Can’t-Miss Takeaways Of Info About Understanding Cash Flows Dupont Ratio Analysis

A company creates value for.

Understanding cash flows. This ratio determines how much cash is being generated for each dollar of sales. Operating activities this represents your net cash inflow or outflow resulting from your actual operations and indicates whether the business model is sustainable. Cash flow is the heartbeat of your small business, reflecting the movement of money in and out.

Having good employees is key to business growth, and in 2024 business owners say it's a top priority, even ahead of cash flow. The cfs measures how well a. Embark on a thrilling adventure through cash flow statements, exploring the wonders of operating, investing, and financing cash flows.

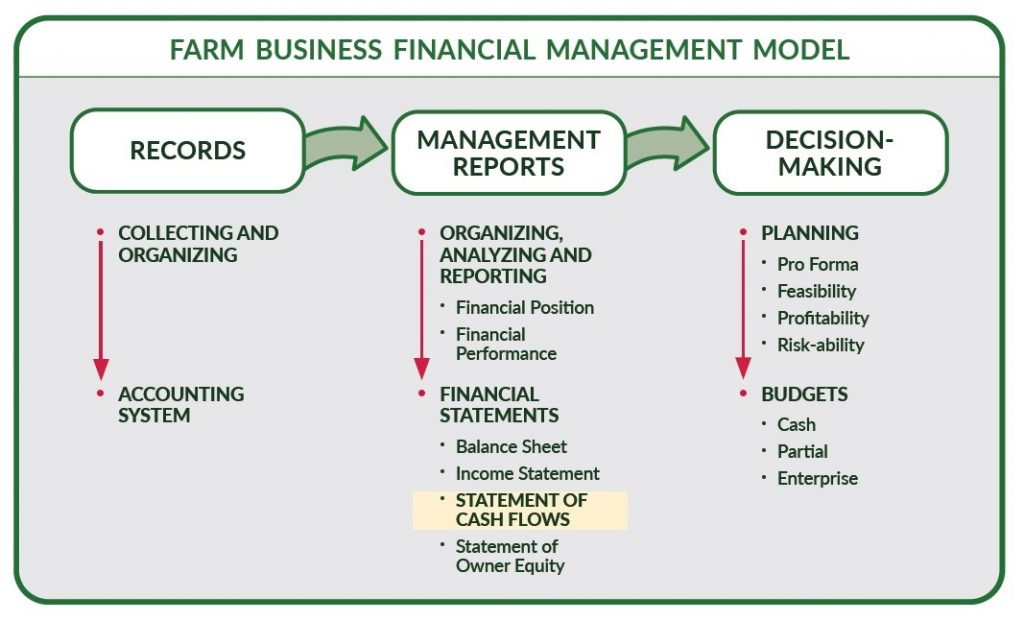

Cash flow is the heartbeat of your business. A cash flow statement is one of the three basic financial reports —the other two being the balance sheet and income statement (or profit and loss statement). Cash flow is typically broken down into cash flow from operating activities, investing activities, and financing activities on the statement of cash flows, a common financial statement.

This includes sales revenue and expenses related to delivering your product or service. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. First, there’s operating cash flow, which reflects the cash generated from your core business operations.

happening now ande investment manager training in phuket, thailand what's happening: Think of it as the vital fluid that keeps your business’s heart pumping, allowing you to cover expenses, pay employees, and invest in growth. The cash flow statement has three main components:

Cash flow (cf) is the increase or decrease in the amount of money a business, institution, or individual has. Entrepreneurs believe hiring skilled employees. 5.1 building a cash flow statement:

Operation is the most important part because it shows how much cash is generated from the actual operations of the business, selling the company’s products. The cash flow statement is required for a complete set of financial statements. Cash flow is the net cash and cash equivalents transferred in and out of a company.

Below is an example from amazon’s 2022 annual report, which breaks down the cash flow generated from operations, investing, and financing activities. Cash flow to sales = operating cash flow ÷ net sales. A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows that a company receives from its ongoing operations and external investment sources.

Cash flow statements prepared using both the indirect and direct methods using the criteria discussed above. The income statement measures a company's financial. The statement of cash flows categorizes cash transactions into three main activities:

Statement of cash flows example. Understanding the cash flow basics involves comprehending its three main components. Cash flow from financing activities;

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)