Looking Good Tips About Statement Of Changes In Equity Frs 102 All The Following Are Financing Cash Flows Except

/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)

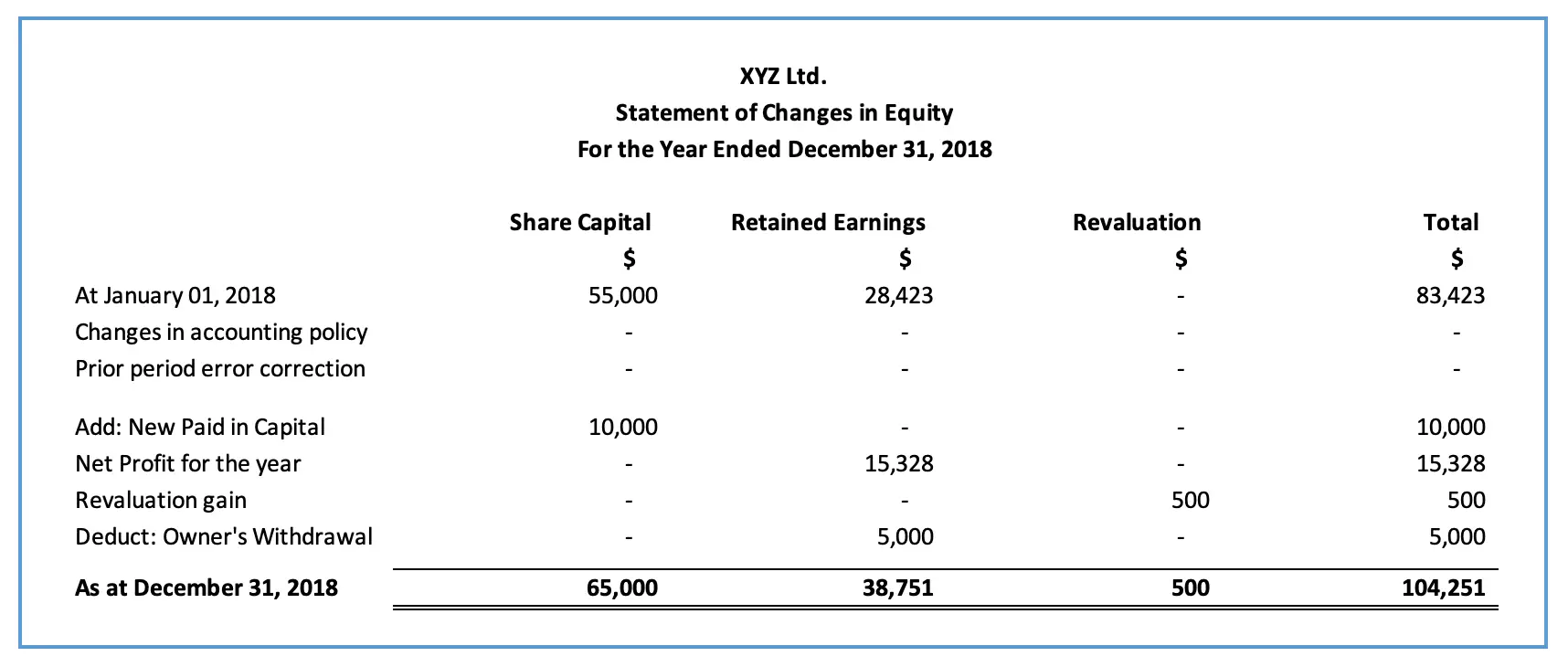

The three items required on the face of the statement are:

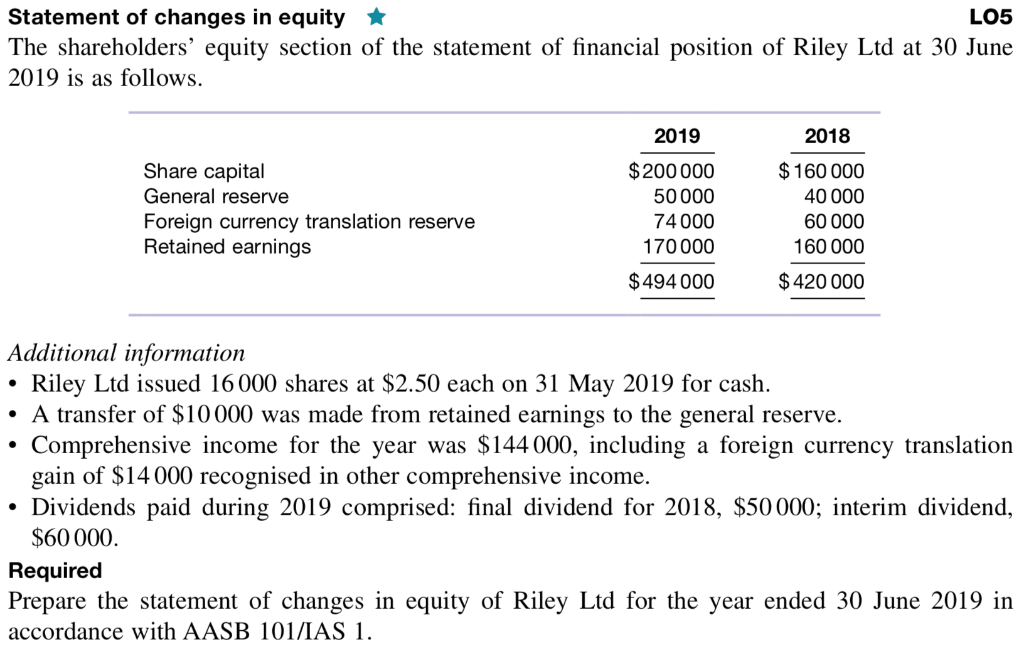

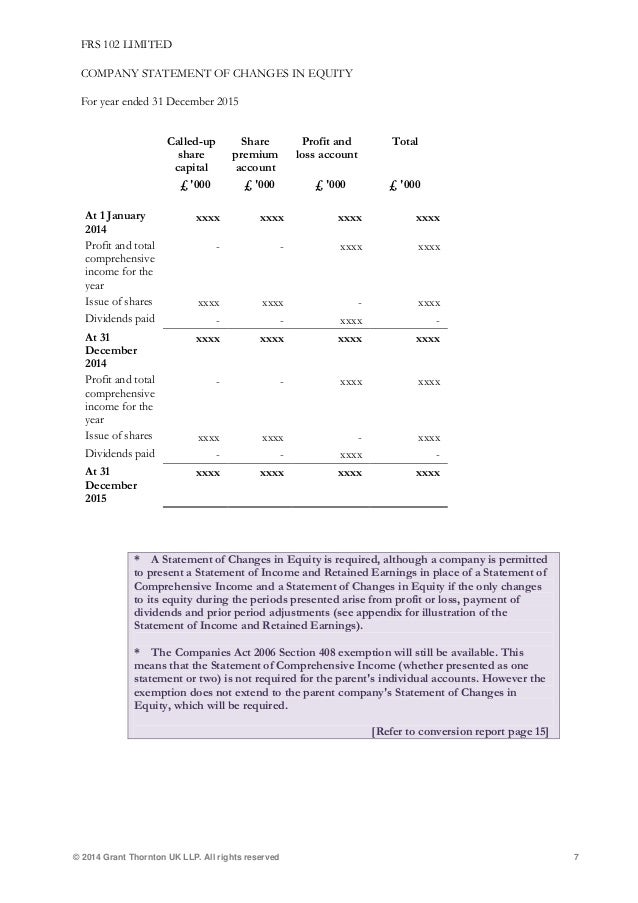

Statement of changes in equity frs 102. The statement of changes in equity (the ‘soce’) is one of the primary financial statements, whereas previously there was a choice to disclose this as a note in the financial statements or on the face of the financial statements. A new model for revenue recognition, aligned to ifrs 15: What are the key points?

Section 6 deals with the requirements for the presentation of changes in an entity’s equity for a period. The ed proposes amendments to frs 102: A small entity applying section 1a of frs 102 is not required to prepare:

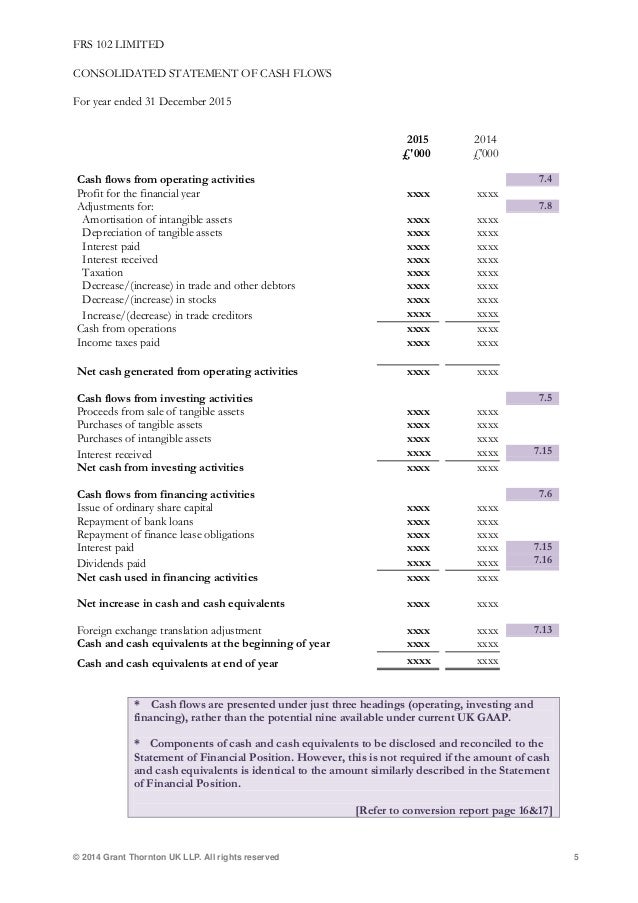

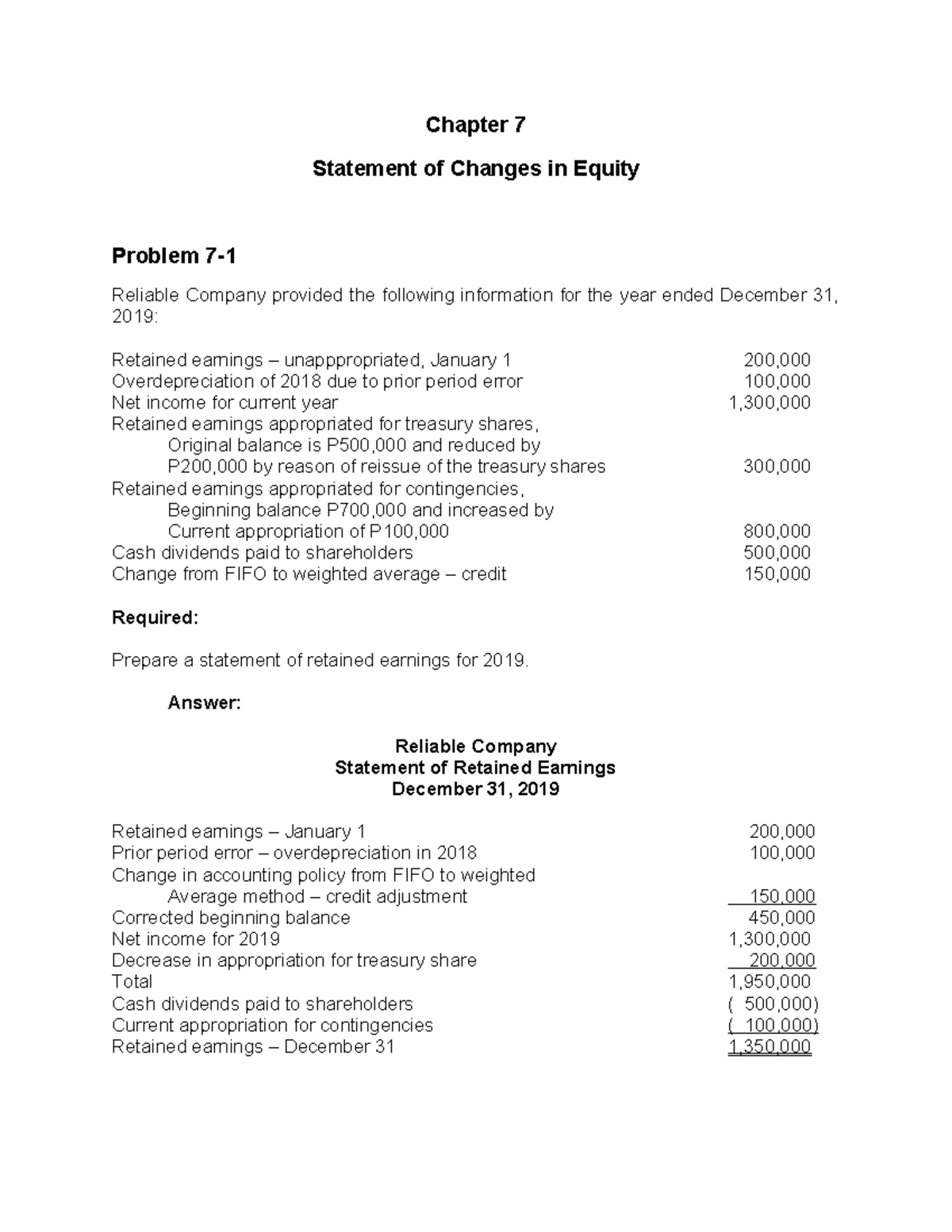

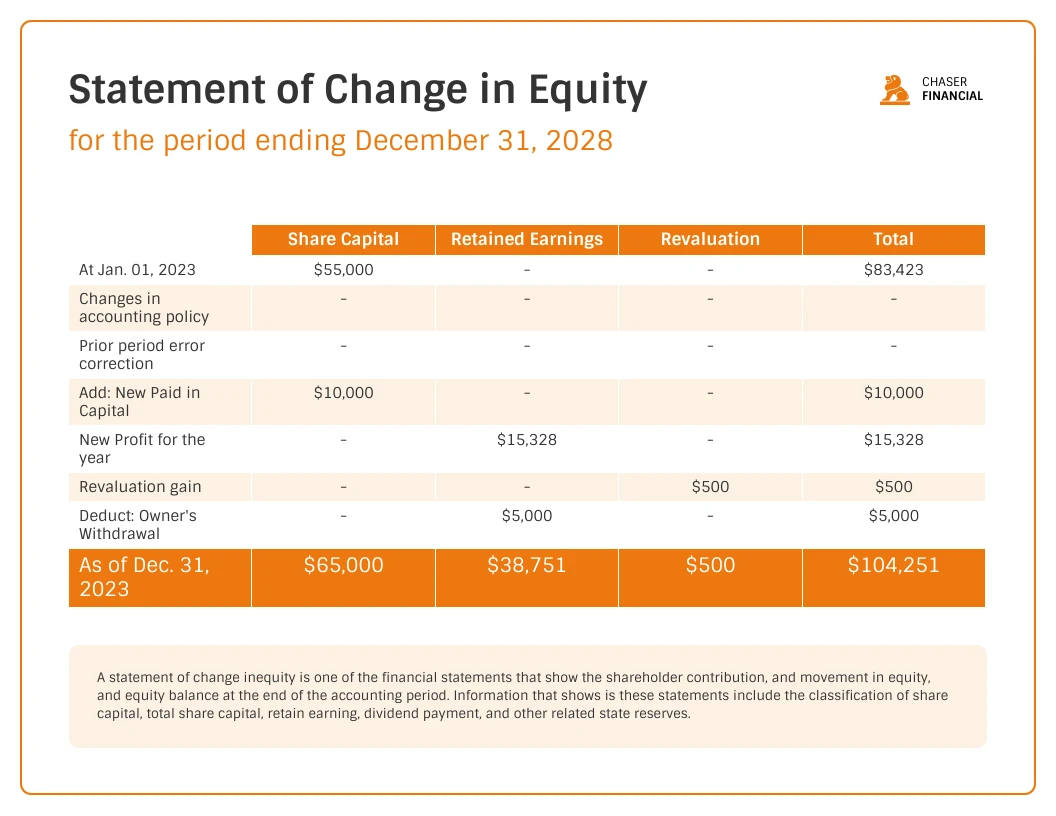

The amendments to frs 105 include the following: Must contain a balance sheet, a profit and loss account and notes to the financial statements (and are encouraged to contain a statement of total comprehensive income and a statement of changes in equity, or a statement of income and retained earnings, where necessary to give a true and fair view). The statement of changes in equity summarises all the elements of the movement between the comparative and current year total equity.

