Marvelous Info About Financial Ratio Meaning Trending And Profit Loss Account

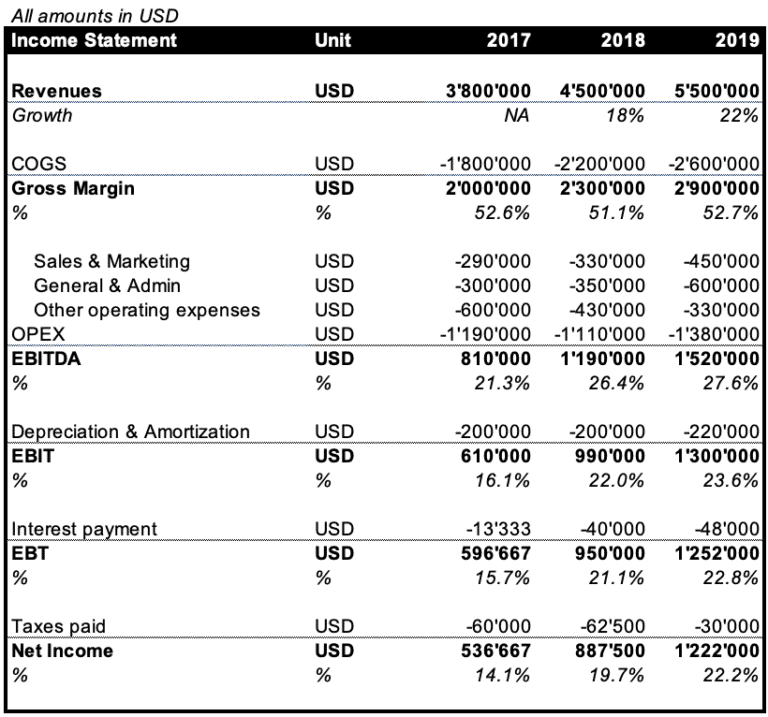

This means that net income changes by 4% for every 1% change in operating profit.

