Unique Tips About Accrued Revenue Income Statement P&l Meaning In Accounting

Accrued revenue has a significant impact on a business’s financial statements.

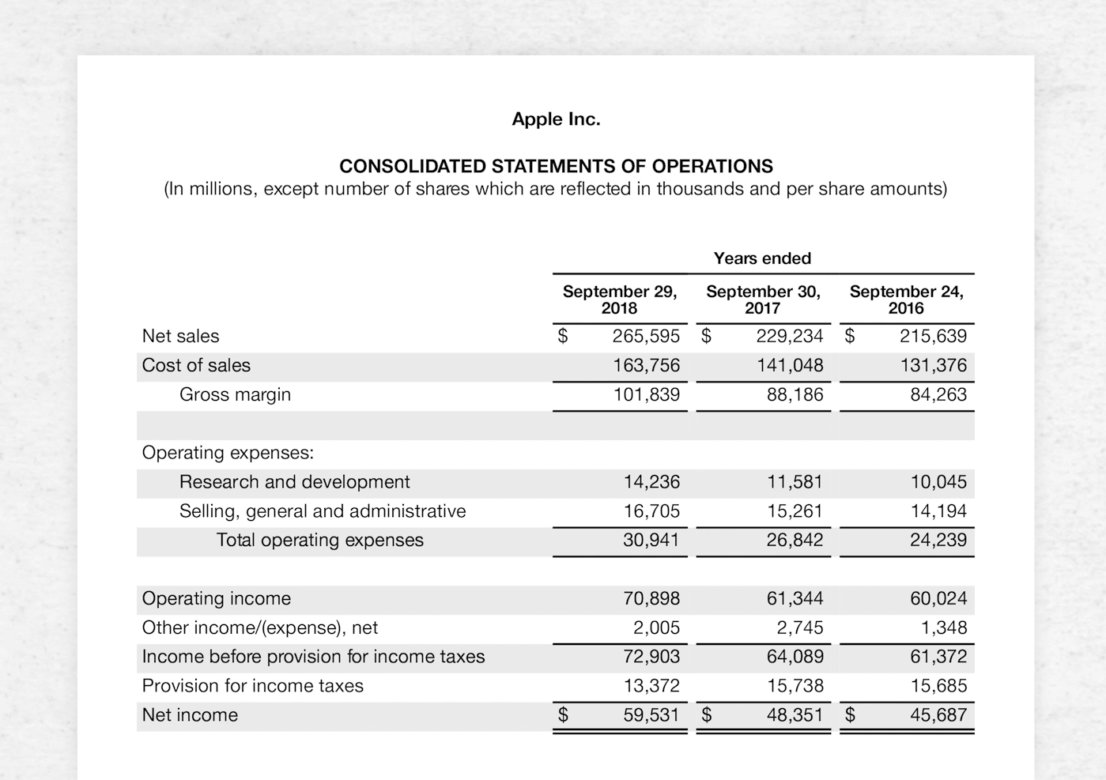

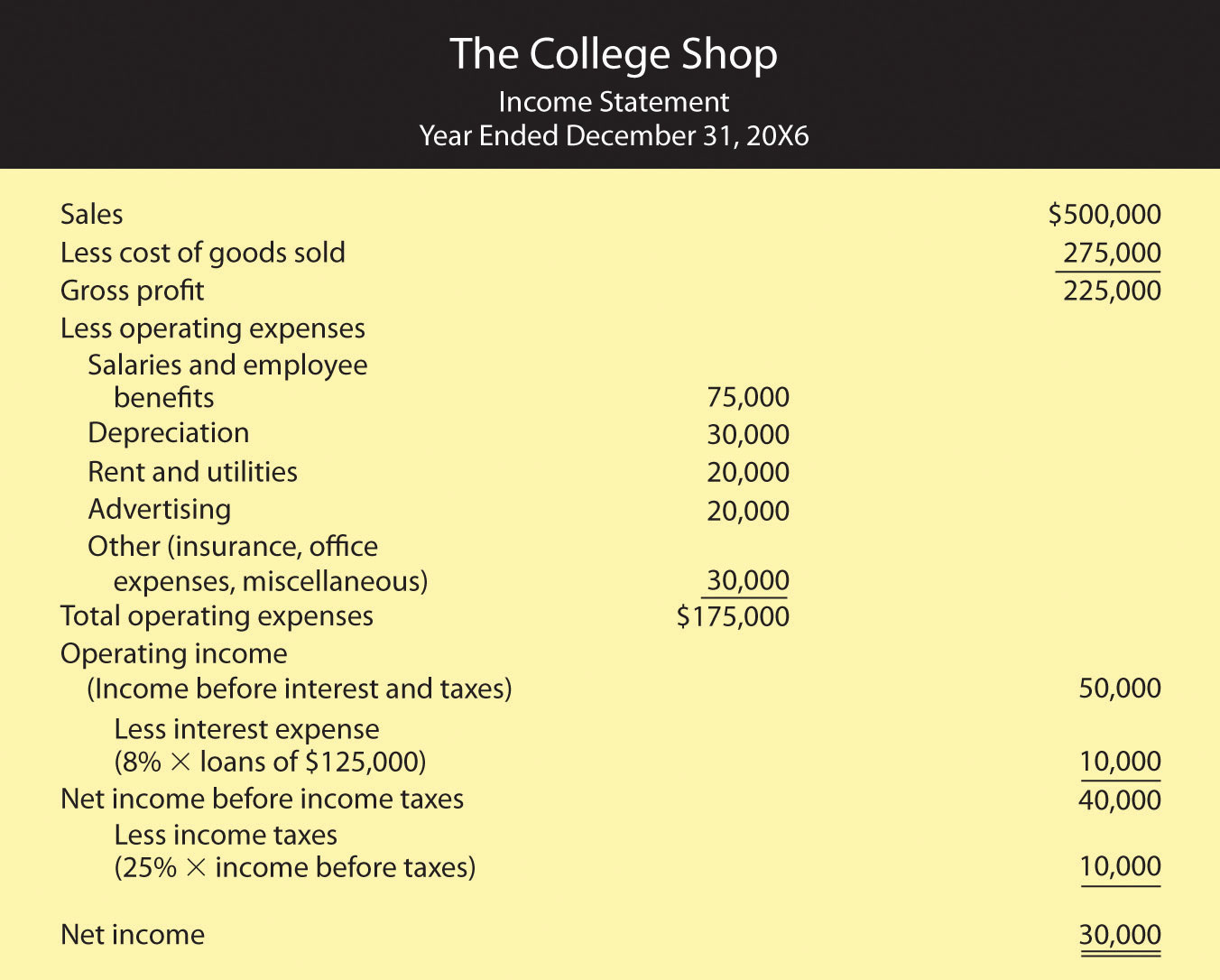

