Neat Tips About Manufacturing Expenses In Profit And Loss Account Puma Financial Statements 2019

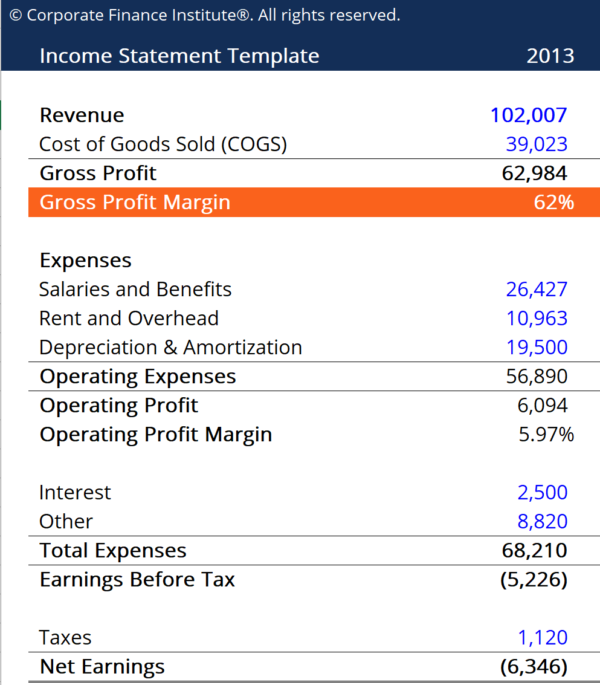

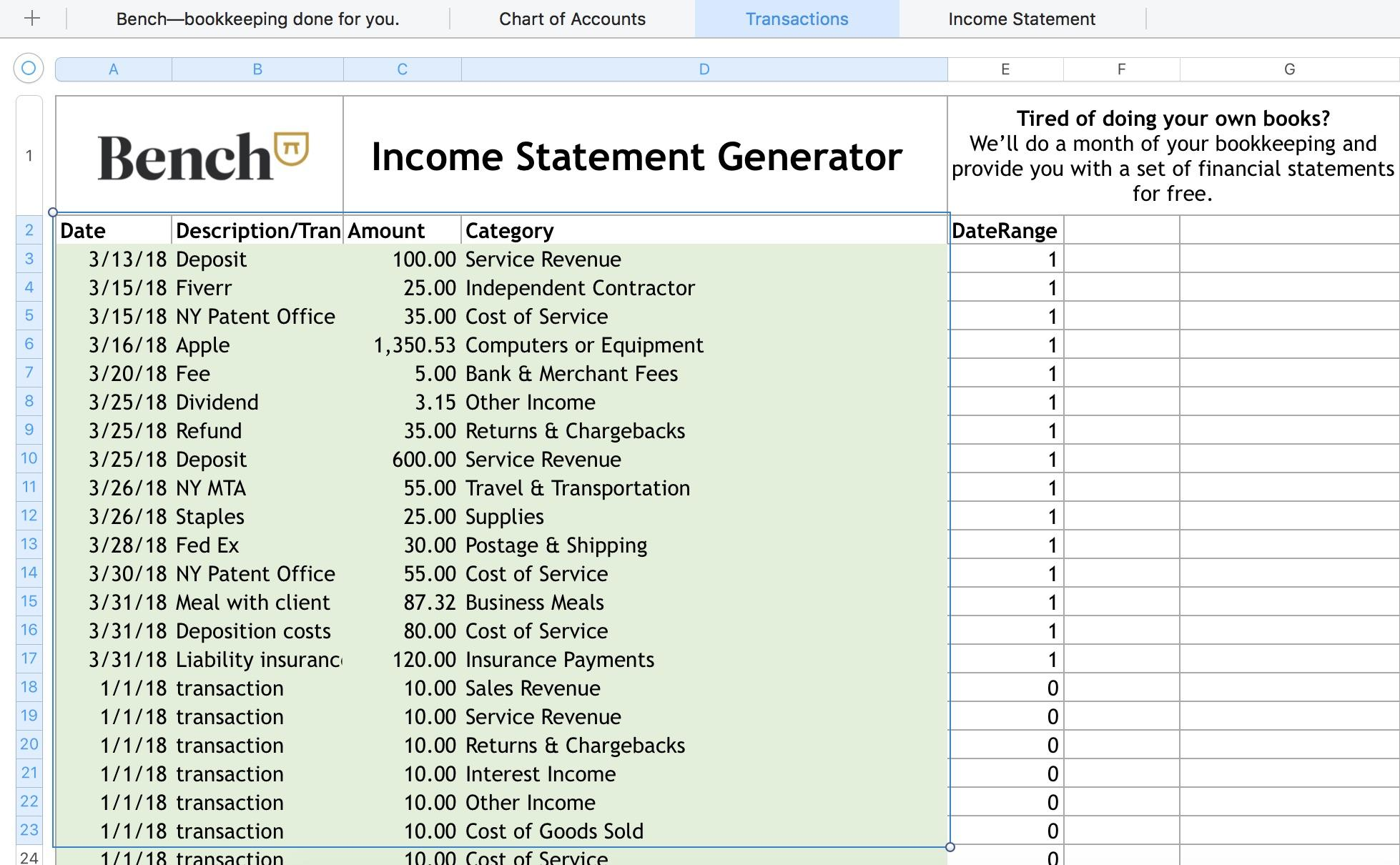