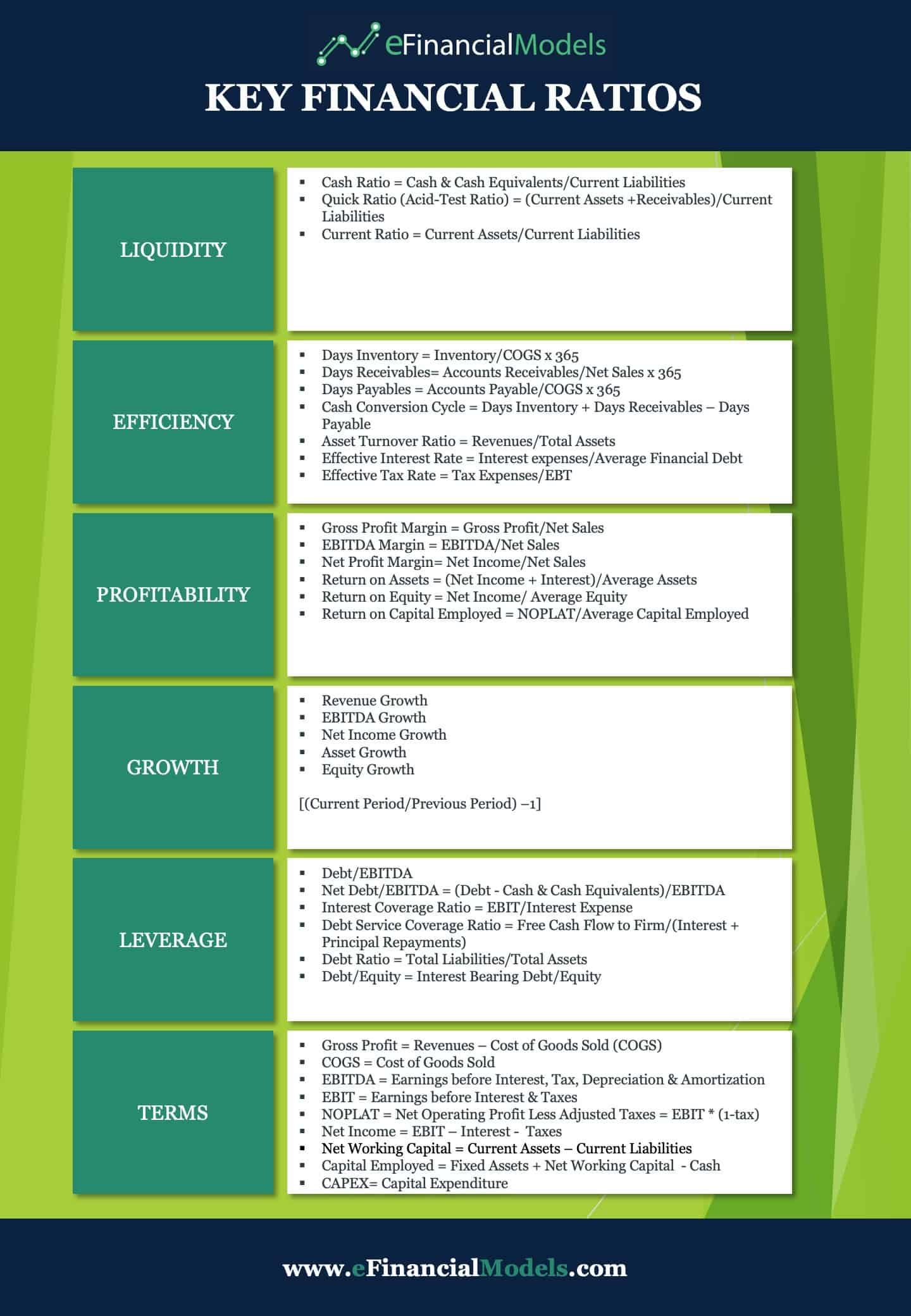

Financial ratio meaning. A financial ratio is used to calculate a company’s financial status or production against other firms. A calculation in which one amount in a company's financial statement is compared to another in order to find out how well the company is performing: The term liquidity refers to how easily a company can turn assets into.

The us business school, part of the. Financial ratios are ratios used to analyze the finances and performance of a company. Russia’s capture of a city that had been a stronghold of ukrainian defenses in the donetsk region is a strategic and symbolic blow.

Financial ratios are the indicators of the financial performance of companies. As with any other financial ratios, calculating just the roce of a company is not enough. A financial ratio is a metric usually given by two values taken from a company’s financial statements that compared give five main types of insights for an organization.

The use of financial ratios is also referred to as financial ratio analysis or ratio. A financial ratio is a means of expressing the relationship between two pieces of numerical data. The use of financial figures to gain significant information about a company.

