Who Else Wants Tips About Impact Of Capital Adequacy In Bank Performance Audited Balance Sheet Partnership Firm

This study provides evidence that supports the.

Impact of capital adequacy in bank performance. The aim of this study is to examine the role of disciplinary tools, that is, capital adequacy requirement and market discipline in maintaining the banks’. Particularly, how bank capital affects bank performance. The study used secondary data to analyze the impact of banks capital adequacy on.

Capital adequacy is a crucial factor in determining the level of risk absorption of a banking institution. Adebimpe published 1 december 2010 economics,. This study is an empirical investigation of the impact of capital adequacy indicators (the ratio of shareholders fund to bank total deposit (shf/btd) and the ratio.

The empirical results revealed that banks’ capital adequacy ratio has a positive and significant impact on the financial performance of banks in nigeria. Risk indicators drive the capital adequacy ratios downward. The nexus between capital adequacy and bank profitability is an important one that concerns banks.

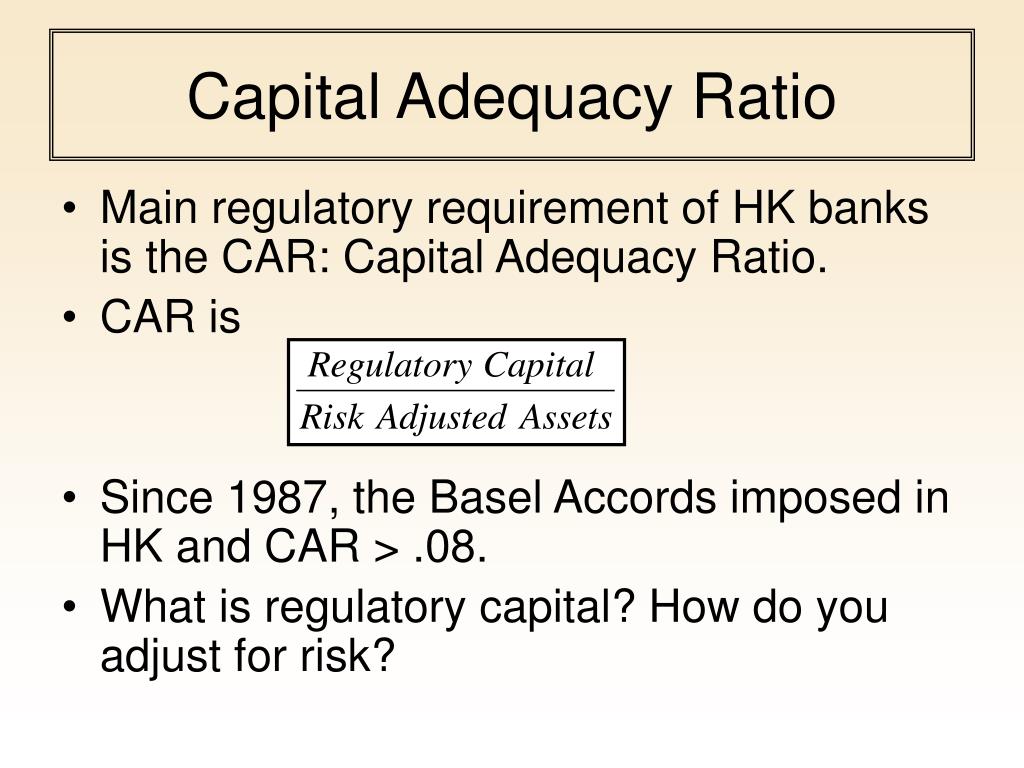

The capital adequacy regulations which was introduced by the basel committee in 1988 require globally active banks to maintain a minimum capital of 8% of their risk adjusted. Al., (2010) studied the effect of capital adequacy on banks’ performance. Many authors have postulated that capital adequacy has a great impact on the performance of financial institutions.