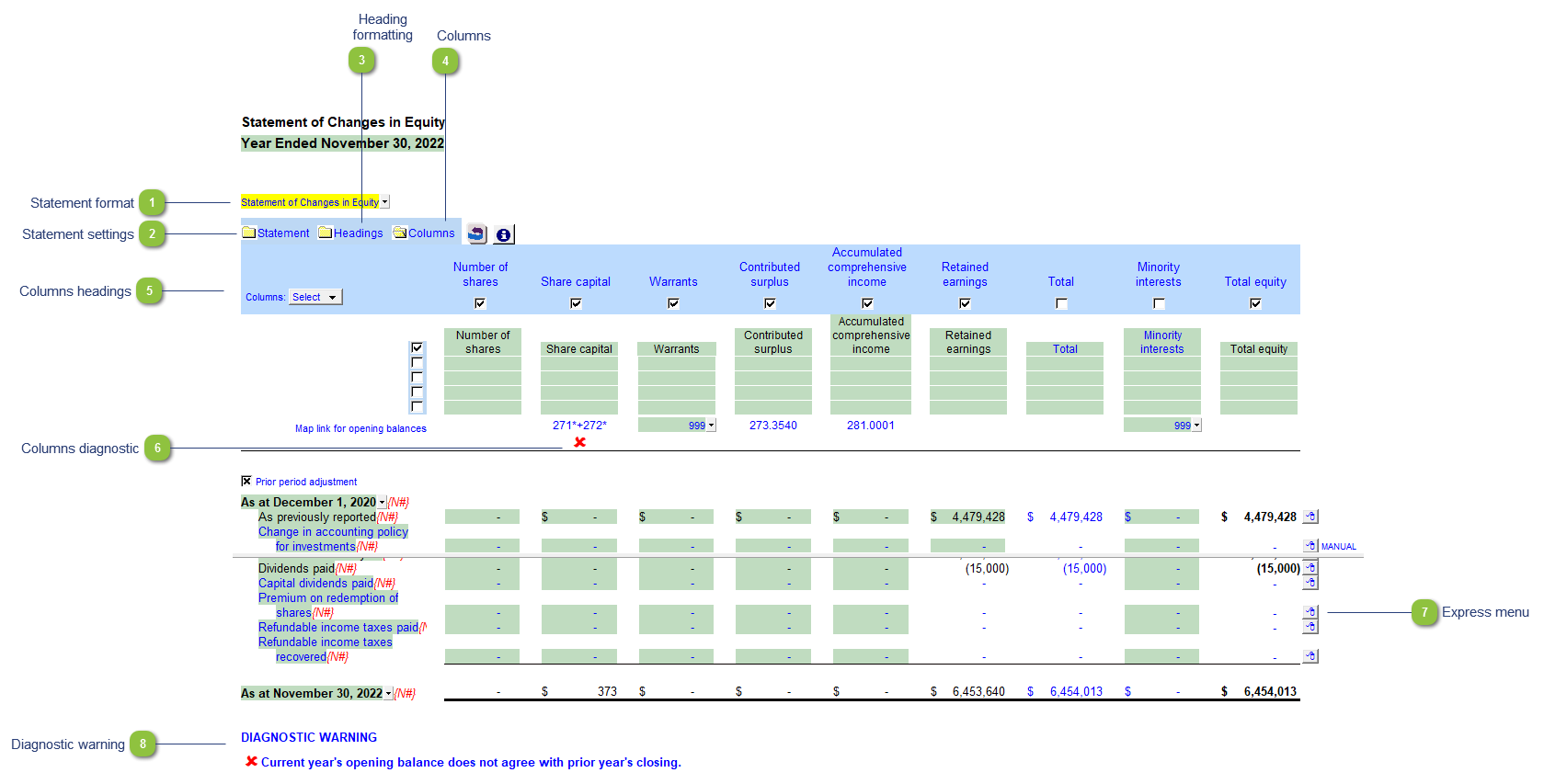

Section 6 describes the requirements for the presentation of changes in an entity’s equity for a period the soce presents all changes in equity, including: Revenue from contracts with customers, but with some simplifications; The proposed amendments seek to provide greater consistency and alignment to international accounting standards including:

The statement of changes in equity (the ‘soce’) is one of the primary financial statements, whereas previously there was a choice to disclose this as a note in the financial statements or on the face of the financial statements. The financial reporting standard to provide greater consistency and alignment to international accounting standards including; The financial reporting exposure draft 82 (‘fred 82’) proposes a suite of changes to uk gaap.

