Stunning Tips About Statement Of Partnership Income Cfi Cash Flow

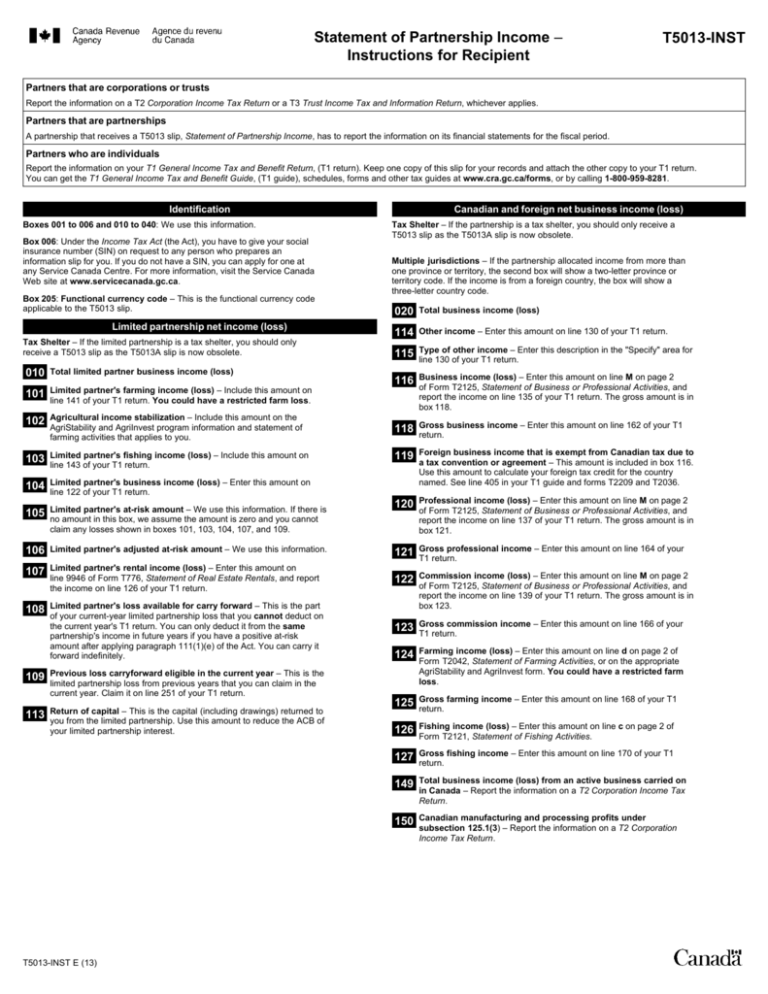

