Casual Info About Purchase Of Ppe In Cash Flow Statement What Are Certified Financial Statements

What is the cash flow statement indirect method.

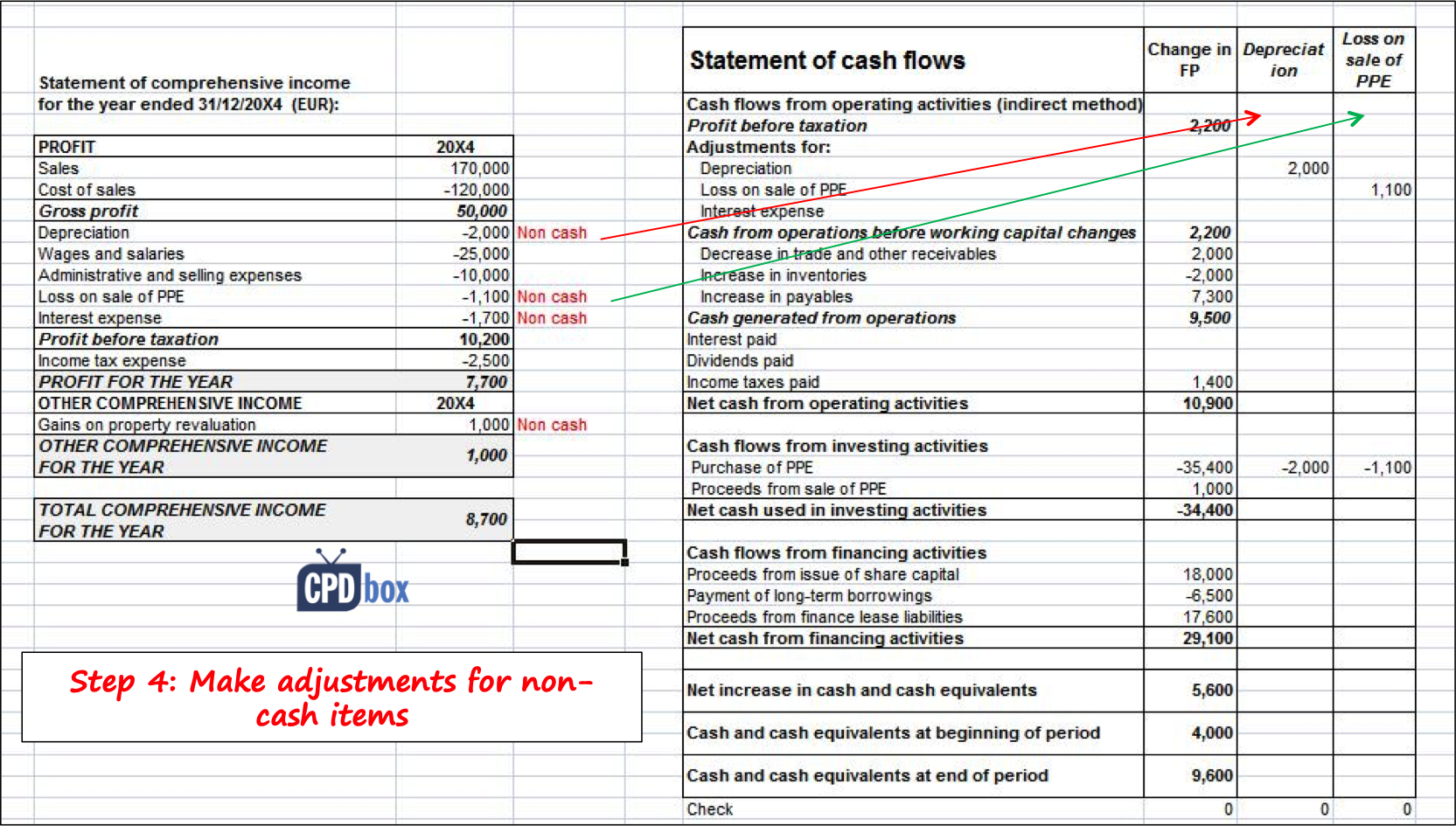

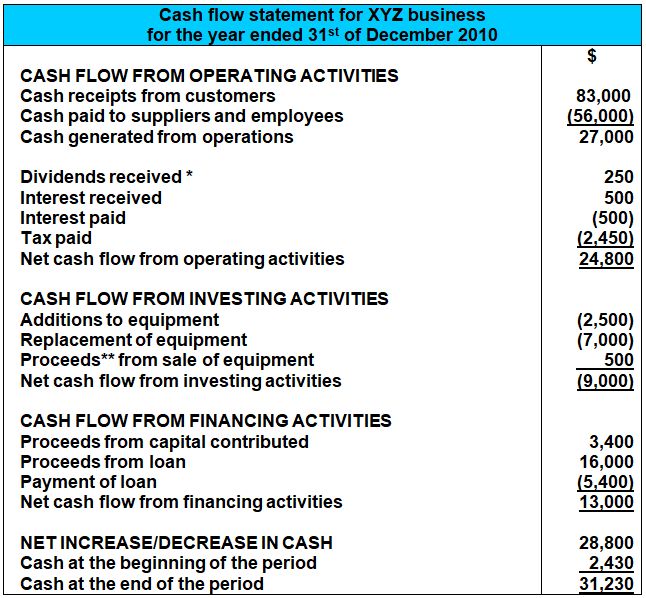

Purchase of ppe in cash flow statement. (with some twists) red star monkey 42 o subscribe a day ago i had an interview for an ib position and was asked. 72 9.8k views 3 years ago statement of cash flows in this financial accounting video, the differences in presentation of property, plant and equipment, net. Common cash flow calculations include the tax paid (which is an operating activity cash outflow), the payment to buy property, plant and equipment (ppe) (which is an investing.

Common cash flow calculations include the tax paid, which is an operating activity cash out flow, the payment to buy property plant and equipment (ppe) which is an investing activity cash out flow and dividends paid, which is a financing activity cash out flow. The purchase of equipment appears as a cash outflow under cash flow from investing activities. Ppe and cash flow statements property, plant and equipments property plant and equipment (ppe) are tangible assets that an entity holds for its own use or for.

