Favorite Info About Cash Outflow Formula Inflow Statement Excel

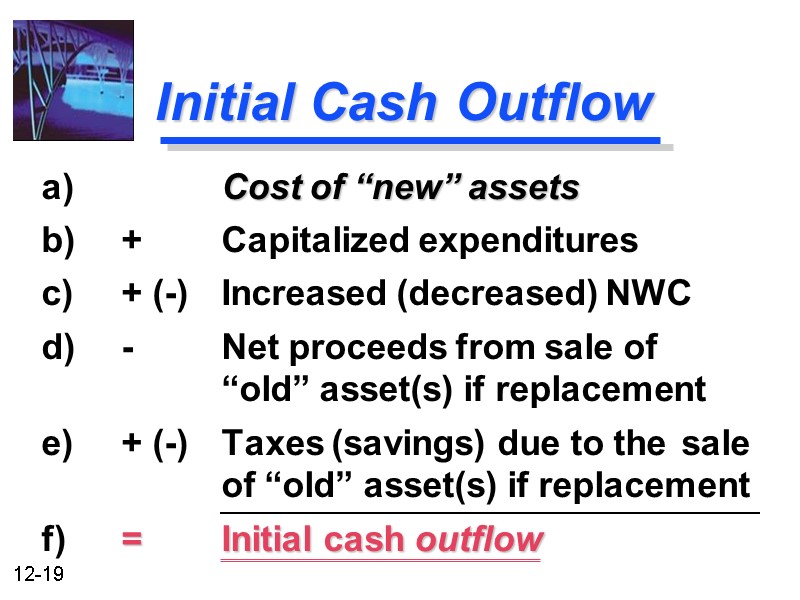

There isn’t a universal cash outflow formula, but any money leaving the company is considered an outflow.

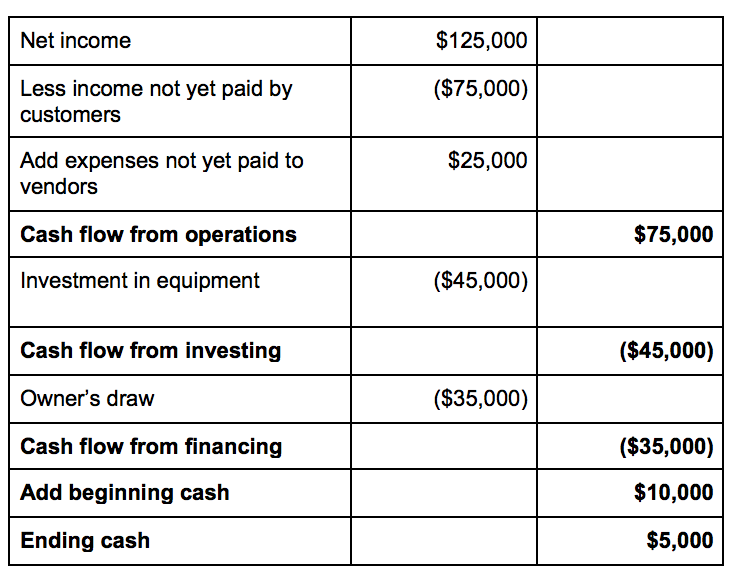

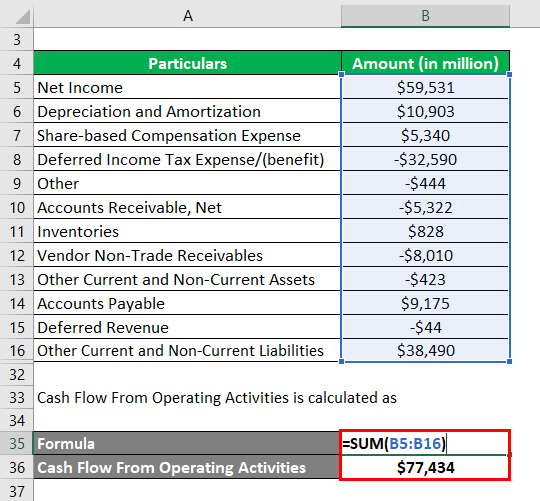

Cash outflow formula. The formula for calculating the cash from investing section is as follows. Net income is the amount of revenue you have earned, calculated using the following formula: The formula for net cash flow calculates cash inflows minus cash outflows:

Cash generated and spent by a. Cash flow from investing activities = (capital expenditures) +. Depreciation is a financial accounting method used to allocate the cost of tangible assets over t.

