Simple Info About Purpose Of Pro Forma Financial Statements Importance Common Size Analysis

Growing just for the sake of growing doesn’t always yield favorable income for the firm.

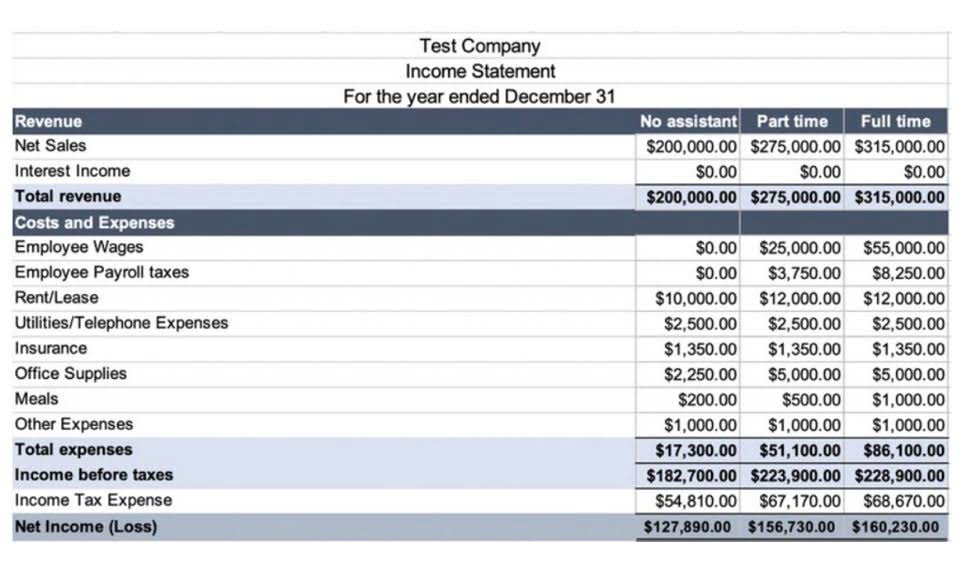

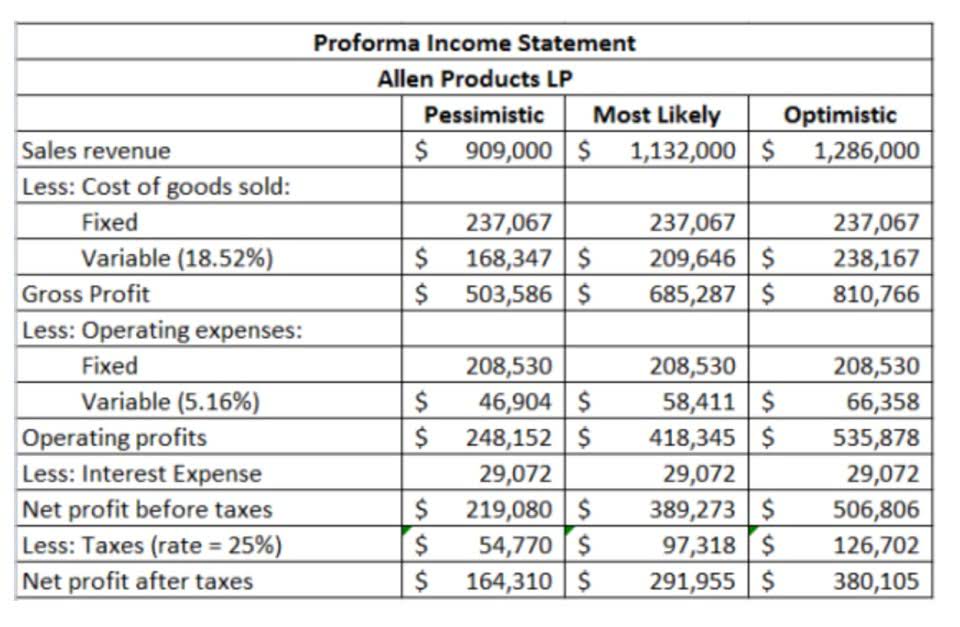

Purpose of pro forma financial statements. As in, “what if my business got a $50,000 loan next year?” Pro forma statements are useful with regard to tracking future financial direction and occurrences, often including some historical numbers to help account for what the projected outcomes should look like. How are pro forma financial statements used?

