Marvelous Info About Ifrs 16 And Cash Flow Statement Comparative Format In Excel

Guidance incorporates the acquisition of ball aerospace from 16 february 2024.

Ifrs 16 and cash flow statement. Ifrs 16 sets out the principles for the recognition, measurement,. Q4 operating margin of 22.8%, adjusted operating margin 1 of 19.7%; Annual recurring revenue (arr) of usd730.0m, up 16% c.c.

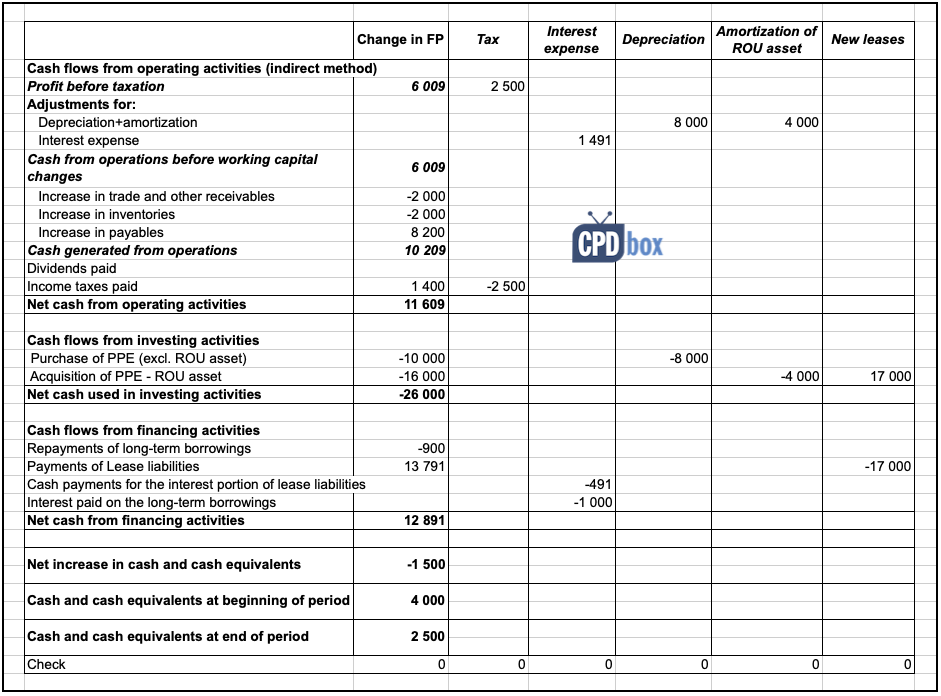

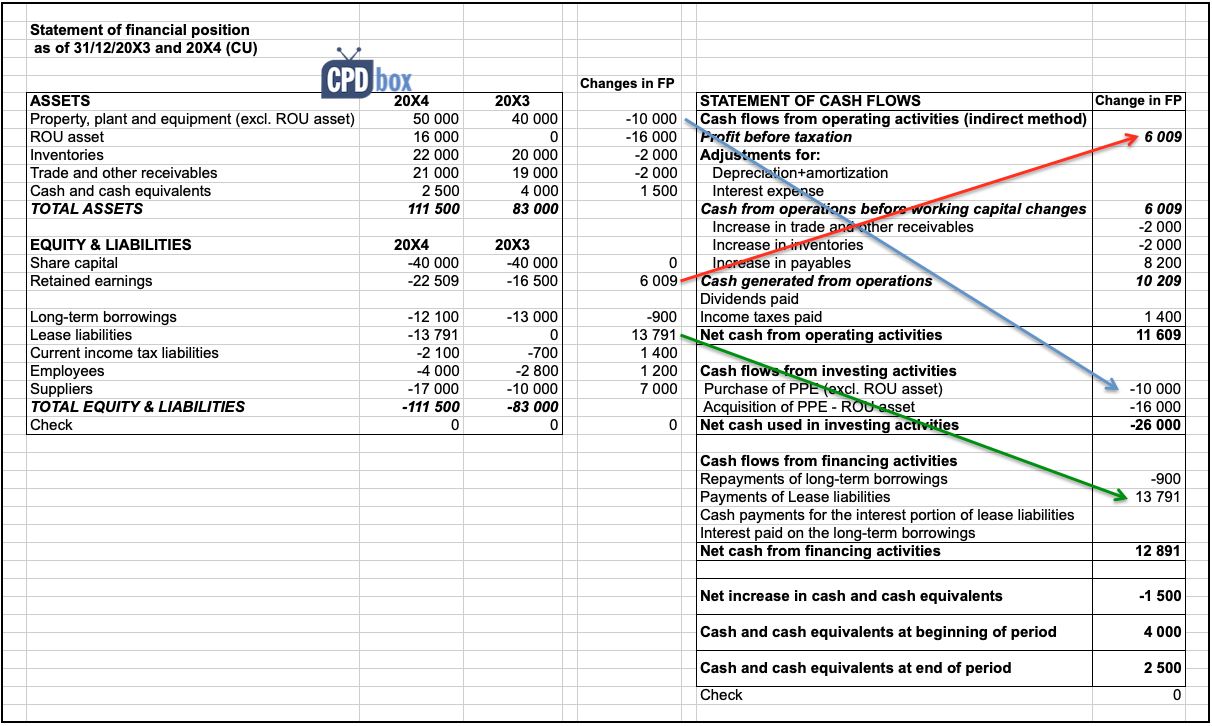

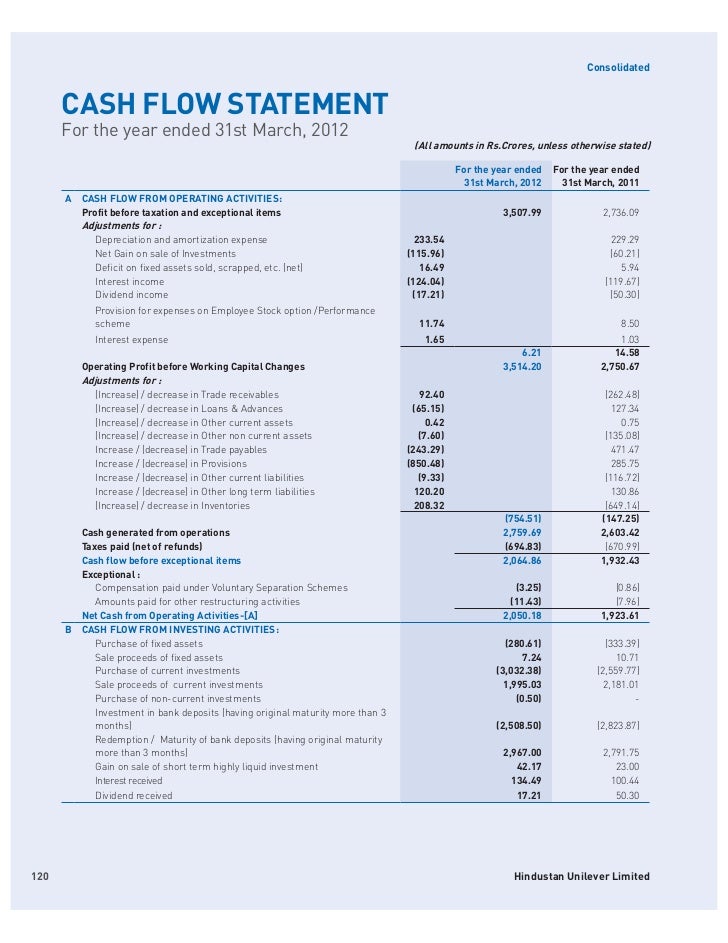

The statement classifies cash flows during a period into cash flows from operating, investing and financing activities: Financial statements and ias 7 statement of cash flows. Cash flows from operating activities.

