Fabulous Tips About Initial Balance Sheet Itc Audit Report

What is a balance sheet?

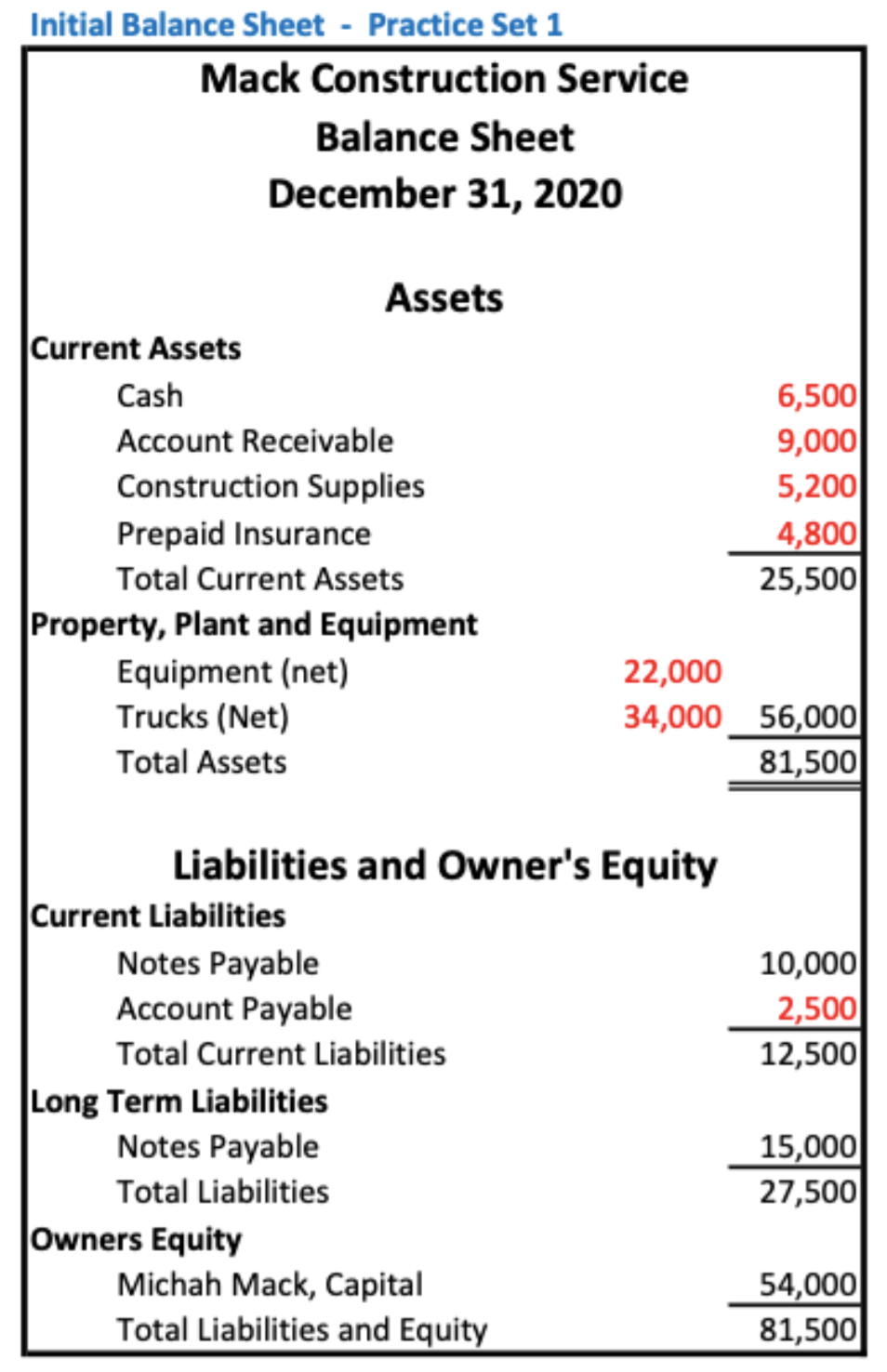

Initial balance sheet. Imagine that we are launching a web design company. Now insert the following formula to sum the debit and drag the fill handle to the right to get the credit total. Balance sheet atau biasa disebut neraca adalah salah satu dari empat laporan keuangan fundamental dan merupakan kunci bagi financial modeling dan akuntansi.