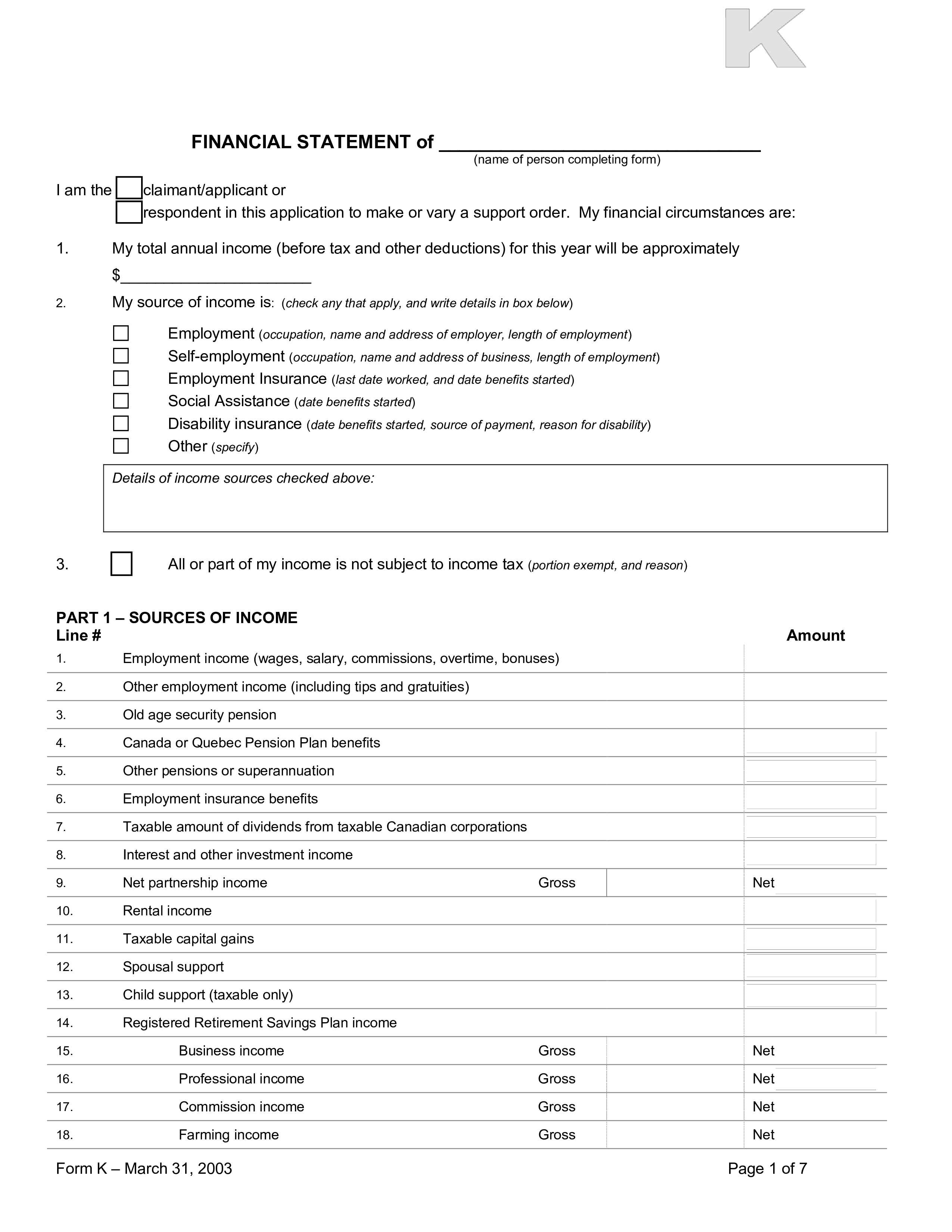

Return of partnership income, including recent updates, related forms and instructions on how to file.