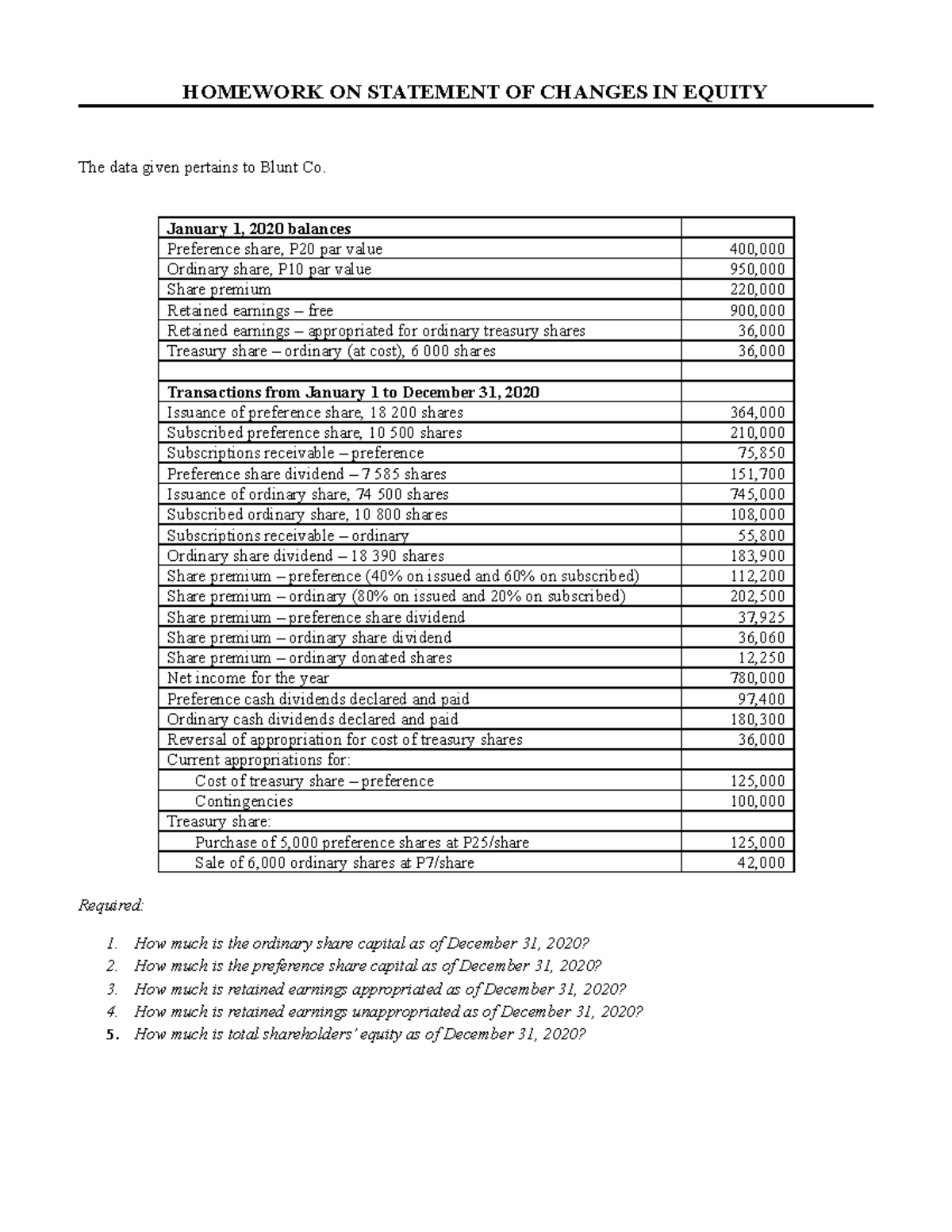

Statement of changes in equity and statement of income and retained earnings. If the only changes in equity arise from profit or loss, dividends, changes in accounting policies or the correction of errors, a combined statement of income and retained earnings may be presented instead of the. Disclose of the fact that the entity is a public benefit entity if.

Disclosure of dividends declared and paid/payable; (frs 102.1a.7, 4.1a and 6.1a) although these statements are not required, entities are encouraged to prepare them in certain. A new model for revenue recognition, aligned to ifrs 15:

It is accessed via the statement of changes in equity link under the financial statements heading on the disclosure tab. Record adjusted ebitda margin fourth. Statement of compliance with section 1a;

Total comprehensive income for the period; Frs 102 is part of a suite of standards that form ‘uk gaap’. Changes to frs 105.

Statement of changes in equity and statement of income and retained earnings. Frs 102 also requires that a statement of changes in equity is presented which captures an entity’s profit or loss for a reporting period, other comprehensive income for the period, the. Frs 102 defines a change in accounting estimate as follows: