Fun Tips About Apple Inc Financial Ratios Cash Flow Statement Of Nestle

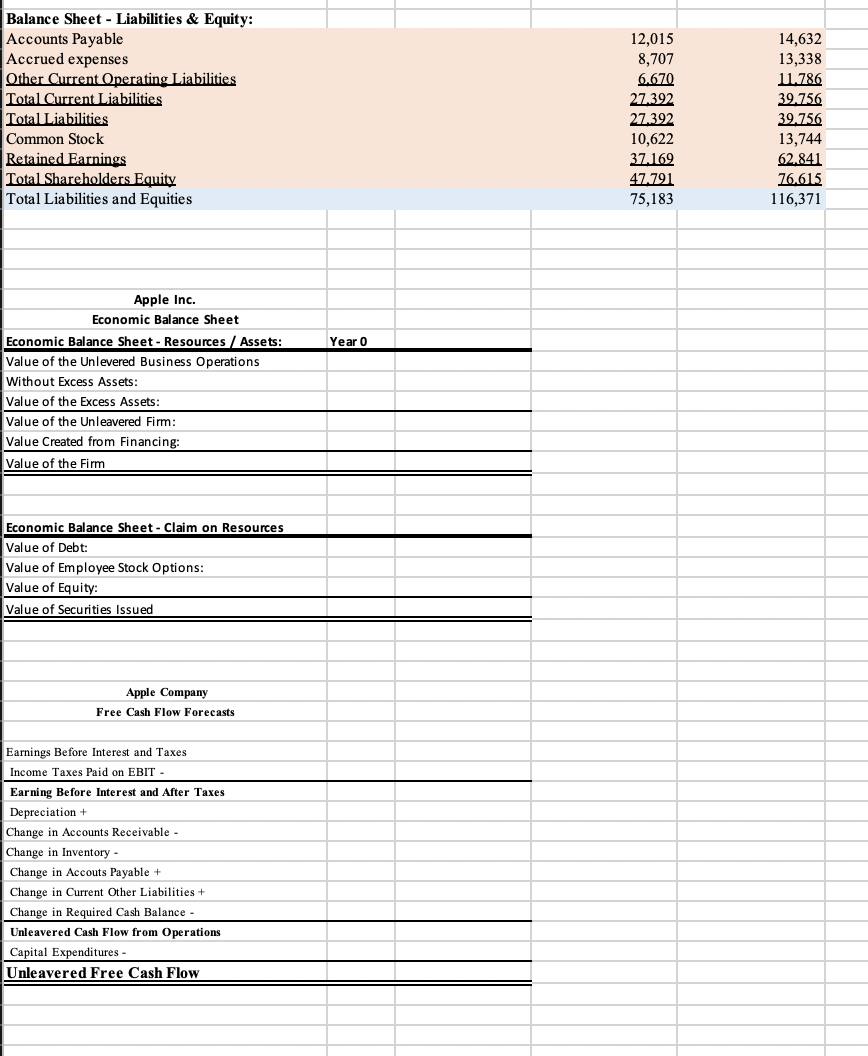

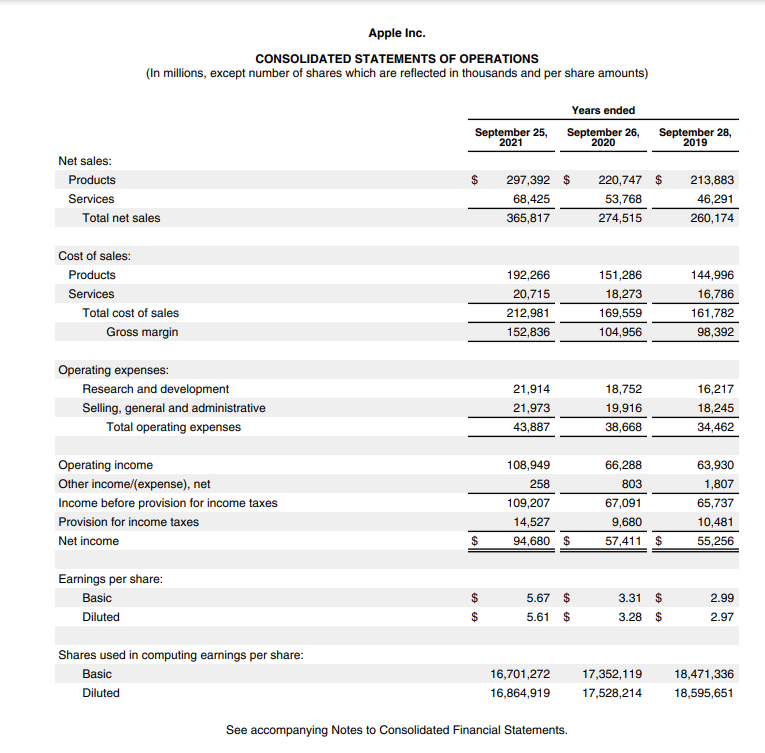

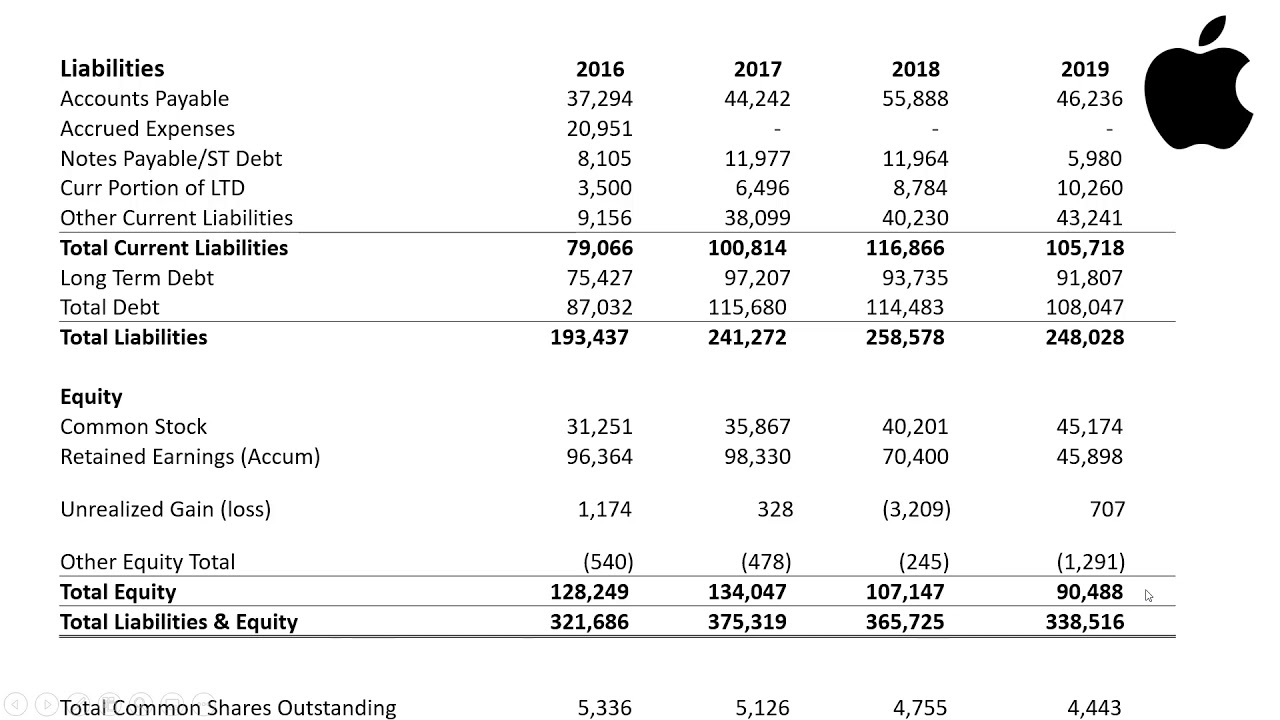

View aapl financial statements in full.

