First Class Info About Profit And Loss Statement A Bank Has The Following Balance Sheet Youtube Financial Statements

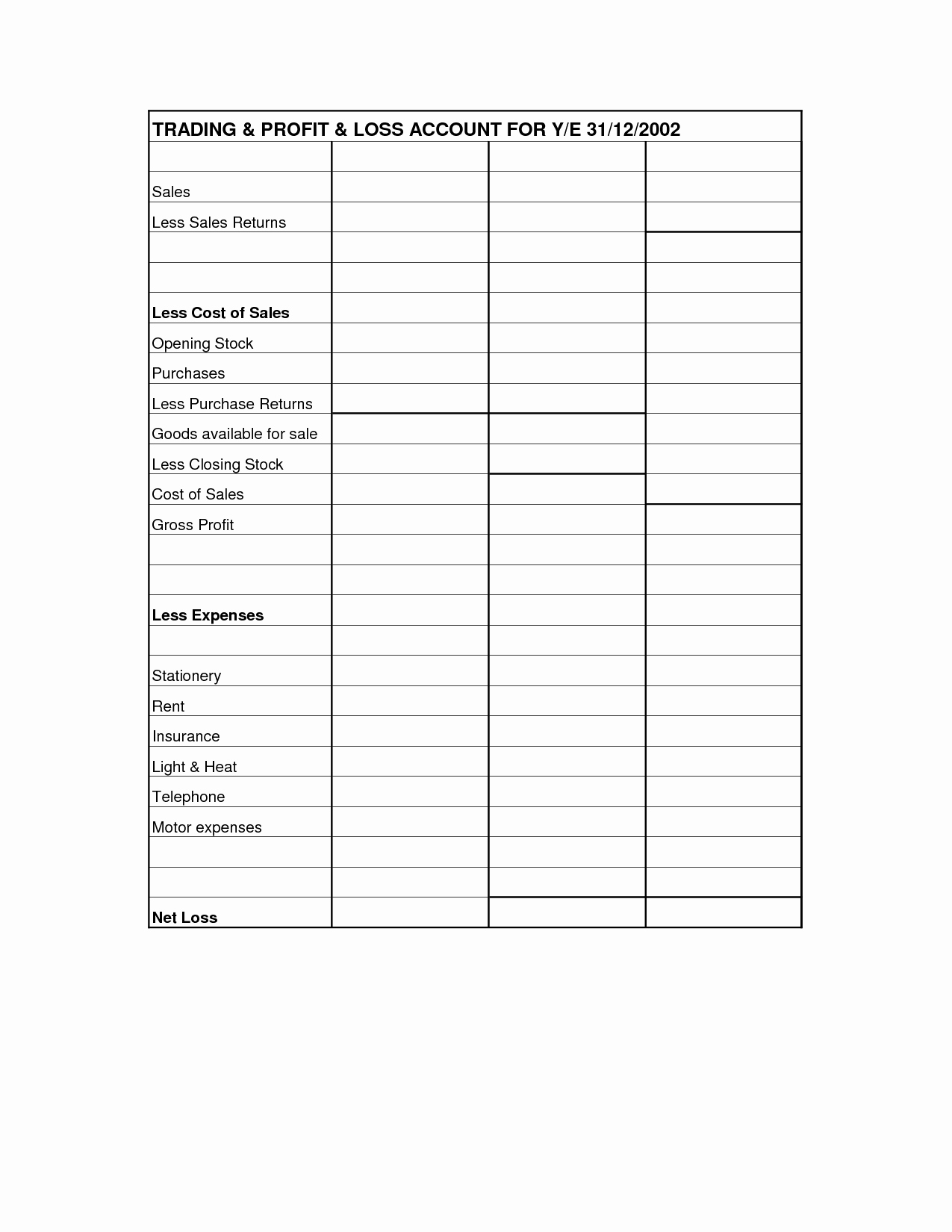

P&l account for superior traders as at 31/12/2004.