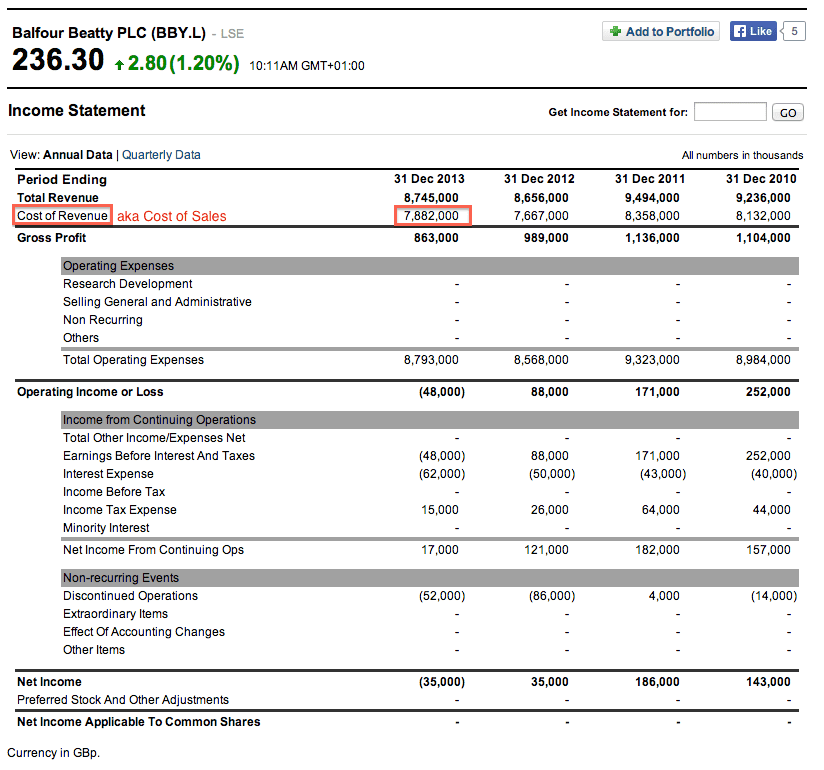

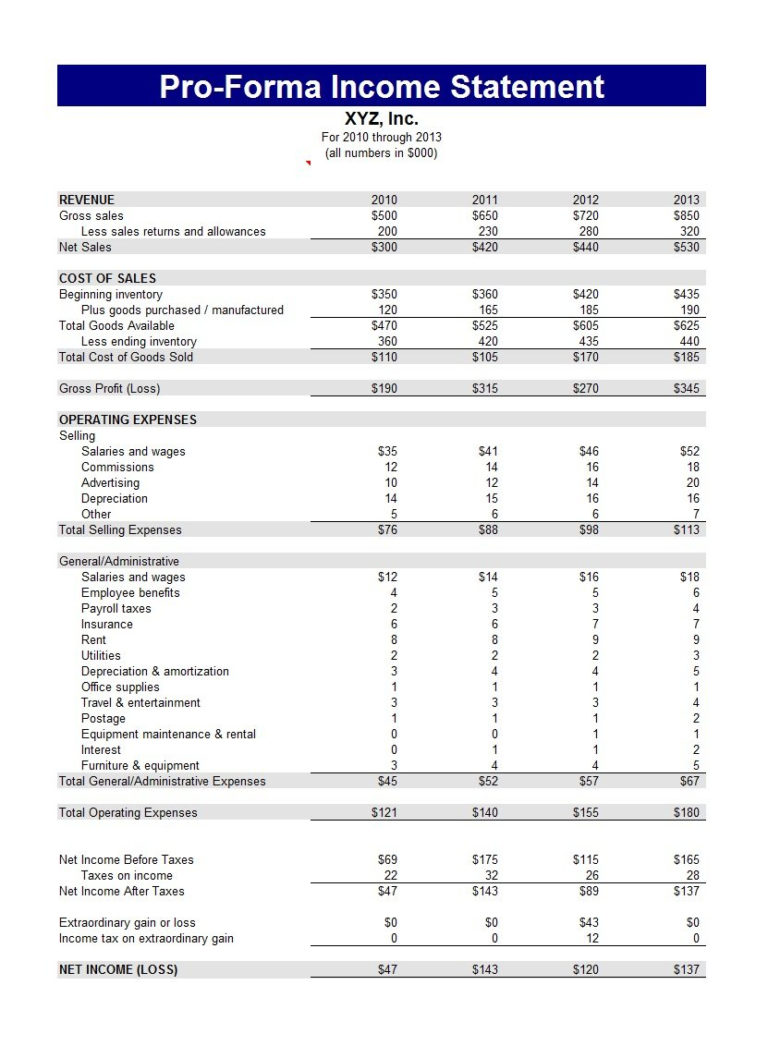

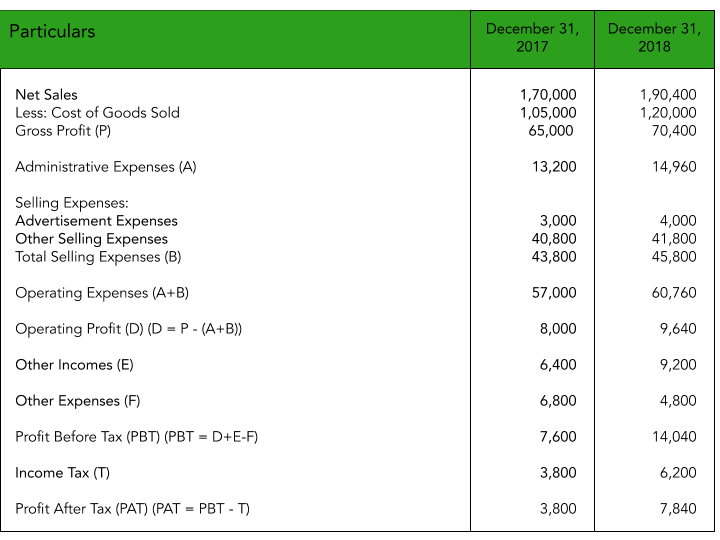

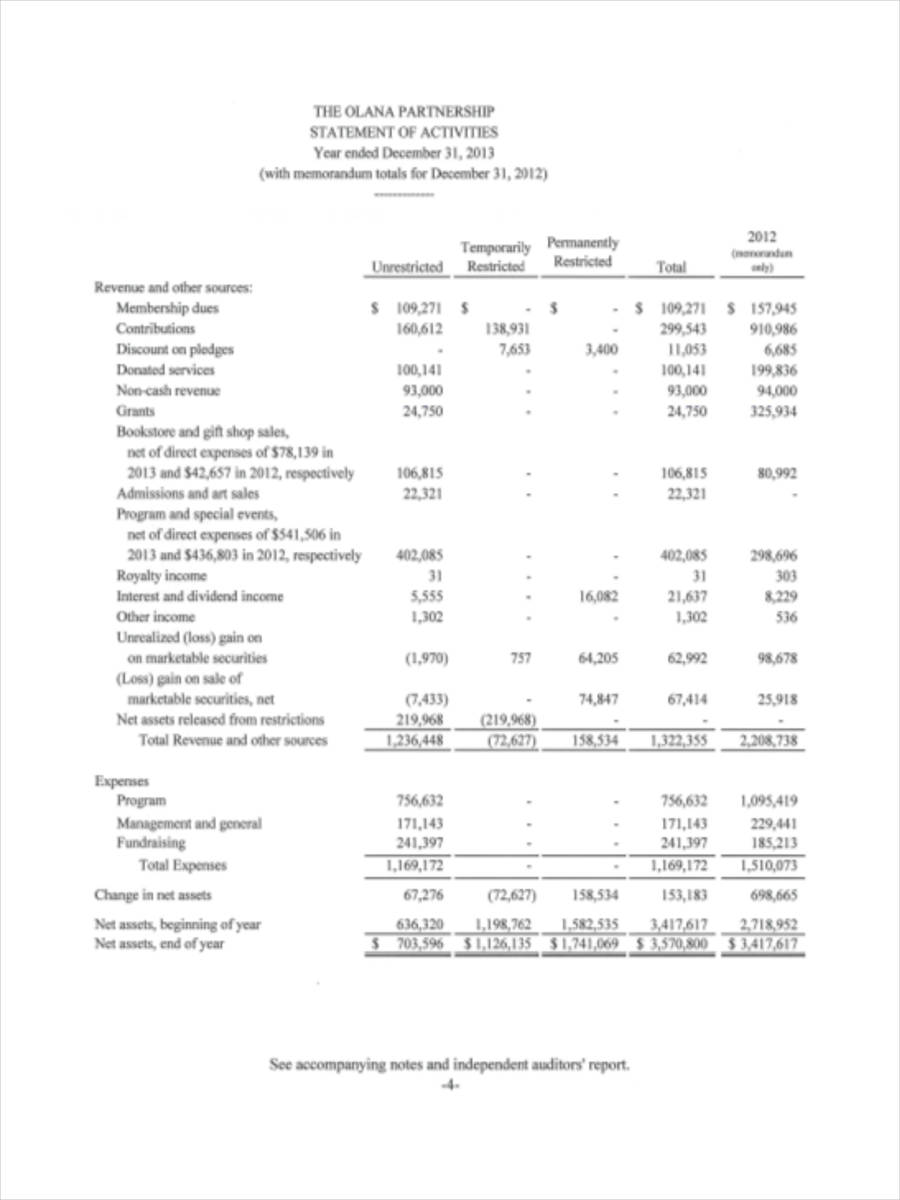

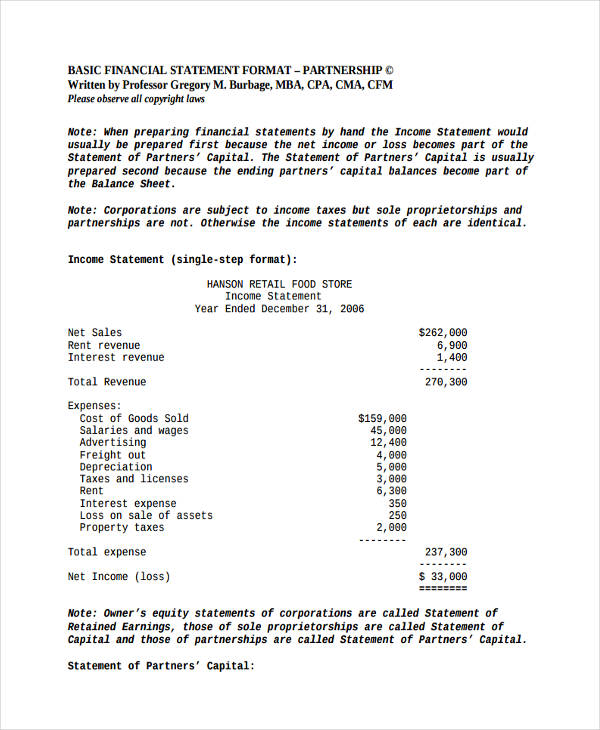

