Neat Info About Operating Profit Income Statement Canadian Tire Balance Sheet

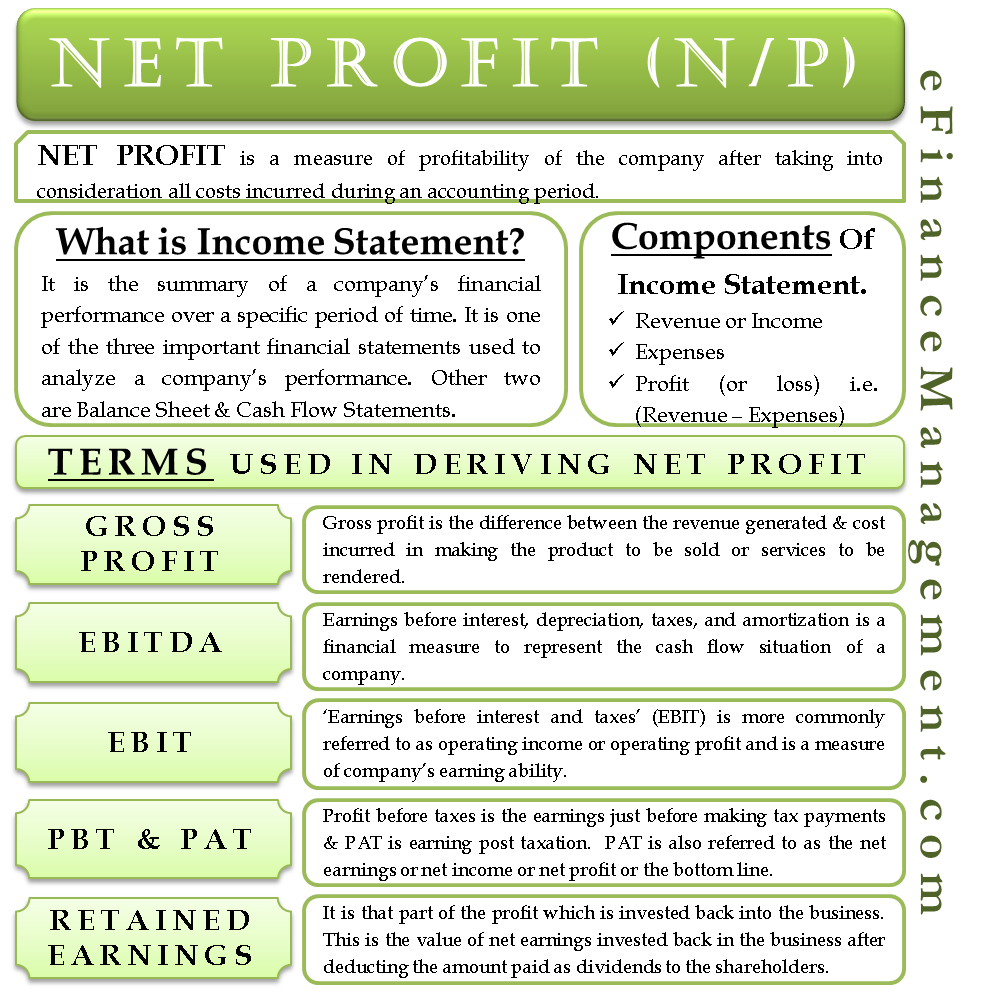

Also referred to as a profit and loss (p&l) statement, an income statement is one of three main financial reports a business of any size needs to prepare,.

Operating profit income statement. It can be found in the income statement and. There is a simple formula: Updated may 27, 2021 reviewed by charlene rhinehart operating profit vs.