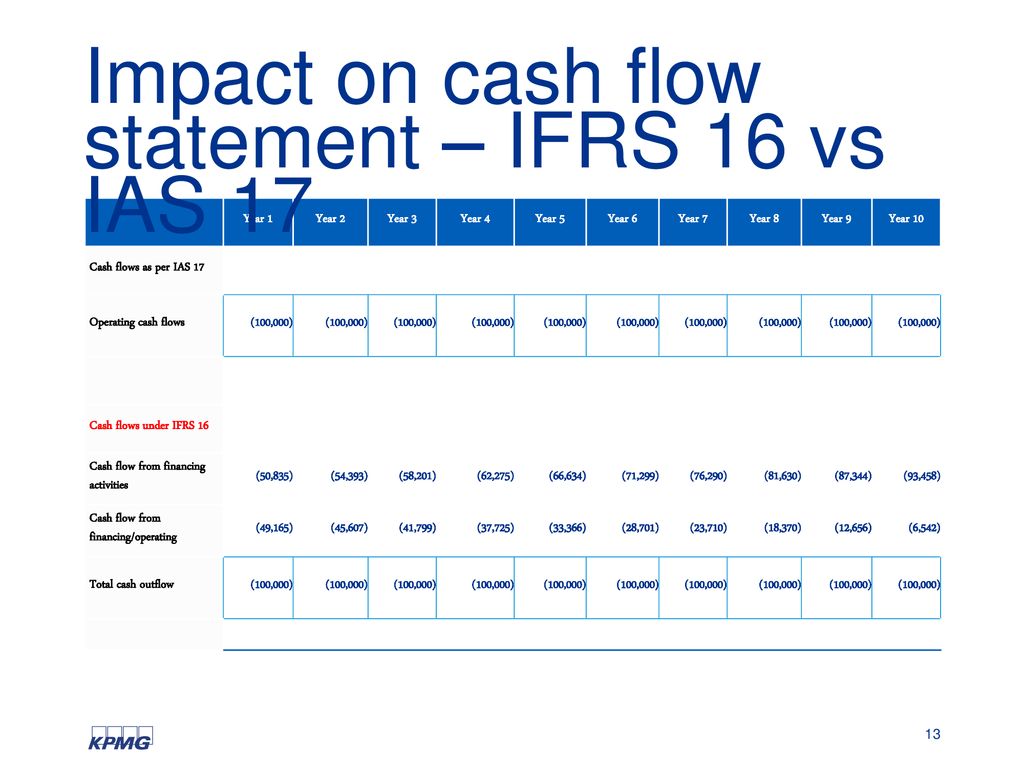

In january 2016 the board issued ifrs 16 leases. Ifrs 16 requires companies to reclassify cash outflows for lease payments from operating to financing activities in the statement of cash flows. Under ifrs 16 8, a lessee classifies cash payments for the principal portion of a lease liability as financing activities in the statement of cash flows.

Full year 2023 highlights. Direct method statement of cash flows. Ifrs 16 leases in the statement of cash flows (ias 7) on 1 january 20x4, abc entered into the lease contract.

Q4 diluted eps of $0.89 up 89%. Income statement and free cash flow. 16 reporting cash flows from investing and financing activities reporting cash flows on a net basis foreign currency cash flows.

Ifrs 16 requires lessees and lessors to provide information about leasing activities within their financial statements. The standard explains how this information should be. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of.

In contrast, ifrs 16 includes specific requirements for the presentation of the rou asset and lease liability and the. What does ifrs 16 mean for a company’s income statement? This publication provides a comprehensive analysis of the impact of ifrs 16 on lessees and lessors, covering the recognition,.

The present value of the lease liability is cu 17 000; Repayments of the principal portion of the lease liability,. The details are as follows:

Sfrs(i) 16/frs 116 leases no longer makes a distinction between operating and finance lease for a lessee and is effective for financial periods beginning 1 january 2019. In addition to the free cash flow above, the group received proceeds of c.£0.2bn. Statement of cash flows the impact of leases on the statement of cash flows includes (ifrs 16.50):

Flows’ (ias 7, the standard). Net sales of $783 million in the fourth quarter, up 9% vs. A new era of lease accounting.