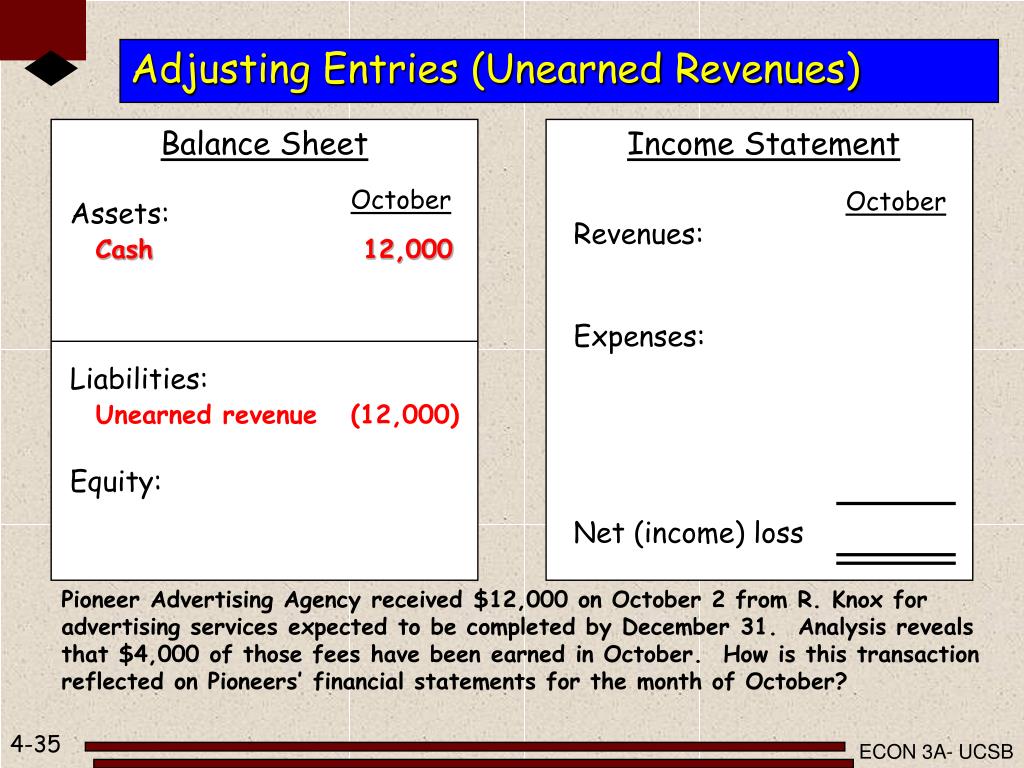

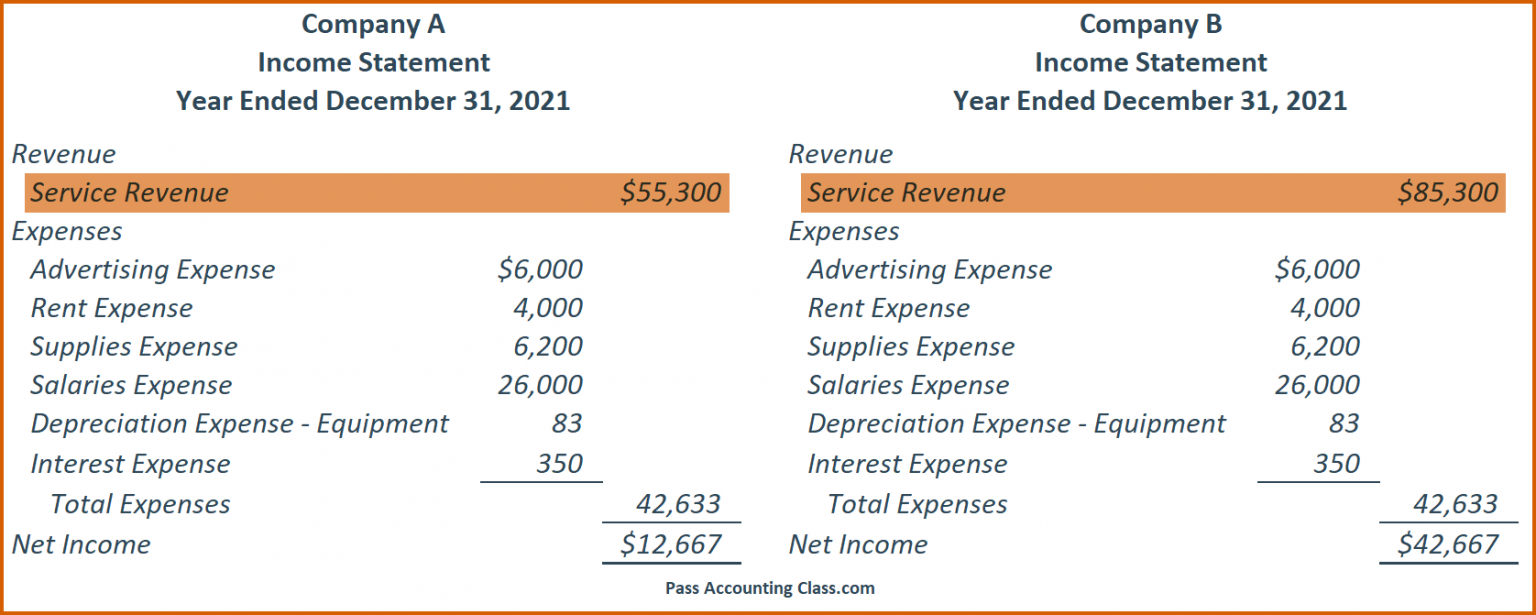

Accrued revenue income statement. This is because it is always an incoming. Accrued revenue refers to the amount that the customers owe to the company against the goods purchased or services taken by them from the company. While accrued revenue becomes a current asset entry on the balance sheet, it is entered as earned revenue in the income statement.

