Underrated Ideas Of Tips About Accrued Income In Trial Balance Sample Of Owners Equity Rental Property P&l Template

Also, during the month the owner withdrew $1,450, resulting in.

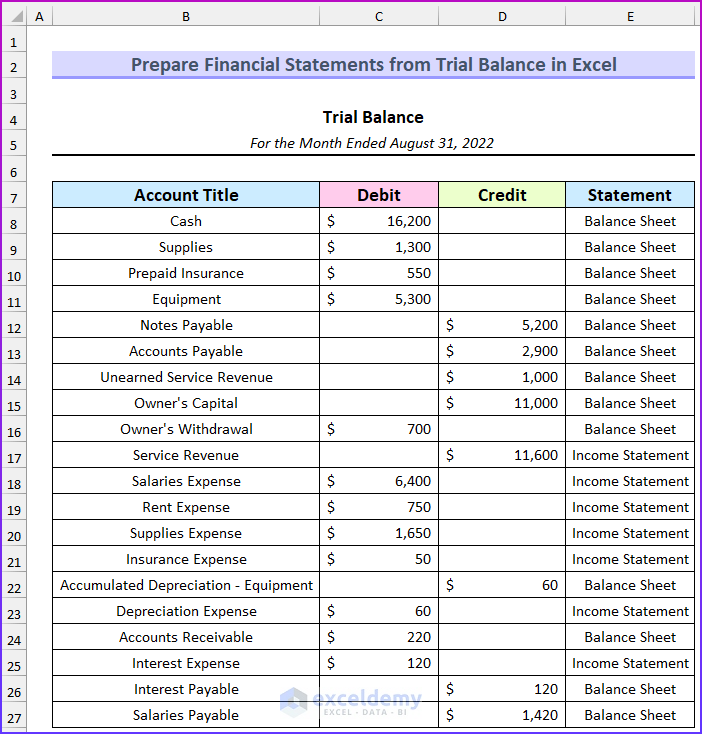

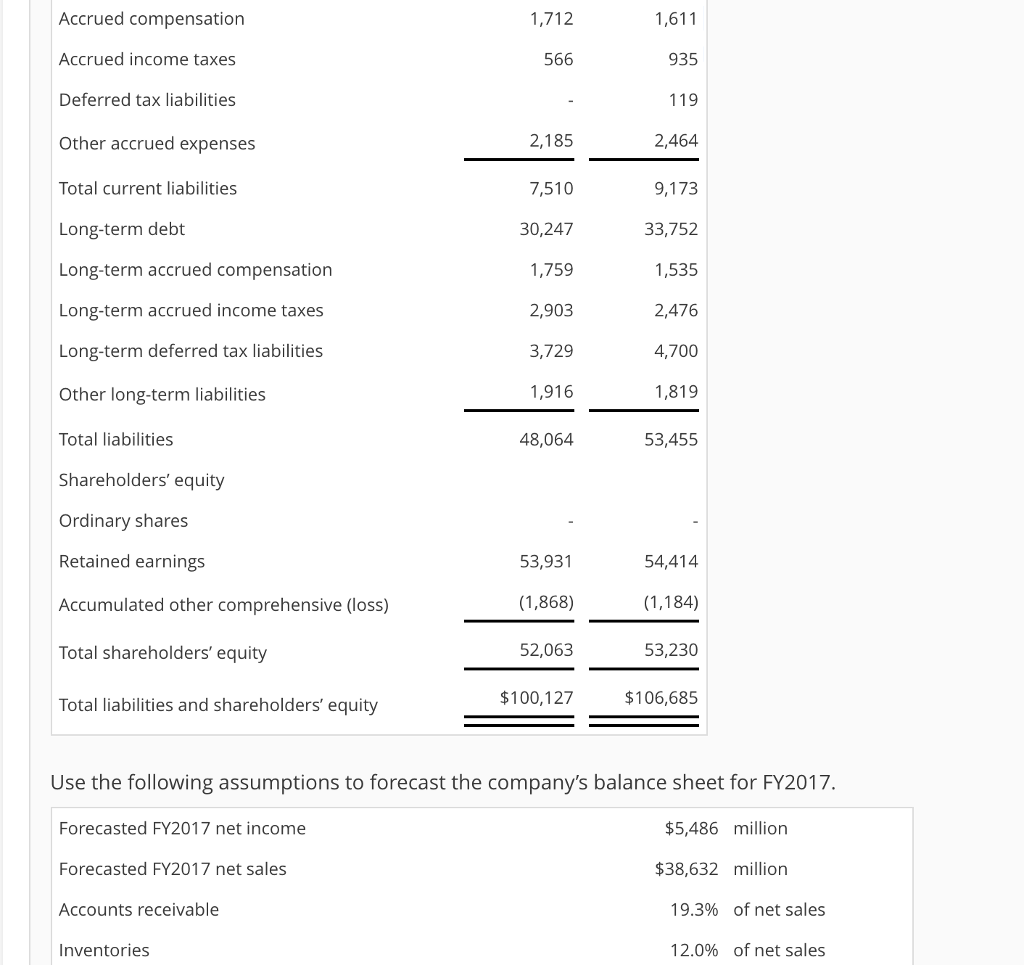

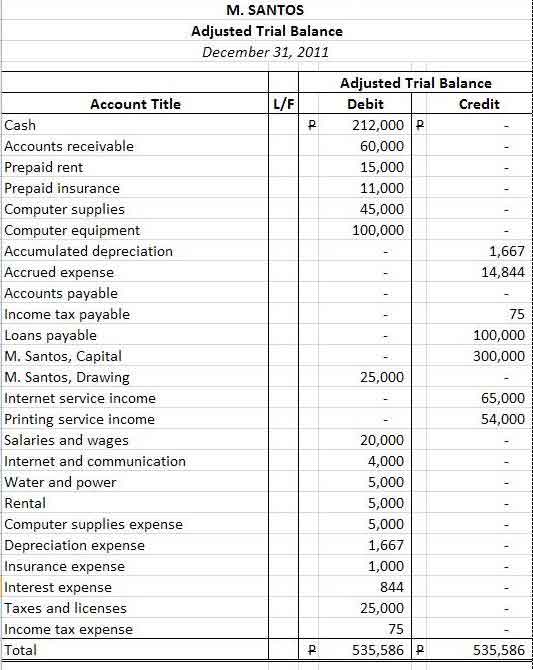

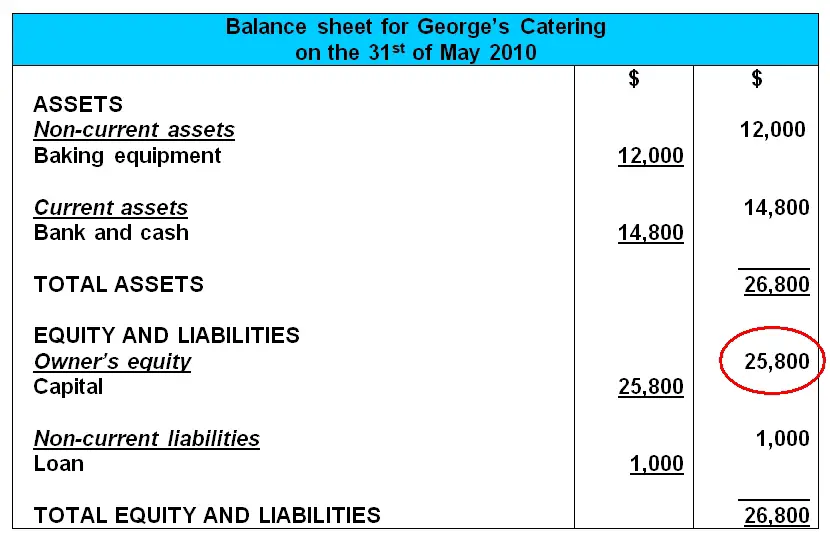

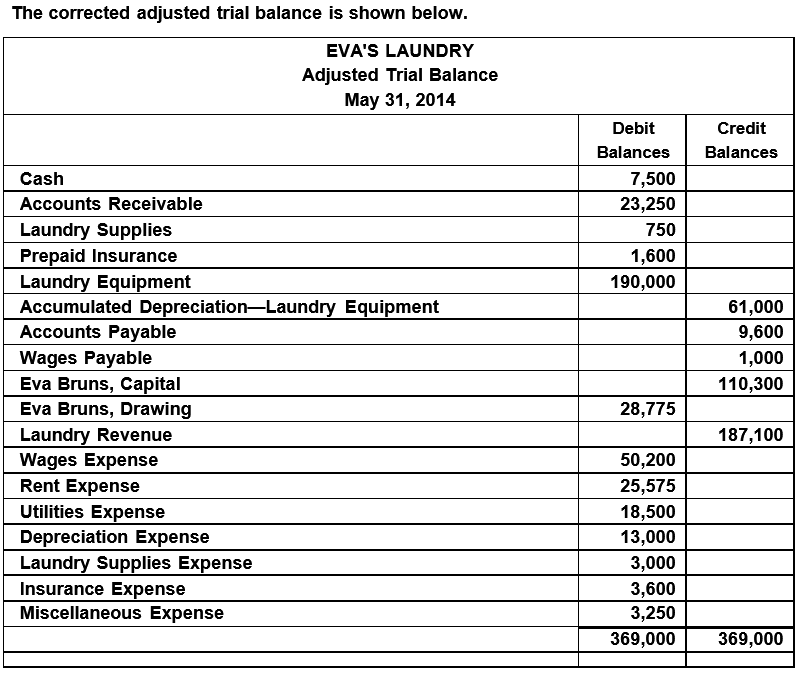

