Build A Tips About Impairment Of Goodwill Ind As Treatment Net Loss In Balance Sheet

Adjusted ebitda for the year was $187.5 million, with a margin of 20.4%.

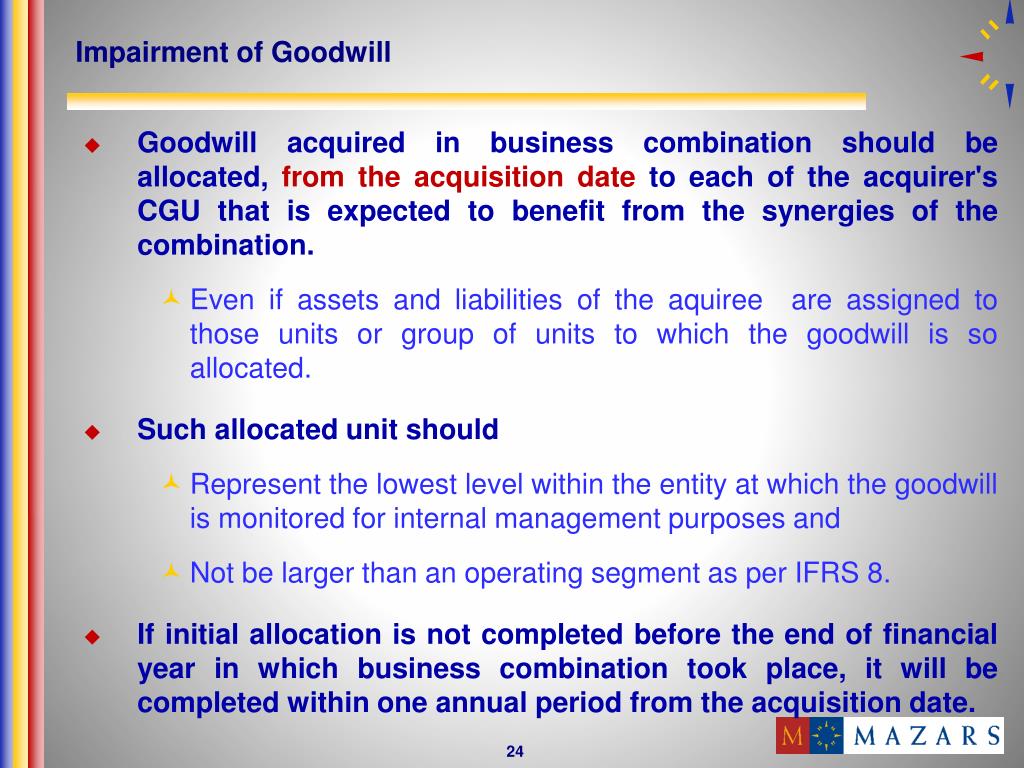

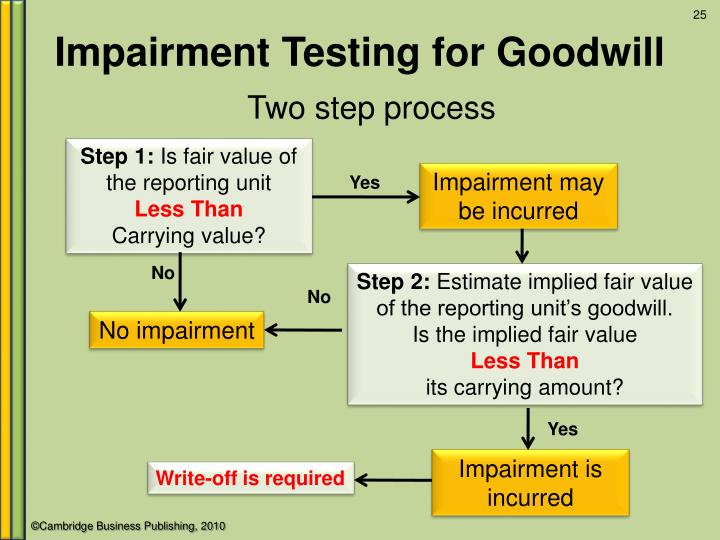

Impairment of goodwill ind as. The testing for impairment involves comparing the recoverable amount of a cash generating unit (cgu) with the carrying amount of the cgu. In particular, the receipt of a Goodwill impairment is an accounting charge that companies record when goodwill's carrying value on financial statements exceeds its fair value.

Ind as 36 requires an impairment test when indicators of potential impairment exist. Company bb acquires the assets of company cc for $15m, valuing its assets at $10m and recognizing goodwill of $5m on its balance sheet. Under ind as, goodwill arises when there is a business combination.