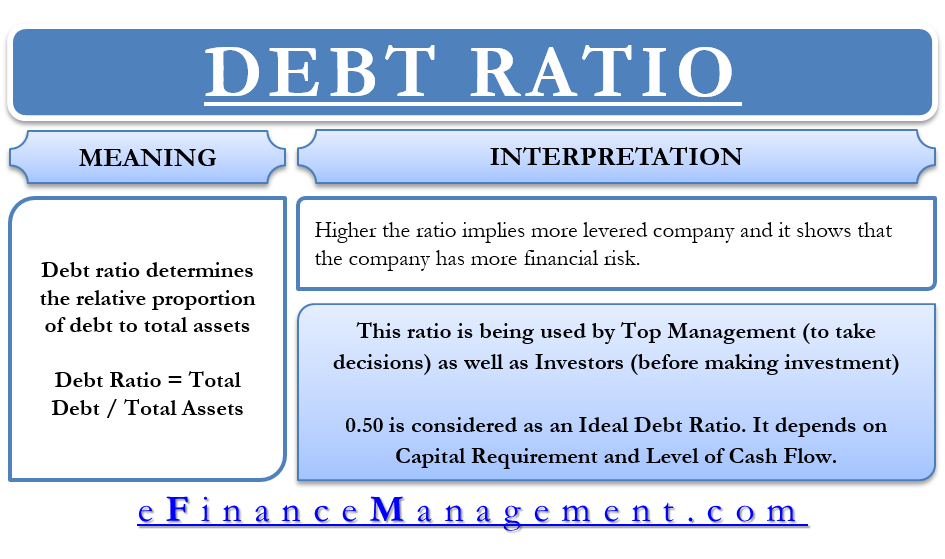

Financial ratios relate or connect two amounts from a company's financial statements (balance sheet, income statement, statement of cash flows, etc.). Things such as l iquidity, profitability, solvency, efficiency, and valuation are assessed via financial ratios.those are metrics that can help internal and external. The greater the debt, the higher is the financial leverage.

The liquidity ratios answer the question of whether a business firm can meet its current debt. What is a financial ratio?

Gearing ratios are financial ratios that compare some form of owner's equity (or capital) to debt, or funds borrowed by the company. A ratio is the relation between two amounts showing the number of times one value contains or is contained within the other. Ratios are comparison points between different figures in a business' financial statements.

Finance management course financial ratio offers a way to evaluate a company’s performance and compare it to similar companies. If one number goes up and another goes down, this means that something has changed. Understanding the ways to apply financial ratios to determine the success of an organization is an important element of finance management.

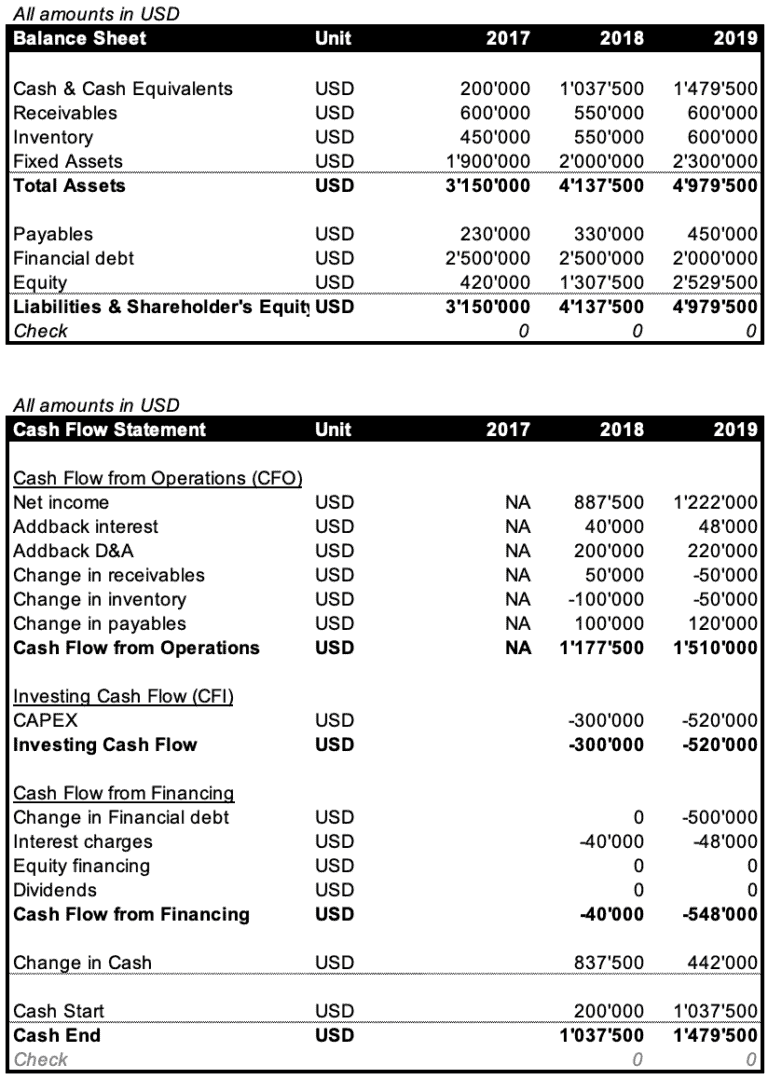

How to read financial statements It is a tool used by investors to analyse and gain information about the finance of a company’s history or the entire business sector. Efficiency ratios, also called asset management ratios or activity ratios, are used to determine how.