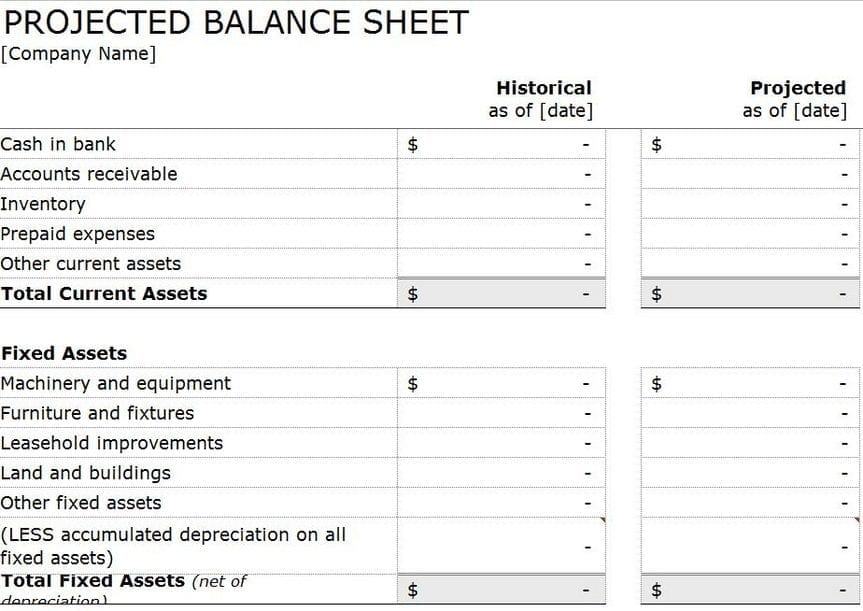

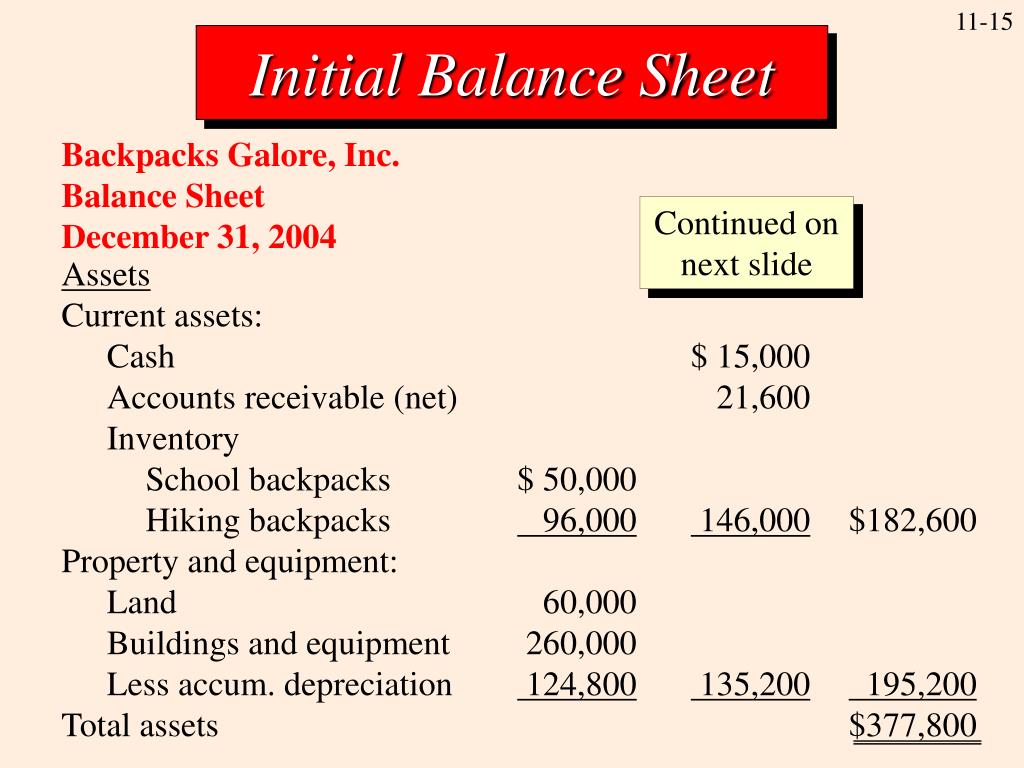

Collect accounts that go on the balance sheet. This balance sheet explains in a summarized way the initial situation of the company on a financial and equity level. A balance sheet is a summary of your startup’s assets, liabilities, and equity to convey your company’s financial position.

We have sar 5000 in personal startup money to get things started. Determine the reporting date and period. Ias 39 requires that all financial assets and all financial liabilities be recognised on the balance sheet.

Companies are required to create three financial reports quarterly and annually: Neraca menampilkan total aset perusahaan, dan bagaimana aset ini dibiayai, baik melalui hutang atau ekuitas. You can think of it like a snapshot of what the business looked like on that day in time.

Write out every asset of the company and how much each asset is worth. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. The balance sheet is a statement that shows the financial position of the business.