Indicators of potential impairment are set out in paragraph 12 of ind as 36. Impairment test of goodwill. How goodwill accounting has evolved.

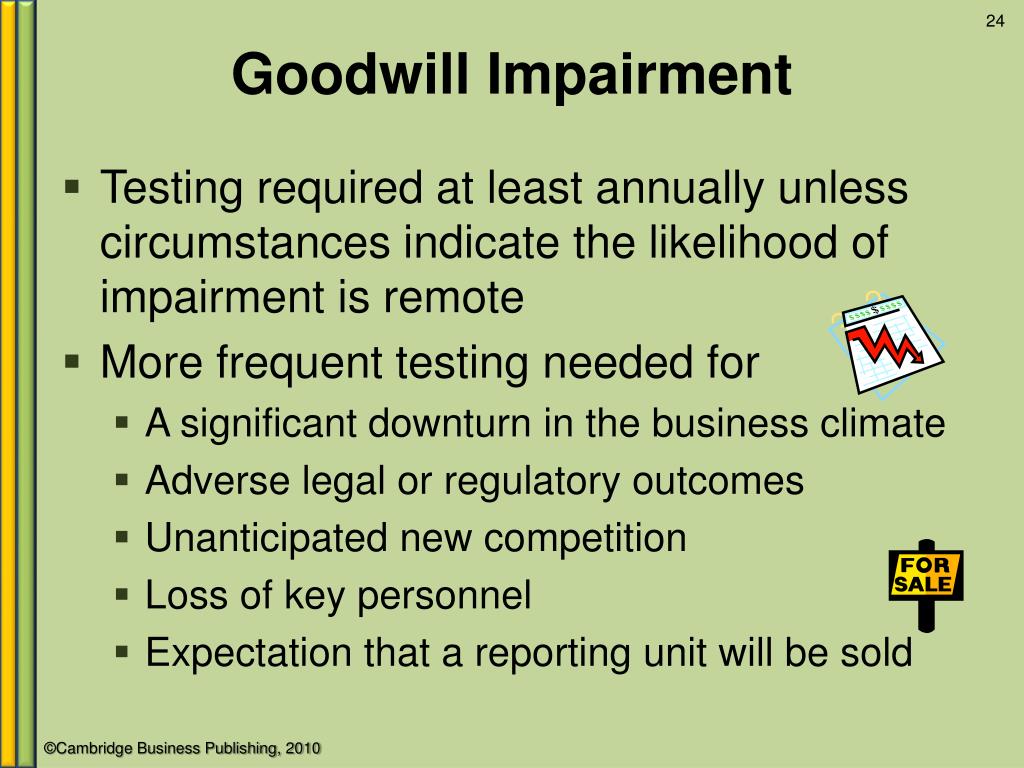

Ind as 36, impairment of assets. A regular valuation of goodwill, just as gilt yields jumped during september, explains the impairment. Frequency of goodwill impairment under ind as, cgus to which goodwill has been allocated are required to be tested for impairment annually.

In addition, impairment tests could be performed by the entity as a result of a triggering event. In the group statement of financial position,. While entities have been required to test goodwill for impairment for many years, the current goodwill accounting model has evolved significantly from the model that the fasb originally introduced in 2001.

Goodwill cannot be tested for impairment at any other level in a company. In accounting, goodwill is recorded after a. Any increase in the recoverable amount of goodwill in the periods following the recognition of an impairment loss for that goodwill is likely to be an increase in internally generated goodwill, rather than a reversal of the impairment loss recognised for the.

Applies to goodwill and intangible assets acquired in business combinations for which the agreement date is on or after 31 march 2004, and for all other assets prospectively from the beginning of the first annual period beginning on or after 31 march 2004: Ind as 38 intangible assets prohibits the recognition of internally generated goodwill. Impairment testing requires entities to exercise considerable judgement and there is a need to use assumptions that represent realistic future expectations.

Recognising and measuring an impairment loss. Indicators of impairment as per ind as 36 As 28 does not require the annual impairment testing for the goodwill unless there is an indication of impairment.

Several opportunities for manipulating impairment numbers have been identified in the academic and practitioner literatures. As scholars have noted, “the subjectivity inherent in estimating. Ias 36 impairment of assets revised:

The consolidated net loss for the year was $259.3 million, including the same goodwill impairment charge. Goodwill impairment testing disclosures under ind as: After a year, company bb tests its assets for impairment and finds out that company cc.

.jpg?width=1194&name=GoodwillImpairmentTestingTables-03 (1).jpg)