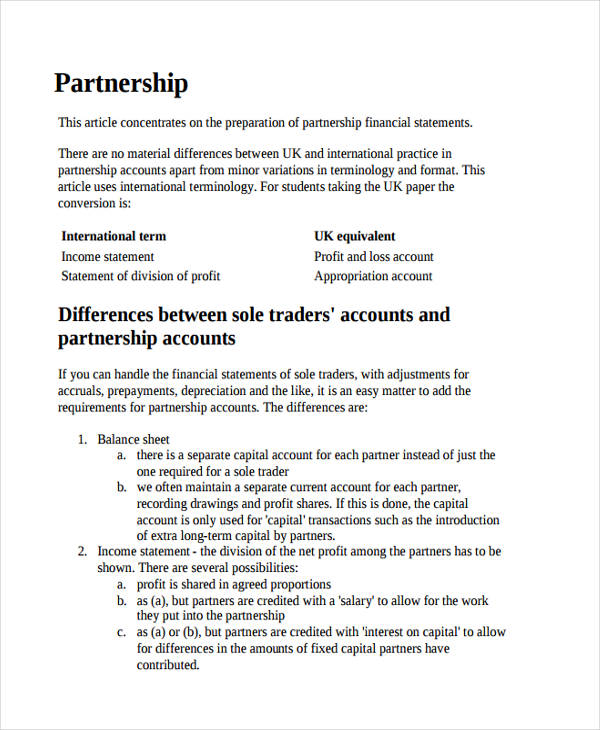

Statement of partnership income. Follow the instructions on information. Income statement for the year ended 30 june 2009. Income statement the main part of the income statement is prepared exactly as for a sole trader.

Form 1065 is used to report the. Exemption for farm partnerships from filing t5013 partnership information return.