The company’s balance sheet is an accounting report that shows a company’s assets, liabilities, and shareholders’ equity. The balance sheet definition of a company is a formal record prepared by a company to present its financial position at the end of an accounting period, typically on a specific date. A balance sheet determines the financial position of your.

Use the appropriate format and structure to present the assets, liabilities, and owner's equity. The balance sheet is a key financial statement that provides a snapshot of a company's finances. How to prepare a balance sheet:

The income statement, statement of cash flows and the balance sheet, also referred to as the statement of financial position. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. What is an opening balance sheet?

The balance sheet is based on the fundamental equation: These balances are usually carried forward from the ending balance sheet for the immediately preceding reporting period. It reports a company’s assets, liabilities, and equity at a single moment in time.

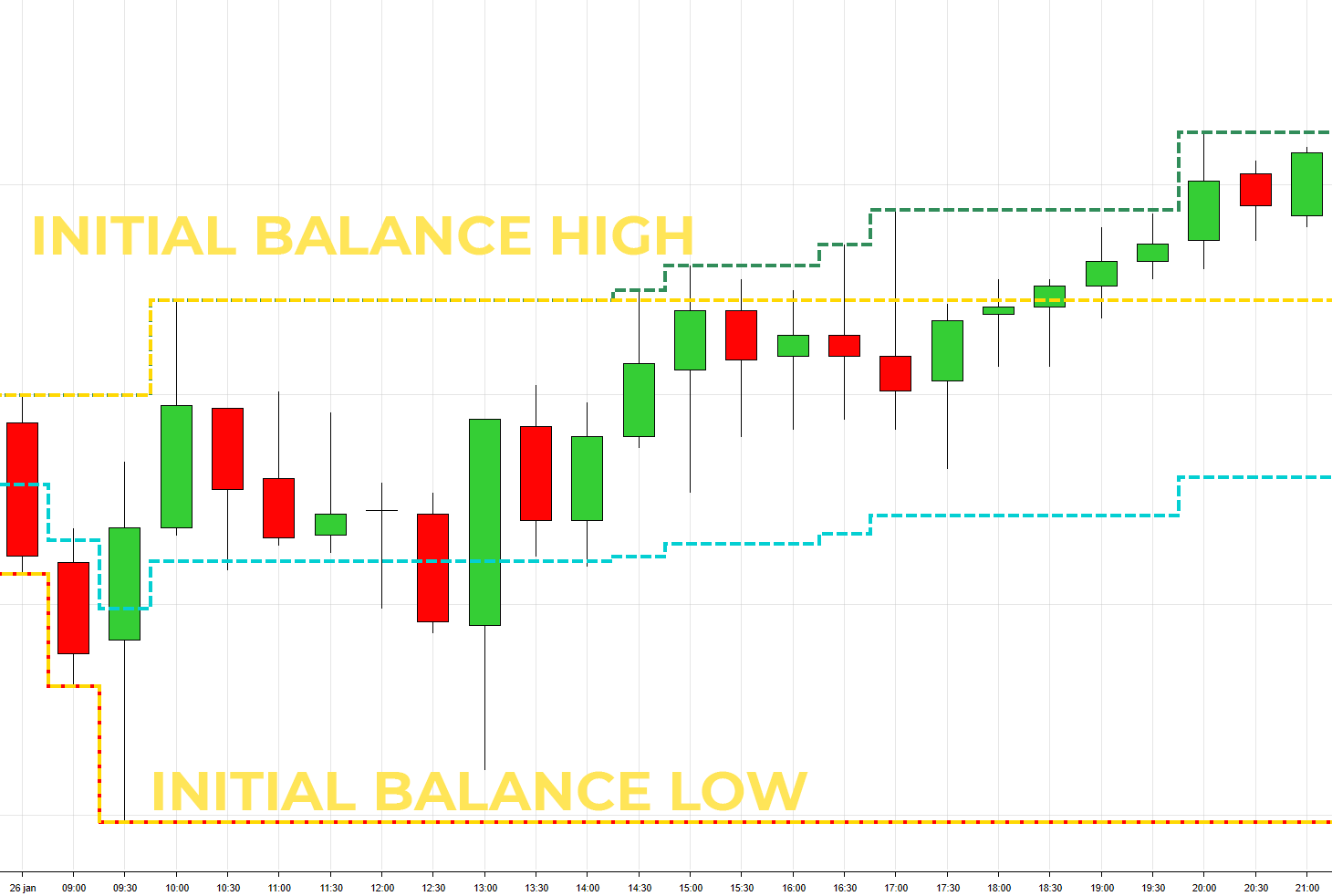

While income statements and cash flow statements show your business’s activity over a period of time, a balance sheet gives a snapshot of your financials at a particular moment. Create formation of an initial balance sheet you must take into account every expense at the start of the business and organize them. The balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle.