Looking Good Info About Types Of Liabilities In Balance Sheet Common Size Statement Value Inventory

This is a list of what the company owes.

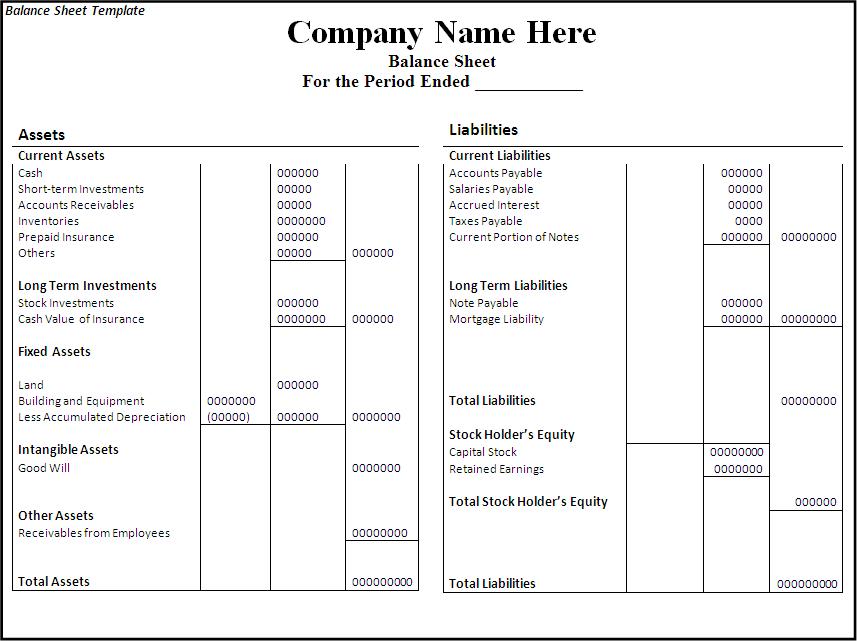

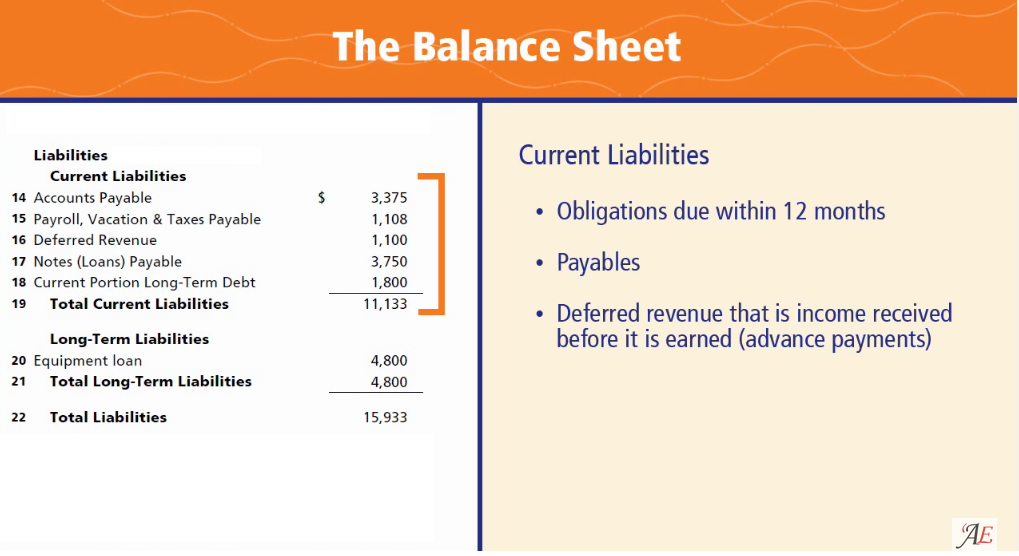

Types of liabilities in balance sheet. There are mainly three types of liabilities on a company’s balance sheet: Current liabilities on the balance sheet, the liabilities section can be split into two components: Most companies will have these two line items on their balance sheet, as they are part of ongoing.

Liabilities on balance sheet common examples of liabilities accounts payable. Types of liabilities on the balance sheet. Liabilities appear on the balance sheet with a categorization of current and noncurrent liabilities.