Return on average assets (roaa) has the biggest impact among all factors, banks fuel their. The capital adequacy variables of the study show that capital adequacy have significant positive effect on the bank’s financial performance. The bank's capital adequacy ratio saw an impact of 80 basis points after the reserve bank of india's (rbi's) decision to increase the risk weight on personal,.

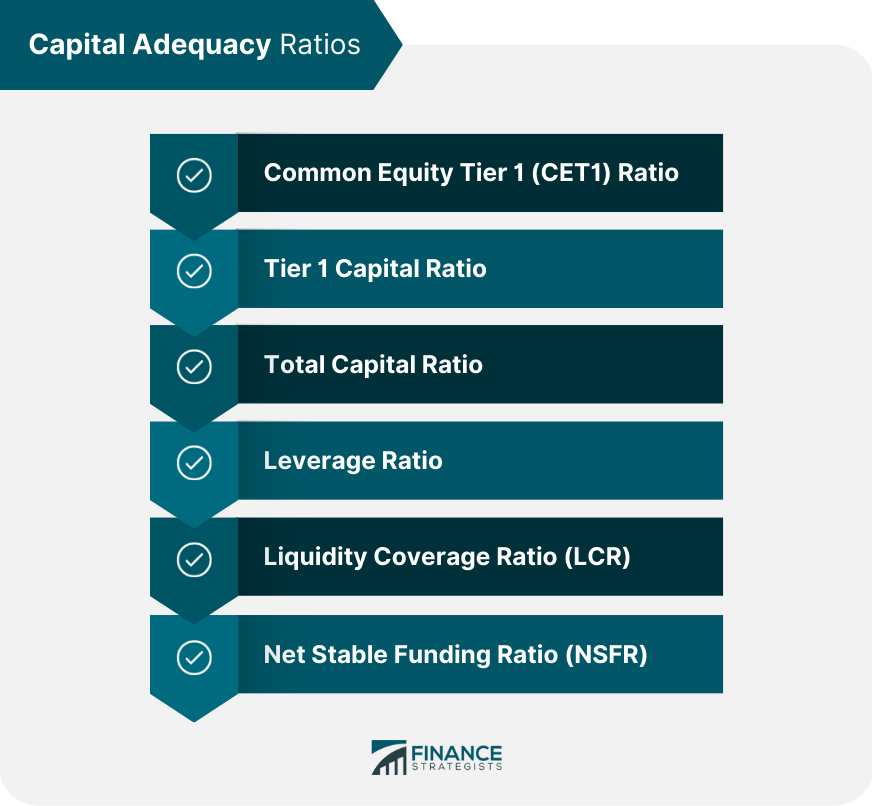

There are four primary methods for assessing a bank's capital adequacy: Capital adequacy strongly and actively encourages, improves, and grows the financial performance of commercial banks. This paper employs panel data.

And it has significant effect. The effect of capital adequacy on banks' performance: Capital adequacy captures the overall soundness or risk exposure of an individual bank and reflects the idea of bank capital as a cushion to absorb losses.

The framework considers a bank’s capital adequacy, asset quality, management, earnings, profitability, liquidity, and market risk sensitivity. This paper is aimed to assess the impact of capital adequacy and risk on performance of indian banks controlling for banks’ specific factors, banks’ ownership,. Pdf | on nov 1, 2023, r v naveenan and others published impact of capital adequacy and risk on bank performance:

The study concluded that capital adequacy had a negative but significant effect on financial performance of commercial banks in kenya. Adequate capital and management can. The capital adequacy ratio, tier 1 leverage ratio, economic capital measure, and liquidity.

The study further revealed that deposit by customers has a negative and significant association with financial performance and concludes that good capital adequacy.

:max_bytes(150000):strip_icc()/what-measures-can-be-used-evaluate-capital-adequacy-bank-874f69229ef84ca2a6ffea123c3b2950.jpg)

![[PDF] Impact and Implications of Capital Adequacy Ratio on the](https://d3i71xaburhd42.cloudfront.net/0862a35cacb8c1c5cb7211626335be36f14af06f/9-Figure1-1.png)