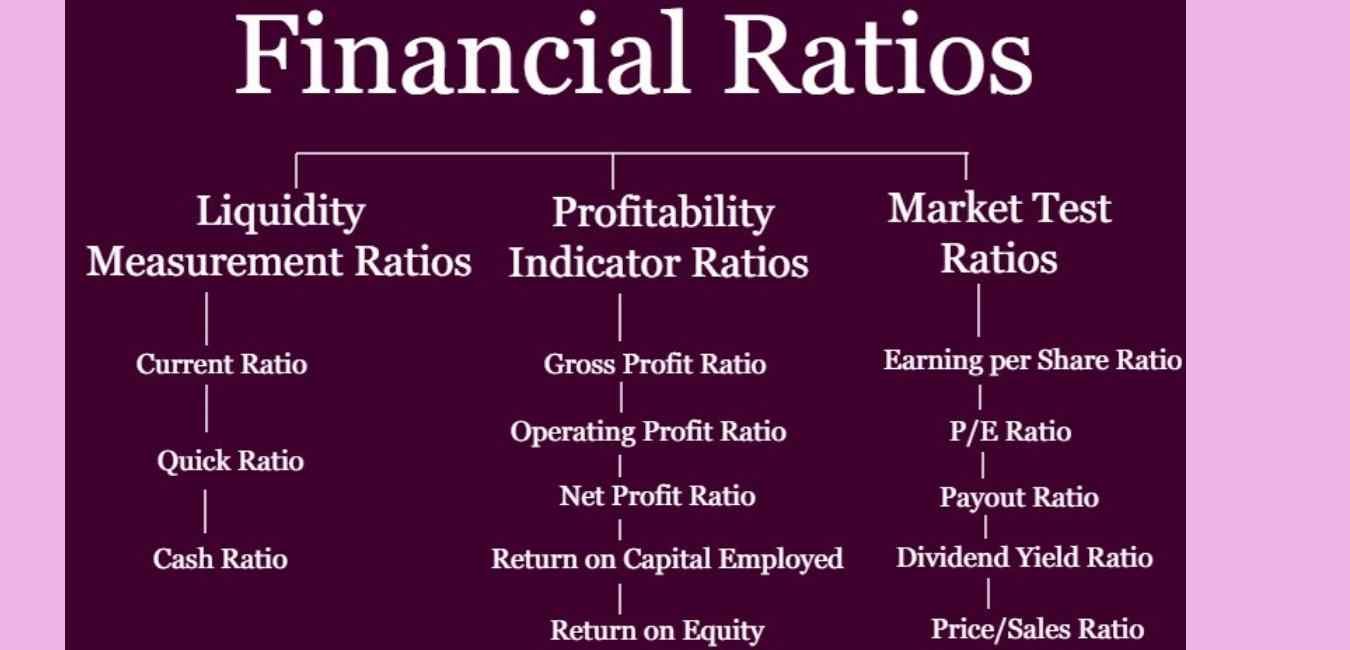

Below are the five most common ratios: One of the purposes of financial ratio analysis is to compare an organization's financial performance with comparable firms in the sector to grasp the organization's situation on the lookout. We'll discuss the 5 main categories of financial ratios and walk through 31 examples, their meanings, and how to interpret them.

![Financial Ratio Analysis Guide for Complete Beginners [2022 Edition]](https://1.bp.blogspot.com/-tbonvRLOtXo/YMJo_p1AG_I/AAAAAAAAJp0/yvMjaglsq-Yk58jDm3P9bgZ_Pw2o2D33gCLcBGAsYHQ/s16000/Ratio-Analysis.webp)