First Class Info About Other Income Statement And Expenditure Template

It shows whether a company.

Other income statement. Comprehensive income is often listed on the financial statements to include all other revenues, expenses, gains, and losses that affected stockholder’s equity account during. An income statement is a financial report detailing a company’s income and expenses over a reporting period. Trump’s civil fraud trial as soon as friday, the former president could.

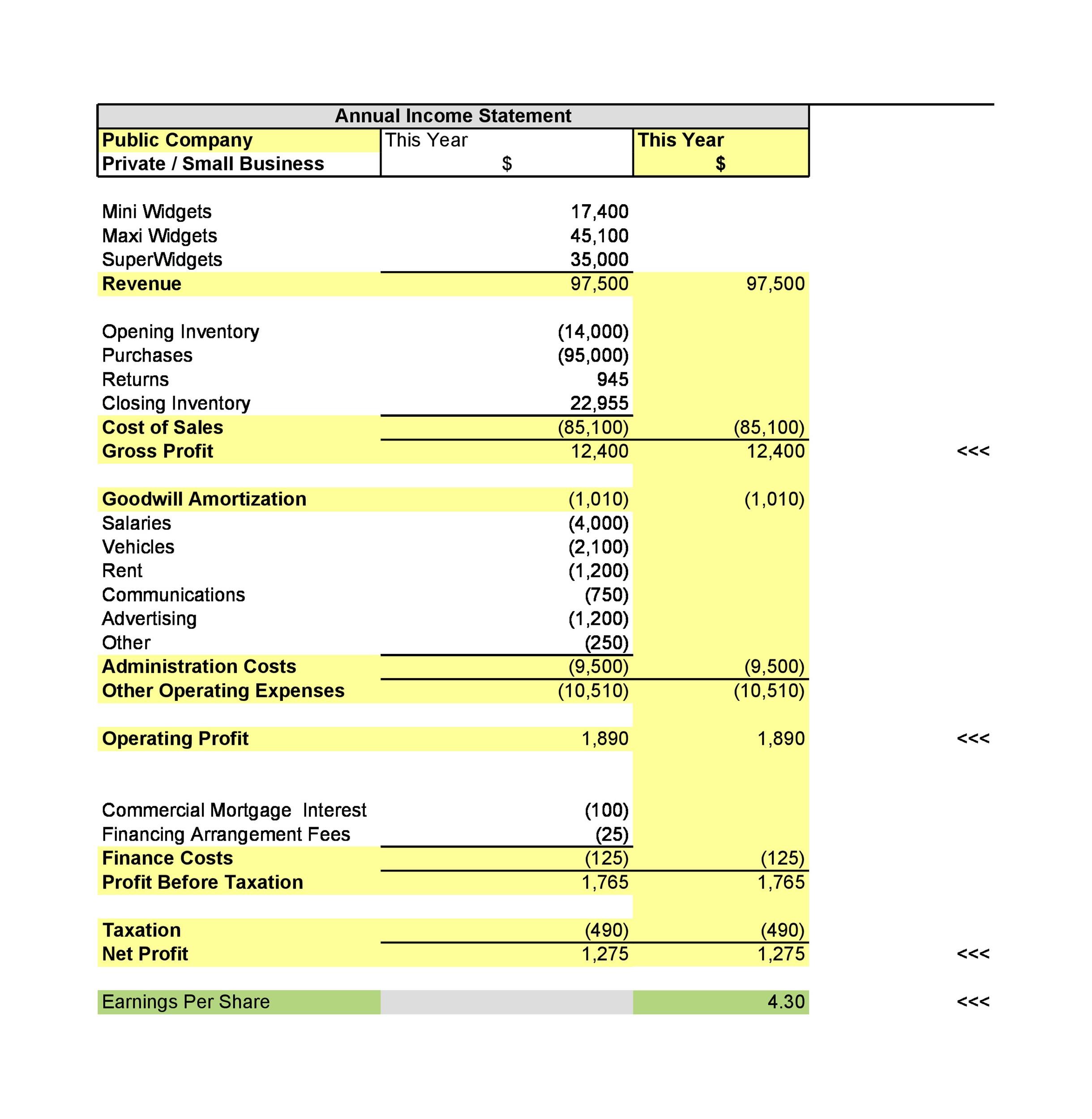

The income statement calculates the company’s net income or net profit by taking into account its earnings, gains, expenses, and losses over a period. The chapea mission 1 crew (from left: When we are auditing the income statement, one of the items that often draws our attention is other income.