Operating activities = £10,000 investing activities = £20,000 financing. A graphic designer has two checking accounts and a savings account. What is the net cash flow formula?

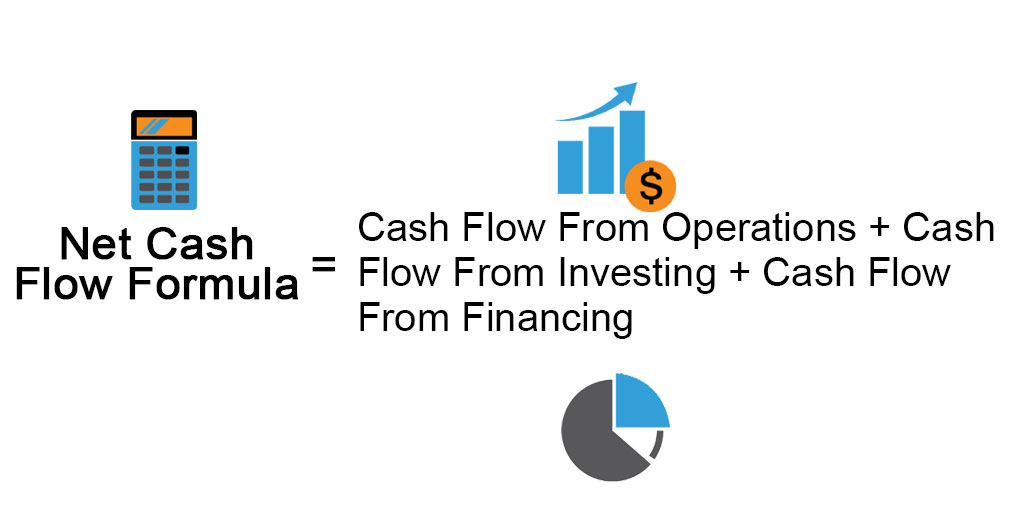

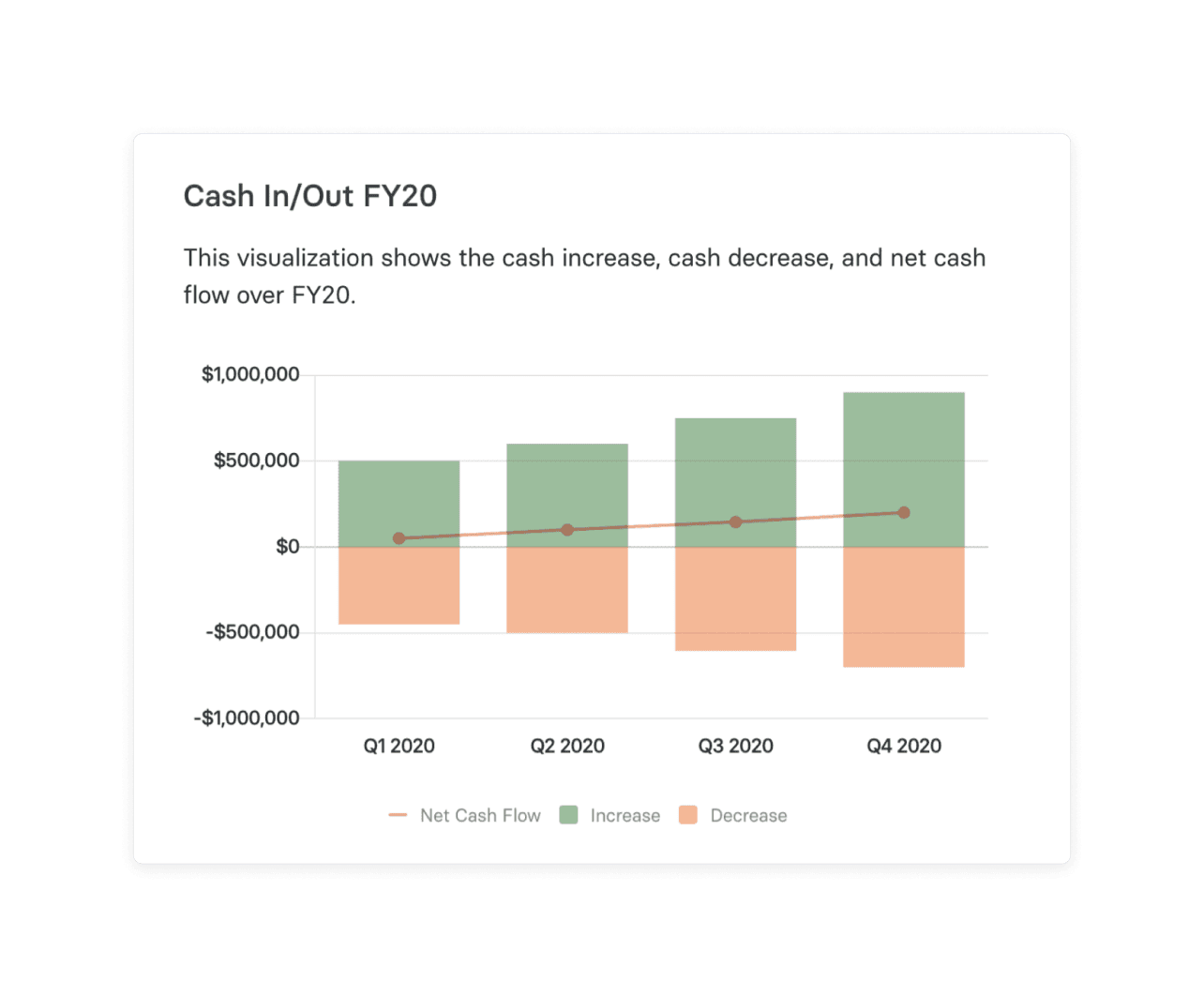

Total cash outflow = cash flow from operating activities + cash outflow from investing activities + cash flow from financing activities. Next page opening and closing balance previous page calculating and interpreting cash flow. To calculate net cash outflows, consult the cash flow statement.