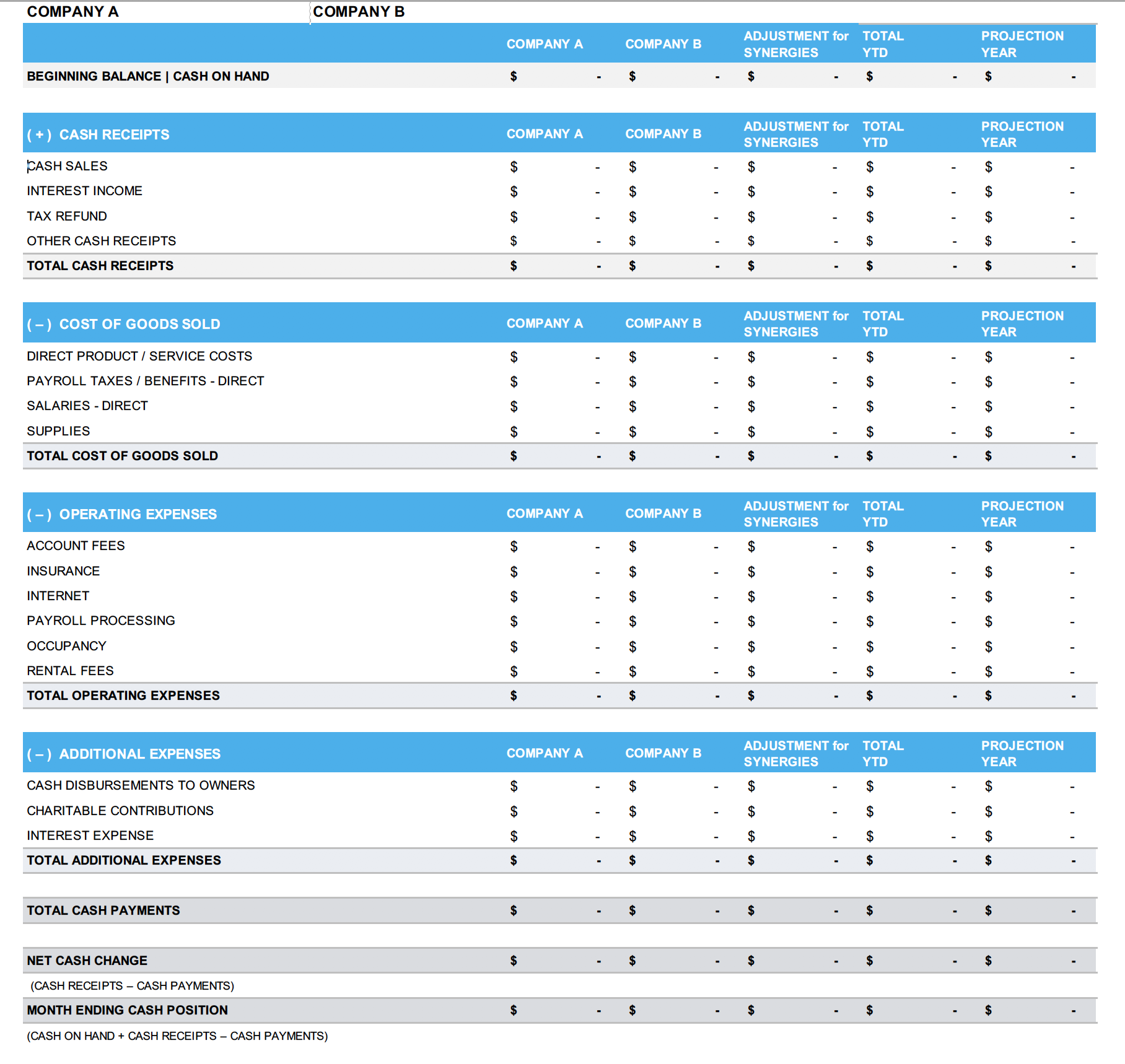

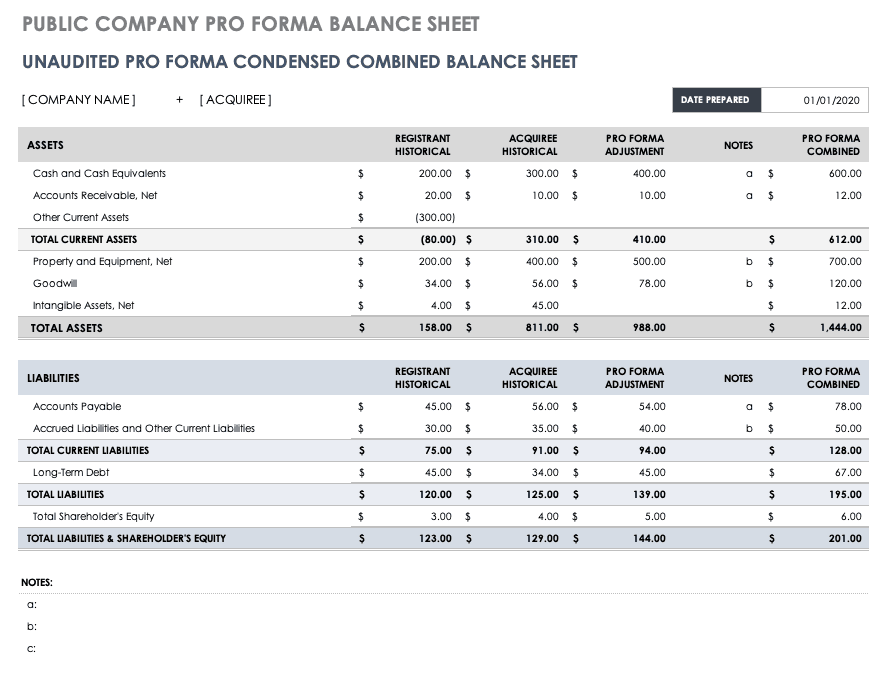

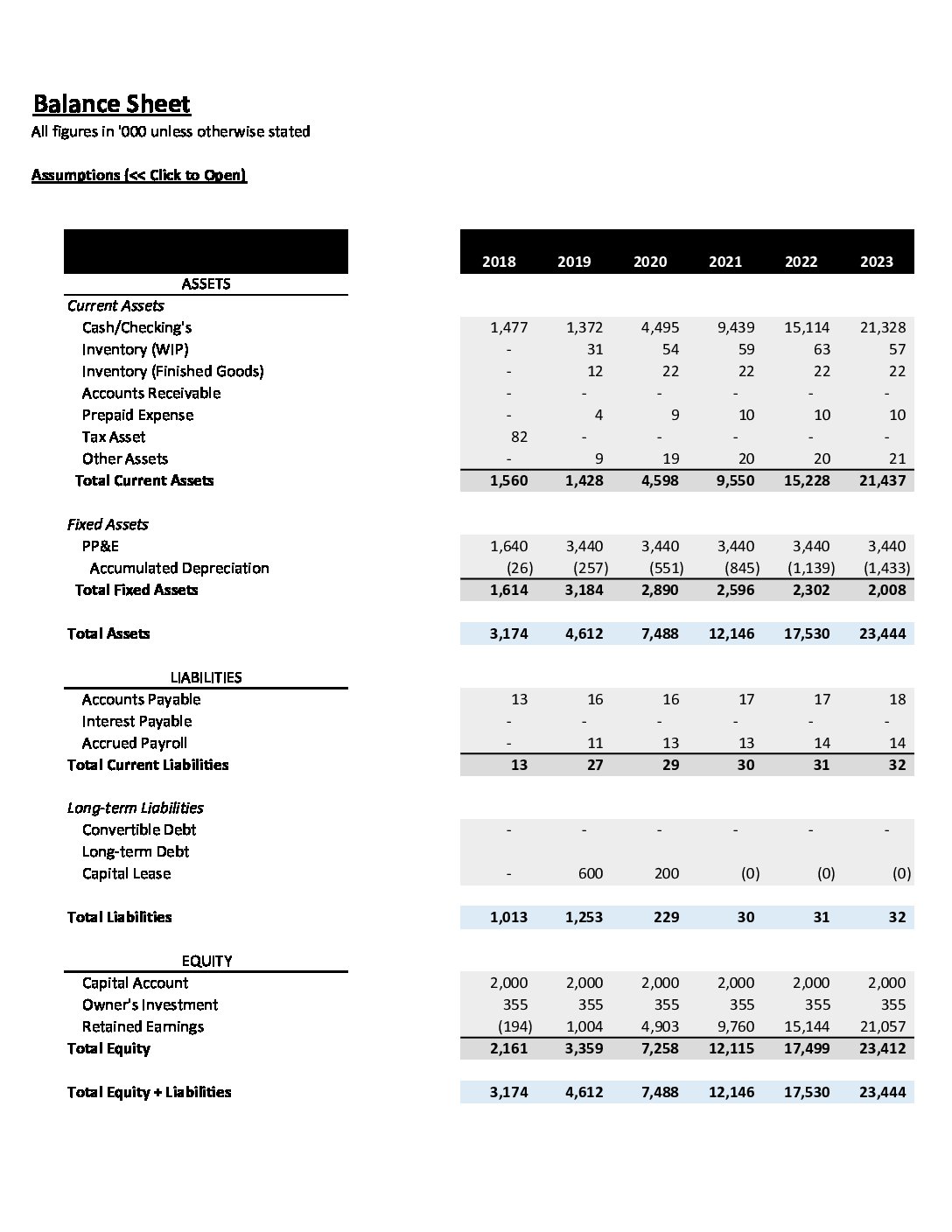

Pro forma financial statements can be used for various purposes, such as evaluating the financial impact of potential business decisions, assessing the feasibility of new projects or investments, and presenting financial projections to stakeholders, including investors and lenders. There are four main types of pro forma financial statements depending on the purpose of your financial forecast. Often used to back up a lending or investment proposal, they are issued in a standardized format that includes balance sheets, income statements, and statements of cash flow.

While this provides insight into a company’s historical health, creating pro forma financial statements focuses on its future. The pro forma statements serve as a tool to demonstrate the feasibility and profitability of proposed projects or business ventures. Pro forma financials may not be.

