Painstaking Lessons Of Info About Cash Flow Fund Statement How Income Is Prepared

Cash flow is based on a narrow concept called “cash.” fund flow is based on a wider concept called “working capital.” usefulness:

Cash flow fund flow statement. They can be for investing, financing, or. The fund flow statement employs the accrual basis of accounting. The cash flow statement focuses on cash inflows and outflows from operating, investing, and financing activities.

A cash flow statement shows the cash flows and cash equivalents of the business during business operations in one time. Fund flow statement is a statement that compares the two balance sheets by analyzing the sources of funds (debt and equity capital) and the application of funds (assets) and its reasons for any differences. Cash flow is recorded in the cash flow statement, which is one of the most important financial statements in accounting.

No doubt, both cash and fund flow offers varied purposes while offering deep insights of a business’s financial health. Cash flow vs fund flow statements? The cfs highlights a company's cash management, including how well it generates.

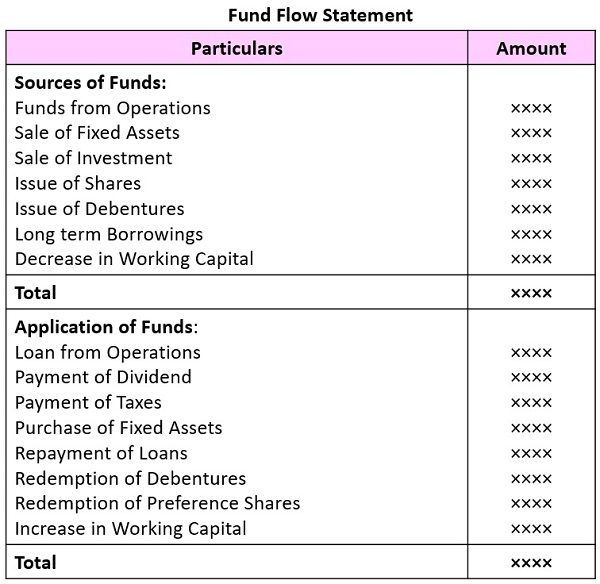

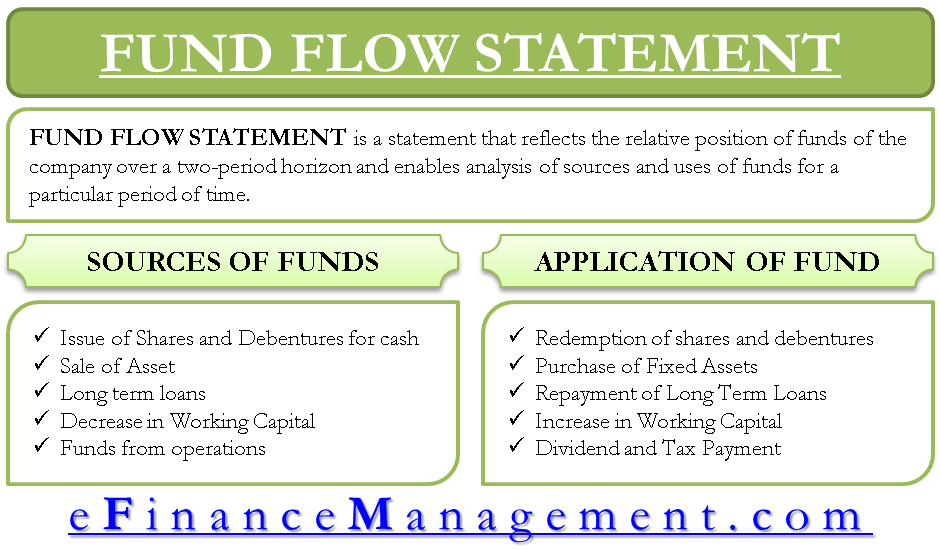

A fund flow statement reveals the periodic increase or decrease in a business enterprise's funds. They help investors, managers, and stakeholders assess the financial health and stability of a company. A fund flow statement is a financial statement that provides information about the inflow and outflow of funds in a business, both from internal and external sources.

Detailed cash flow statements for morgan stanley direct lending fund (msdl), including operating cash flow, capex and free cash flow. However, there is a vast difference between cash flow and fund flow. Importance of cash flow and fund flow statment analysis:

Examples of fund flow statement Fund flow statement a company's balance sheet and income statement measures one aspect of performance of the business over a period of time. Management can ensure the long term and the short term solvency of the firm by studying the internal funds flow cycles.

It describes how each transaction has resulted in a change in the company’s cash position and calculates the company’s net cash flows at the end of the accounting period. The cash flow statement’s utility is finding out the net cash flow. The utility of fund flow is to understand the financial position of the company.

Cash flow is recorded on a company's cash flow statement. A sources and uses of funds statement, otherwise known as a flow of funds statement, gives an updated look into a project, the allocated funds for that project, and how they are being spent. The statement reflects the efficiency of financial management staff in generating funds from various sources and applying them to generate income without sacrificing the company's financial health.

Fund flow doesn't measure the. Fund flow is the cash that flows into and out of various financial assets for specific periods of time. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

Cash flow is a financial statement that details the cash inflows and outflows that happened during that particular accounting period. The cash flow statement shows the inflow and outflow of cash, whereas the fund flow. How to prepare a cash flow statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)