Simple Tips About Important Ratios In Balance Sheet Liquidity Based

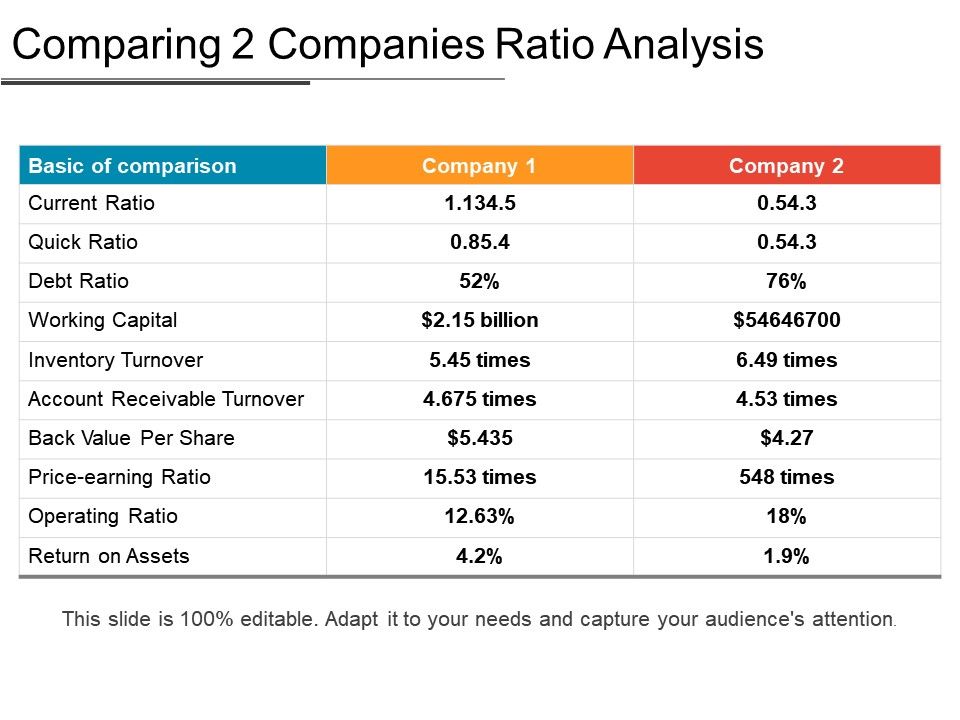

Ratio #10 receivables turnover ratio

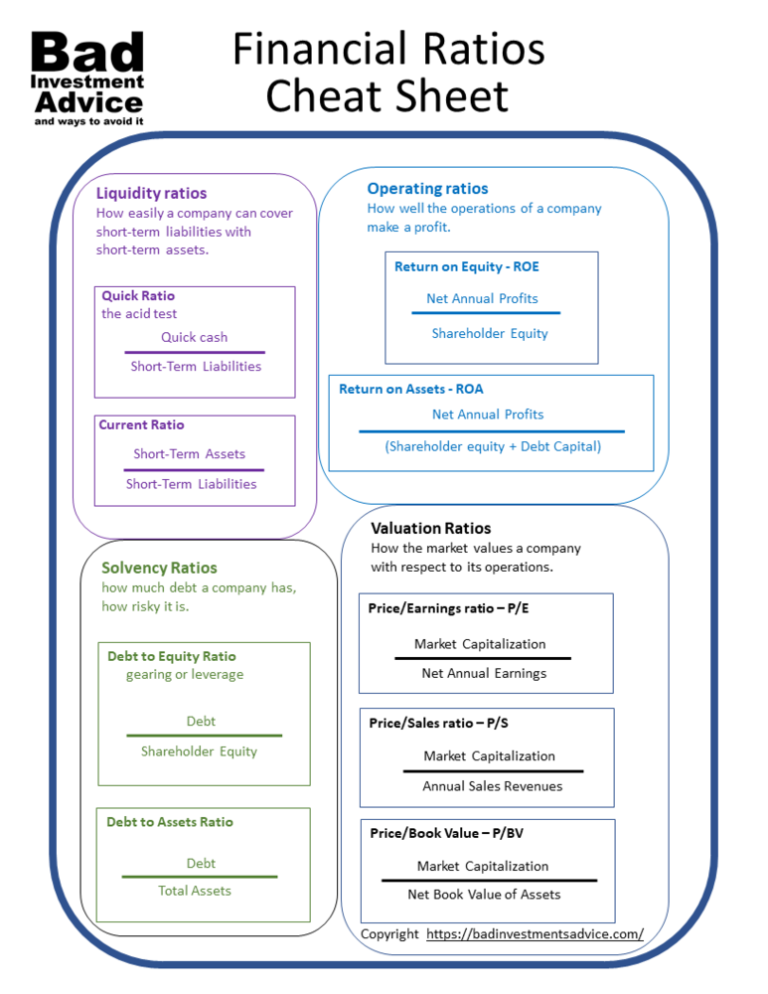

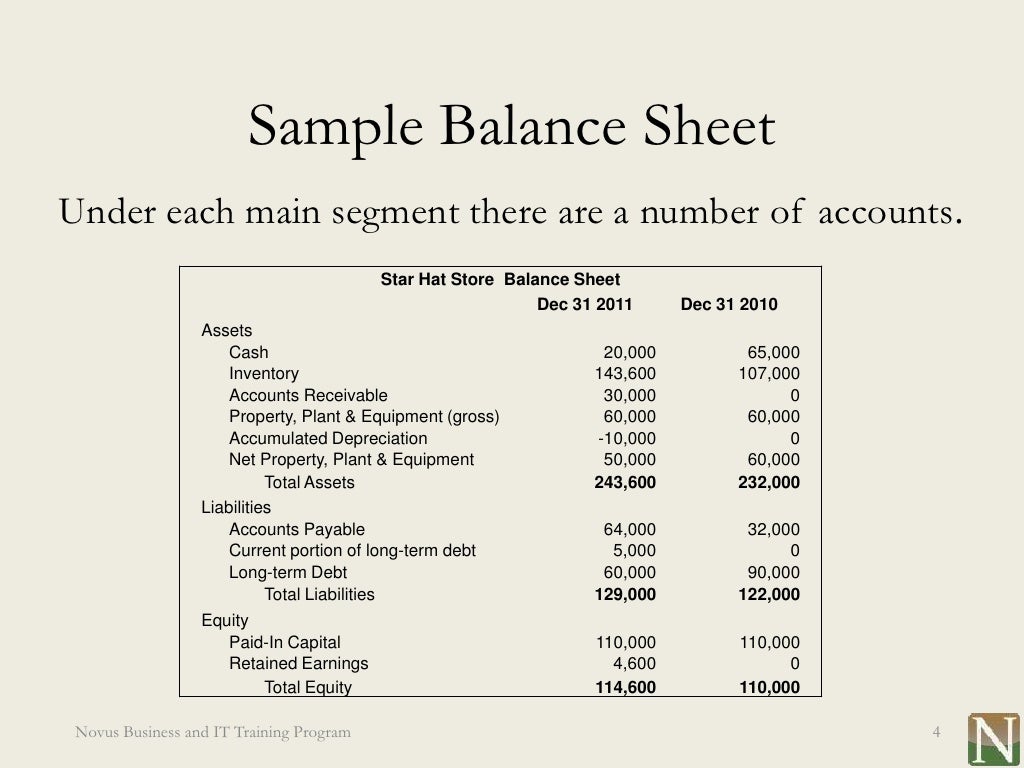

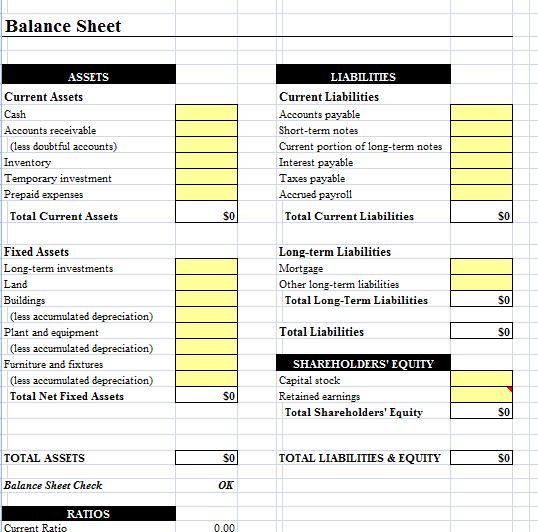

Important ratios in balance sheet. Key takeaways a balance sheet is a financial statement. These financial ratios quickly break down the complex information from financial statements. Financial ratios using amounts from the balance sheet and income statement.