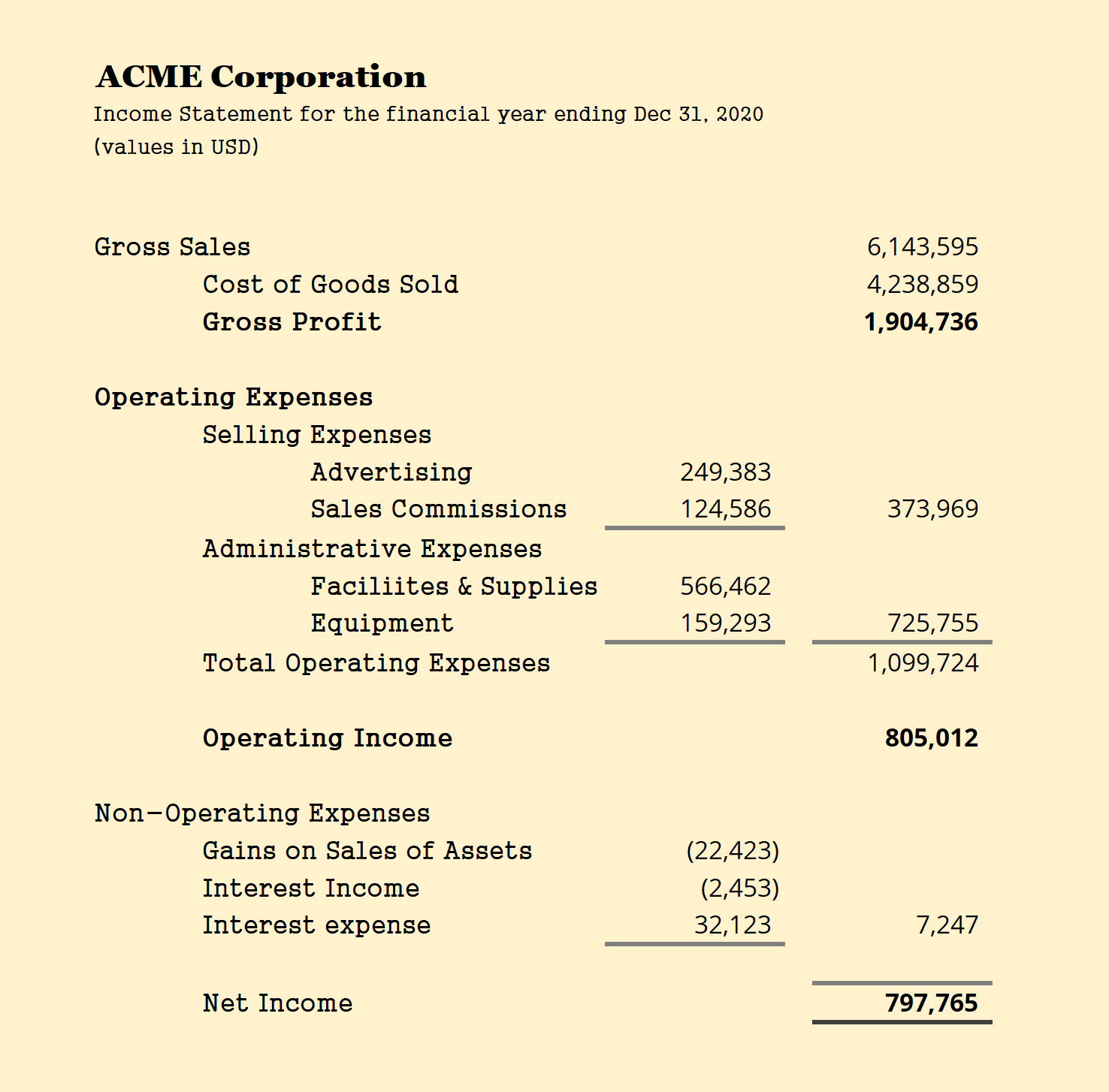

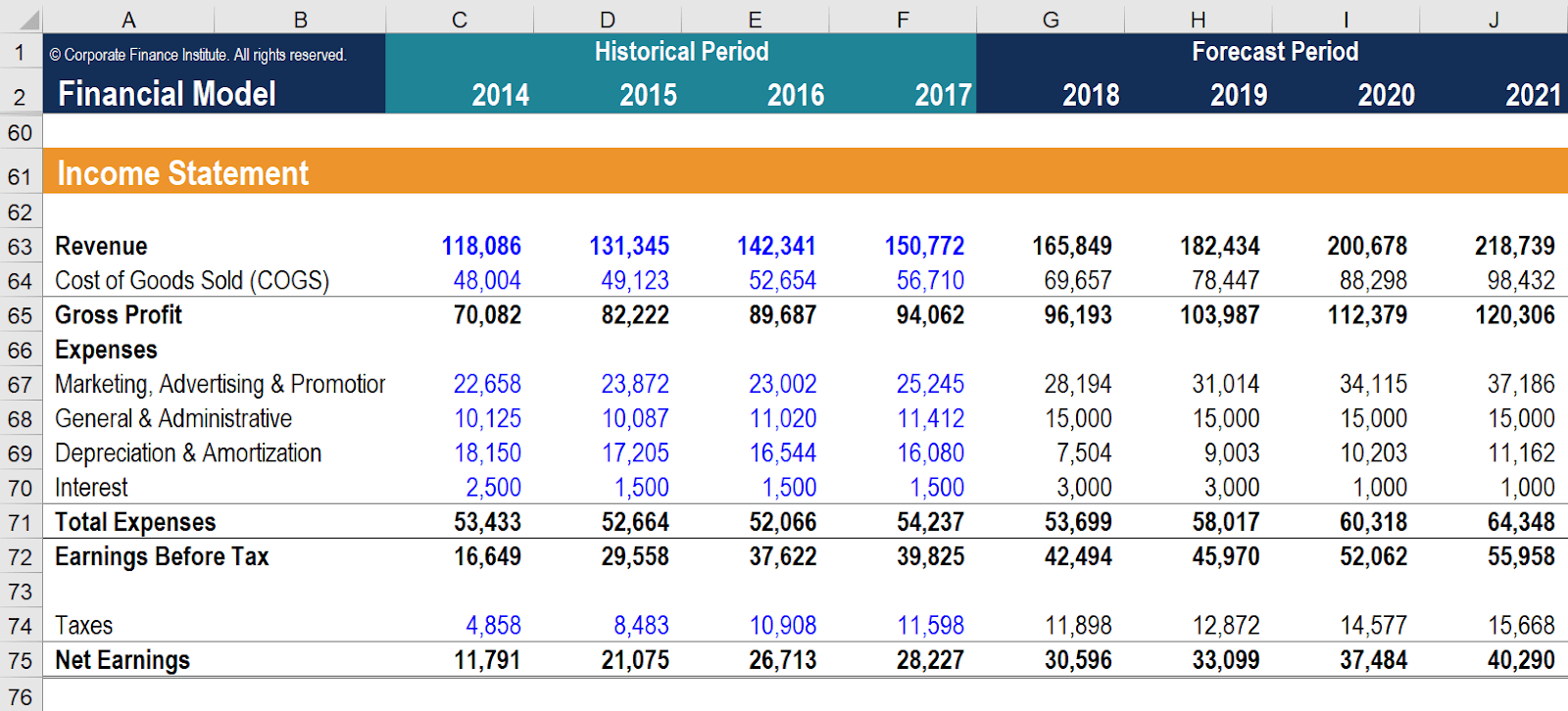

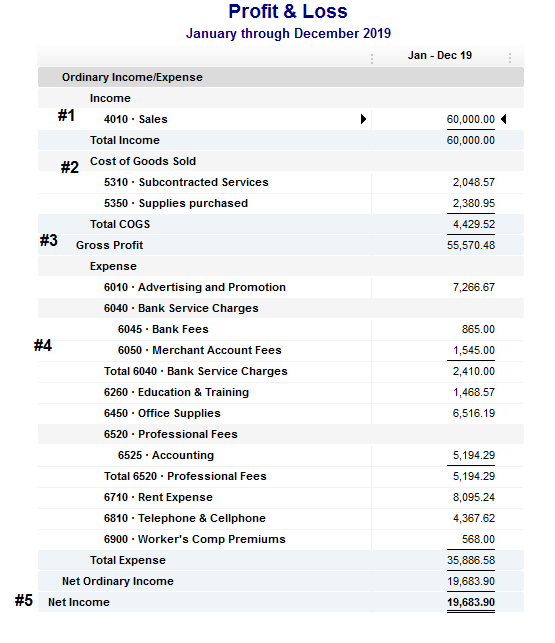