Pro forma statements look like regular statements, except they’re based on what ifs, not real financial results. Pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions. Unlike audited or reviewed quarterly or annual financial reports, pro forma financial statements use assumptions and estimates to predict a company's future financial performance.

There are three major pro forma statements: These statements are used to present a view of corporate results to outsiders, perhaps as part of an investment or lending proposal. In contrast, the purpose of pro forma financial statements is to look to the future or to analyze hypothetical scenarios of what could be.

Pro forma financial information (pro formas) presents historical balance sheet and income statement information adjusted as if a transaction had occurred at an. There are three main types of pro forma statements: Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future.

Pro forma financial information | 1 1 overview we are pleased to present this publication, pro forma financial information: In the event that the projected numbers show that profits are likely to drop, the pro forma statement allows a company to see the need for.

The term pro forma is latin for as a matter of form or for the sake of form. Definition and purpose of pro forma financial statements. Pro forma cash flow statements;

Traditionally, financial statement analysis is used to better understand a company’s performance over a specified period. For instance, a startup seeking venture capital funding may use pro forma financial statements to outline projected revenue growth, expenses, and potential return on investment. You can create pro forma statements by using online sample spreadsheets, templates, or existing financial statements in your accounts.

Pro forma financial statements are financial reports that depict a company's hypothetical financial performance under certain assumed conditions or events. From the angle of business management, pro forma financial statements serve multiple purposes. Pro forma financial statements serve as financial projections, helping businesses plan for future growth, prepare for potential challenges, and communicate financial expectations to stakeholders.