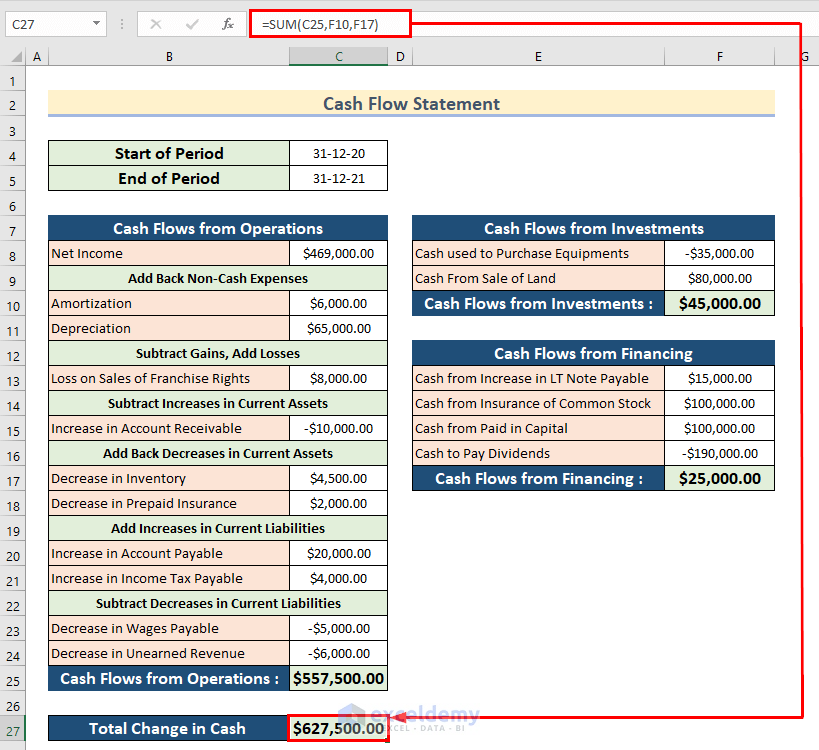

Computation of cash paid for the purchase of equipment: The input that will cause this change to. The cash flow statement explains how a company’s cash and cash equivalents have changed during a specified period of time.

Ppe with a carrying amount of £486,000 was sold during the year land was revalued upwards during the year by £4,000,000 all sales and purchases were on. How sale of ppe flow through the 3 statements? This will involve some degree of incomplete records knowledge.

The cash flow (i.e., proceeds from the sale) goes on the statement of cash. The cash flow statement indirect method is one way to present a company’s total cash flow. Property, plant, and equipment (pp&e) refers to a company’s tangible fixed assets that are expected to provide positive economic benefits over the long term (> 12.

The gain or loss goes on the income statement, not on the statement of cash flows. Cash flow from investing activities (cfi) is one of the sections on the cash flow statement that reports how much cash has been generated or spent from various. The cash flow statement is organized into.

Purchase of property, plant, and equipment (ppe):

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)