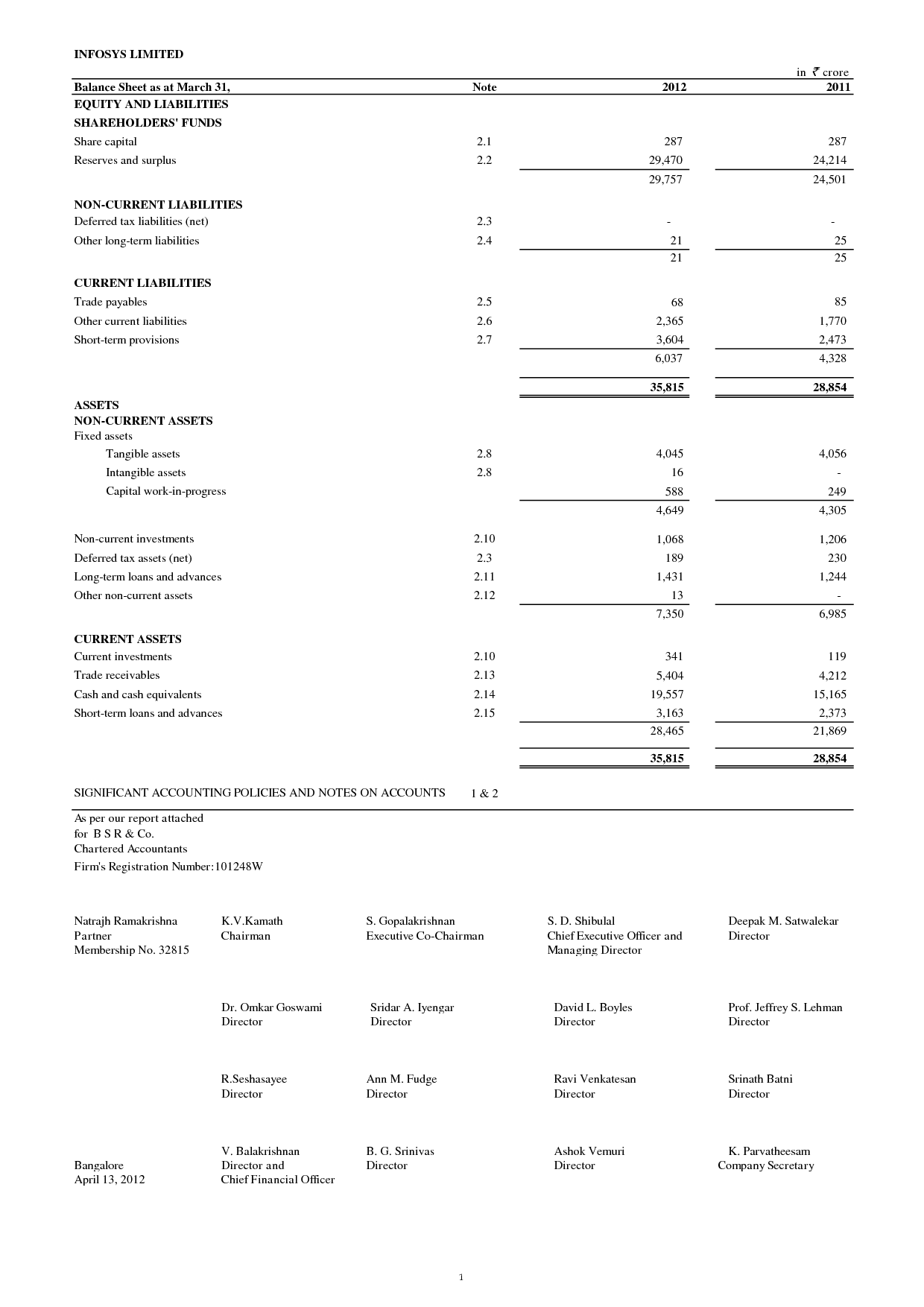

Profit and loss statement a bank has the following balance sheet. Balance sheets usually include more broad information like accounts payable, loans, cash, inventory, assets, investments, securities, expenses and dividends. Dudley bank has the following balance sheet and income statement. A balance sheet is a statement that discloses the financial position of its assets, liabilities and capital on a specific date.