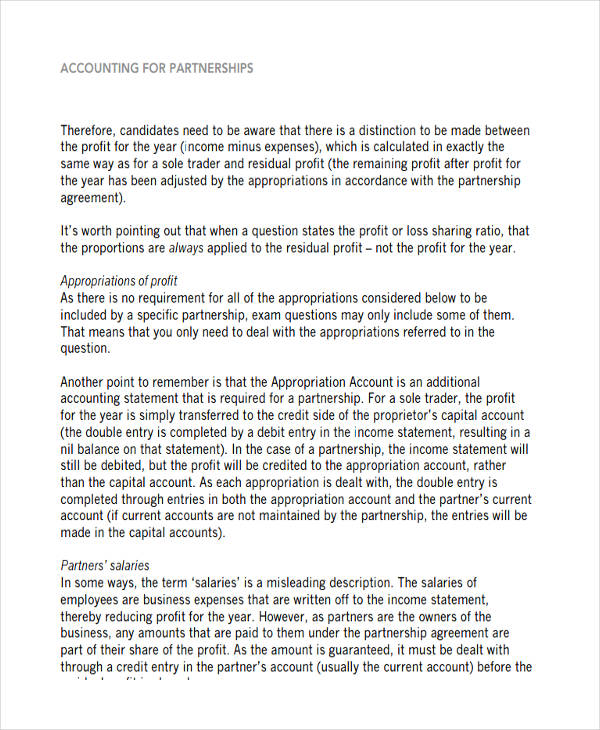

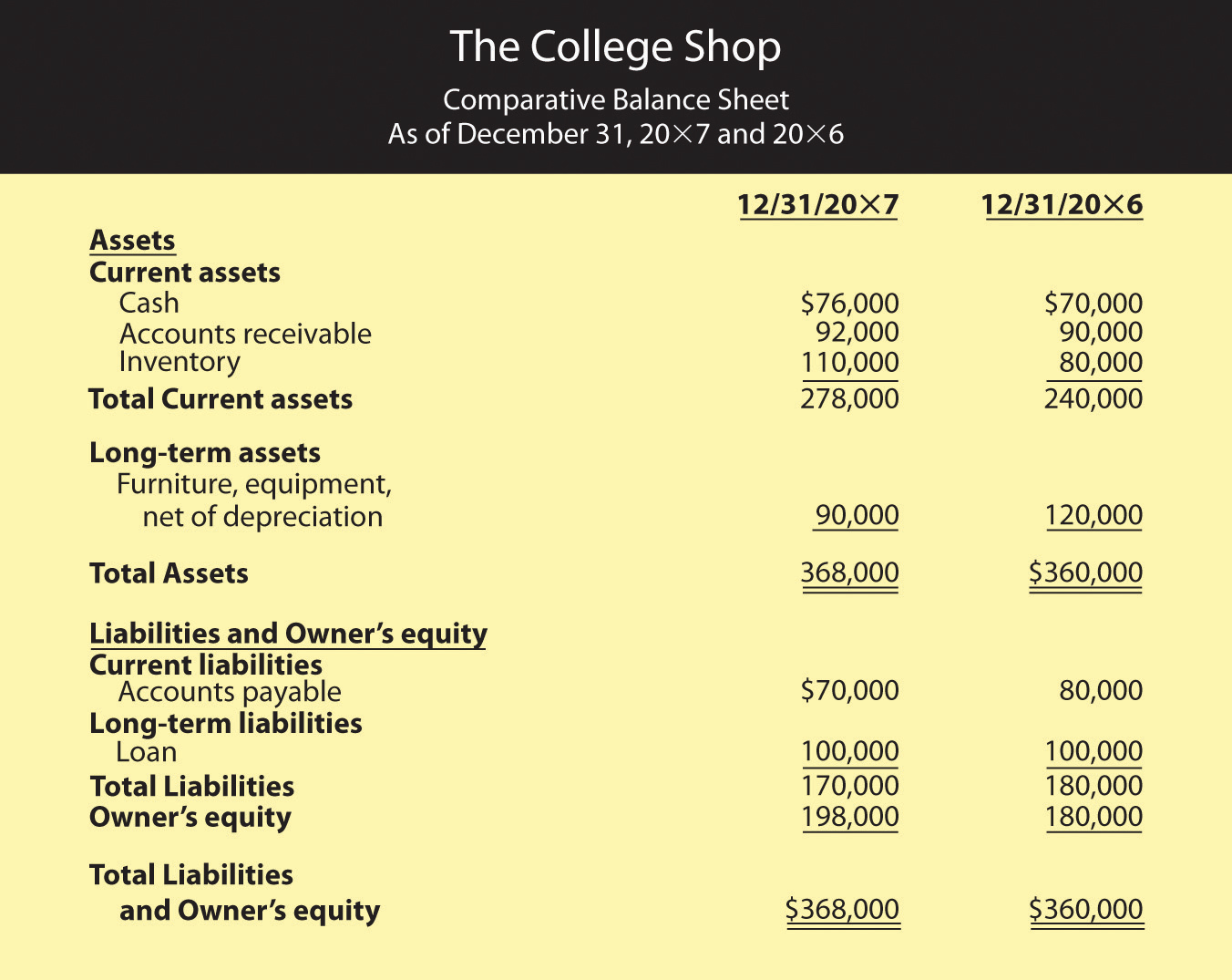

Preparing partnership financial statements. Net income for the year equalled $15,000, allocated as a: In the case of a partnership, the income statement will still be debited, but the profit will be credited to the appropriation account, rather than the capital account.

