Inspirating Info About Difference Balance Sheet And Income Statement Cash Fund Flow

An income statement shows what income is going in and what spending is going out, detailing a net profit or loss for a company.

Difference balance sheet and income statement. A p&l statement provides information about whether a company can. Income statements emphasize net profit within an accounting period. Together, they’re a financial force to reckon with.

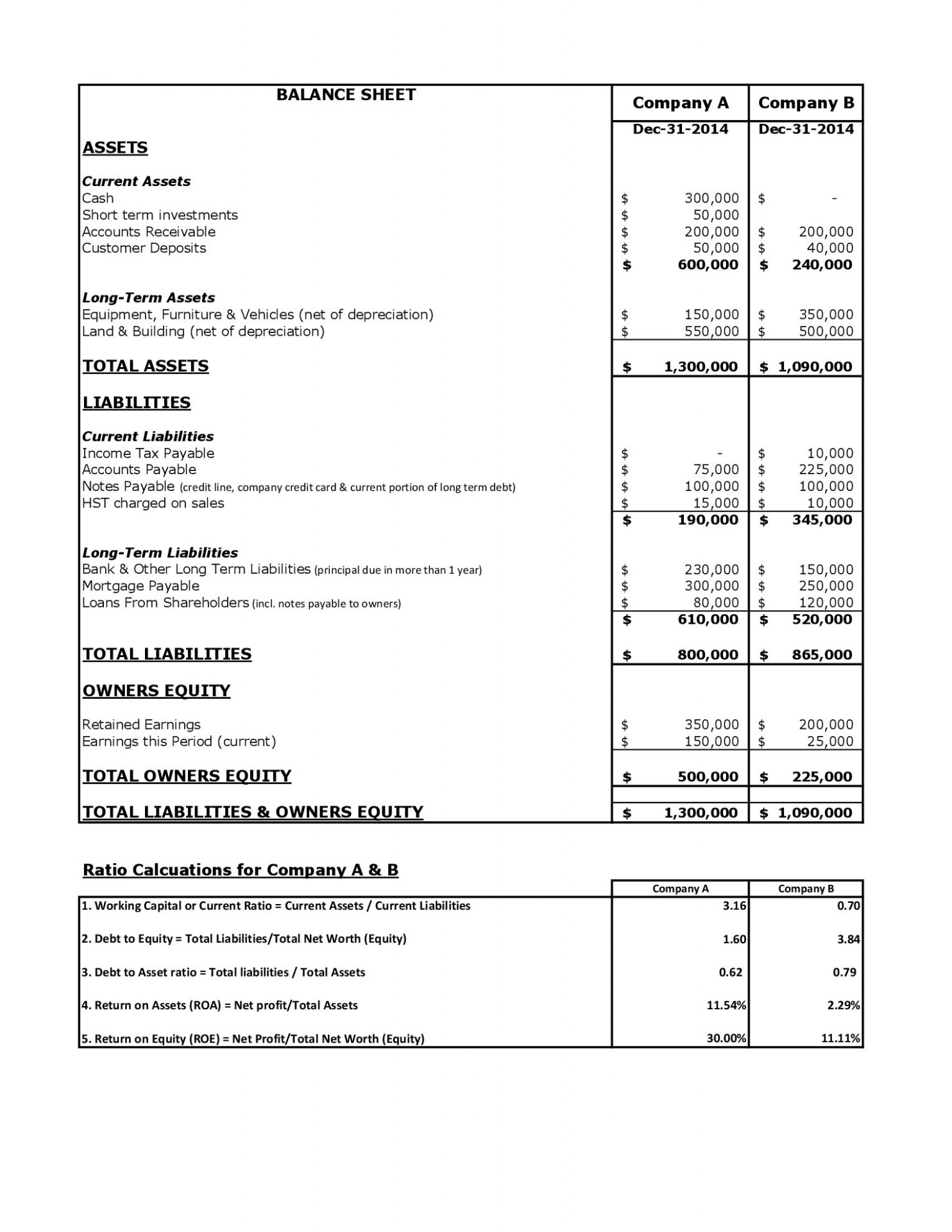

Balances sheets cover assets, liabilities, and. On the other hand, the income statement shows the company’s total income and expenditure over some time. Updated february 3, 2023 a business records accounting activities using several key financial reports, including the balance sheet and income statement.

Income statements, balance sheets, and cash flow statements are all financial reports that detail how money enters and departs a company. The income statement, often called the profit and loss statement, shows the revenues, costs, and. The balance sheet shows the company assets and liabilities (what it owns and what it owes) at a specific period.

A comparative balance sheet and income statement is shown for cruz, incorporated. Analyzing a balance sheet vs. The balance sheet is a powerful.

A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. For example, the balance sheet from the 14th of the month could be different from a balance sheet. (1) the income statement, (2) the balance sheet, and (3) the cash flow statement.

And the balance sheet gives you a snapshot of your assets and liabilities. (1) reporting periods (most income statements come out quarterly, whereas balance sheets are less tied to specific accounting periods); They are important, yet very different.

The income statement provides the company’s business performance during the given period. In contrast, a balance sheet is one of the company’s financial statements that present the shareholders’ equity, liabilities, and the company’s assets at a particular time. By dori zinn october 28, 2019.

These two documents are essential for tracking financial status across all company departments. The income statement includes a specified period of time, which can be as short as a week to as long as several years. A balance sheet shows a company’s assets, liabilities and equity at a specific point in time.

And (3) detailed revenue streams. Cash flow statements go into the greatest detail about specific revenue sources and expenses. Below, you will find few points showing the difference between the income statement and balance sheet.

A company's assets must be equal to (or. Balance sheets income statements; Investors and creditors analyze the balance sheet to determine how well management is putting a company's.

.png)