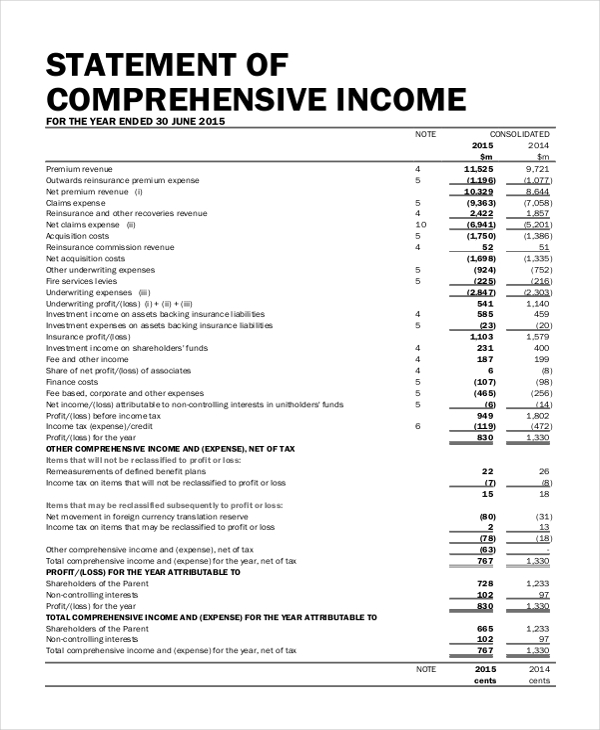

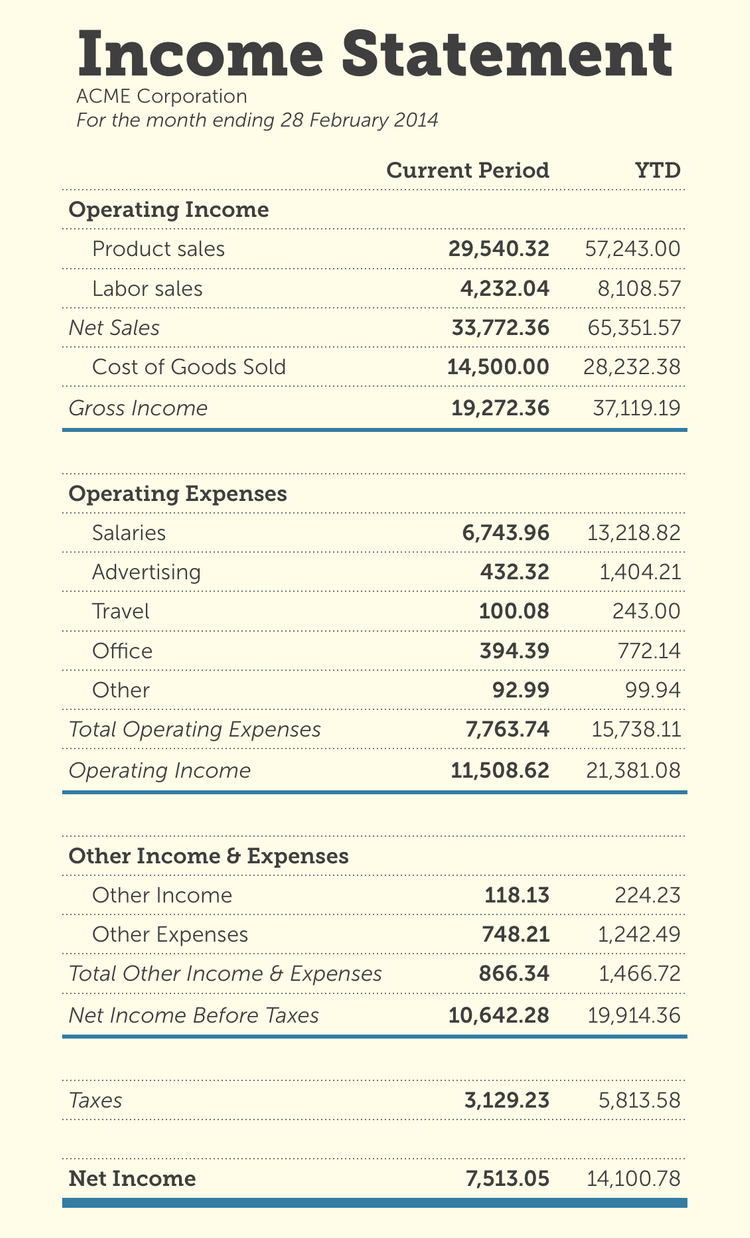

Financial statements for businesses usually include income statements , balance sheets , statements of retained earnings and cash flows. Other comprehensive income (including selected financial statements), pages 2, 8, 14, 18. While it is primarily used to evaluate the past,.

