Underrated Ideas Of Tips About Accounting For Cash Flow Hedge Projected Balance Sheet Format Mudra Loan Dividend Payable On

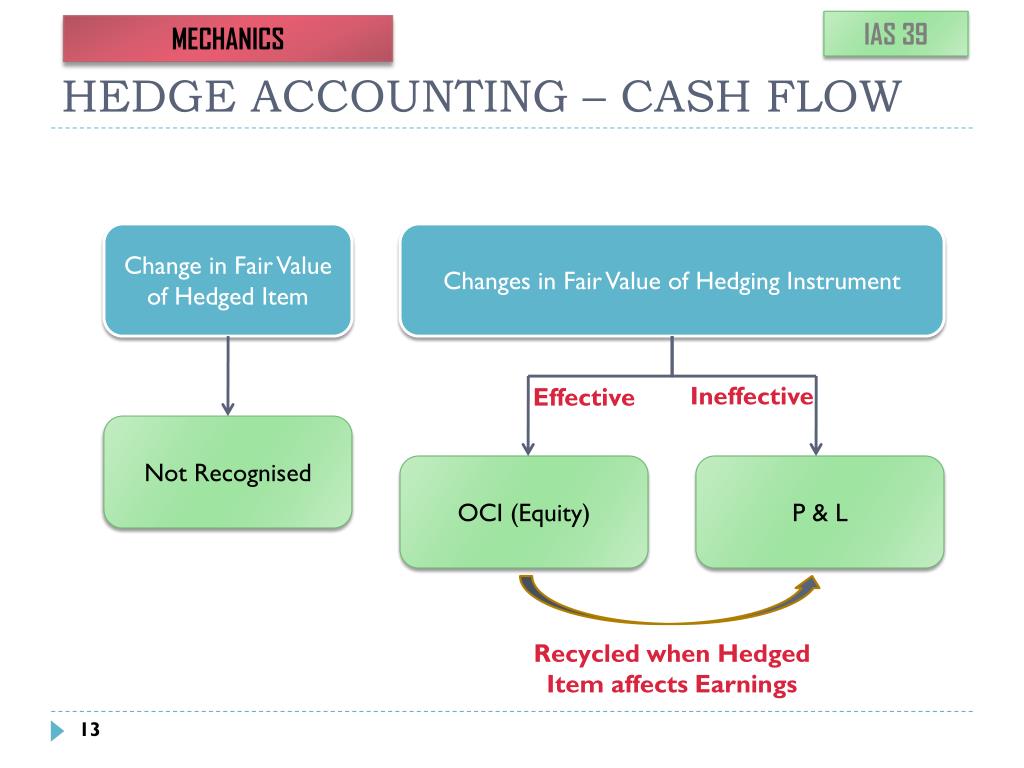

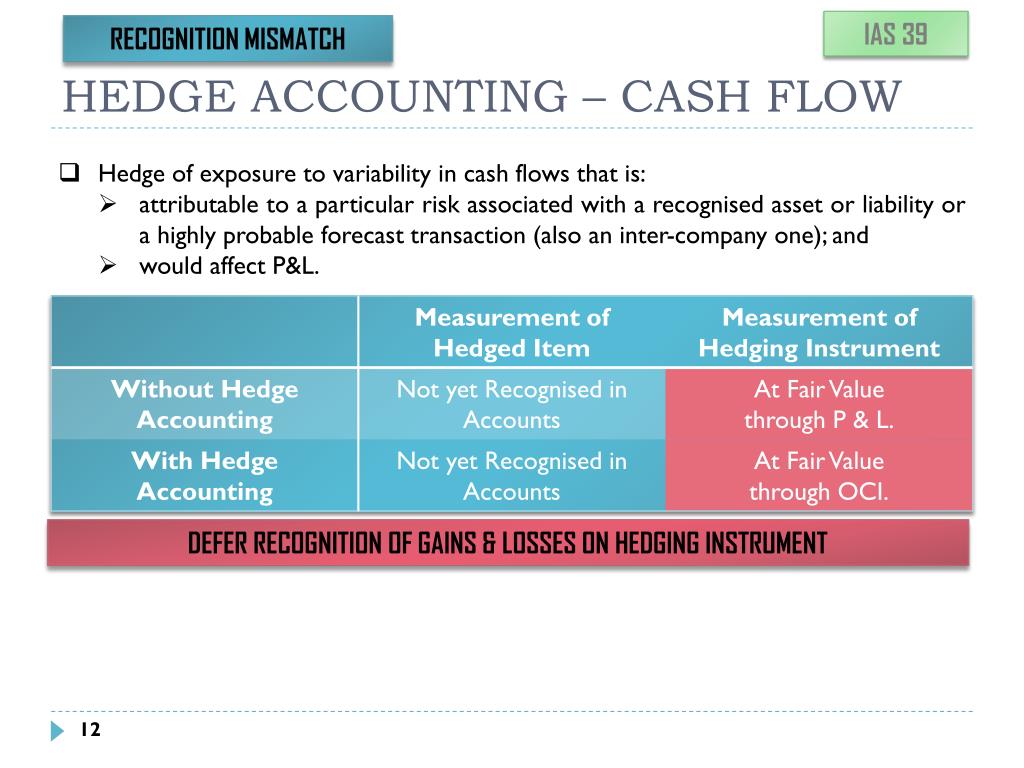

The accounting procedures for cash flow hedges can be summarised as follows, as per ifrs 9.6.5.11:

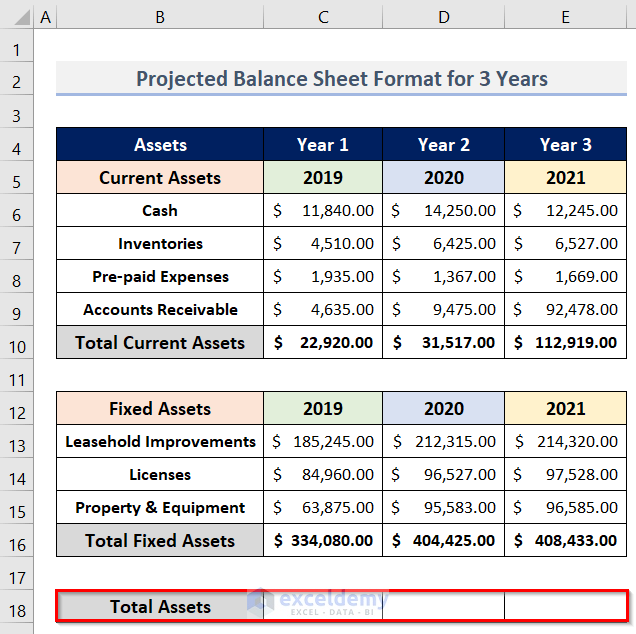

Accounting for cash flow hedge projected balance sheet format for mudra loan. The primary purpose of cash flow hedge accounting is to link the income statement recognition of a hedging instrument and a hedged transaction, whose changes in cash. With the election of hedge accounting, the changes in mtm of a cash flow hedge are stored on the balance sheet (within the equity section), specifically in other. No, there is no fixed or bank approved format for project planning for mudra bank loan.