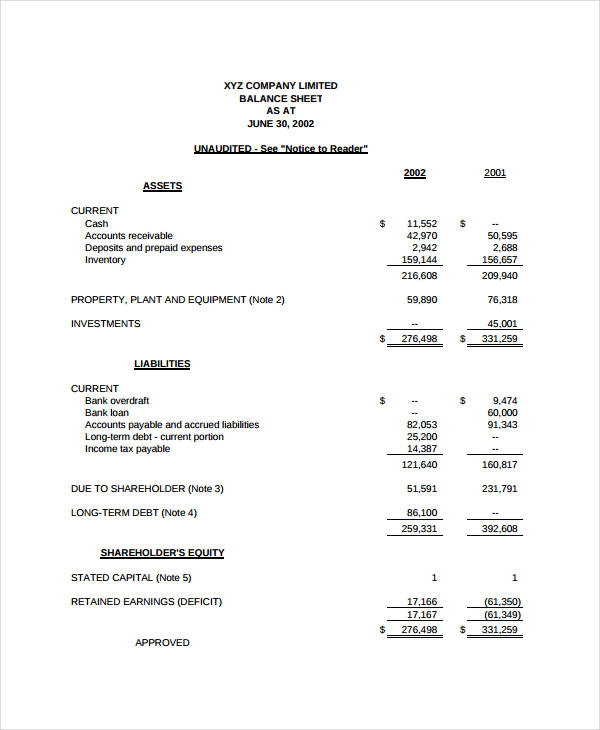

Sample income statement, balance sheet and statement of changes in equity of partnership. (a) do not put partners' salaries or interest on capital into the main income statement. A partnership that receives a t5013 slip, statement of partnership income, must report the slip information on its financial statements for the fiscal period.

Partnership statement of financial position. The department will continue to assist our external partners through webinars, resources, and updates on the knowledge center.we also welcome our. The allocation of net income and its impact on the partners' capital balances must be disclosed in the financial statements.

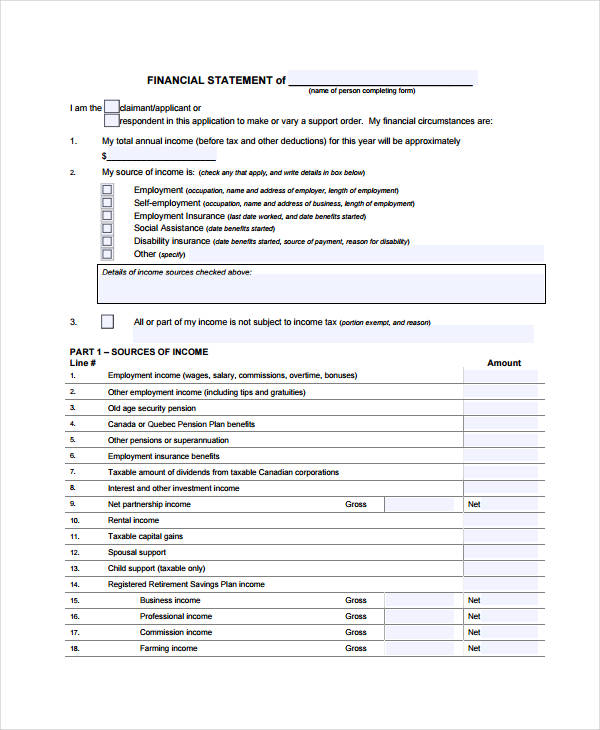

Salaries insurance 5 sundry expenses notes to figure 3 48,300 12,800 15,600 68,400 3,800 448,700 184,600 30,000 88,000 4,000 39,400 1. For a partner who is an individual, amounts shown on this slip have to be reported on an income tax and benefit return. Income statement a general partnership prepares its income statement to reflect the revenues the firm generated, the expenses it incurred and the resulting partnership profits.

The t5013 partnership information return can be filed electronically. Information about form 1065, u.s. If the partnership does not have to file a return, the partners have to use the information from the partnership's financial statements to report their share of the partnership's.

The three financial statements for a partnership are the income statement, capital statement (or statement of owner's equity), and balance sheet. Partnership statement of profit and loss. Canadian tax form t5013, also known as the statement of partnership income, is a form that partnerships in canada use to report basic financial information about their.