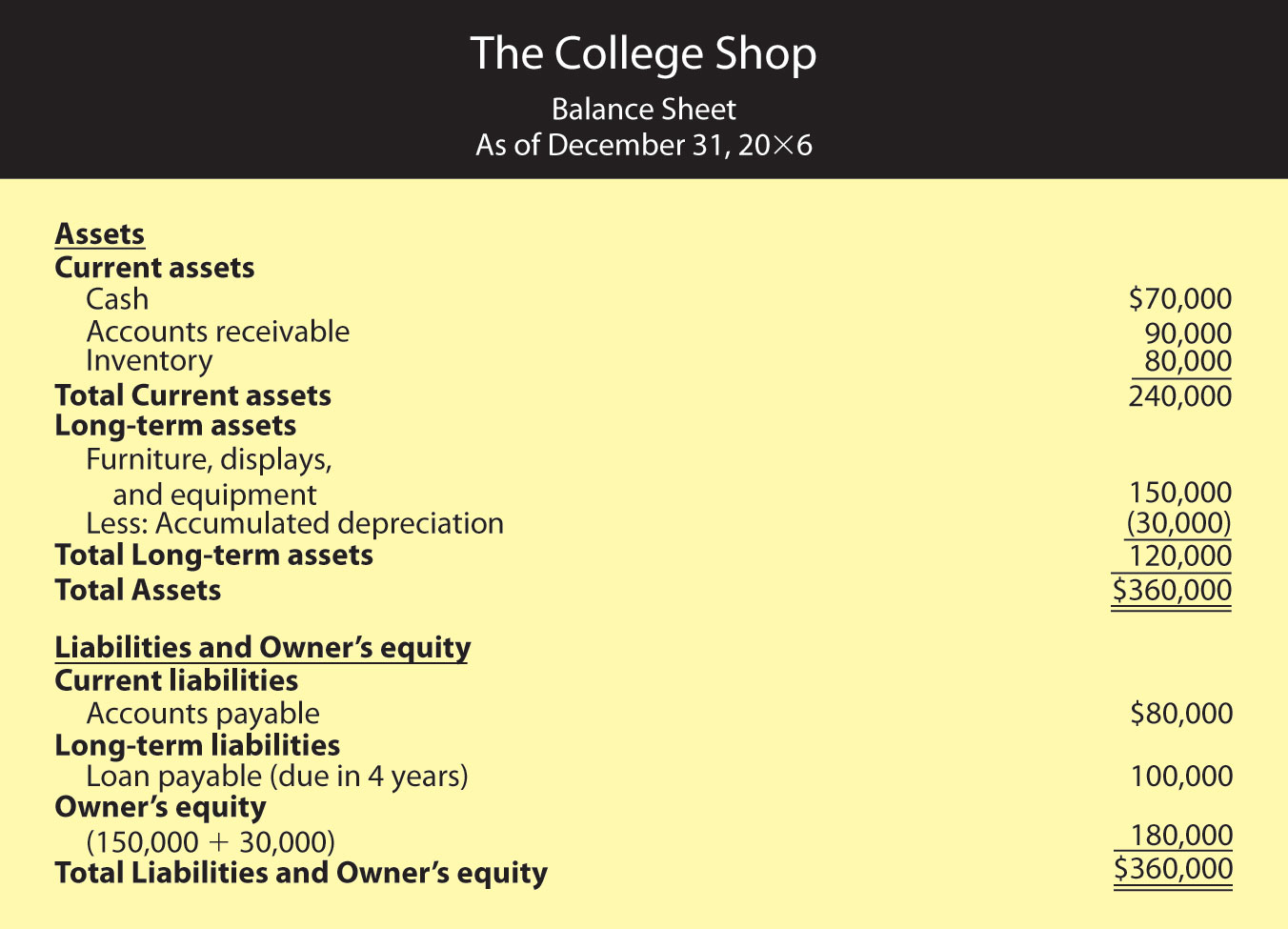

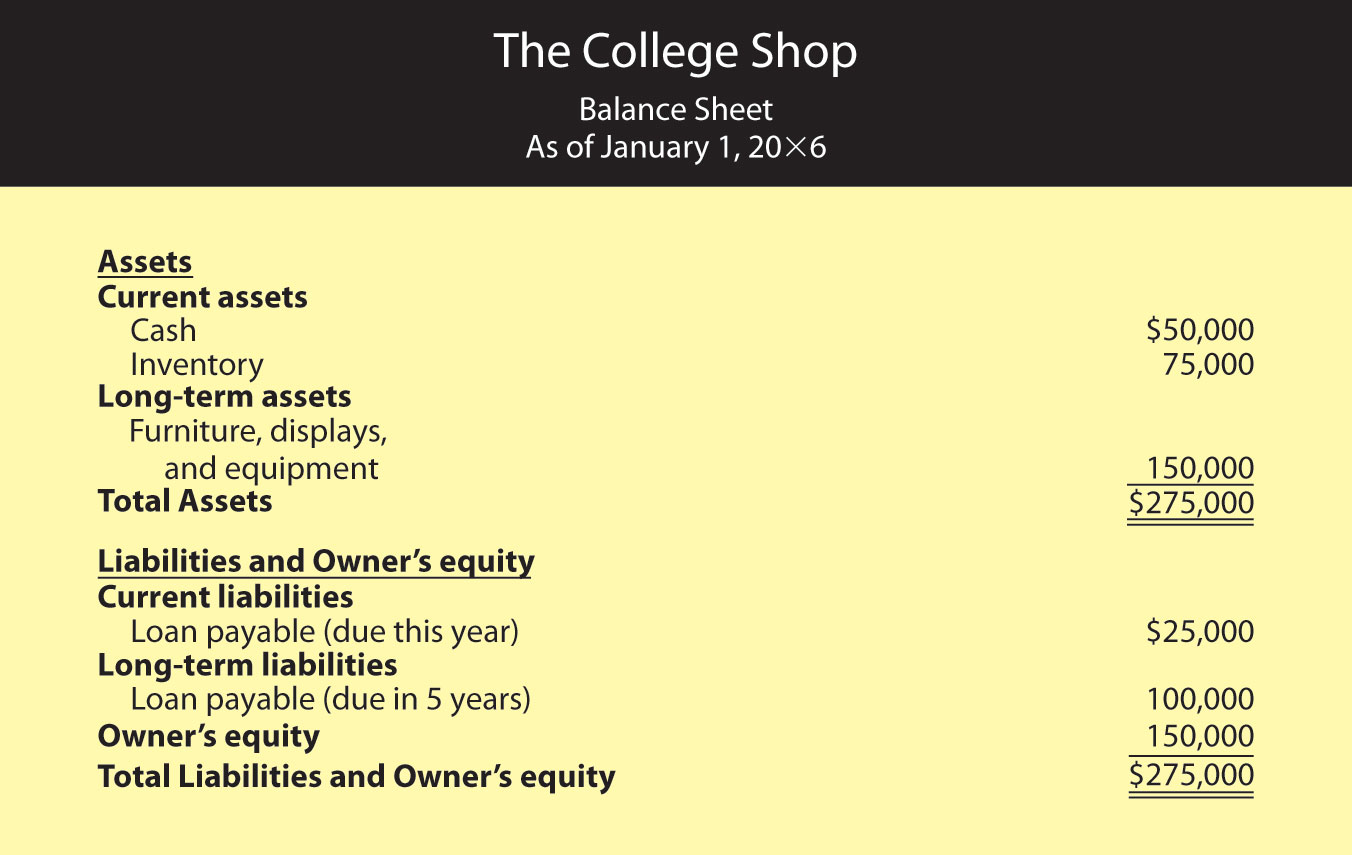

Accrued income in trial balance sample of owners equity. The balance sheet reports the assets, liabilities, and stockholders’ equity of a. Types of assets common types of assets include. The adjusted trial balance is used to prepare the income statement and the balance sheet.