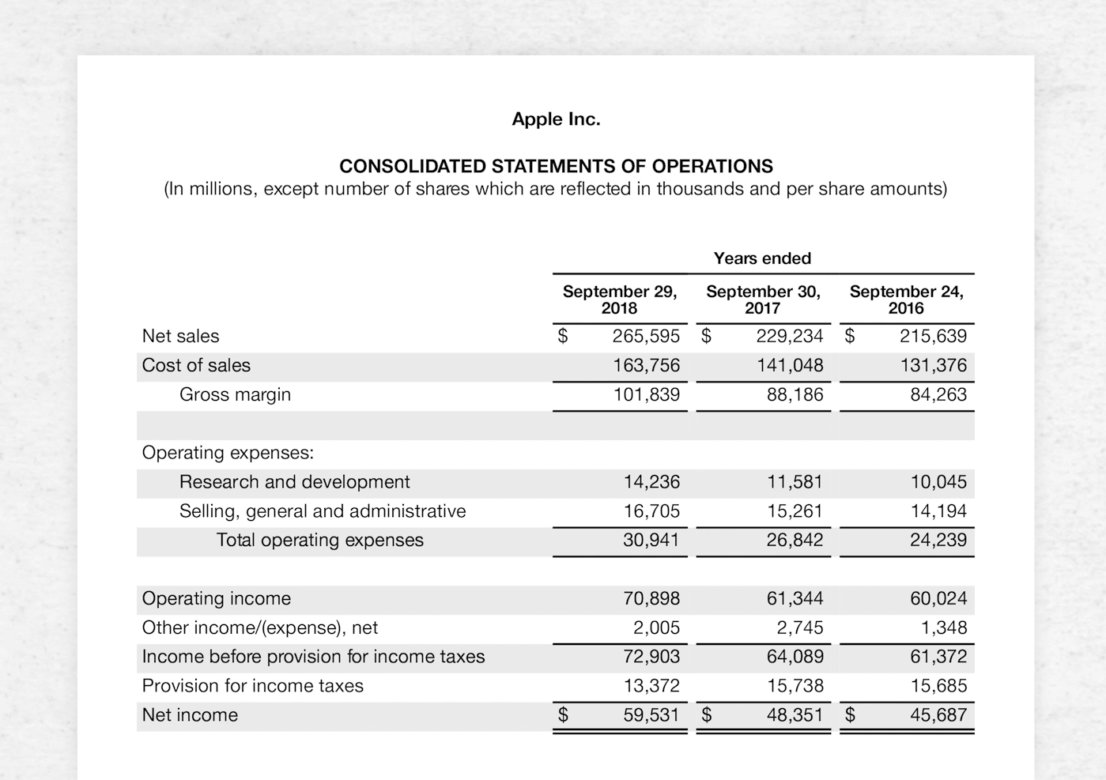

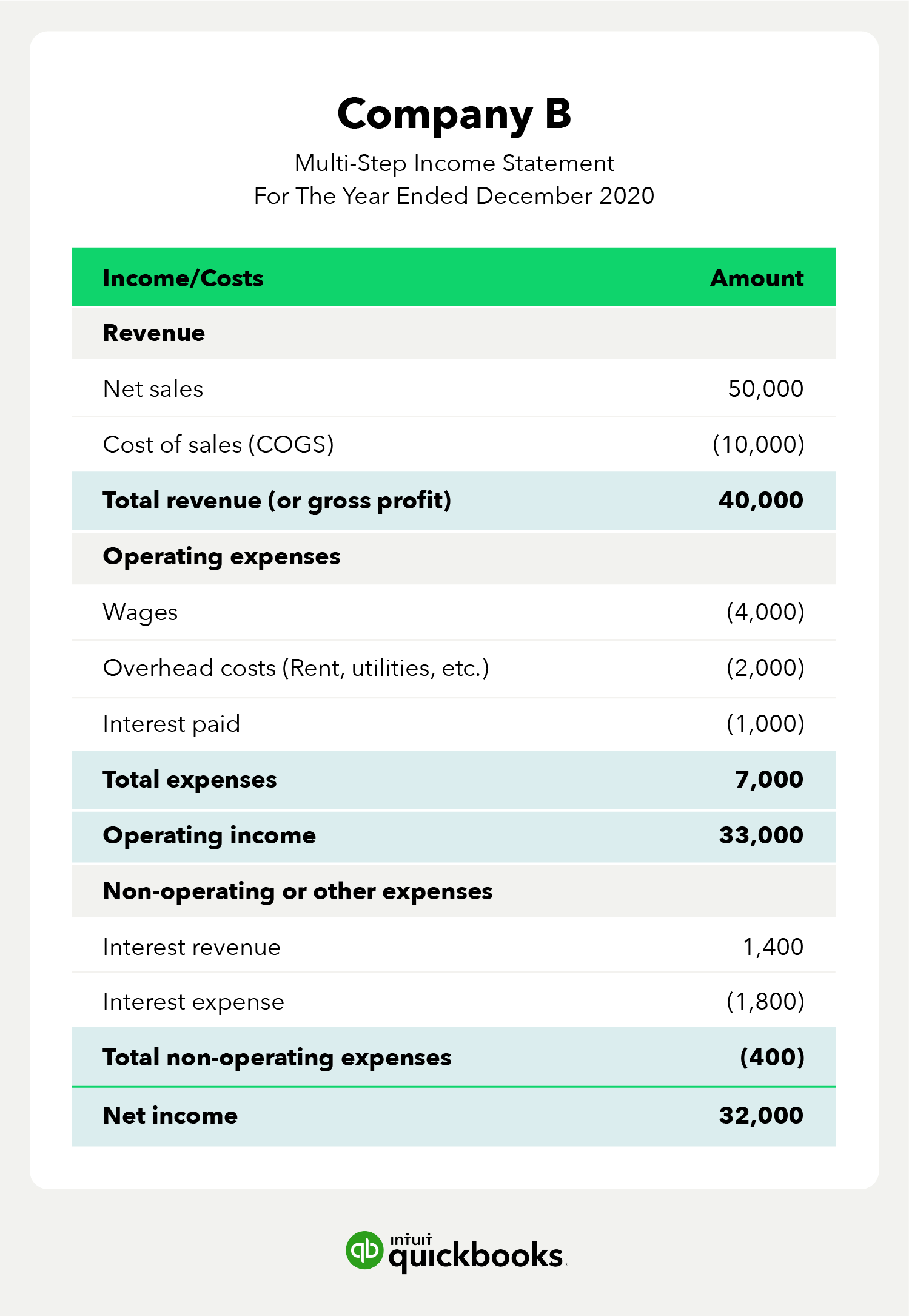

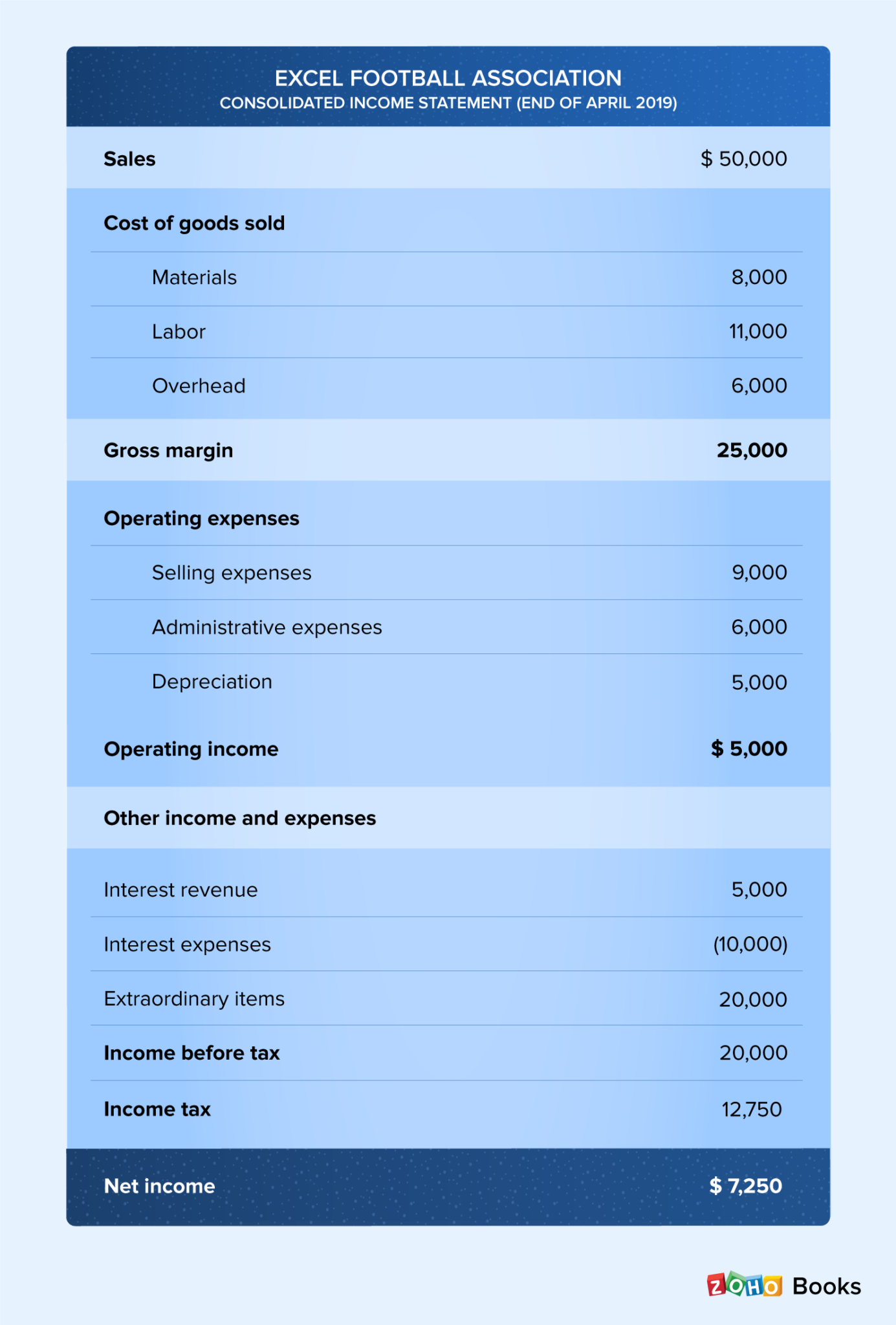

It also shows whether a company is making profit or loss for a given. The income statement is a type of financial statement that determines how a company performed financially in the past. The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time.