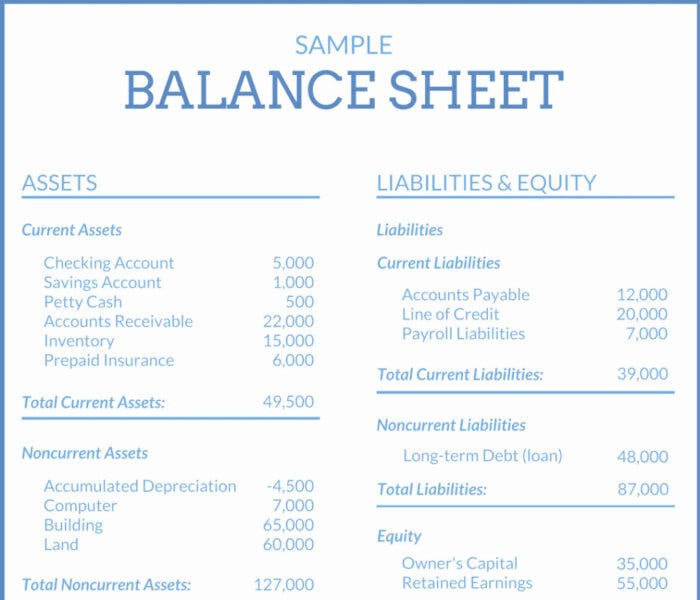

This refers to everything you owe to other people and entities. Simply put, liabilities are any current debts that your business owes. The liabilities that your business has are going to fluctuate.

If you’ve promised to pay someone a sum of money in the future and haven’t paid them yet, that’s a liability. The interest rates are fixed and the amounts owed are clear. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company.

If companies are unable to repay long term loans as they become due, the company can face a significant solvency crisis. This is a list of what the company owes. Liabilities are common when conducting normal business operations.

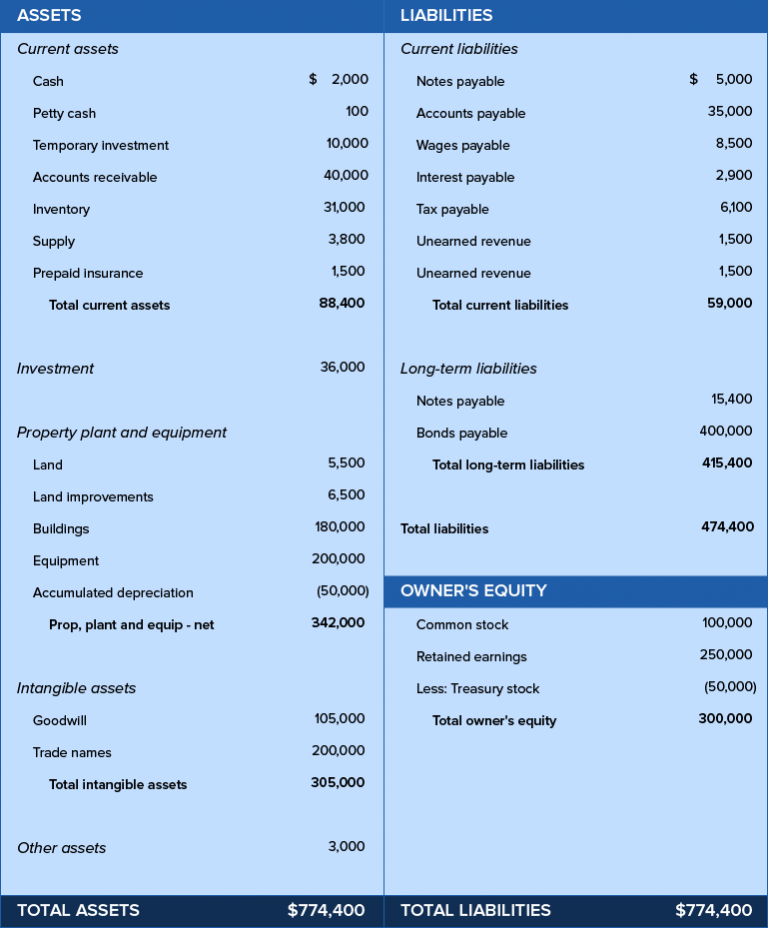

Sequence of accounts in a balance sheet analyzing the balance sheet a. Financial liabilities include debt payable and interest payable, which is as a result of the use of others’ money in the past, accounts payable to other parties, which are as a result of past purchases, rent and lease payable to the space owners, which are as a result of the use of others’ property in the past and several taxes payable which are. With liabilities, this is obvious—you owe loans to a bank, or.

Types of balance sheets what is balance sheet format in excel? And this can be to other businesses, vendors, employees, organizations or government agencies. Equity how does a balance sheet work?

Liabilities are any debts your company has, whether it's bank loans, mortgages, unpaid bills, ious, or any other sum of money that you owe someone else. Purchase of a fixed asset or current asset. There are two main categories of balance sheet liabilities:

Accounts payable is concerned with the amount of money. Current liabilities — coming due within one year (e.g. Assets are the items your company owns that bring in income or provide a future benefit.

What are the different types of liabilities on the balance sheet? Special considerations as noted above, you can find information about assets, liabilities, and shareholder equity on a company's balance sheet. The most common liabilities are usually the largest like accounts payable and bonds payable.

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

/investing-lesson-3-analyzing-a-balance-sheet-357264_FINAL-ff829eab9bf045c981c883c323bc0ca6.png)