Best Info About P&l Cost Of Sales Frs 102 Balance Sheet Format

February 8, 2024 at 1:30 pm pst.

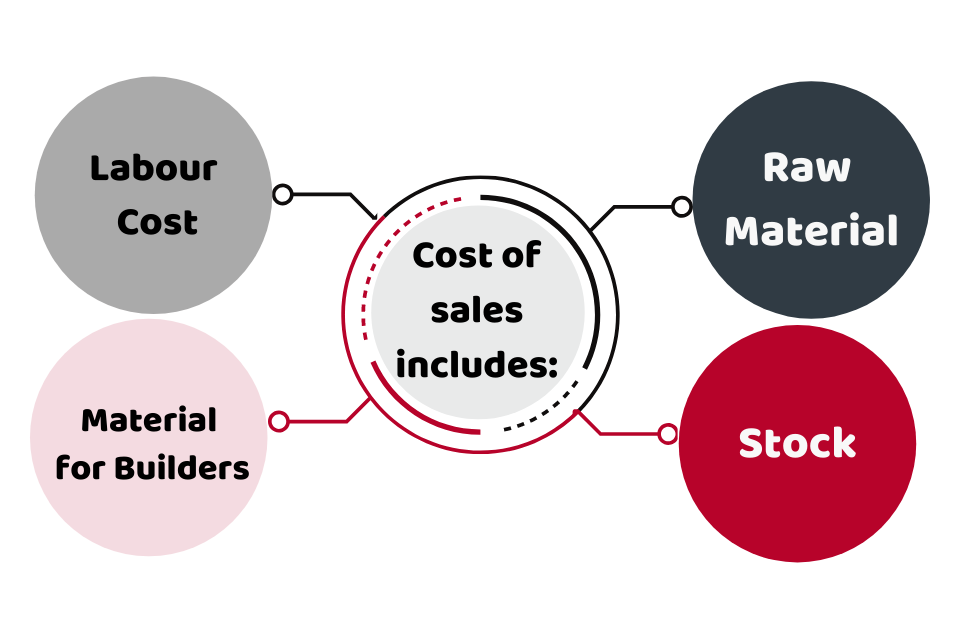

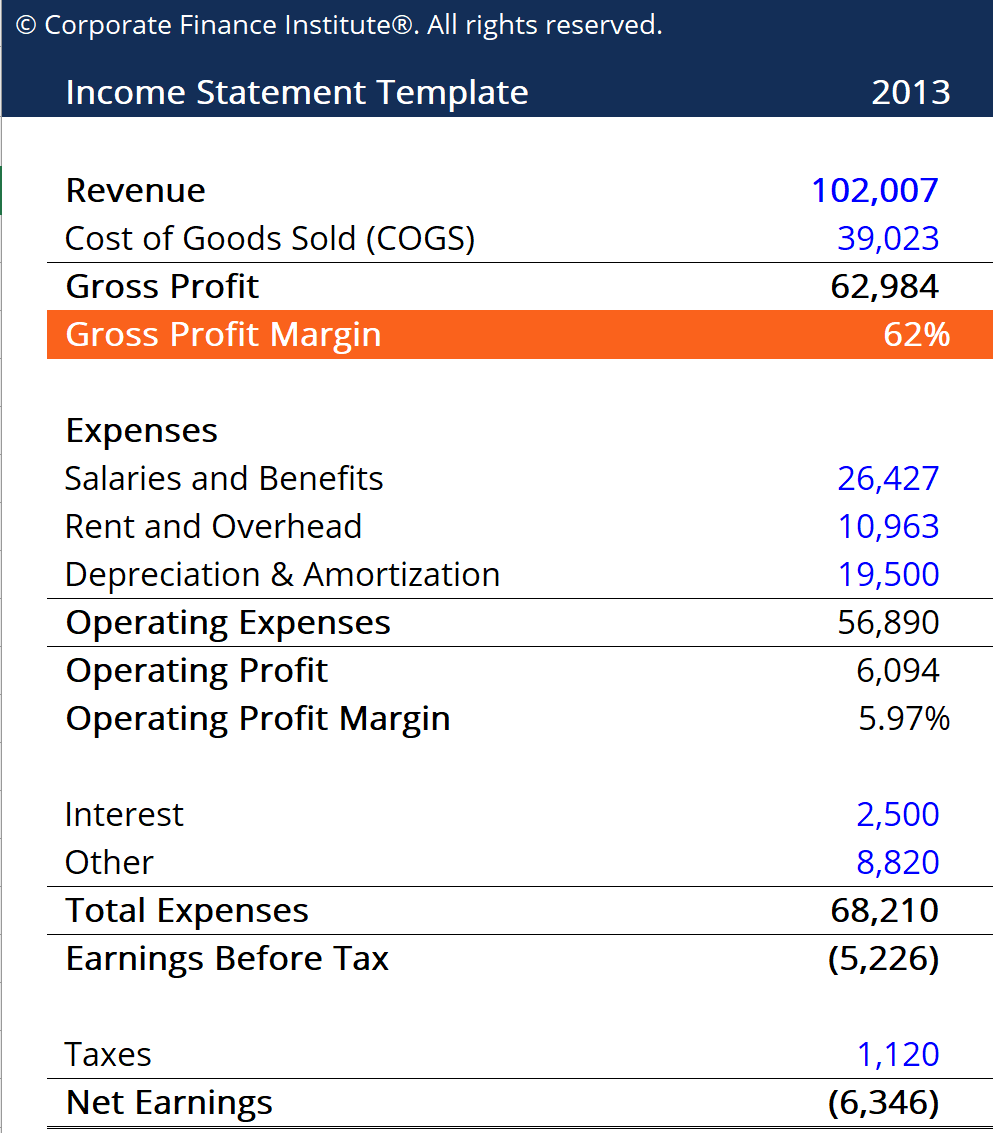

P&l cost of sales. Your p&l statement will draw on the following data points and calculations: We explain how companies use cost information to calculate their profit and assess their profitability. The report helps investors determine a company’s profitability.

Operating profit (aka earnings before interest and tax) is calculated as: The spending of the company on the rent was $6,000, on utility was $5,000, and on the salary of one staff working was $7,000. The top line of the p&l statement isrevenue, or the total amount of income from the sale of goods or services associated with the company’s primary operations.

Revenue is known as the. Below is a profit and loss account example in the uk for a period of a year. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

If you see a month was particularly good, try to remember why so you can duplicate what you did in the future. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. A p&l statement shows a company’s overall financial health — how much profit it has made, how much it costs to make that profit, and any financial losses the company sustained.

For a company that manufactures products, gross profit is sales less cost of goods sold (cogs). It also demonstrates the company’s ability to increase sales and profits by controlling its debts and costs. The result is either your final profit (if things went well) or loss.