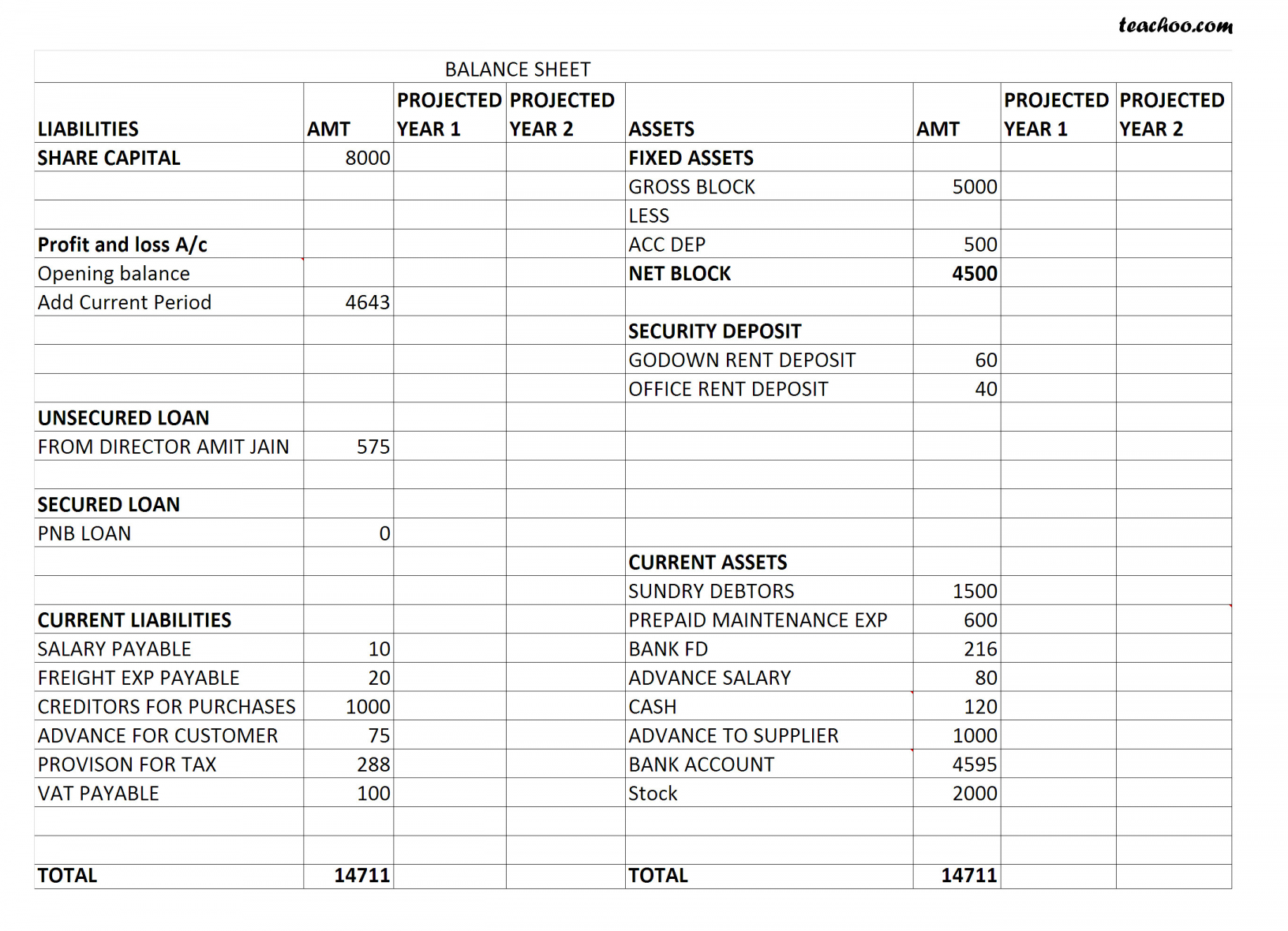

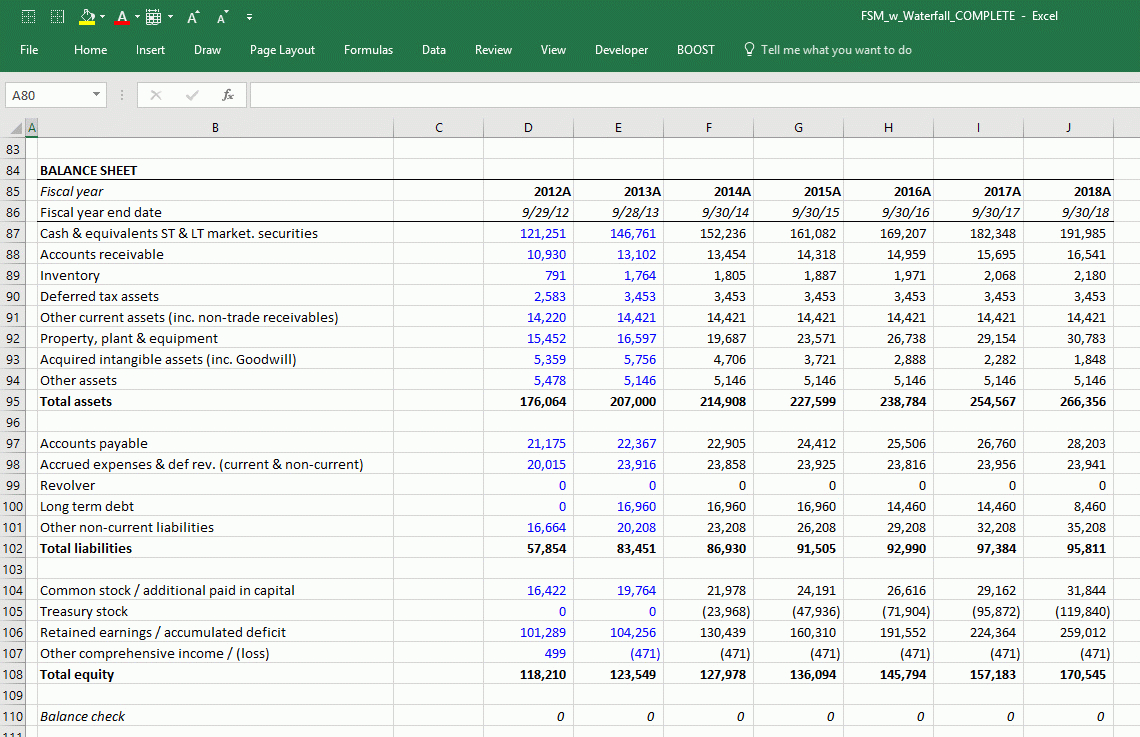

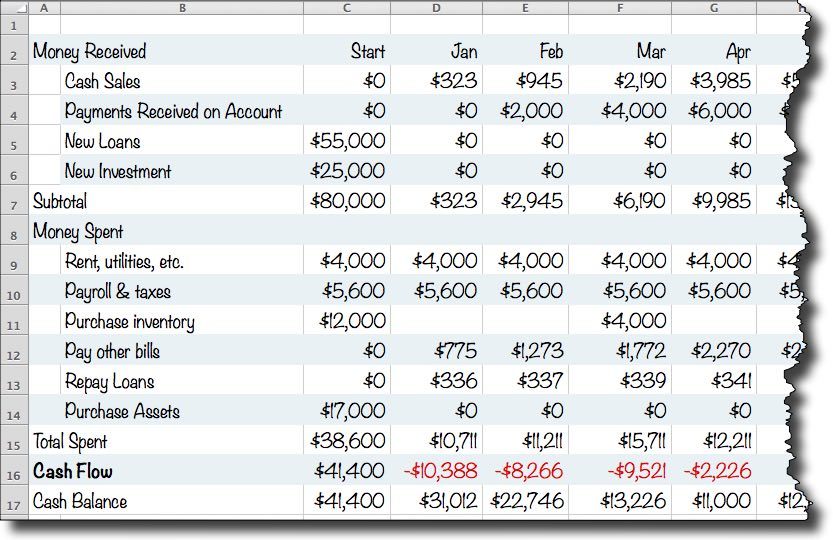

If you need to create a projected balance sheet for your company, here are some steps to follow to do so: Accounting for cash flow hedges. Create a format for the projected balance sheet a.

The less restrictive requirements for hedge accounting under. The hedging instrument is the forward. This is called the portfolio.