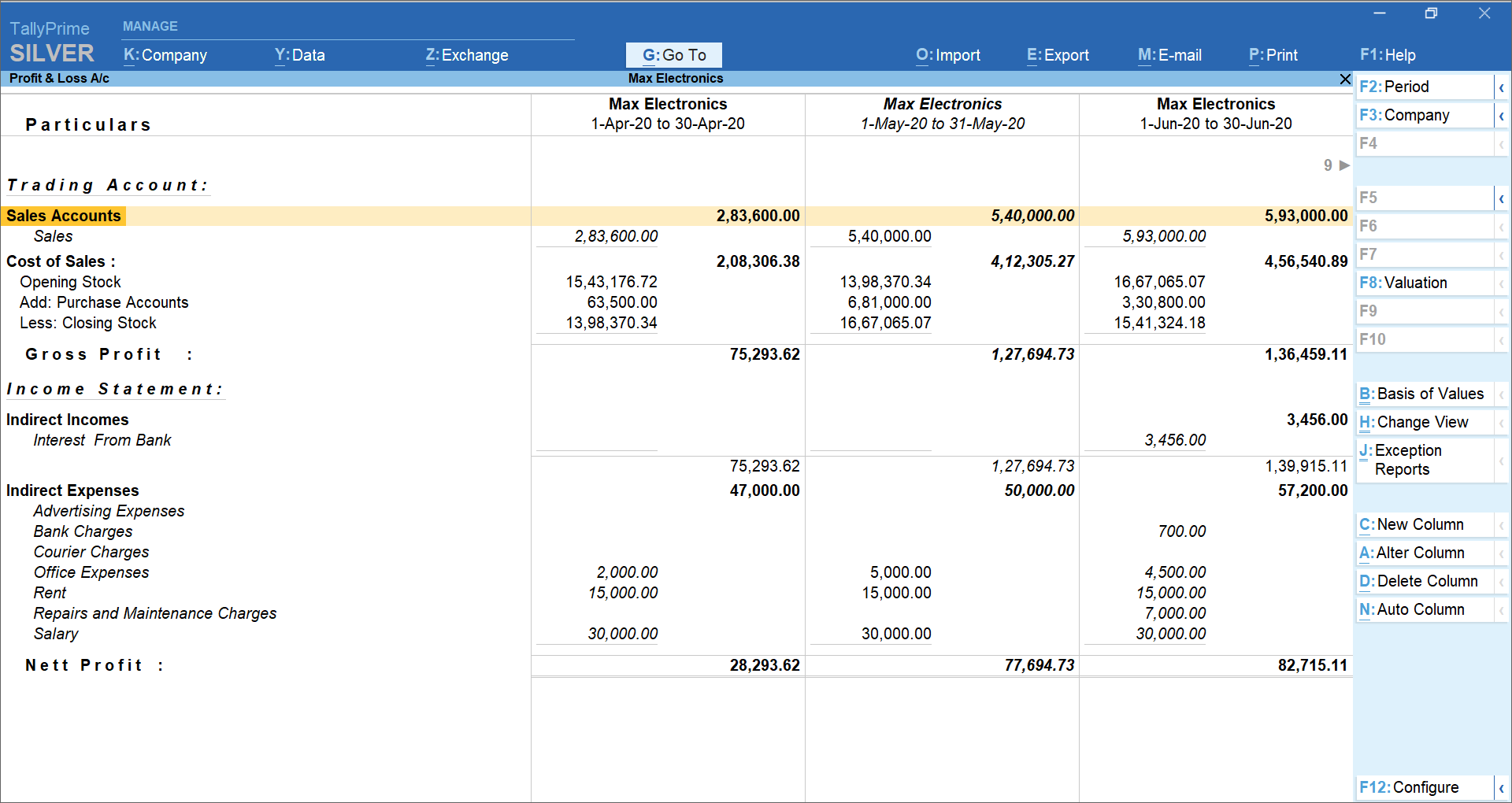

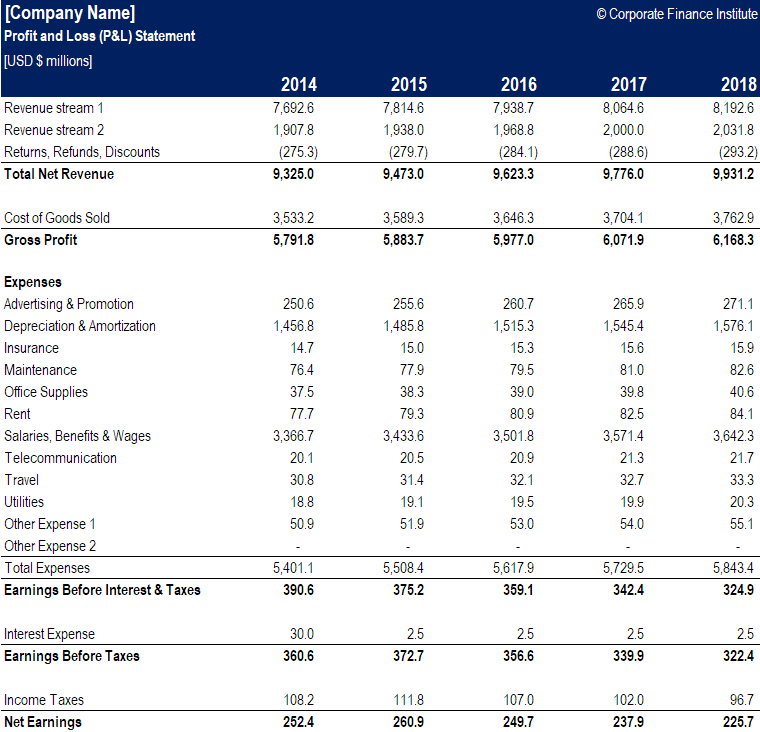

The profit and loss (p&l) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period.