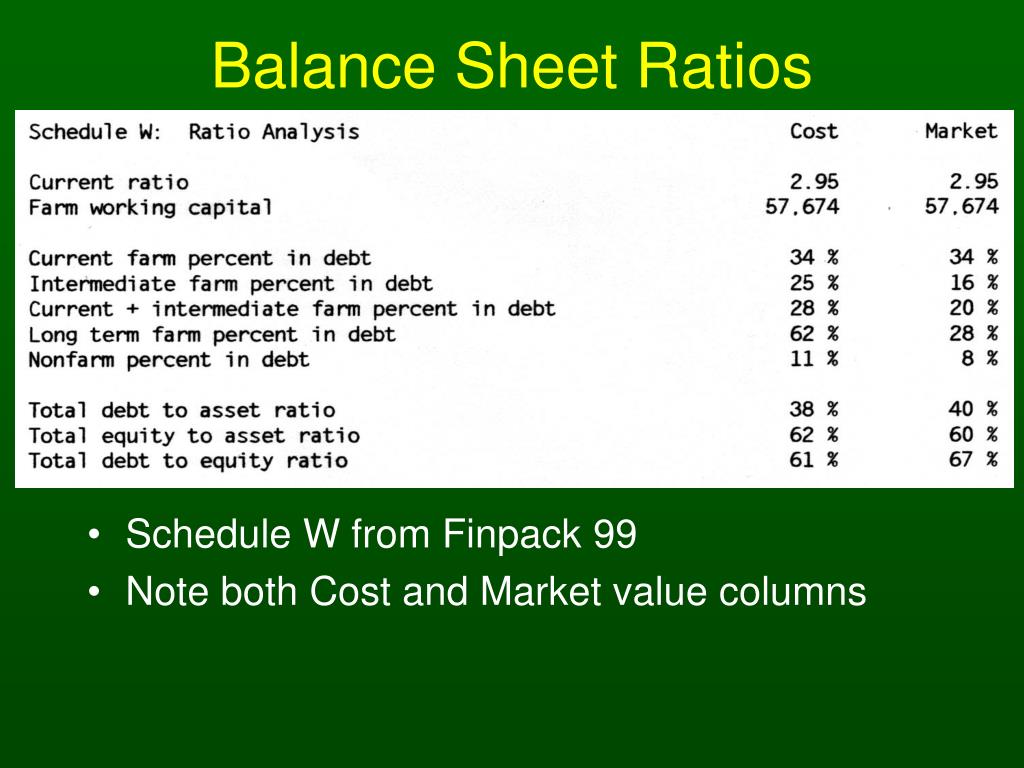

You can learn a lot about a business’s health by looking at its balance sheet and calculating some ratios. Balance sheet ratios are the ratios that analyze the company’s balance sheet which indicate. Balance sheet ratios are formulas you can use to assess your finances based on your balance sheet information.

