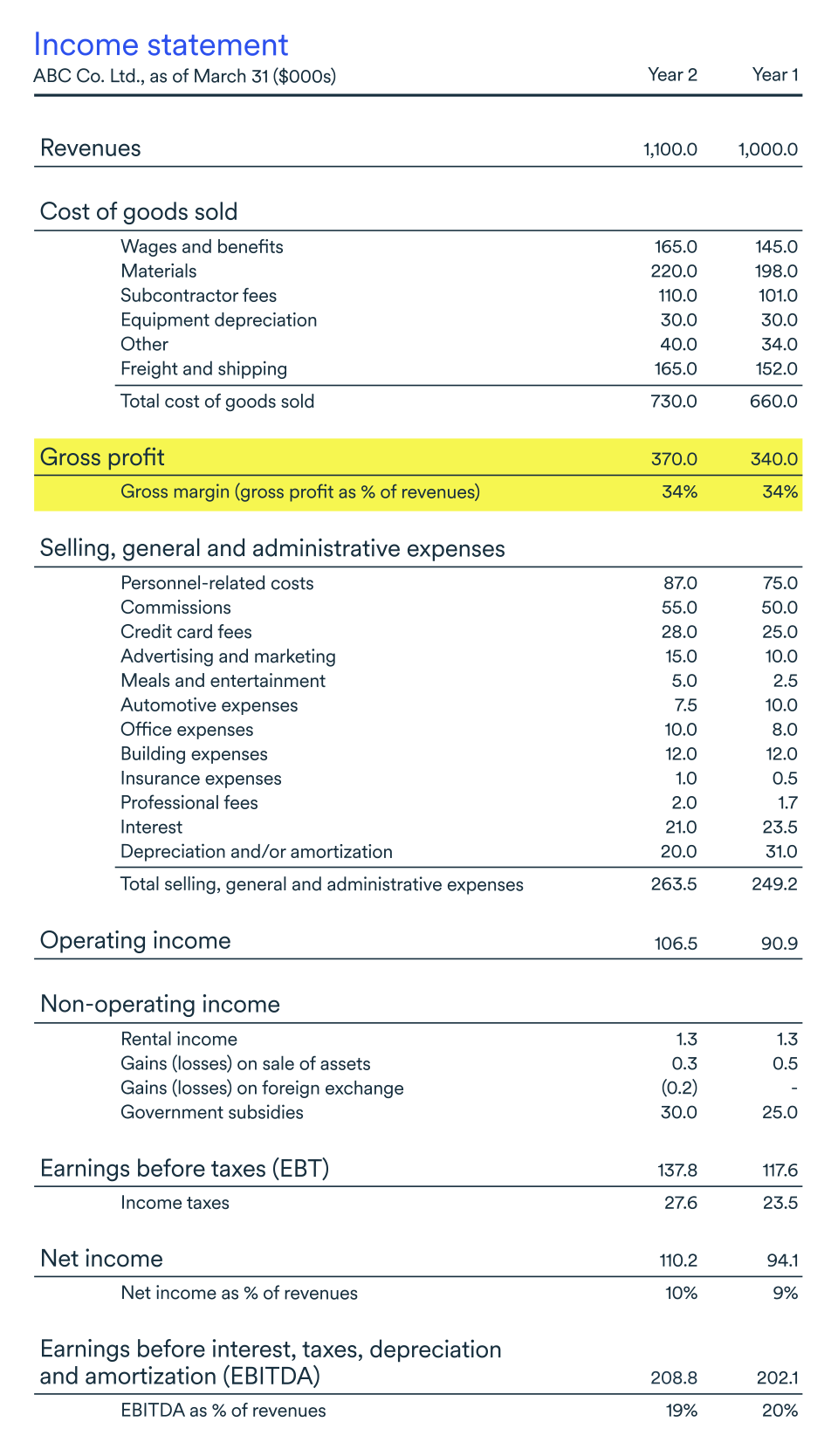

Balance sheet vs. 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate; The line items on the income statement are compared to the sales figure to find your company’s gross margin, operating income and net income, as percentages.

2.2 define, explain, and provide examples of current and noncurrent assets, current and noncurrent liabilities, equity, revenues, and expenses The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period.

A company’s gross income, found on the income statement, is the revenue from all sources minus the firm’s cost. A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time. What is comparative income statement and balance sheet ?

You can learn about the health of a business—up and down, and across time—by looking at its income statement. Many key fundamental ratios use information from the income statement. Keep reading for suggestions about the types of data you can include on each of these financial statements.

Gross margin is a company's profit before operating expenses, interest payments and taxes. A balance sheet provides a snapshot of a company’s financial performance at a given point in time. While the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses.

Wondering what information you should include on an income statement or balance sheet? An income statement compares revenue to expenses to determine profit or loss. Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date.

The term gross margin refers to a profitability measure that looks at a company's gross profit compared to its revenue or sales. To express the metric in percentage form, the resulting decimal value figure must be multiplied by 100. In a horizontal format, assets and liabilities are presented descriptively.

Have a look at the balance sheet template in our handy company workbook to assist you. The line items on the balance sheet can be used to. An income statement tallies income and expenses;

A ‘profit’ means that the business’s income is greater than its expenses. Like the regular income statement, this report can be used to view and print income statements for the current period, or for previous periods. Gross margin (%) = gross profit ÷ net revenue.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)