First Class Info About Other Operating Income In Statement Profit And Loss Account Is Prepared To Find Out

What is operating income?

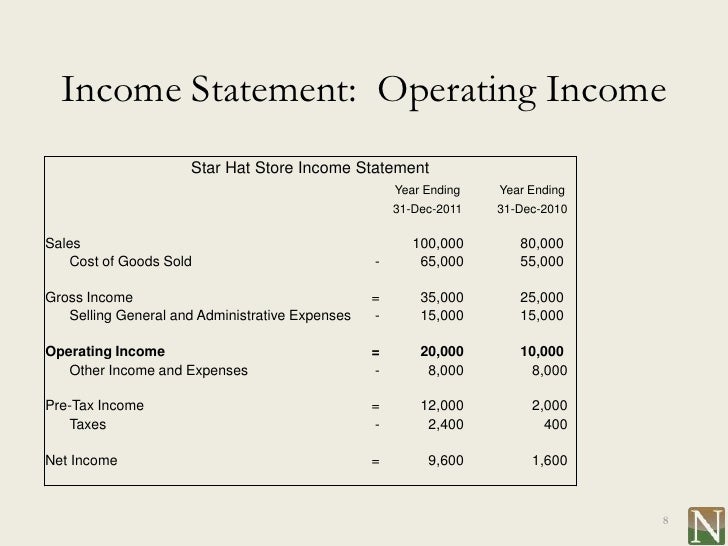

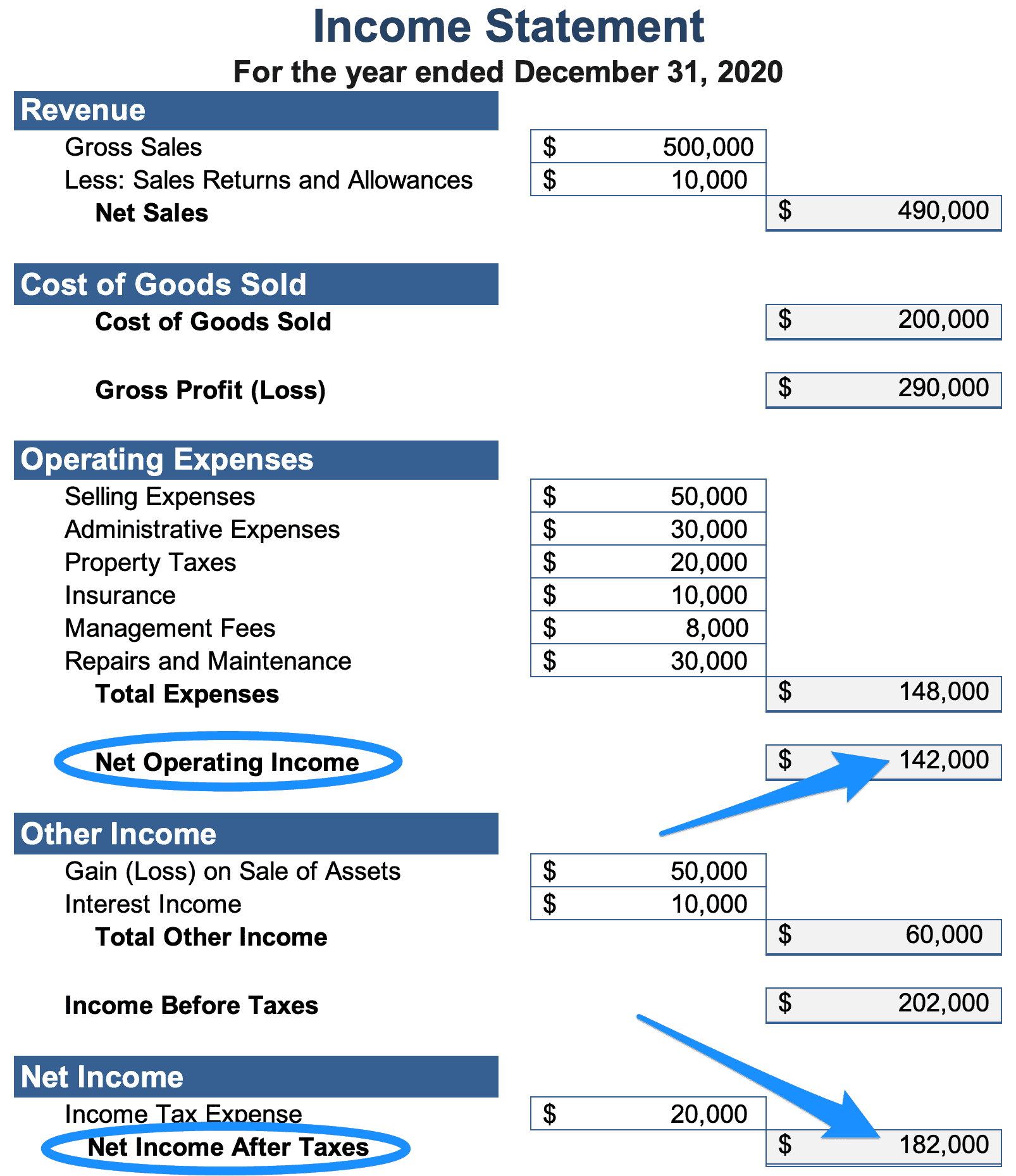

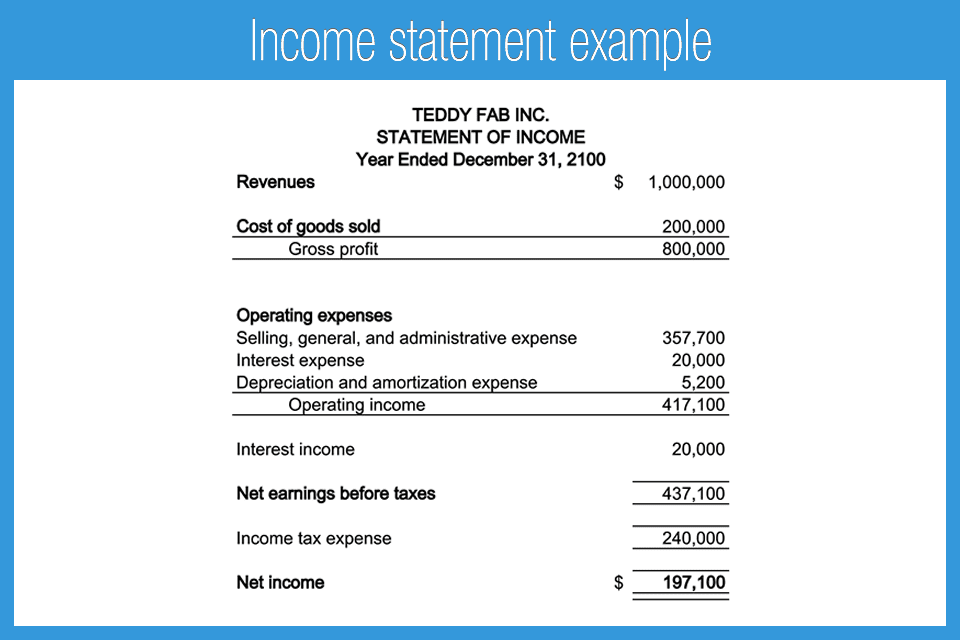

Other operating income in income statement. To calculate operating income, you must find the total revenue (gross income), cogs, and the operating expenses on the income statement. Operating income = net earnings + interest expense + taxes. Cogd = (300,000) gross profit = 200,000.