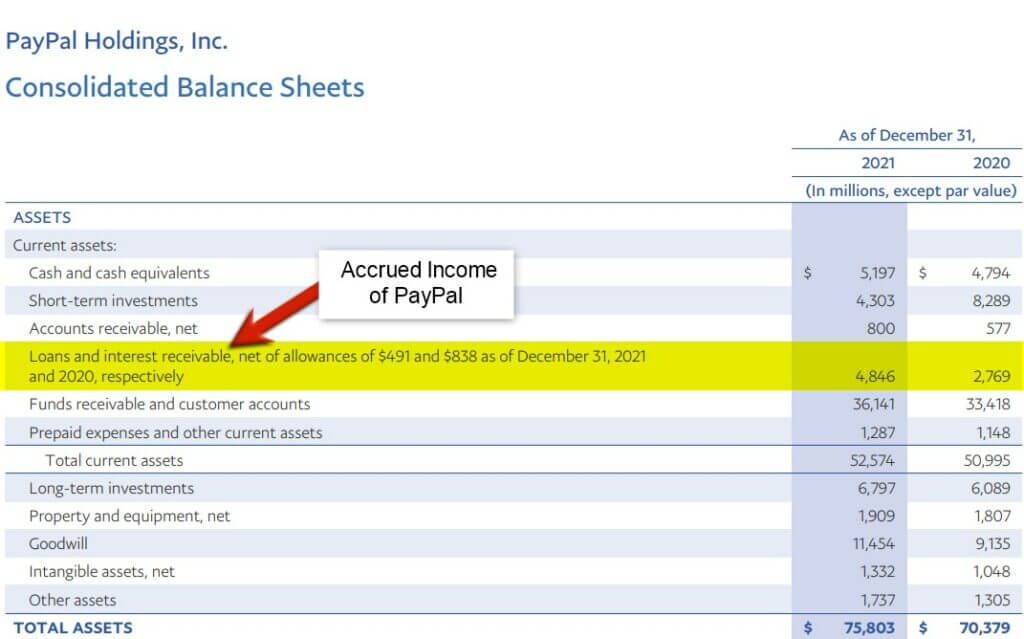

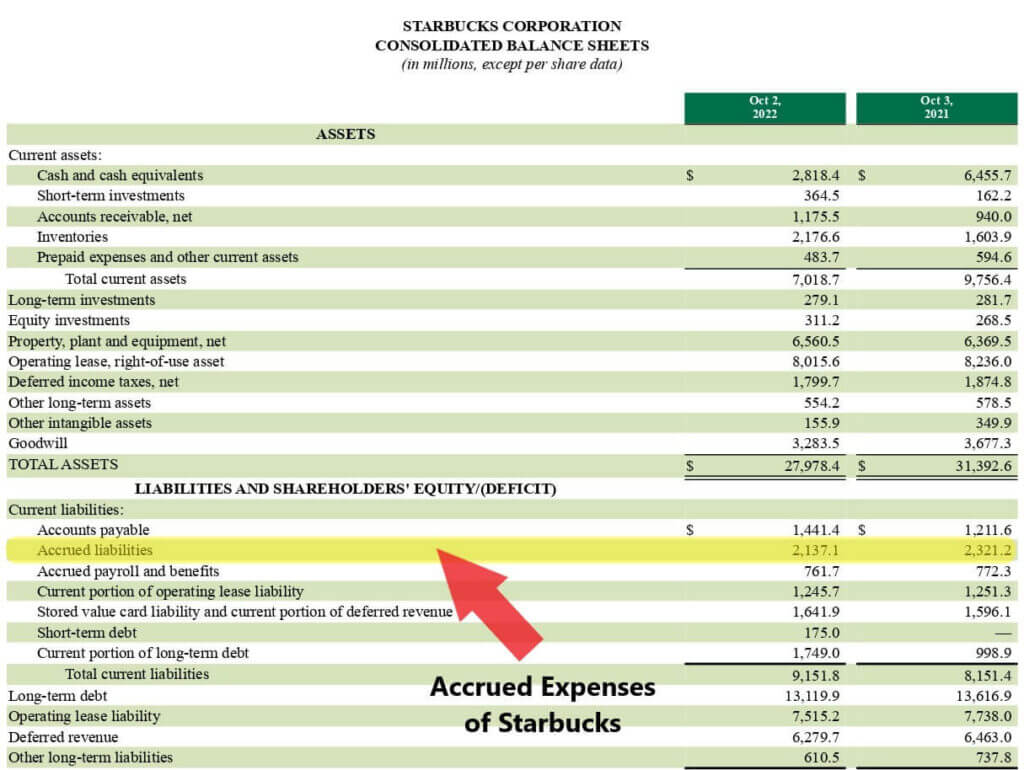

On the income statement, accrued revenues increase the company’s. Accrued revenues are recorded as receivables on the balance sheetto reflect the amount of money that customers owe the business for the goods or services they purchased. Accrued revenue represents the income earned from offering a product or service for which the payment is still due.

Which have been earned by a business, but the. Accrued revenue is income that a company has earned but for which it has not yet received payment. Definition of accrued revenues.

Accrued revenue refers to a situation where the goods or services have been delivered to the client but the payment for the same has not been received. Revenue is reported on the income statement the same regardless of whether it is accrued revenue or cash revenue. Accrued revenues include service revenues, interest income, sales of goods, etc.

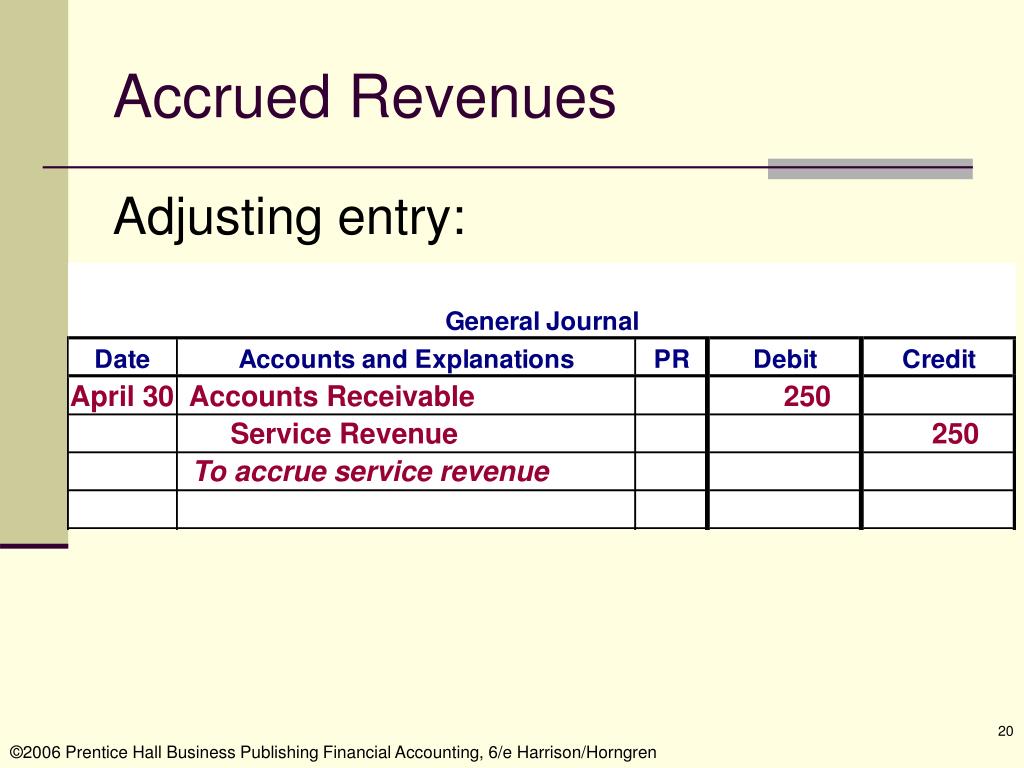

Accrued revenue is a part of accrual accounting. Read running payroll for details of. The journal entry is made for accrued revenue as an asset.