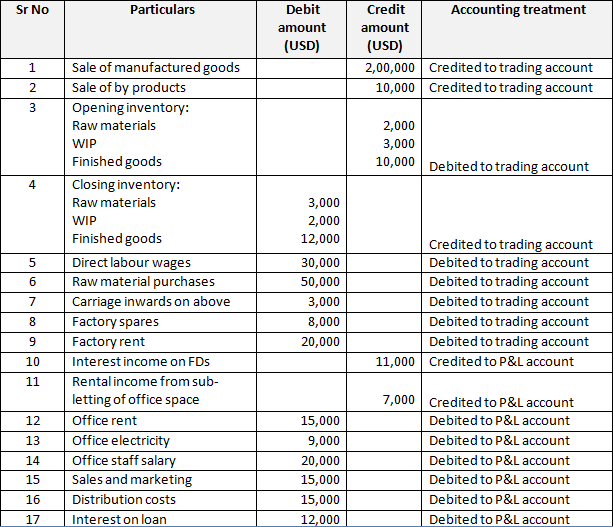

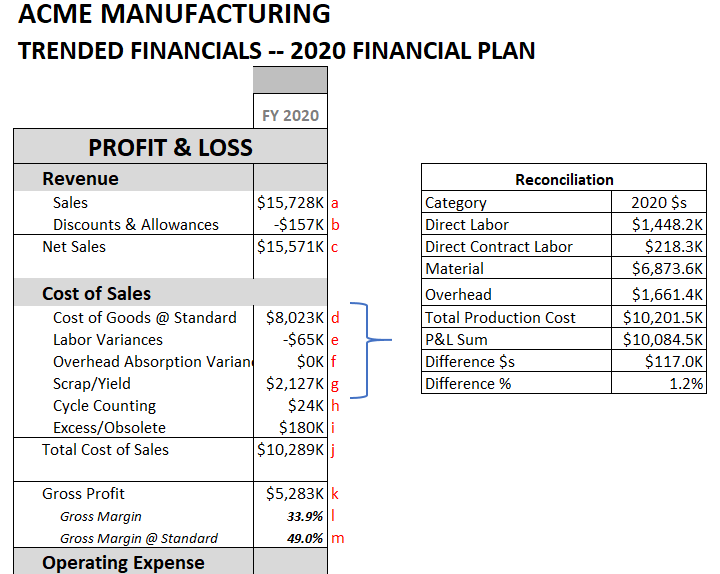

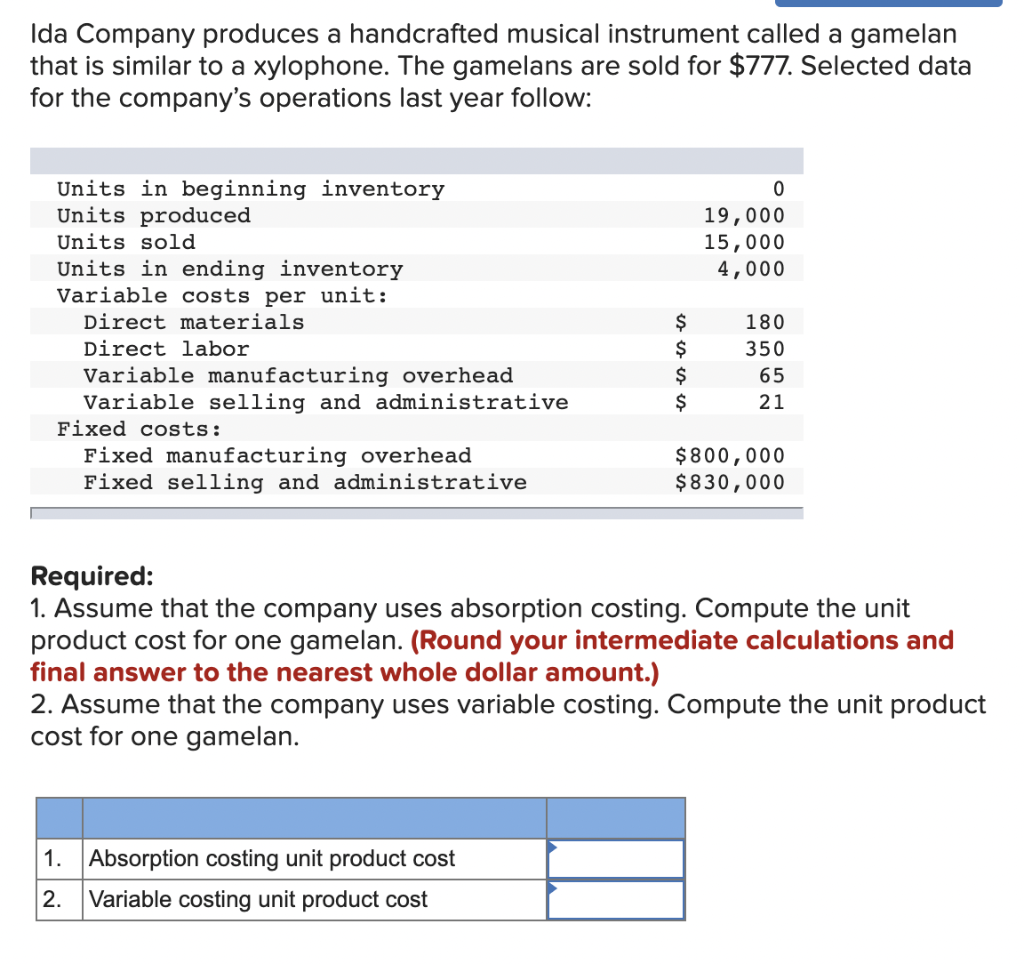

Manufacturing expenses in profit and loss account. The main purpose of preparing the manufacturing account is to ascertain the cost of goods manufactured during the financial year and to ascertain the amount of. Standard costs in most manufacturing environments consist of three components: All the items of revenue and expenses.