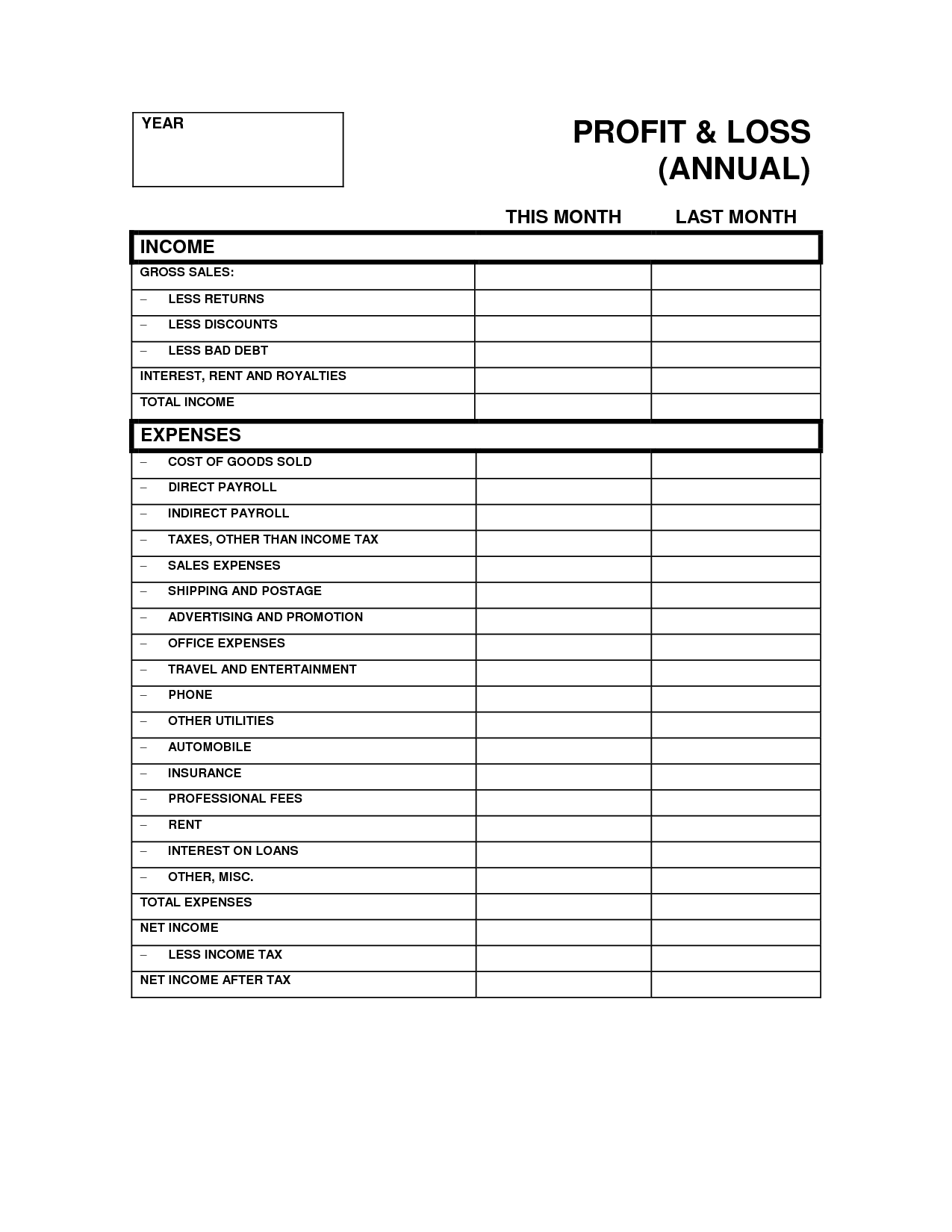

The profit and loss statement (p&l), also referred to as the income statement, is one of three financial statements that companies regularly produce. The profit and loss statement, abbreviated as p&l, is a financial statement. It captures a snapshot of the business’s assets, debts, and equity in a single moment, whereas a p&l.

