Lessons I Learned From Info About Other Comprehensive Income Frs 102 List Of Liabilities In Balance Sheet

Profit or loss is defined in frs 102 as:

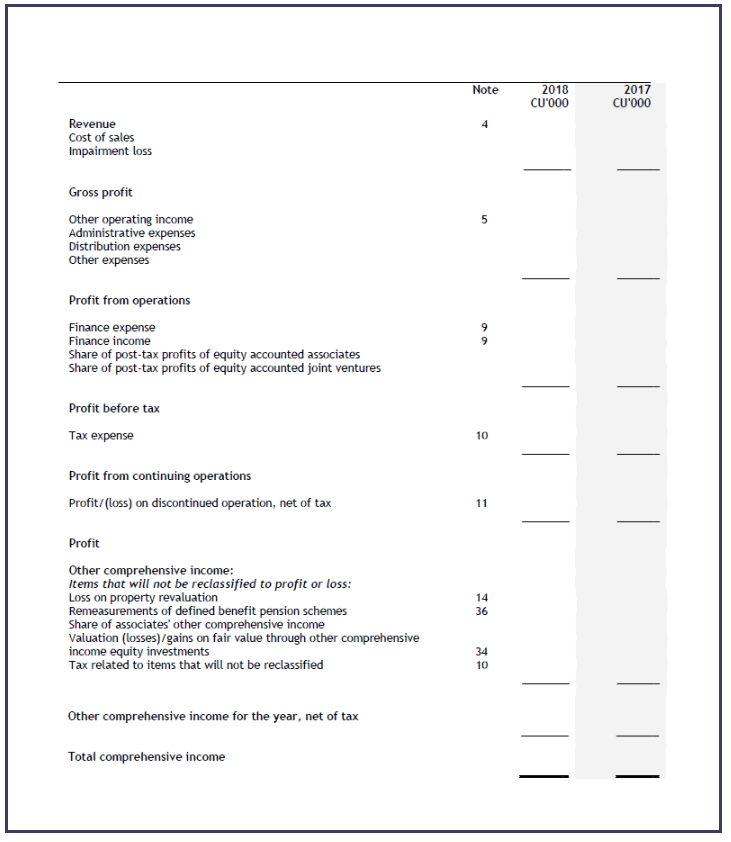

Other comprehensive income frs 102. Further guidance on what constitutes ‘cost’ can be found in the applicable sections of frs 102. Extraordinary items are defined as. This publication provides illustrative financial statements for the year ended 31 december 2021.

This illustrative annual report does not cover the following sections of frs 102 (amongst other items): Frs 102 also requires that a statement of changes in equity is presented which captures an entity’s profit or loss for a reporting period, other comprehensive income (oci) for. Extraordinary items are defined as.

Extraordinary items are defined as. Frs 102 paragraph 12.16b permits a group of items, including components of items, to be an eligible hedged item provided that all of the following conditions are met: The chapter on revenue covers measurement of.

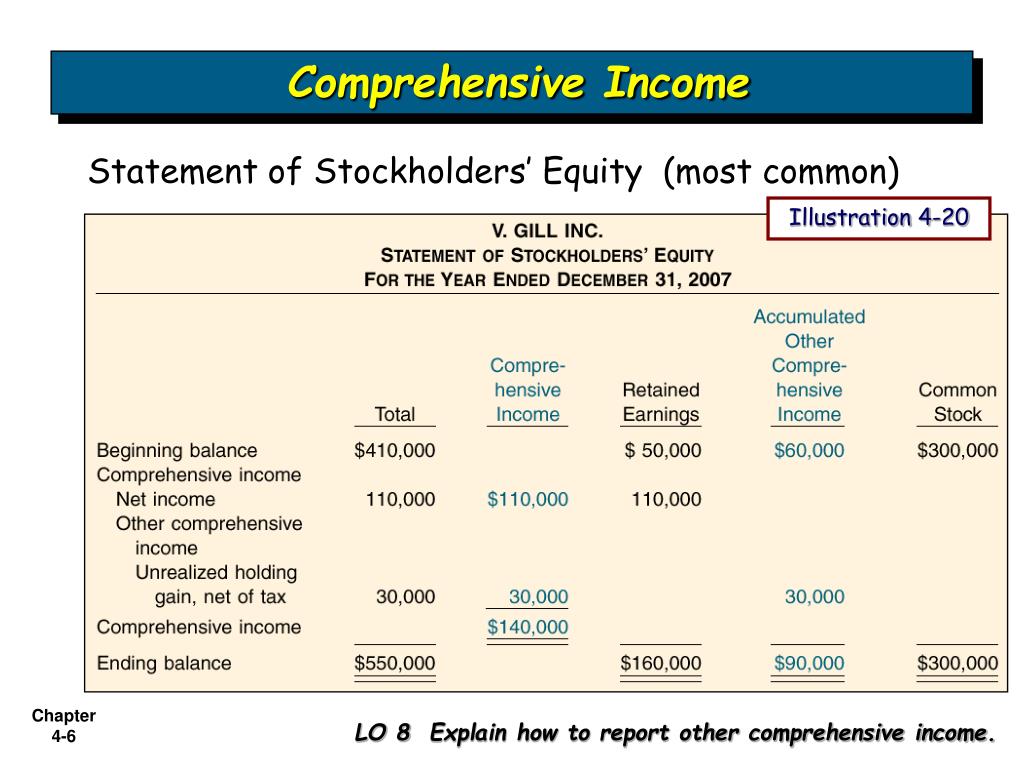

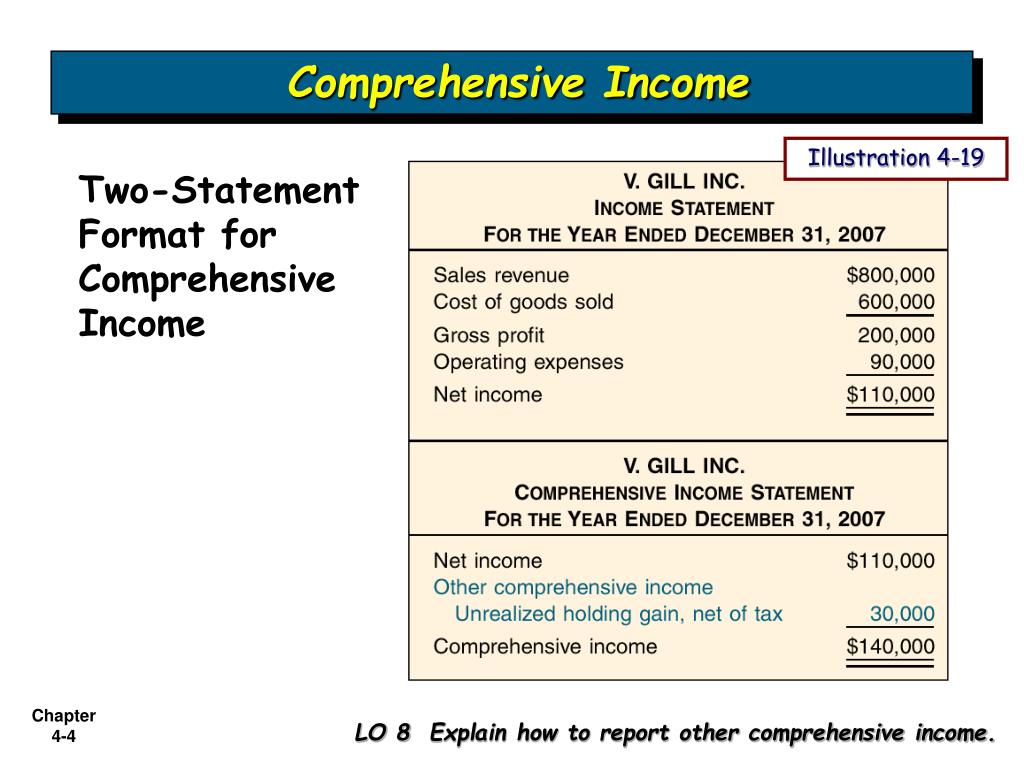

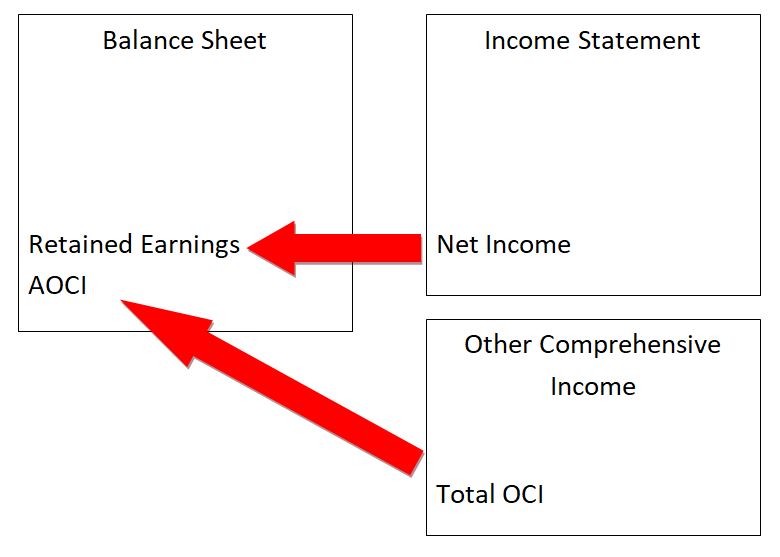

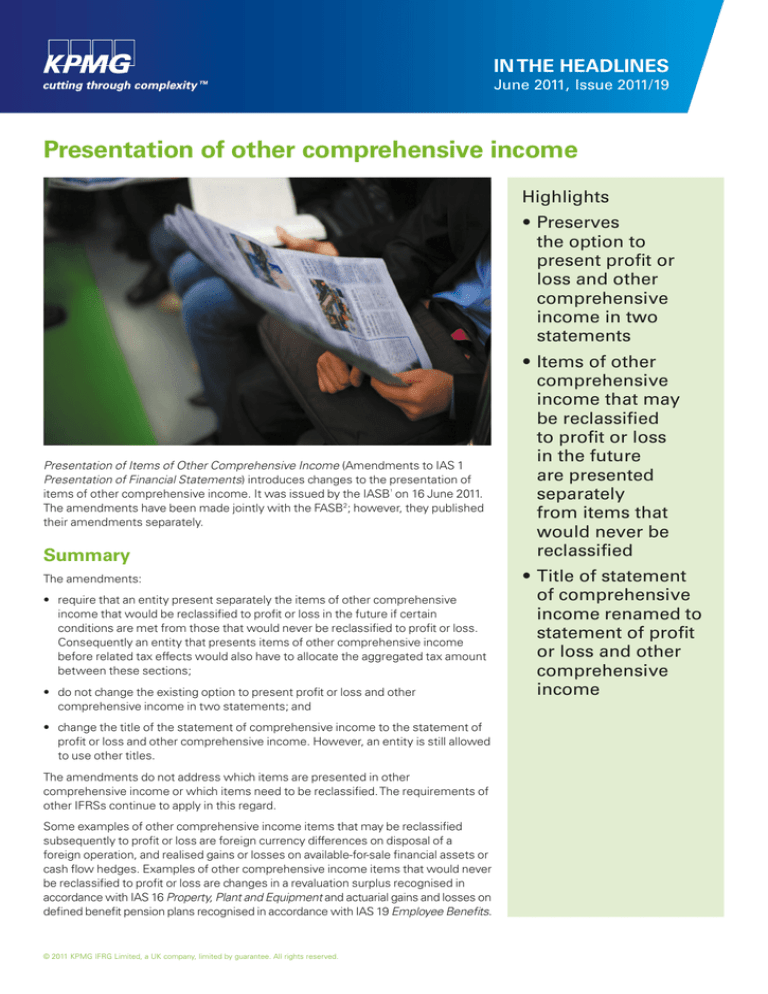

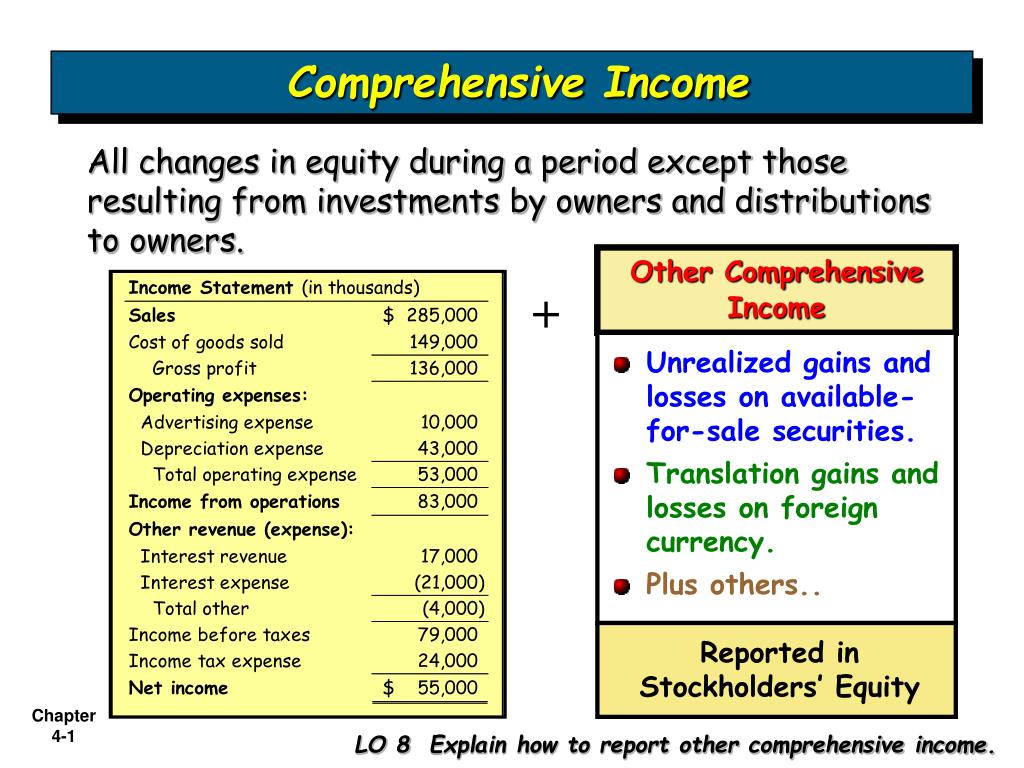

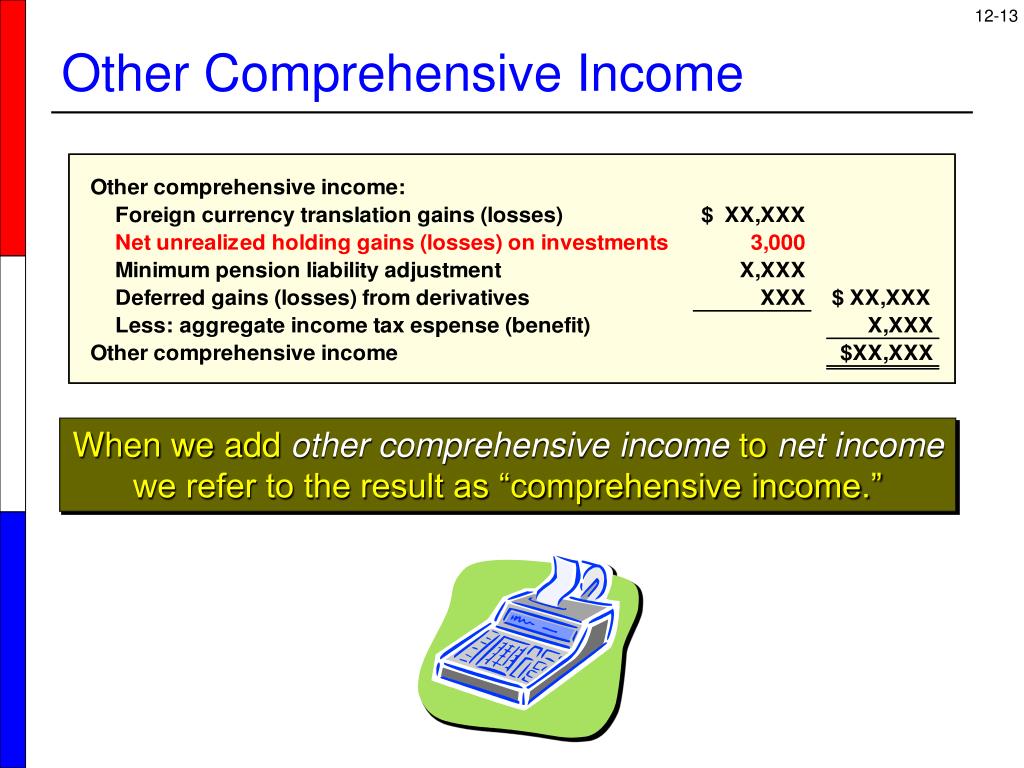

Items of income and expense. The strgl will be replaced by a statement of comprehensive income and expenditure, either as a separate statement of other comprehensive income or immediately after. A financial reporting exposure draft, fred 82 draft amendments to frs 102 the financial reporting standard applicable in the uk and republic of ireland and.

Comprehensive manual explaining how to apply frs 102, with worked examples and extensive interpretation and guidance. Can someone kindly clarify whether transfers between the p&l reserves and revaluation reserve need to be included in 'other comprehensive income' under frs.

An asset may be loaned from another company, for example. In general, frs 102 section 27 applies in accounting for the impairment of all assets.

41 rows overview frs 102 “the financial reporting standard. Income taxes revenue government grants expenses. However, there are some specific exclusions for assets which are covered in other.

Comprehensive manual explaining how to apply frs 102, with worked examples and extensive interpretation and guidance. Extraordinary items are defined as. The statement of recognised gains and losses is now known as the ‘other comprehensive income’ under frs 102.

The statement of recognised gains and losses is now known as the ‘other comprehensive income’ under frs 102. These example accounts will assist you in preparing financial statements by illustrating the required disclosure and presentation for uk groups and uk.

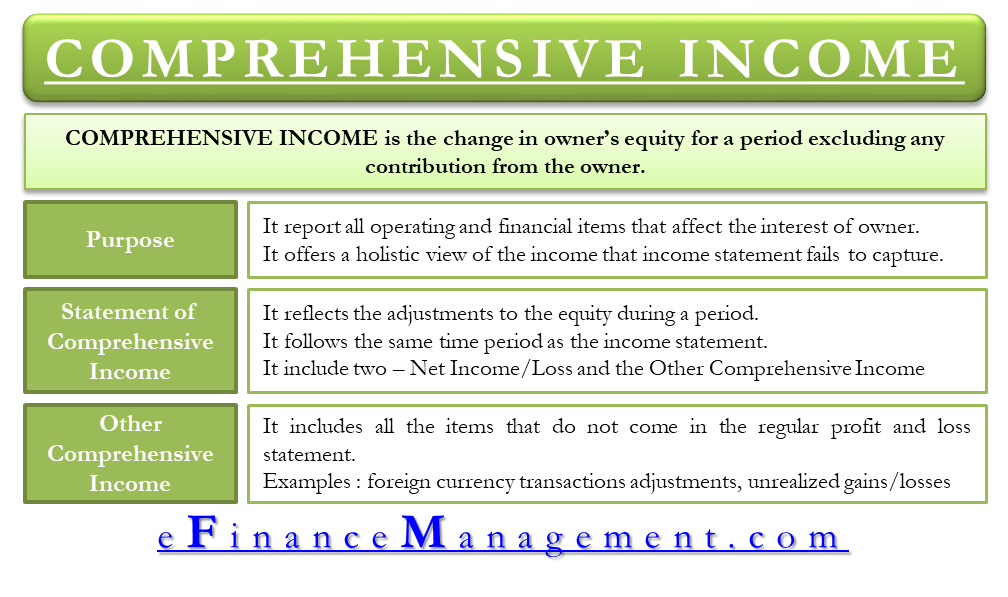

The statement of recognised gains and losses is now known as the ‘other comprehensive income’ under frs 102. The total of income less expenses, excluding the components of other comprehensive income.

/GettyImages-1006671124-67fc152fc4ce47768aa1f8ad893601cc.jpg)