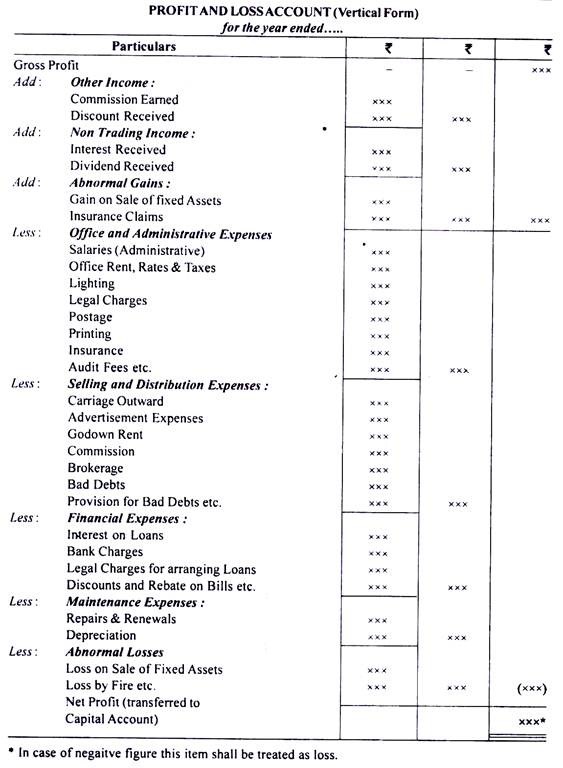

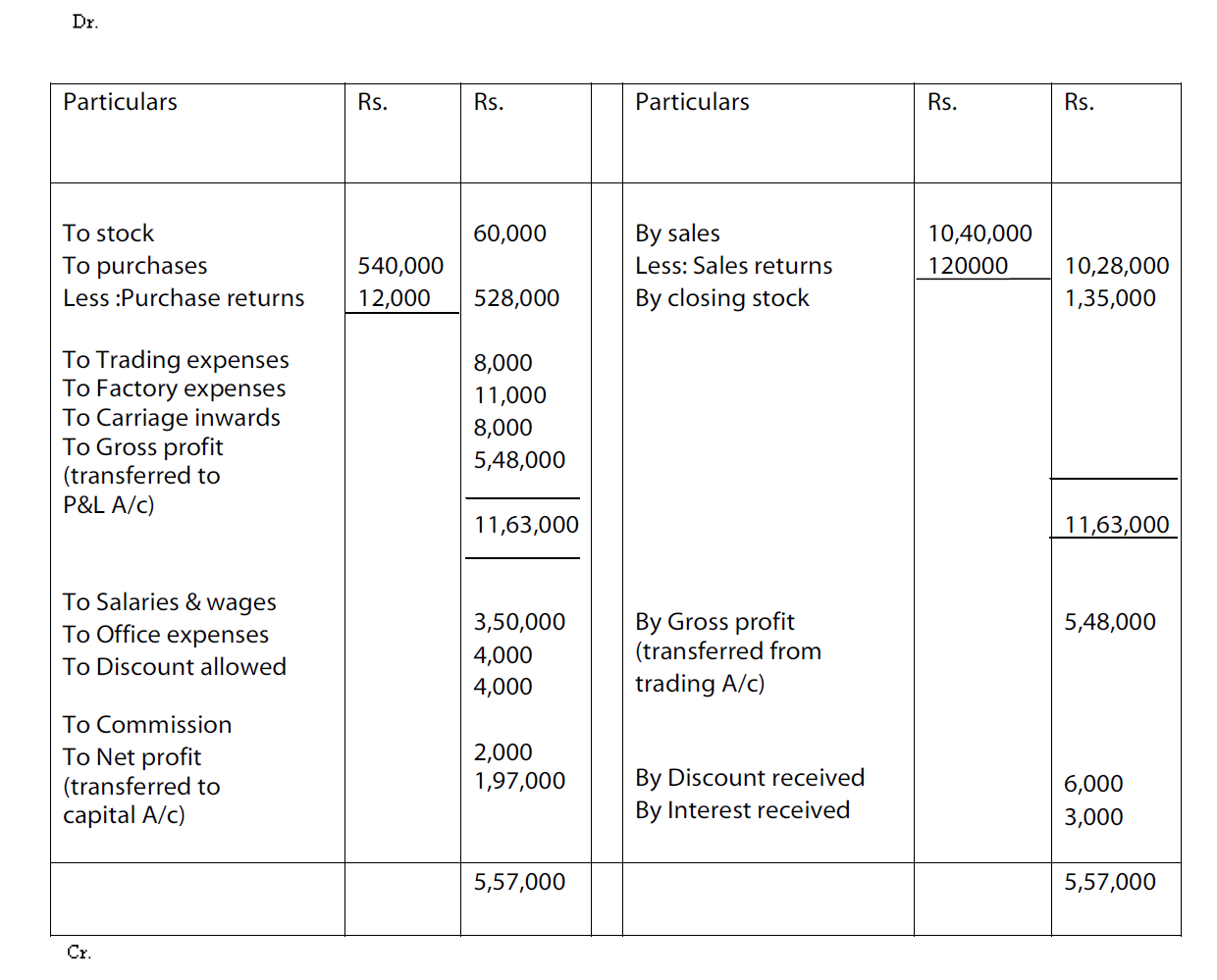

Cbse cbse study material textbook solutions cbse notes what is manufacturing account? This reveals the total profit your company has made. Only indirect expenses are shown in this account.