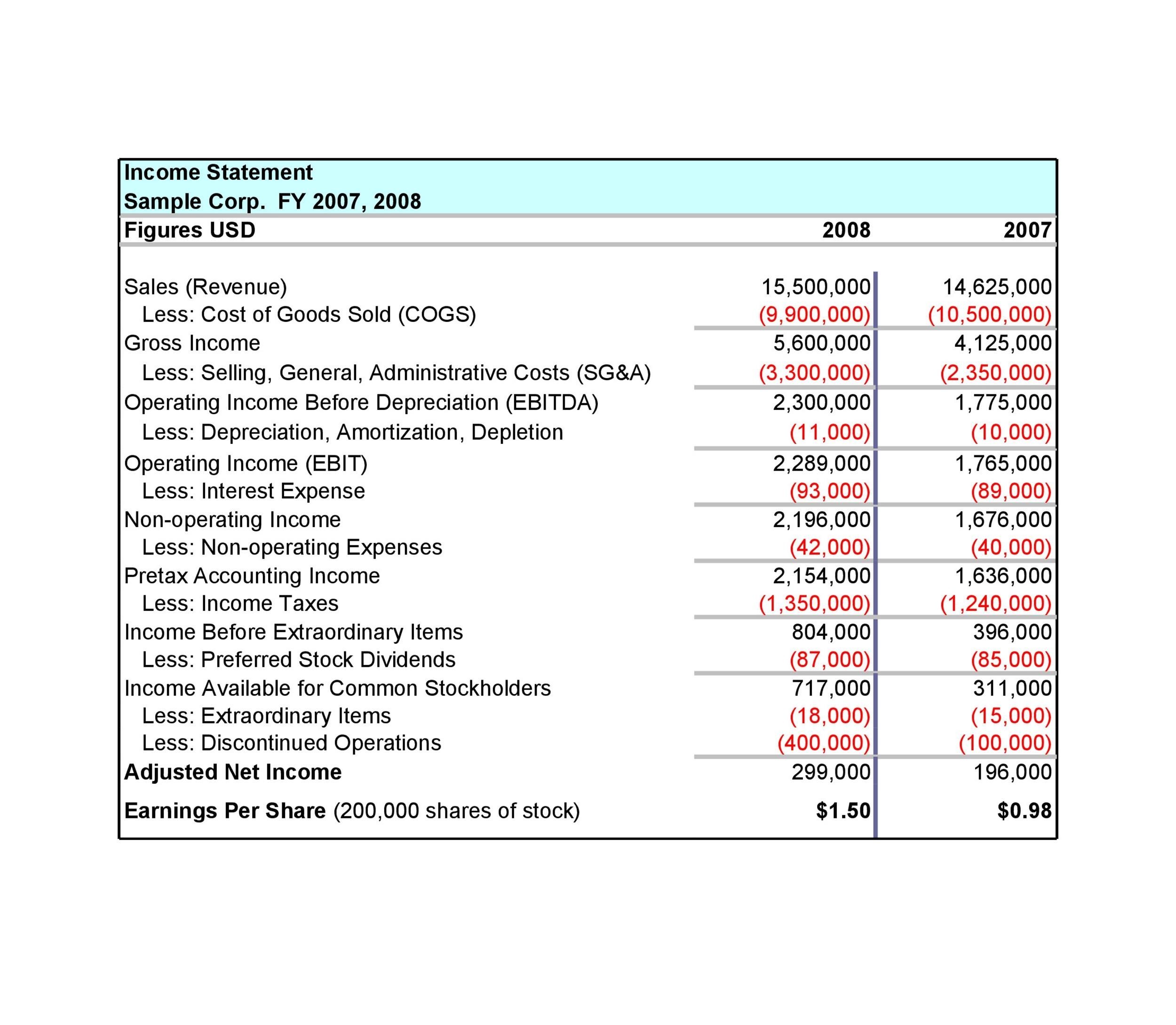

Example #1 american apparel, inc. Written by cfi team what is other comprehensive income? It can also be referred to as a profit and loss (p&l).

Nathan jones, ross brockwell, kelly haston, anca selariu) exit a prototype of a pressurized rover and make their way to the. Accountingverse.com here is a sample income statement of a service type sole proprietorship business. Other income is basically an income that is not revenue,.