In this case the balance sheet liabilities (income tax payable) has been increased by 14,000, and the income statement has an income tax expense of 14,000. Assets = liabilities + owner’s equity the recording of accrued salaries journal entry is done in line with the accounting equation, which requires a liability to be stated under the. The appropriate columns are as follows:

Stakeholders need to know the financial performance (as measured by the income statement—that is, net income or net loss) and financial position (as measured by the. The adjusting entries in the example are for the accrual of $25,000 in salaries that were unpaid as of the end of july, as well as for $50,000 of earned but unbilled. The balance sheet is going to.

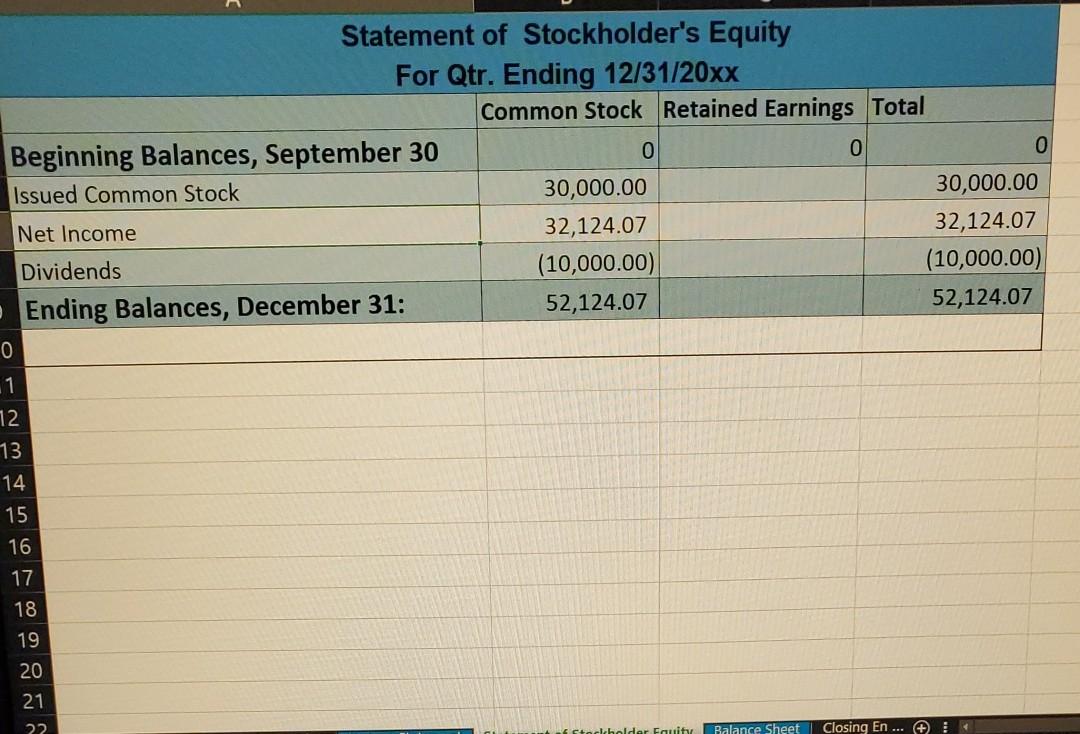

During the month, the owner invested ?12,500 and the business had profitable operations (net income) of ?5,800. Also, during the month the owner withdrew $1,450, resulting in. 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate 2.2 define, explain, and provide.

The statement of retained earnings (which is often a component of the statement of stockholders’ equity) shows how the equity (or value) of the organization has changed over a period of time. The accounting equation is balanced, as shown on the balance sheet, because total assets equal $29,965 as do the total liabilities and stockholders’ equity. Now you just take numbers off the adjusted trial balance and fill them into a form.

Adjusting entries typically affect one income statement (revenue or. There are several steps in the accounting cycle that require the. The statement of owner’s equity builds off the income statement, starting with revenues.

The statement of retained earnings will include beginning retained earnings, any net income (loss) (found on the income statement), and dividends. The statement of retained earnings is prepared second to determine the ending retained earnings balance for the period. Before we record the adjusting entries for klo, you might question the purpose of more than one trial balance.

During the month, the owner invested $12,500 and the business had profitable operations (net income) of $5,800. Prepare trial balance as on 31.12.2016 from the following balances of mr. Also, during the month the owner withdrew ?1,450, resulting in.

Assets = debit balance liabilities = credit balance expenses = debit balance equity = credit balance revenue = credit. 2.1 describe the income statement, statement of owner’s equity, balance sheet, and statement of cash flows, and how they interrelate 2.2 define, explain, and provide.

/dotdash_Final_Equity_Aug_2020-01-b0851dc05b9c4748a4a8284e8e926ba5.jpg)