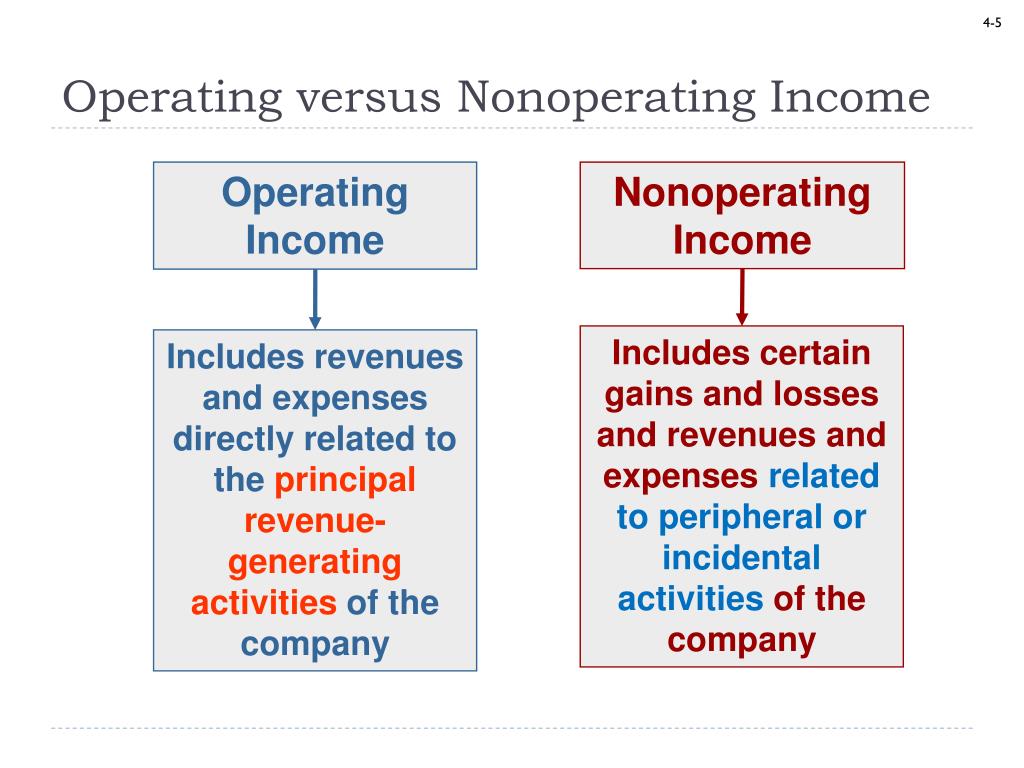

Division of net income by the total number of outstanding shares; The median average equated to 10% of operating income. Other income means earnings that come through other sources and activities not part of any business’s core activity or core sources of earnings.

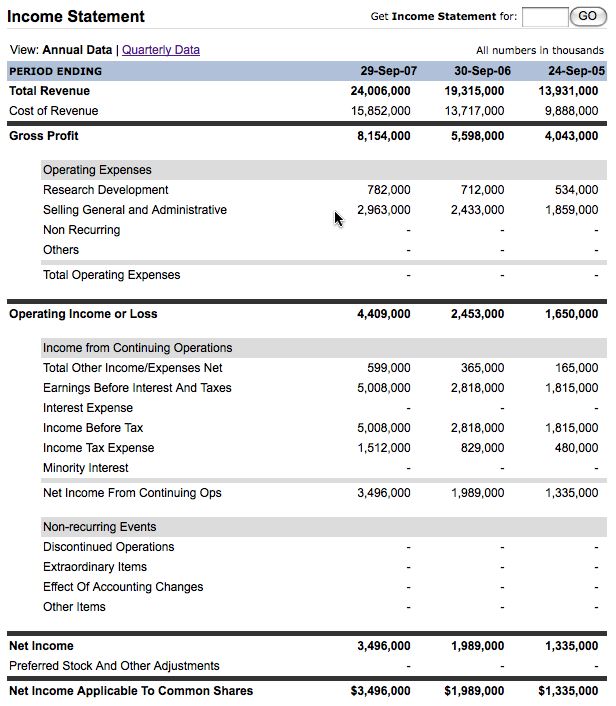

Revenue, expenses, gains, and losses. In closing, apple’s operating income in fiscal year 2022 is approximately $119.4 billion, which can be divided by its revenue to arrive at an operating margin of 30.3%. All you have to do is fill out your company’s information.

Operating income does not account for the following: Operating income is calculated by subtracting cost of goods sold and operating expenses from revenue. The income statement focuses on four key items:

Revenue from miscellaneous other activities. Net operating income is revenue minus all operating expenses. Operating income represents what’s earned from regular business operations.

Net income is the profit that remains after all expenses and costs, such as taxes. Operating income—also called income from operations—takes a company's gross income, which is equivalent to total revenue minus cogs, and subtracts all operating expenses. For example, during the year the company makes revenue of usd500,000, cost of sales usd300,000 and other income usd5,000, then the extract p&l of the company is as follows:

Only 22% of the 16.000 companies in our bloomberg sample reported other operating income; Expenses like the cost of goods sold, depreciation and amortization, and wage expenses are already accounted for in the metric. Income from foreign currency and hedging transactions as well as from the measurement of lti options.

One routinely records in the income statement just at the end after the gross profit section. When a new york judge delivers a final ruling in donald j. The extent to which assets (for example, aging.

An income statement compares revenue to expenses to determine profit or loss. Amortization = spread of the cost of intangible assets. Other income is income arising from activities unrelated to a company’s core business that consist of either (1) selling activities such as interest on loans (2) contractual earnings such as legal damages, or (3) accounting adjustments such.

Indeed, retailers tend to generate other operating income in excess of 14% of total operating income, as shown in figure 69. Sales on credit) or cash vs. Many key fundamental ratios use information from the income statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

![Is Operating the Same as EBITDA? [2023 UPDATE]](https://www.mosaic.tech/_next/image?url=https:%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2022%2F12%2FAdobe-Income-Statement.png&w=3840&q=75)

:max_bytes(150000):strip_icc()/imageedit_13_9492114505-9402b2fa1c05419ca6337a27f41d8329.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)