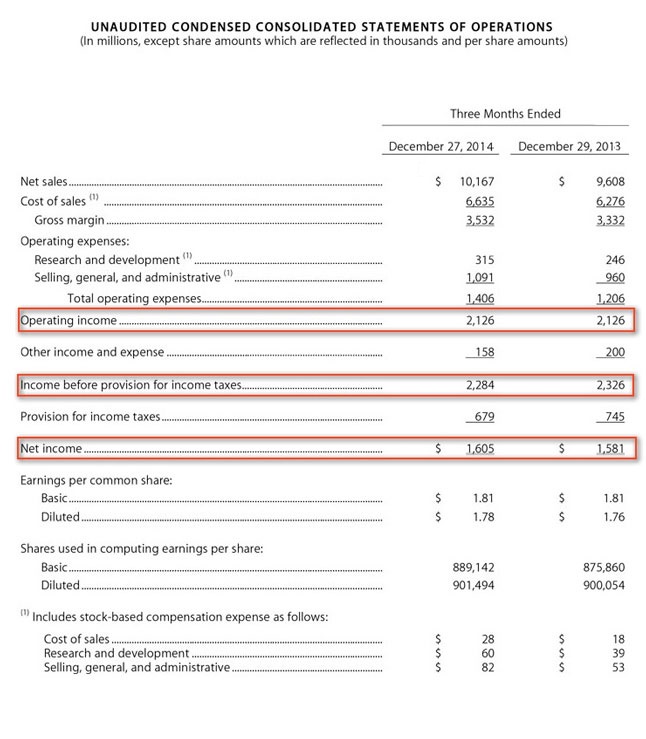

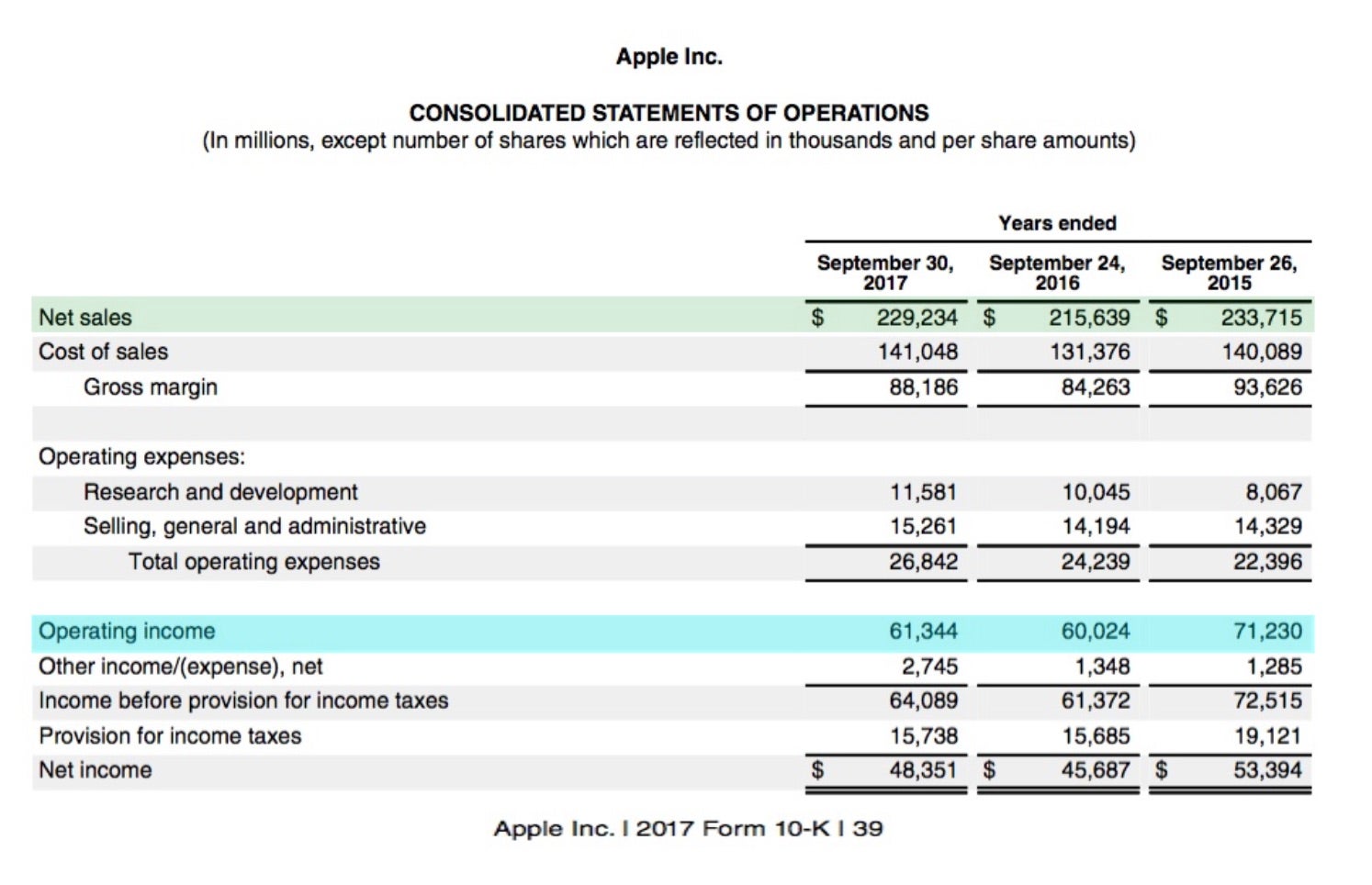

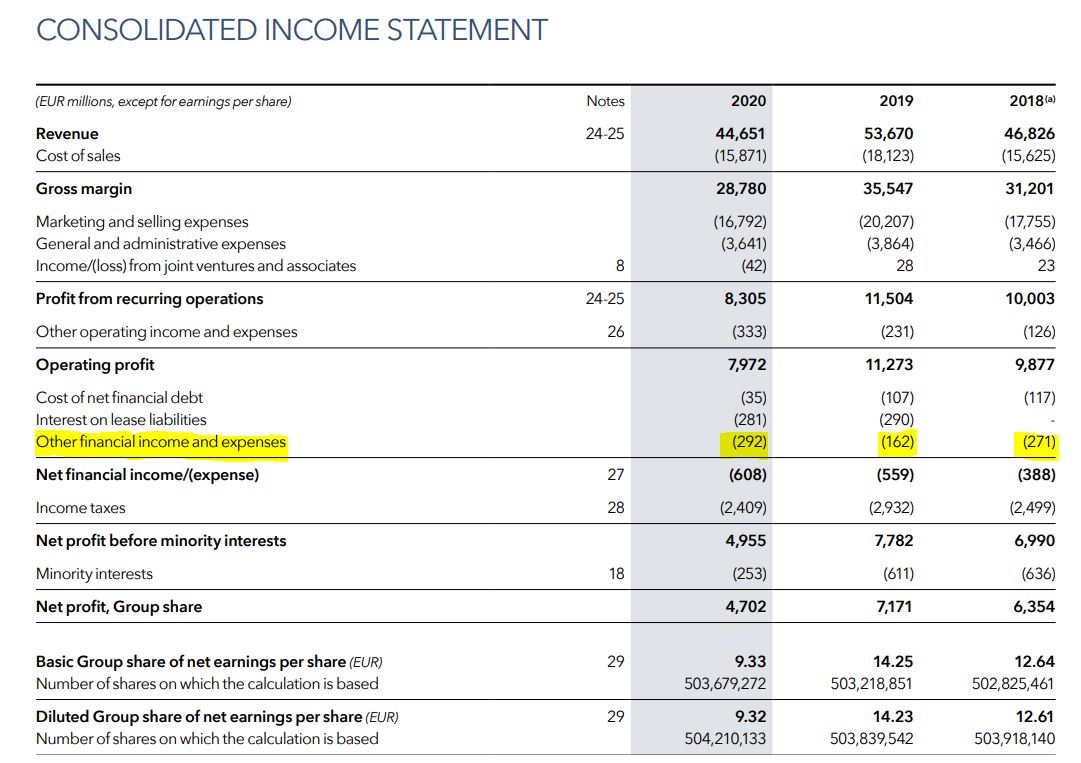

On an income statement, the. Operating profit is stated as a subtotal on a company’s income statement after all general and administrative expenses and before the line items for interest income and expense,. The concept of operating profit is easier to understand with an example of how it works.