It gives you a financial snapshot of how much money you’re making (or. Although the balance sheet and the p&l statement contain some of the same financial information—including revenues, expenses and profits—there are important differences between them. Balance sheet profit and loss account;

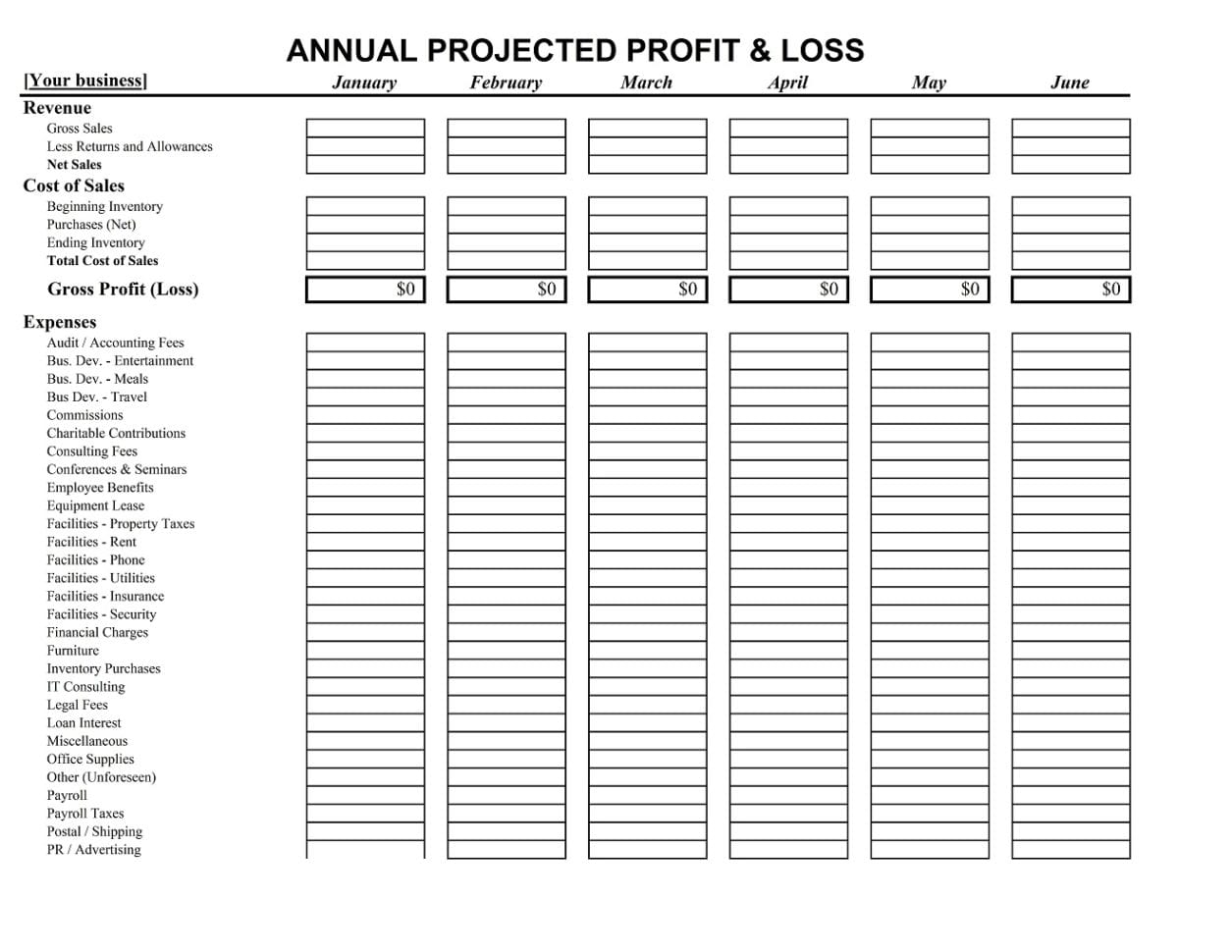

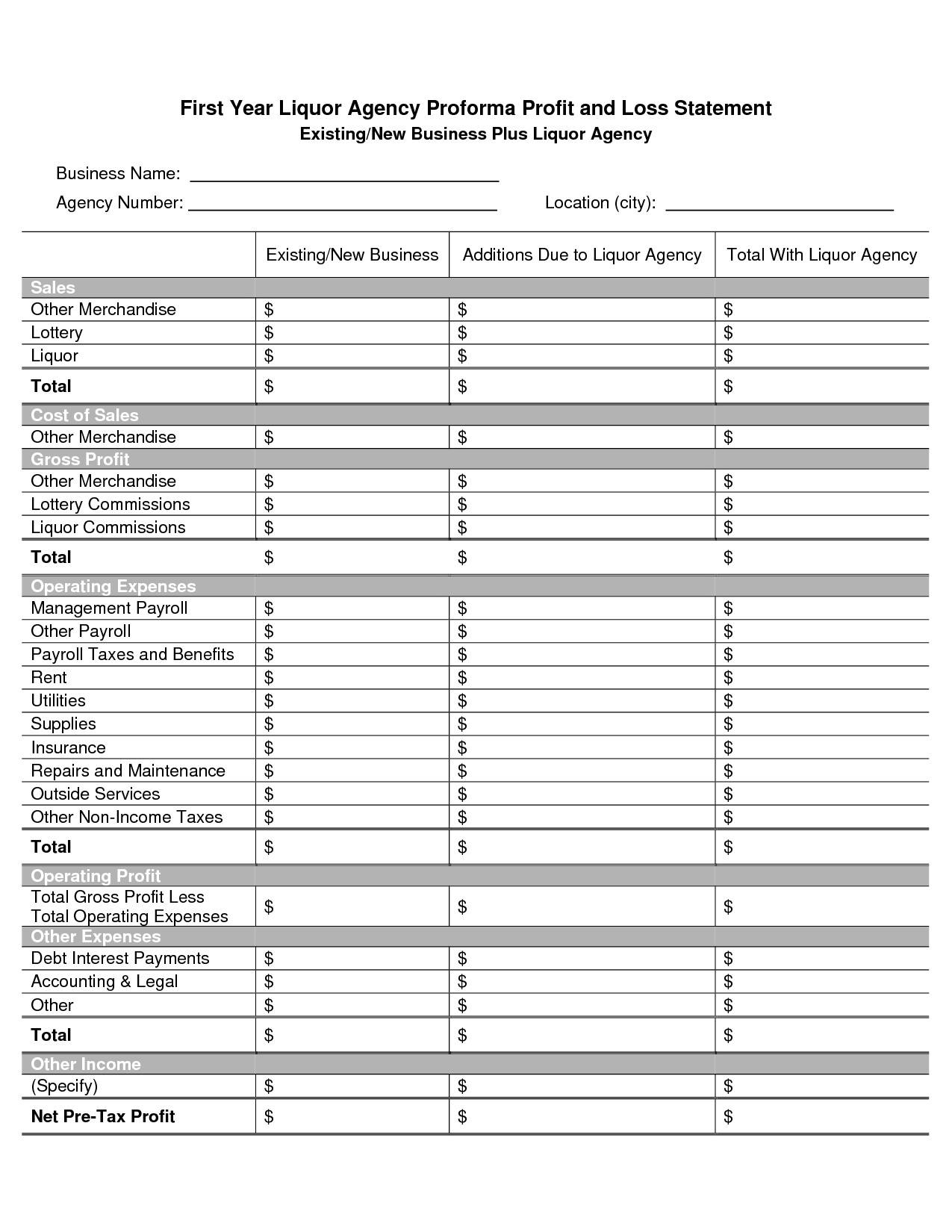

10/28/21 table of contents what is the balance sheet? Profit and loss statement vs balance sheet: A typical p&l account will look like the following:

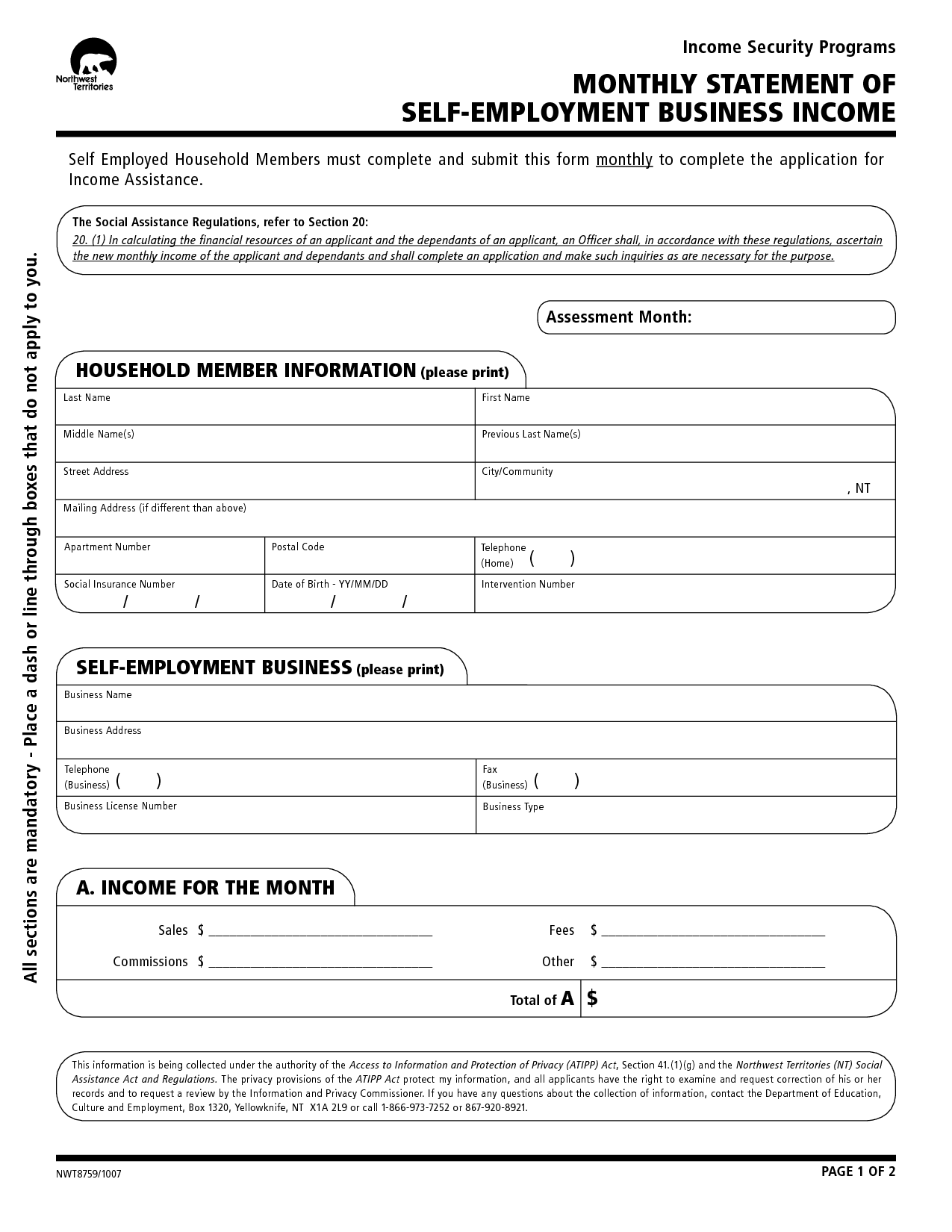

On january 25, 2022 a profit and loss statement (p&l) is an effective tool for managing your business. The balance sheet reports the assets, liabilities and shareholder equity at a specific point in time, while a. A profit and loss statement is a financial statement that summarizes your company’s revenue, costs and expenses incurred during a specified period (e.g., a month, a quarter.

A balance sheet is different from a profit and loss statement. The main difference between a balance sheet and a profit and loss statement is that a balance sheet shows a company's assets, liabilities, and owner's equity at a specific. Profit and loss account.