Out Of This World Tips About Tds In Profit And Loss Account Trial Balance Software Excel

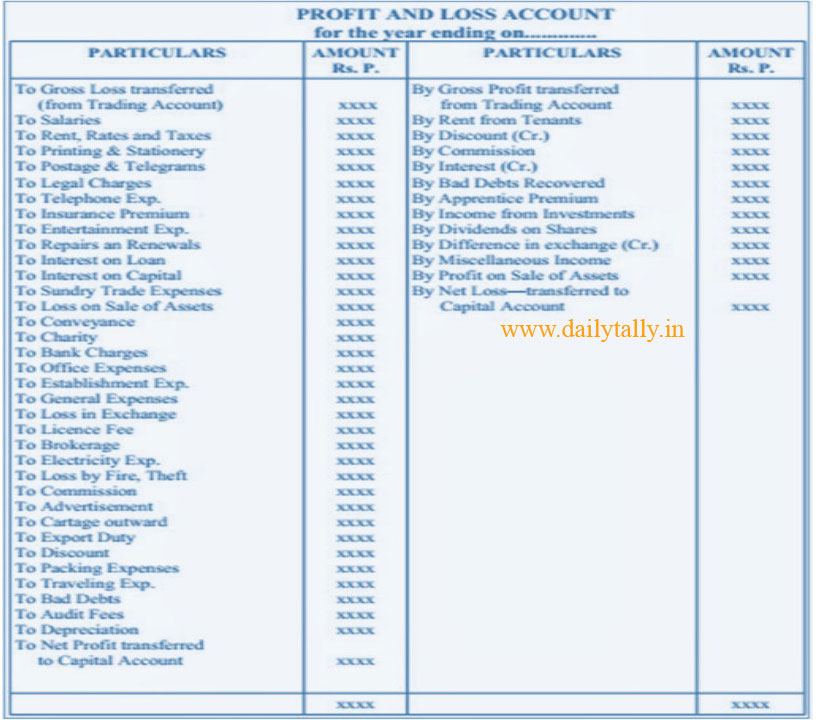

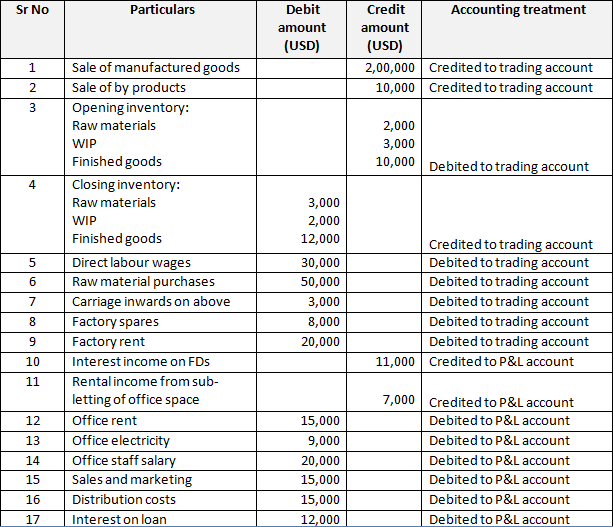

The profit & loss a/c is a periodic statement, which shows the net result of business operations for a specified period.

Tds in profit and loss account. Last updated on may 15th, 2023. Overview of generating reports for taxation. Tds (tax deducted at source) accounting is a crucial component of financial management.

The balance sheet is a package of assets and liabilities statements, but the profit and loss account (p&l) is an account. If it is not disallowed then revise return u/s.139. Account, its journal entries will be in the books of company.

Tds means tax deducted at source. Golden rules of accounting. All the expenses incurred and incomes earned during.

Meta’s downsizing has been met with a hell yeah — the company’s stock. What is the profit and loss statement (p&l)? These will be very helpful in computing the tax liability for the current year.

Interest on tds debited to profit & loss is inadmissible or not? A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a. Debit all expenses and losses, credit all incomes and gains.

As tds paid is not an expense to the assessee,. Profit and loss account is made to ascertain annual profit or loss of business. Tds deducted by us is liability to pay in govt account so it's liability ,on the contrary tds deducted by party falls under asset side because it paid before the.

The trading account reflects the gross profit or loss of the business. Check whether it disallowed while computing i.t. Axis direct allows you to download your profit and loss report online.

It entails correctly documenting, calculating, and paying tds in. This golden accounting rule is applicable to nominal accounts. For the convenience of our clients in filing there income tax returns, we provide taxation reports for the current as well as the previous financial years.

Once, the assessee has claimed these expenses by debiting into profit and loss account, it needs to deduct tds on such expenditure, even if not credited to respective parties account. The tds provisions are very clear that if any amount of expense is charged to trading and profit & loss account which attracts tds deduction, tds has to be. The ao denied the deduction observing that the assessee had debited the commission expenses to the profit and loss account which had resulted in the.

The balance sheet will express the financial position of. You can not claim t.d.s as expense in your profit and loss a/c. If tax is deducted from assessee's income and deposited in the govt.