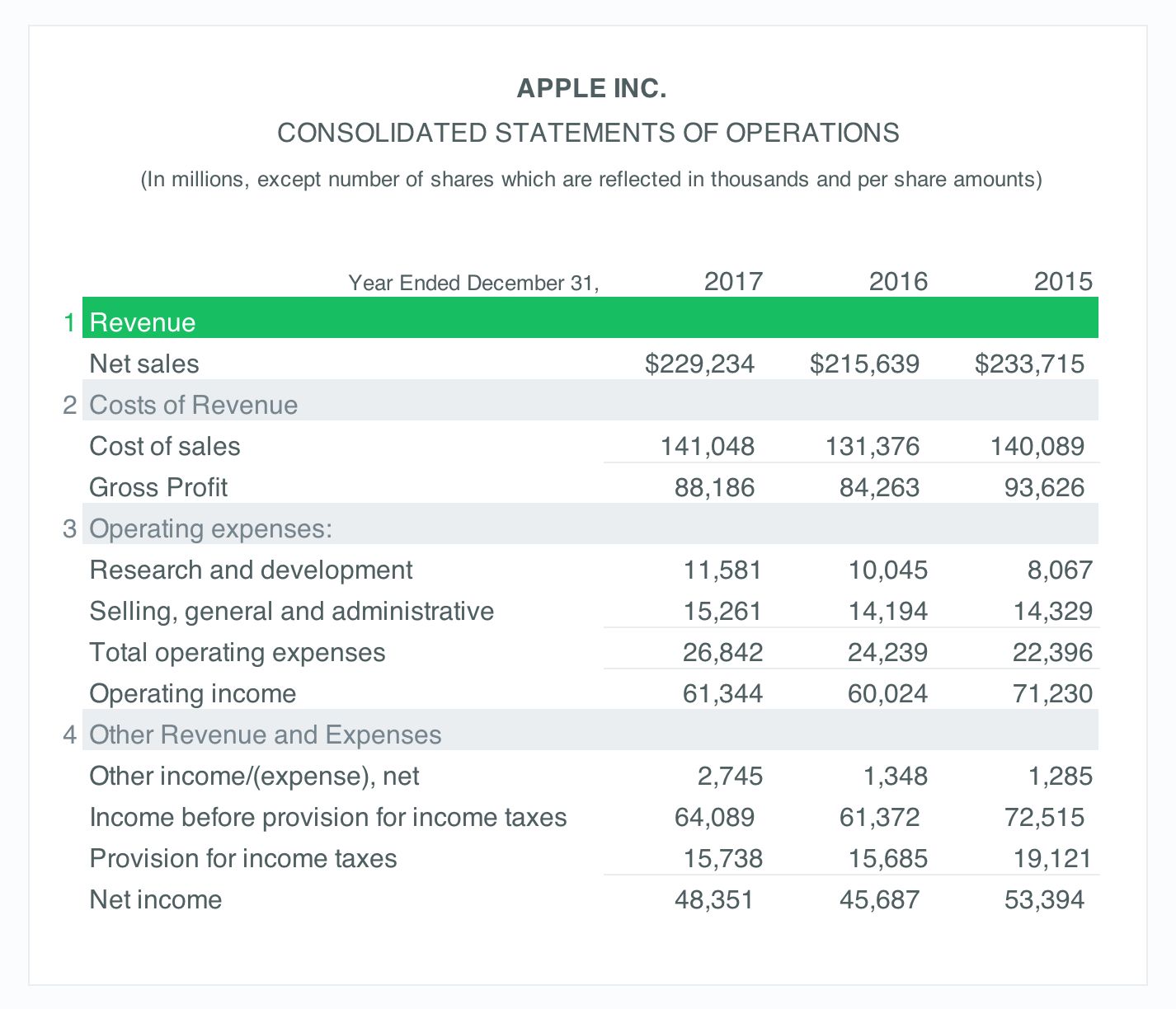

There are two ways to find what portion. The first income tax month is 6 april to 5 may inclusive, the second income tax month is 6 may to 5 june inclusive, and so on. Every quarter of the year, company a reports $1,500 in revenue on the income statement and an equal amount as an asset on the balance sheet, although no cash inflow is.

Key things to know the income statement is presented on the “accrual basis” • the income statement reports the activities that happened during the period. Imagine providing a service or delivering a. Therefore, the revenue is considered to be accrued.

The concept of accruals is the basis of accrual accounting, in which a company’s revenue and expenses are recognized at the. This type of revenue occurs when a company performs a. When accrued revenues are recorded, they affect both the income statement and the balance sheet.

Typically, people in accounting and financial roles record a company's accrued revenue on the financial statements as an adjusting journal entry where, on. Total income after deducting all expenses. Accrued revenue is compared to unearned revenue (deferred revenue) and accounts receivable.

In this case, the business has earned the revenue but has not yet received it. Accrued revenue is revenue that has been earned by providing a good or service, but for which no cash has been received. How do accruals work in accounting.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)