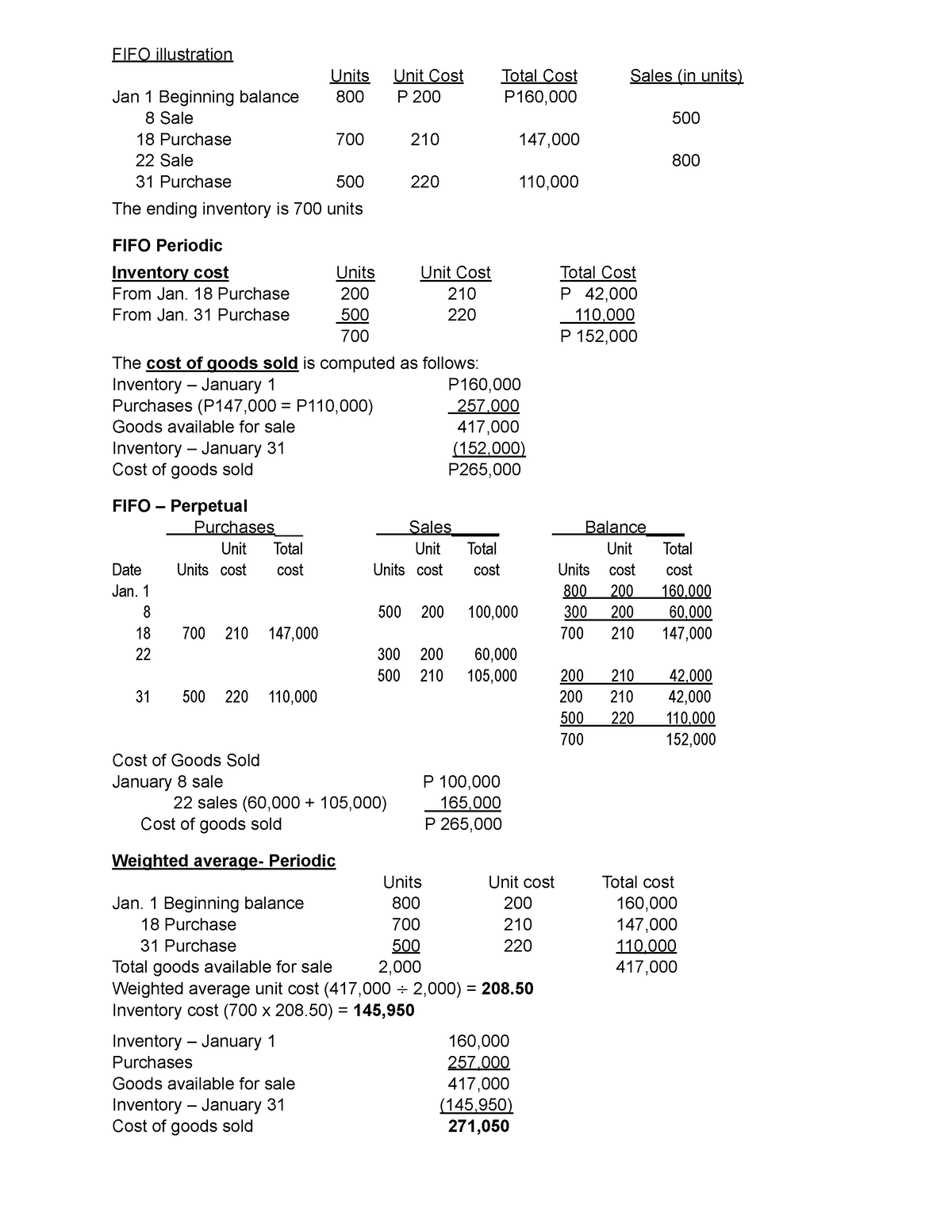

These terms can be confusing. First, find your gross profit by subtracting your cogs from your gross revenue. Prepare the profit and loss statement for the year ended december 31, 2018, for the shop.

Generate revenue → “top line” sales growth. It shows company revenues, expenses, and net income over that period. Gross margin, operating margin, ebitda margin, net profit margin.

