Simple Tips About Trial Balance Meaning Wiley Ifrs 2019

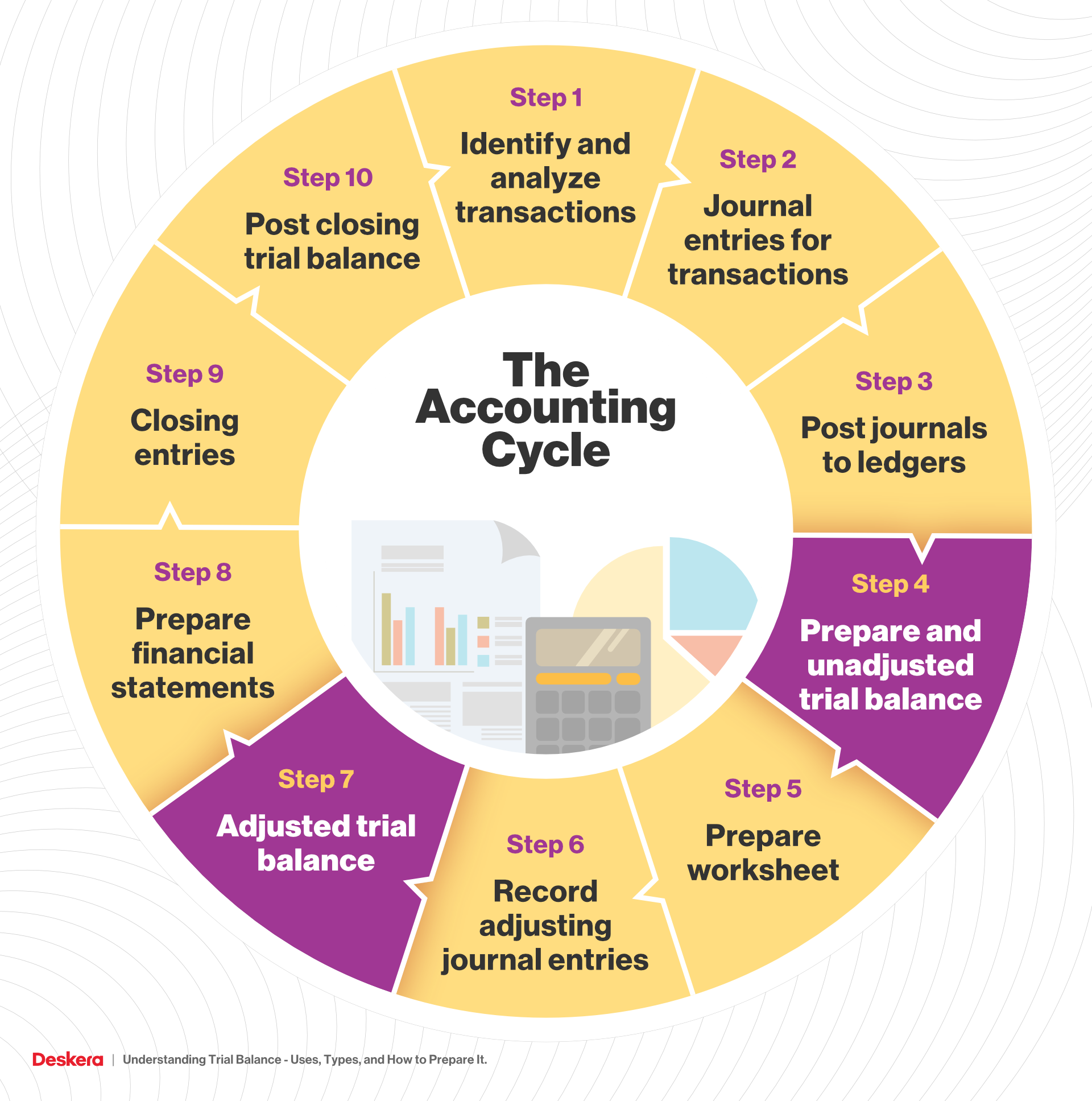

The accountant posts ledger account through a journal during the accounting period, and it needs to be finalized and verified.

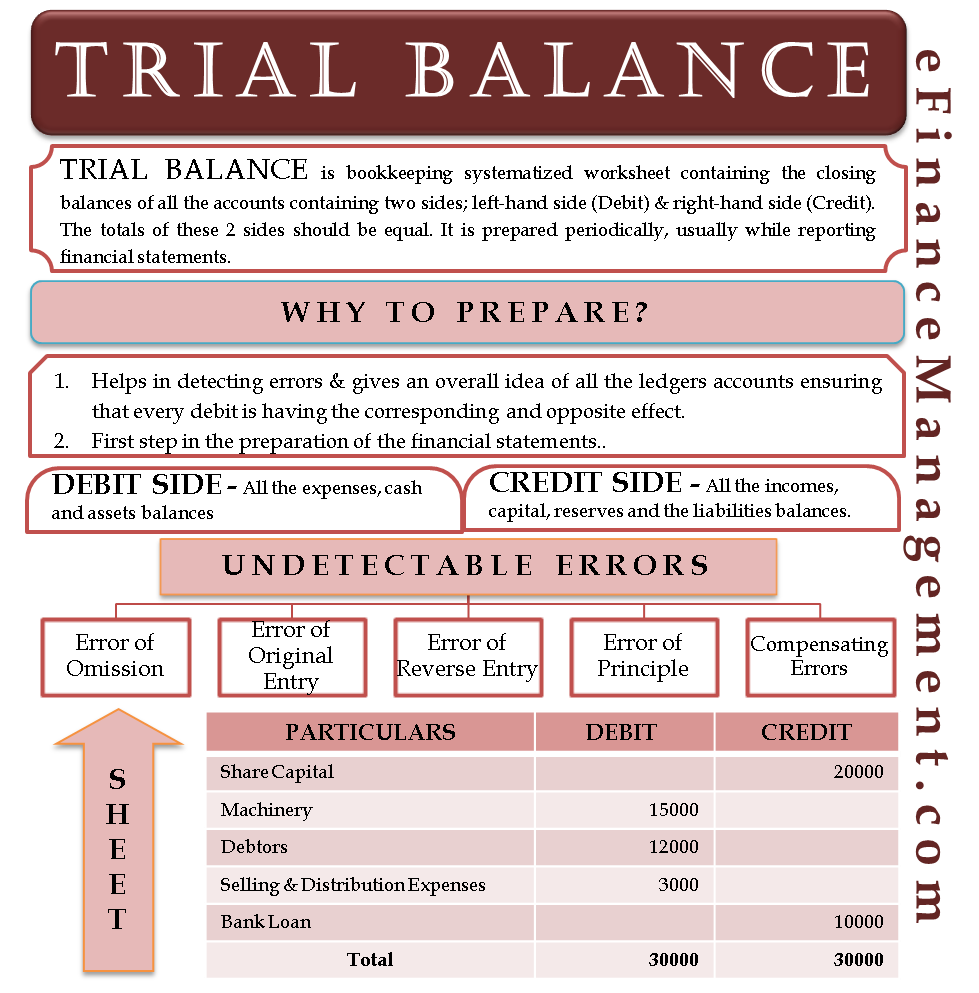

Trial balance meaning. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. Your trial balance is comprised of the results of stocktaking. With double entry bookkeeping, you make two entries, one credit and the other debit.

One of them is arithmetical errors, which can happen due to erroneously eliminating any amount from the total or taking an amount twice in the total or taking a wrong amount. All the businessmen after completion of postings from journal or subsidiary books to the ledger, want to verify accuracy of the posting. Hence, for checking the accuracy of ledger.

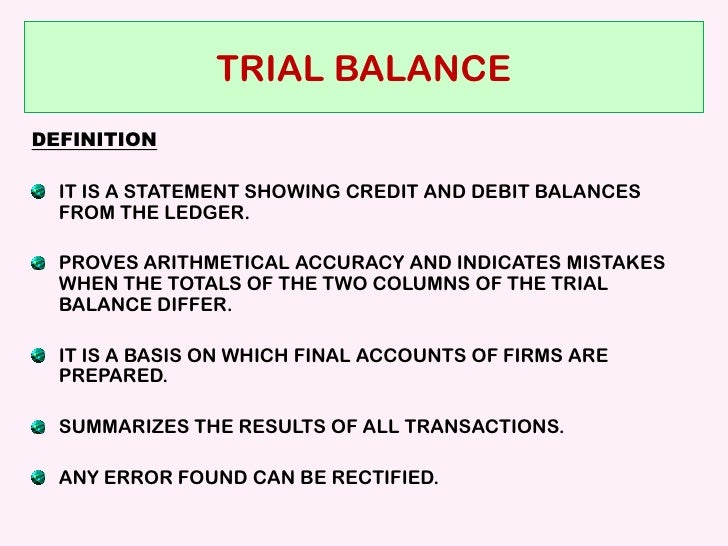

What is a trial balance? A trial balance is a statement, prepared with the debit and credit balances of the ledger accounts to test the arithmetical accuracy of the books. The trial balance verifies the accounting records' mathematical accuracy by guaranteeing that the total debits and credits are equal.

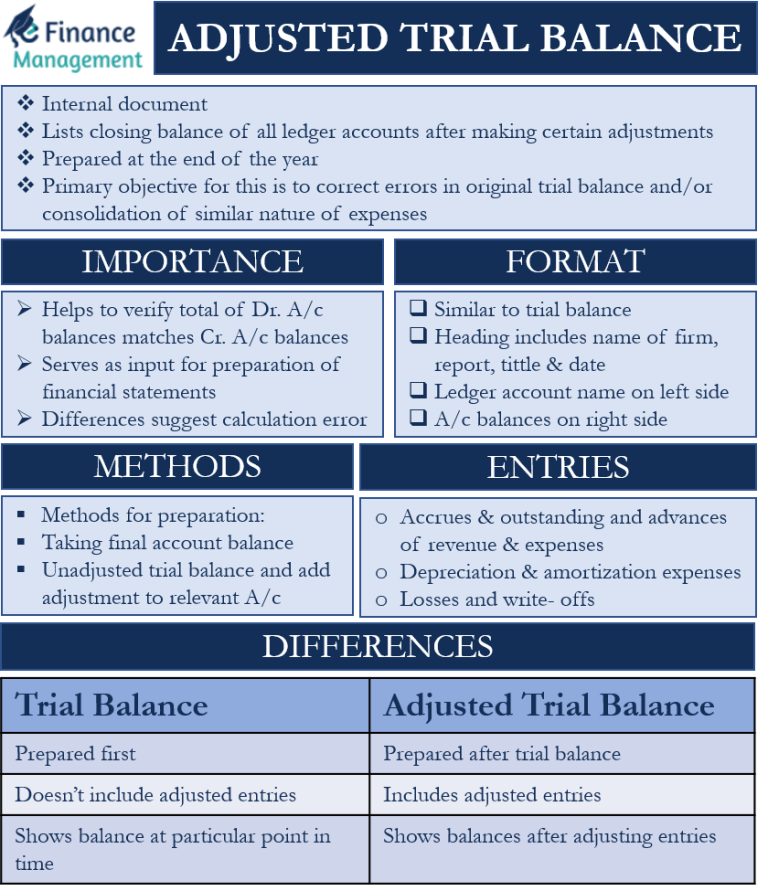

A trial balance is an internal financial statement that lists the adjusted closing balances of all the general ledger accounts (both revenue and capital) contained in the ledger of a business as at a specific date. The total of both should be equal. The law under which ms.

The trial balance is prepared with the objective to eliminate all kinds of accounting errors. This is something that needs to be done once a year. The announcement came one day after a new york judge ordered trump and the trump organization to pay over $355 million as part of a civil fraud case.

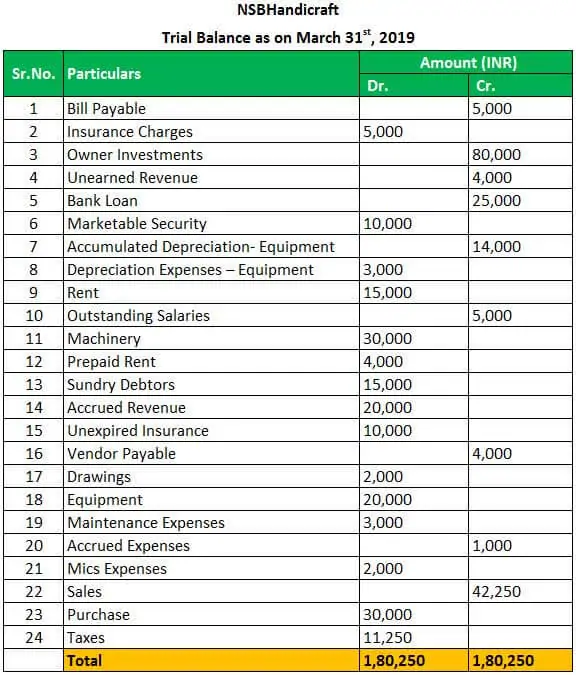

The trial balance is a bookkeeping systematized worksheet containing the closing balances of all the accounts. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Example of a trial balance document

Trial balance is the report of accounting in which ending balances of a different general ledger of the company are and is presented into the debit/credit column as per their balances, where debit amounts are listed on the debit column, and credit amounts are listed on the credit column. There are two sides to it: An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

Trial balance is basically a statement having a debit side and a credit side where all the debit balances of journal entries and ledger postings are recorded on the debit side of the trial balance, and all the credit balances of journal entries and ledger postings are recorded on the credit side of the trial balance. Trial balance meaning. Same as trial balance, if total debit and credit are the same, that means the debit or credit rule probably correctly applies.

What is a trial balance? Trial balances can summarize account performance, providing an overview of individual account balances. Definition of trial balance in accounting as per the accounting cycle, preparing a trial balance is the next step after posting and balancing ledger accounts.

Trial balance is prepared at the end of a year and is used to prepare financial statements like profit and loss account or balance sheet. This statement comprises two columns: The entries have been accurately recorded and balanced if the trial balance is balanced.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)