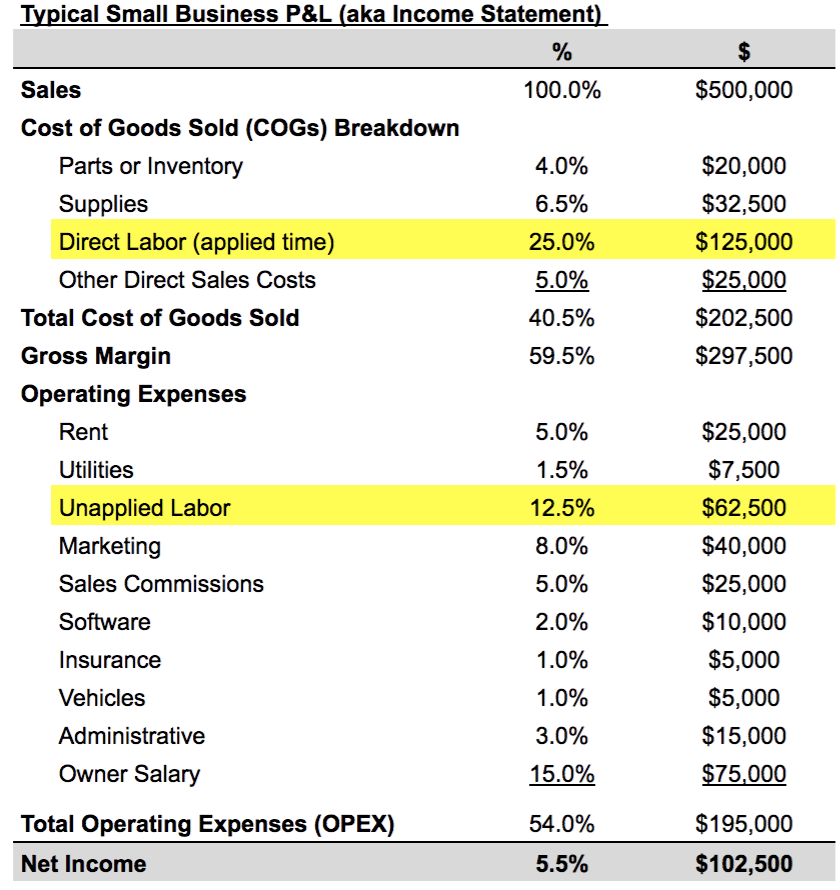

Other comprehensive income consists of revenues, expenses, gains, and losses that, according to the gaap. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income. In the income statement, other income is presented after the other gross profit.

The main difference between income tax and tds is that the income tax is deducted from the payer’s overall profit or annual return, on the other hand, tds refers. Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. Net income is the profit that remains after all.

Below are the various expenses of american apparels: The income statement is one of the five financial statements that report and present an entity’s financial transactions or performance, including revenues, expenses,. When a new york judge delivers a final ruling in donald j.

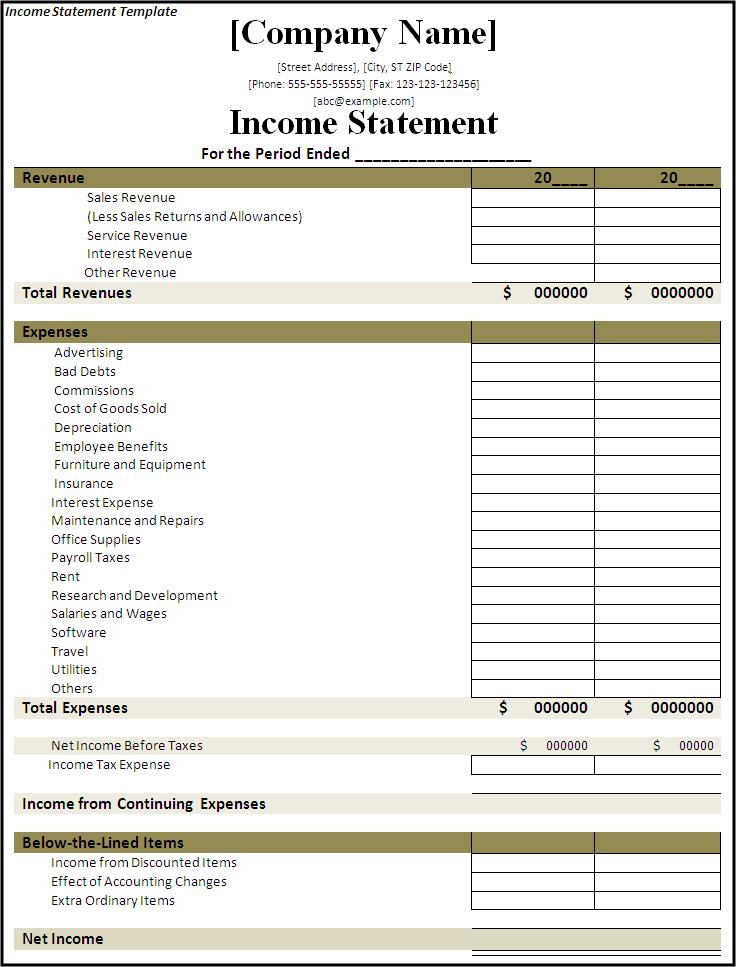

An income statement is a financial statement that shows you the company’s income and expenditures. 16, 2024 updated 9:59 a.m. The exact type of transaction characterized as other income will vary by.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)