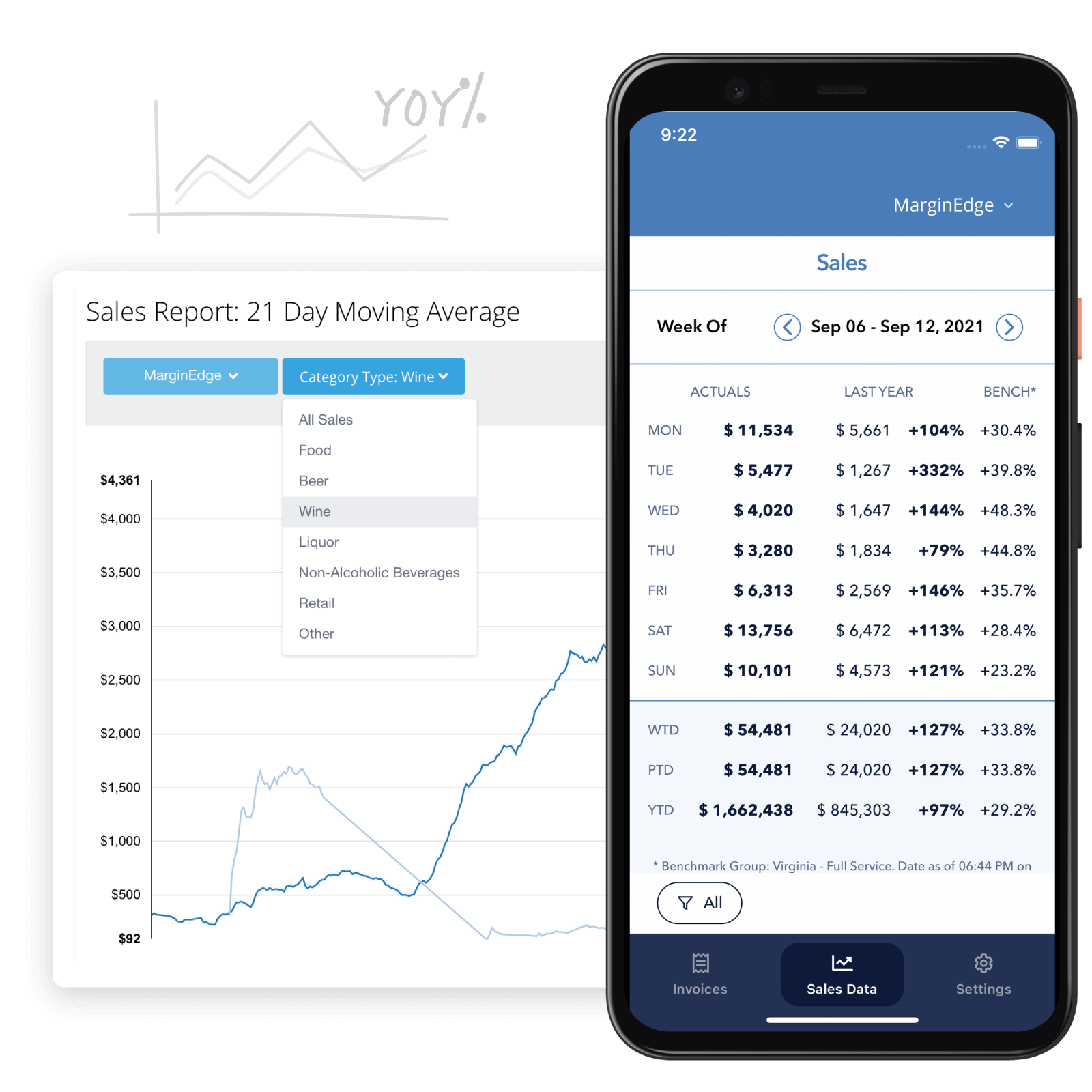

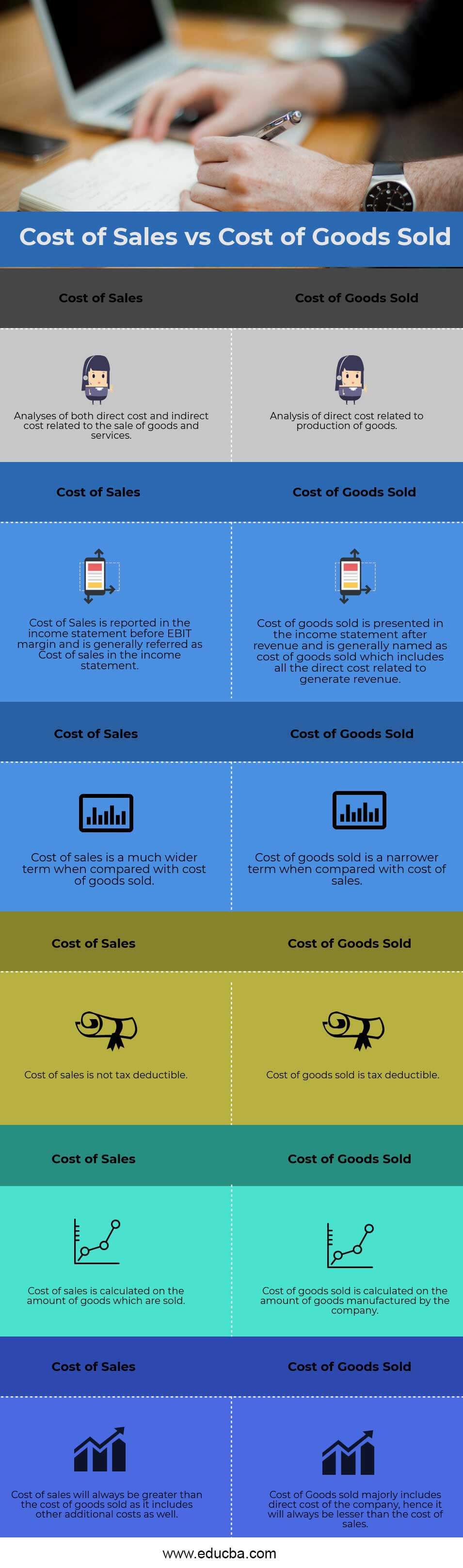

The cost of sales is the accumulated total of all costs used to create a product or service, which has been sold. The p&l report also allows you to investigate revenue and expense trends, net income, and overall profitability to then allocate resources and budgets accordingly. The two others are the balance sheet and the cash flow statement.

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. A profit and loss (p&l) statement, also known as an income statement, provides a comprehensive overview of your company's revenue, costs, and expenses over a specific period. The cost of sales is a key part of the performance metrics of a company, since it measures the ability of an entity to design, source, and manufacture goods at a reasonable cost.

The profit and loss statement summarizes all revenues and expenses a company has generated in a given timeframe. Key components of the statement include: Calculating gross profit on the p&l.

:max_bytes(150000):strip_icc()/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_How_operating_expenses_and_cost_of_goods_sold_differ_Sep_2020-01-558a19250f604ecabba2901d5f312b31.jpg)

![Restaurant Profit and Loss Complete Guide [Free template]](https://sharpsheets.io/wp-content/uploads/2022/12/Screenshot-2022-12-16-at-17.10.04.png)