Matchless Info About Loan Repayment Cash Flow Statement What Is In A Post Closing Trial Balance

Accurately estimating these values is useful for a wide variety of analyses and applications.

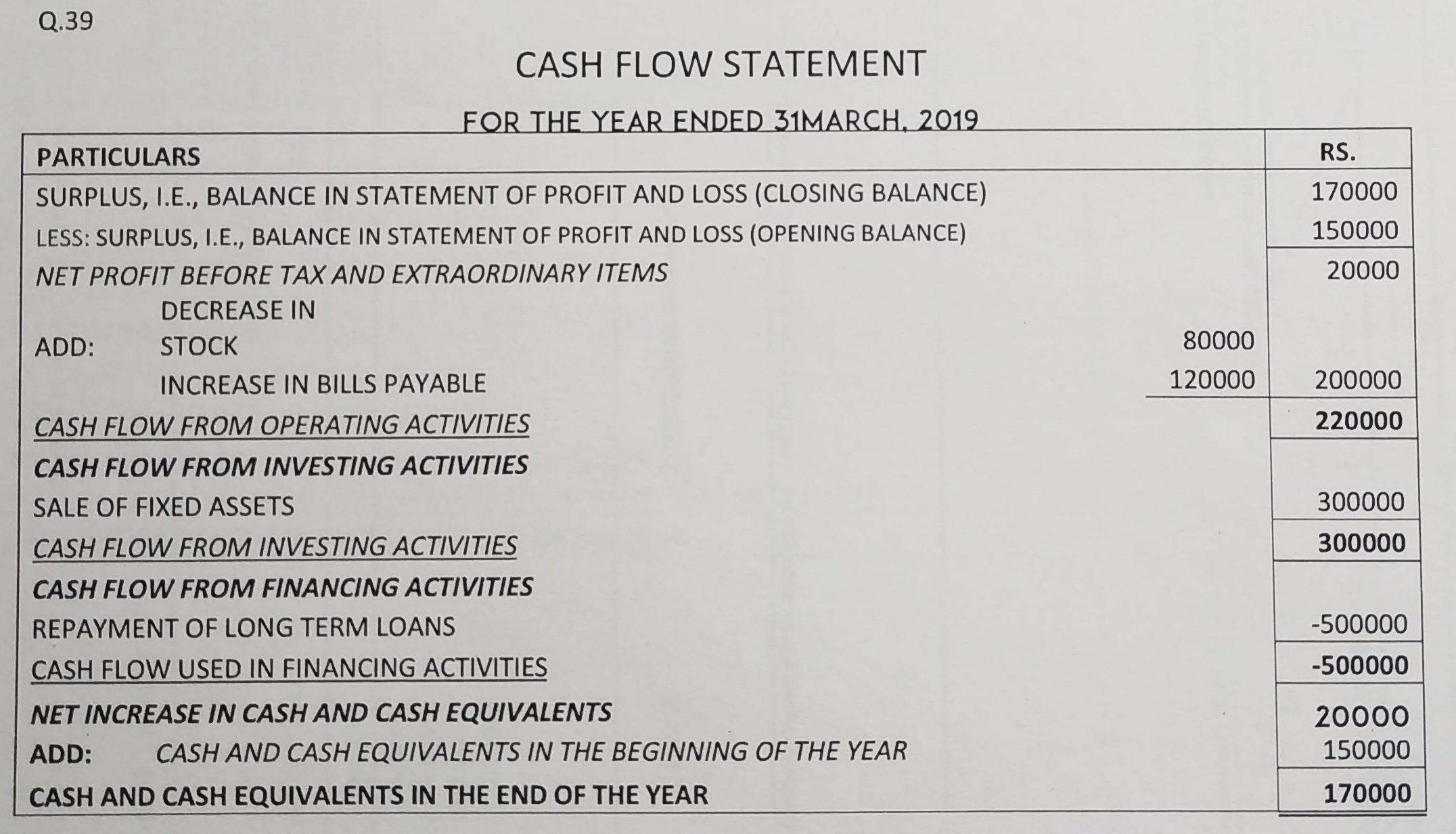

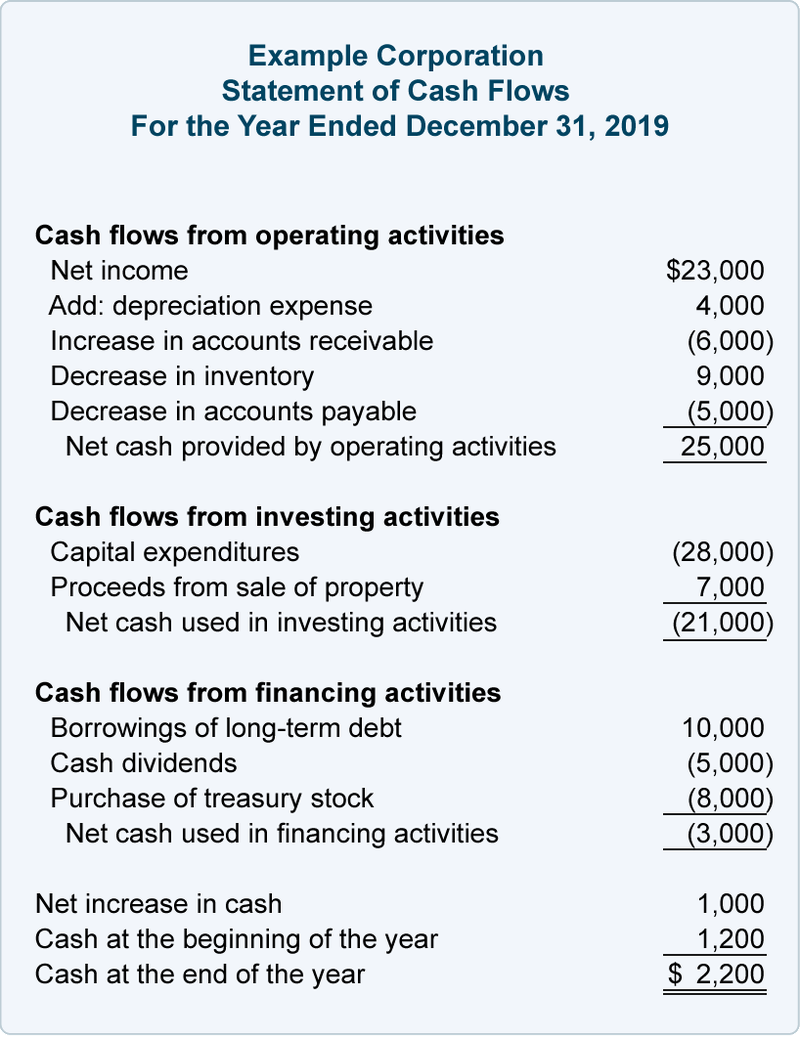

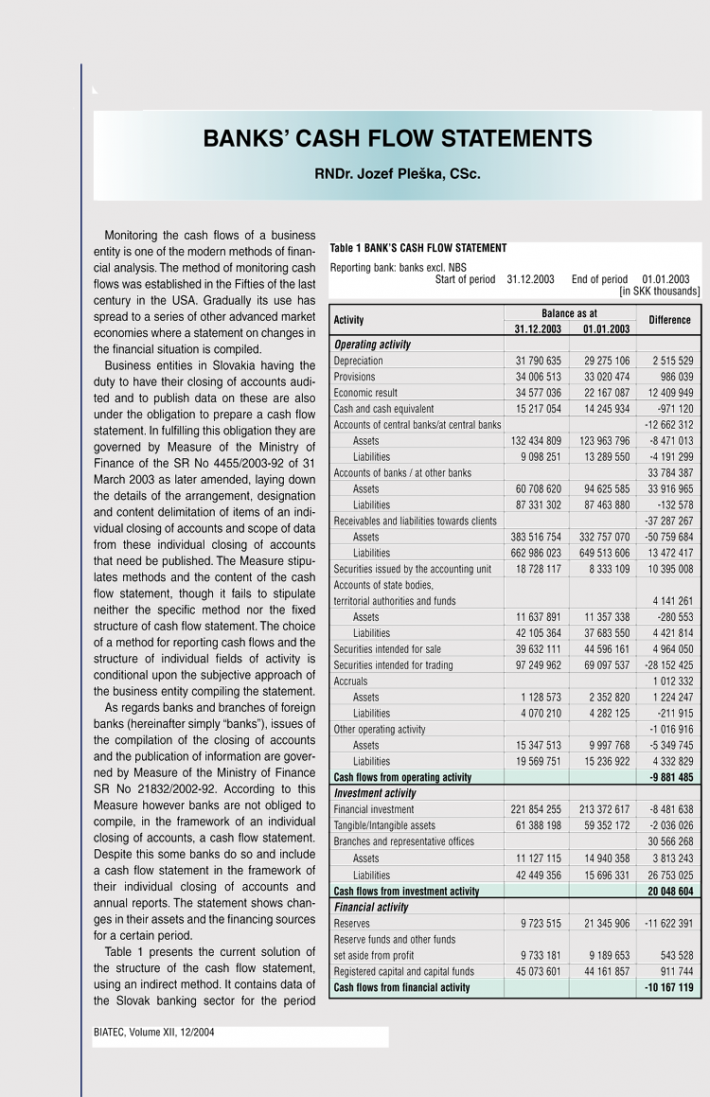

Loan repayment cash flow statement. The cash flow statement looks at the inflow and outflow of cash within a company. Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in october 1977). To grasp the concept of cash flow projections, we must first understand the essence of cash flow itself.

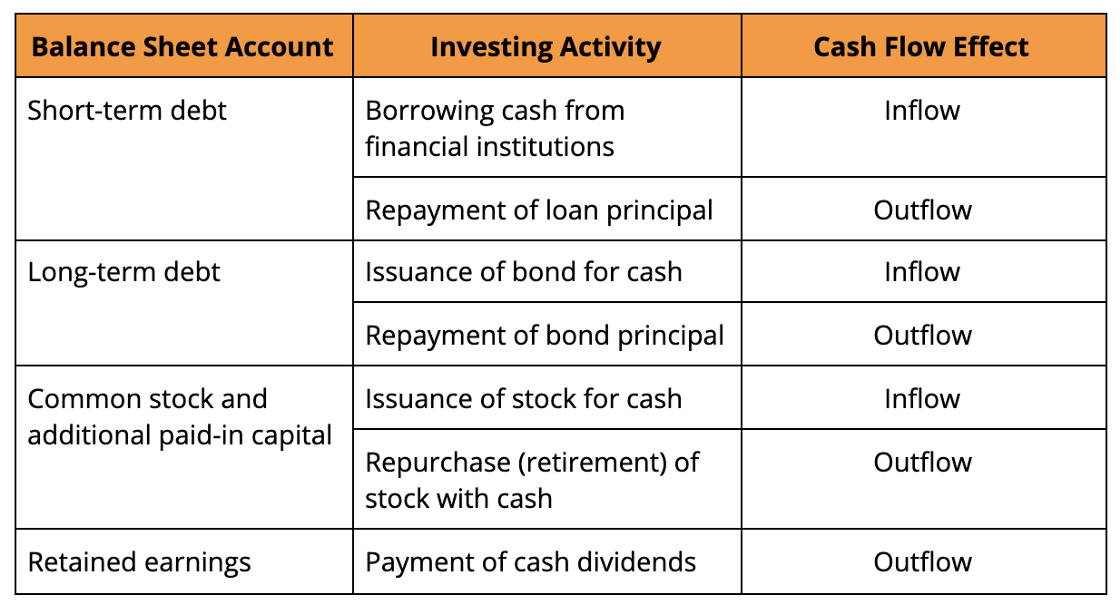

One of the categories on the cash flow statement is cash flow from financing activities, which includes all cash that has been used to repay loans. Examples of cash flows from financing activities include: Now let us take an example of an organization and see how detailed cash flow from financing activities can help us determine information about the company.

Lower monthly payments via save means more cash flow. Effective interest rate of 6% p.a. Cash outflows to pay dividends

Cash flow financing is a form of financing in which a loan made to a company is backed by the company's expected cash flows. The formula for calculating the cash from financing section is as follows: Example of a loan principal payment

Cash flow financing helps companies that generate cash from. 3 years remaining on the loan. Pensions and other employee benefits.

Someone not repaying a part or all of a loan), how quickly a loan is repaid, and the monthly cash flow for a given set of loans. Cash outflows from buying back equity/shares; Carrying amount immediately prior to waiver is $1,000,000.

For example, when the cash repayment of a loan includes both interest and capital, the interest element may be. The payment of a dividend is also treated as a financing cash flow. First things first, a loan can be repaid in number of ways for example in cash, by handing over certain asset or converting debt to shares etc.

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. For cash flow statement reporting purposes, any pppl proceeds received that the entity expects to be forgiven would be classified as cash flows from operating activities or financing activities, depending on how the entity interprets asc 230. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

It reflects the company’s financial health and liquidity, capturing the inflows and outflows of cash over a specific timeframe. The collection of advanced loans or debt repayment is considered an investing activity on your cash flow statement. Loan repayment can have a major impact on a business’s cash flow, so it is important to carefully track and report this information.

Cash flow from financing = debt issuances + equity issuances + (share buybacks) + (debt repayment) + (dividends) note that the parentheses signify that the item is an outflow of cash (i.e. Best for long repayment terms. If a company's business operations can generate positive cash flow, negative overall cash flow.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)