Profit and loss account trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business while the profit and loss. If a business actually makes the goods that they will sell, we need to calculate the cost of producing the goods and use this instead of 'purchases' in the. Conclusion expenses are amounts paid for goods or services purchased.

1) it is important to know that examiners will have a list of expenses for you to categorize whether there are “factory overhead,” “administration expenses” and. The aim is to transfer the indirect expenses and indirect revenue accounts to the profit and loss account. The manufacturing account gives information on all the.

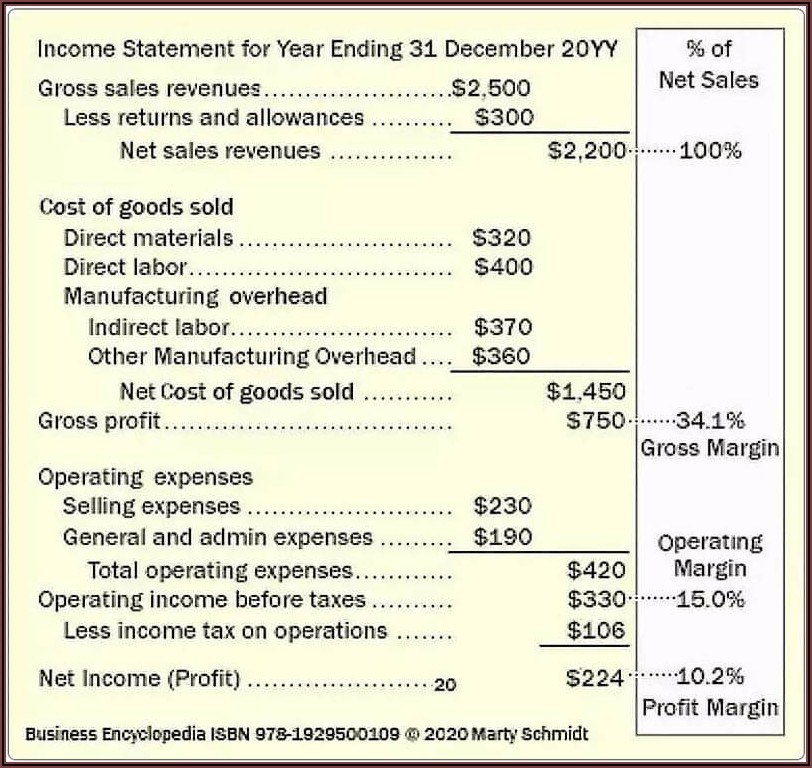

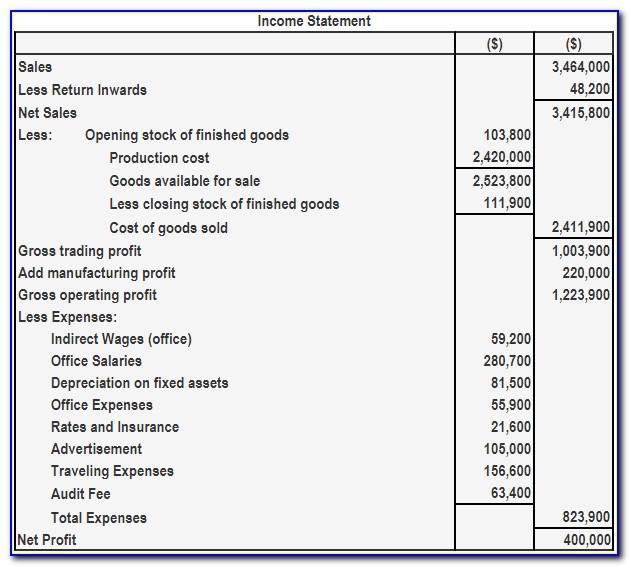

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. Profit and loss account is made to ascertain annual profit or loss of business. Manufacturing trading profit and loss account for the month of december 31 2020.

The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. Your net profit deducts all expenses (direct and indirect) from your total revenue. It helps in improving the cost.

The type of expense and. Manufacturing account the main purpose of preparing manufacturing account is to determine manufacturing costs of finished goods. The trading profit and loss account of a manufacturing business is similar in format to that of a merchandising business except that purchases is replaced by the manufacturing cost of goods completed.

7000 41000 www.igcseaccounts.com sales 80000 cost of goods sold open stock (of finished goods) 4000 production cost of goods completed 41000 45000. The profit & loss account reports the incomes and expenses directly related to an organisation to measure the performance in terms of profit or loss.