There were inflows of $16.1 billion to stocks, and $11.6 billion to bonds, compared to outflows of $18.4 billion from cash, the most in eight weeks, bofa said in its. Direct method the cash flow formula according to the direct method is one way of calculating the cash flow balance so that other cash flow. For instance, if your cash outflow from:

It can also be expressed as the sum of. Put simply, ncf is a business’s total cash inflow minus the total cash outflow over a particular period. Cash flow formula:

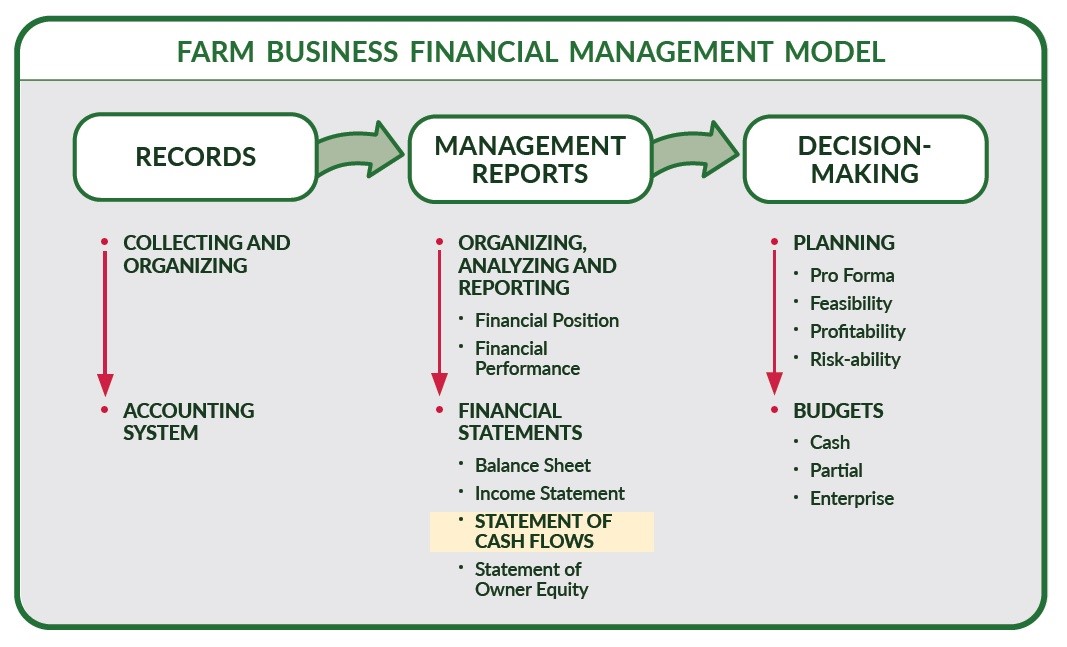

Cash inflow refers to what comes in, and cash outflow is what goes out. Net cash flow comes from three business activities:

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)