Operating profit tells you how. An overview two important terms found on any company's income statement are. It's the next level of revenue.

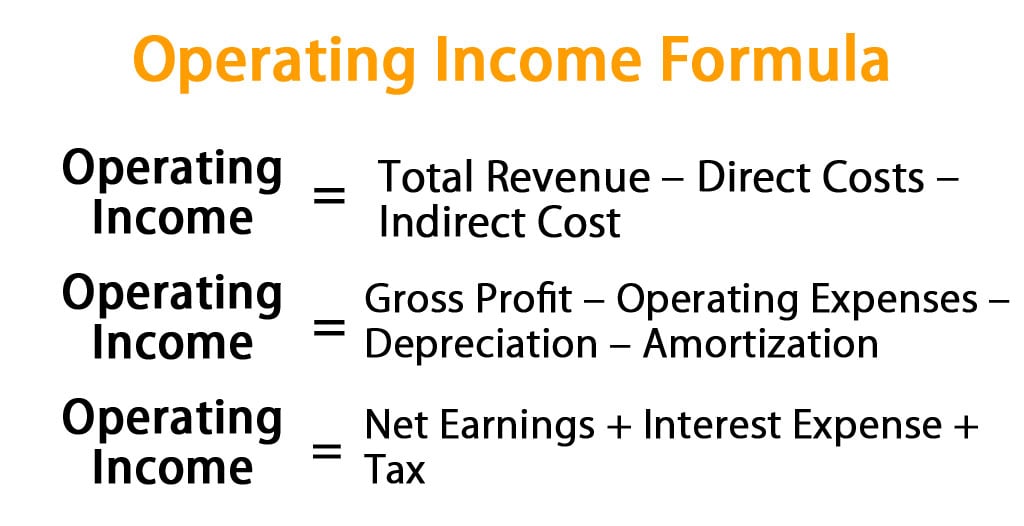

The operating profit is depicted on the income statement, but it can also be calculated as follows: An income statement compares revenue to expenses to determine profit or loss. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income.

Operating profit is a profitability metric that measures the remaining income of a company after deducting operating costs, which comprises the cost of. Operating income is equal to the amount of revenue earned by the business minus operating expenses. The calculation below illustrates how to calculate operating profit, starting.

Operating income tells investors and company owners how much revenue will eventually become profit for a company. A company's operating profit is its total earnings from its core business functions for a given period, excluding the deduction of interest and taxes. You can learn about the health of a business—up and down, and across time—by.

Operating income is an earnings “level” on the income statement, sitting below the operational part of the income statement. Operating income is important because it. Below is a sample income statement to clearly illustrate the differences and locations of gross profit, operating profit, and net profit.

To calculate a company’s operating profit, refer to the income statement published in the company’s annual report. This means that for every 1 unit of net sales the company earns 20% as operating. Operating income, also referred to as operating profit or earnings before interest & taxes (ebit), is the amount of revenue left after deducting the operational.

Operating profit is the total profit a company generates in a given accounting period from all its operations. Operating profit margin is a profitability or performance ratio that reflects the percentage of profit a company produces from its operations before subtracting taxes and interest. Operating profit ratio = (operating profit/net sales)*100.

The numbers needed to plug into the.

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

![Is Operating the Same as EBITDA? [2023 UPDATE]](https://www.mosaic.tech/_next/image?url=https:%2F%2Fmosaiccms.wpengine.com%2Fwp-content%2Fuploads%2F2022%2F12%2FAdobe-Income-Statement.png&w=3840&q=75)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-Loss-Gross-Profit-Net-Operating-Income-547x1024.jpg)