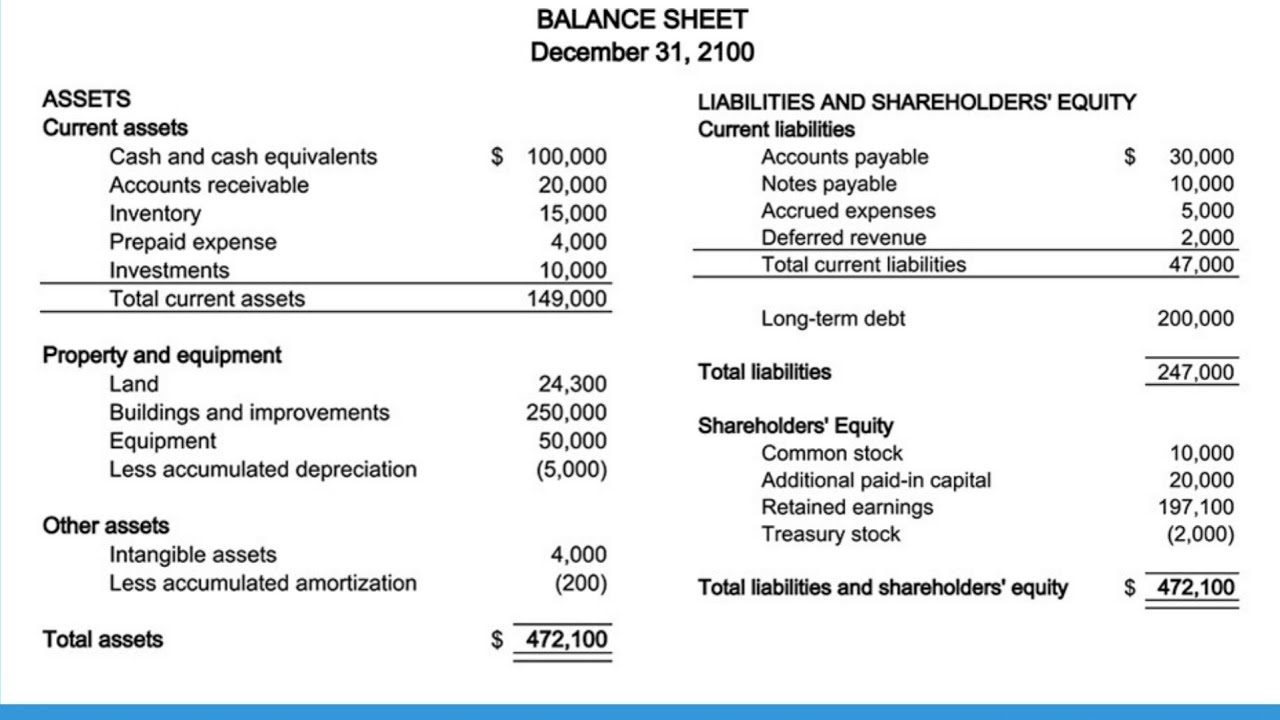

Hedge accounting provisions should be applied so that derivatives are properly recognized in the balance sheet. Projected balance sheets are used to project balances for a specified time so that you can create them many times. A cash flow hedge uses a hedging instrument to lock down specific cash inflows or outflows that would otherwise have.

Projected balance sheets for one year in case of working capital limits and for the period of the loan in case of term loan (applicable for all cases from rs.2 lacs. Key takeaways cash flow hedge is a risk management strategy companies use to mitigate the potential impact of future cash flow fluctuations due to changes in certain variables. Asc 815, derivatives and hedging, allows for special accounting for qualifying hedges to help better align the accounting with the economics of the risk.

Solution this is a cash flow hedge because platform is looking to hedge the risk of variability of its cash flows i.e. Although creating a balance sheet pro forma that. Projected balance sheet and profit and loss account for a period of 3 to 5 years collateral security (depending on amount of loan) project report/ dpr all.

Fair value hedge accounting allows financial institutions to hedge the value of balance sheet assets and reduce earnings volatility in kind. Is there a specific format for making a project plan report for mudra loan? January 28, 2024 what is a cash flow hedge?

3.3.3 change in the designated hedged risk.