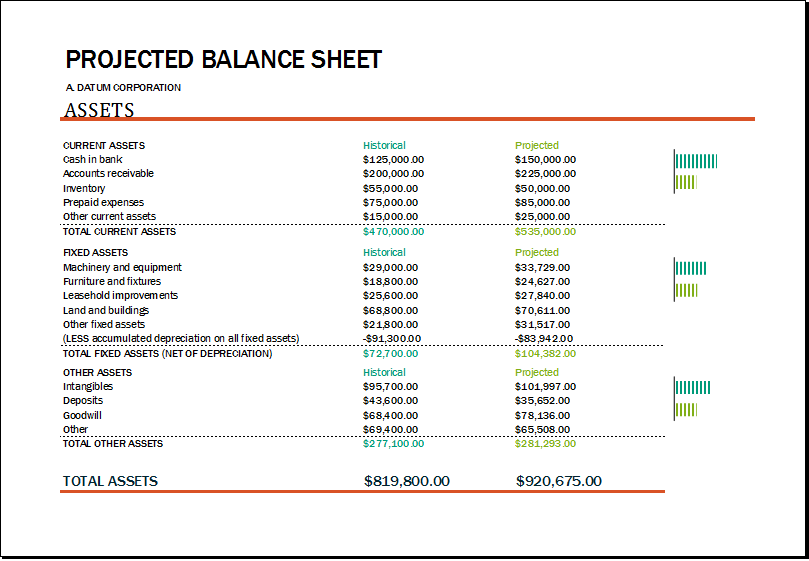

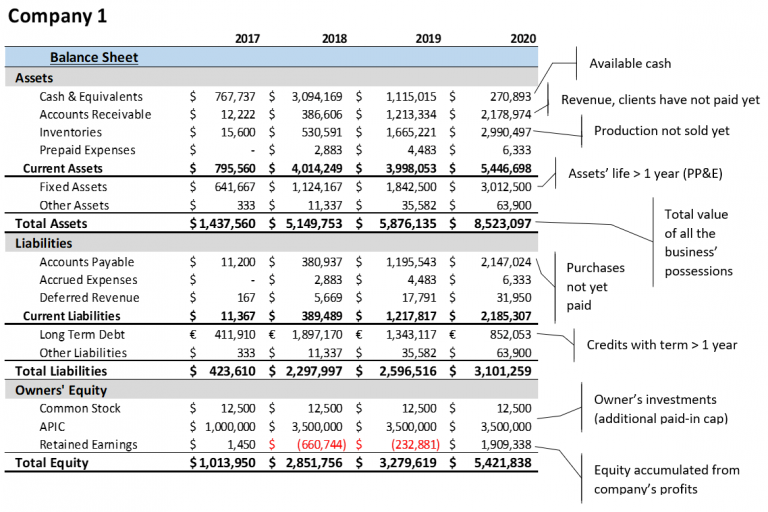

What balance sheet ratios are. Comparing several years of a company’s balance sheet may highlight trends, for better or worse. The balance sheet, also known as the statement of financial position, is one of the three key financial statements.

20 critical balance sheet ratios investors must analyze 1192shares there’s only one reason why i continue to hold the majority of my portfolio in us stocks: There are three types of ratios derived from the balance sheet: This concludes our discussion of the three financial ratios using the current asset and current liability amounts from the balance sheet.

Without them, calculating the below balance sheet ratios would be a nightmare. The balance sheet is unlike the other key financial statements that. Profitability ratios show the ability to generate income.

Reading a balance sheet is important in determining the financial health of a company. 5 important ratios for measuring company health fundamentals, ratios for stocks cameron smith february 5, 2020 fundamentals, ratios for stocks This type of balance sheet ratio analysis, i.e., efficiency ratio, is used to analyze how.

Accounts receivable turnover the accounts receivable turnover ratio compares net credit sales for the year to average receivables in order to determine how quickly receivables are being collected. The balance sheet is based on the fundamental equation: In this article, you will learn:

A company’s balance sheet is a snapshot in time. Balance sheet ratios are short formulas you can use to assess your financial health—just by looking at your balance sheet. In leverage ratios, the debt to equity ratio is the most popular.

Quick ratio = 1.25 (or 1.25 to 1 or 1.25:1 ) if beta's quick assets are mostly cash and temporary investments, it has a great quick ratio. A higher ratio may signal. This type of important balance.

Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company. Balance sheet ratios evaluate a company's financial performance. Most analysts prefer would consider a ratio of 1.5 to two or higher as adequate, though how high this ratio depends upon the business in which the company operates.

![Download [Free] Balance Sheet with Ratios Format in Excel](https://exceldownloads.com/wp-content/uploads/2021/09/Balance-Sheet-Template-Feature-Image.png?v=1685413421)