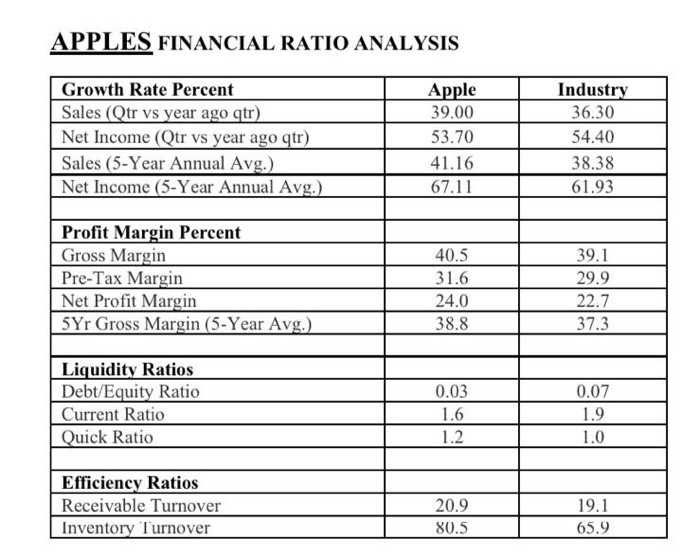

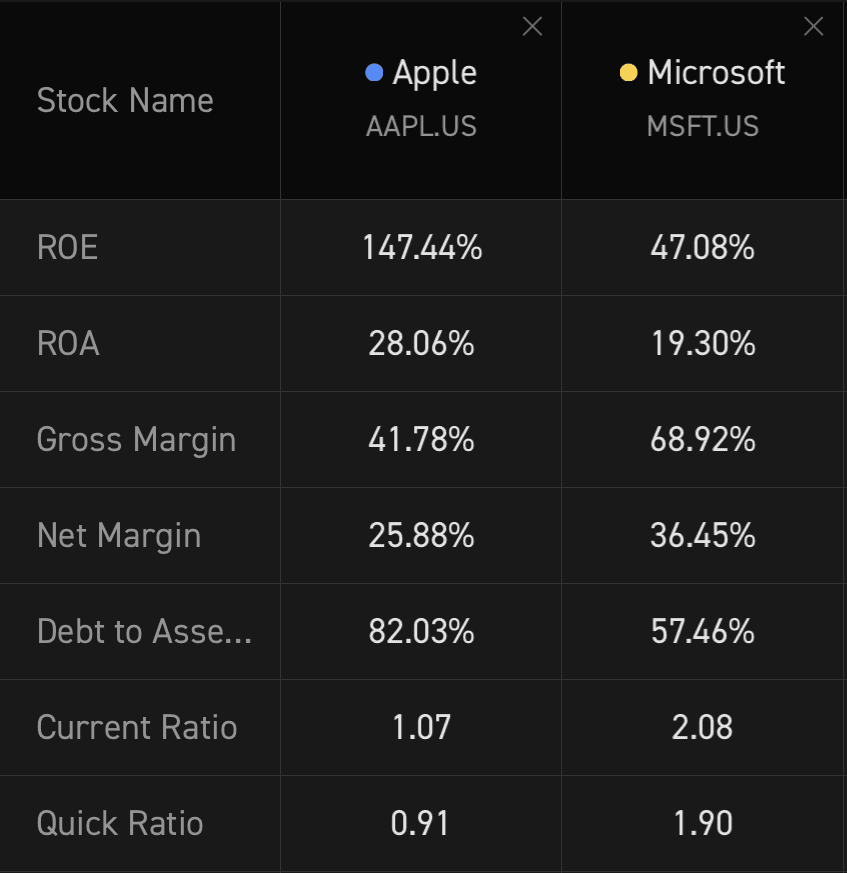

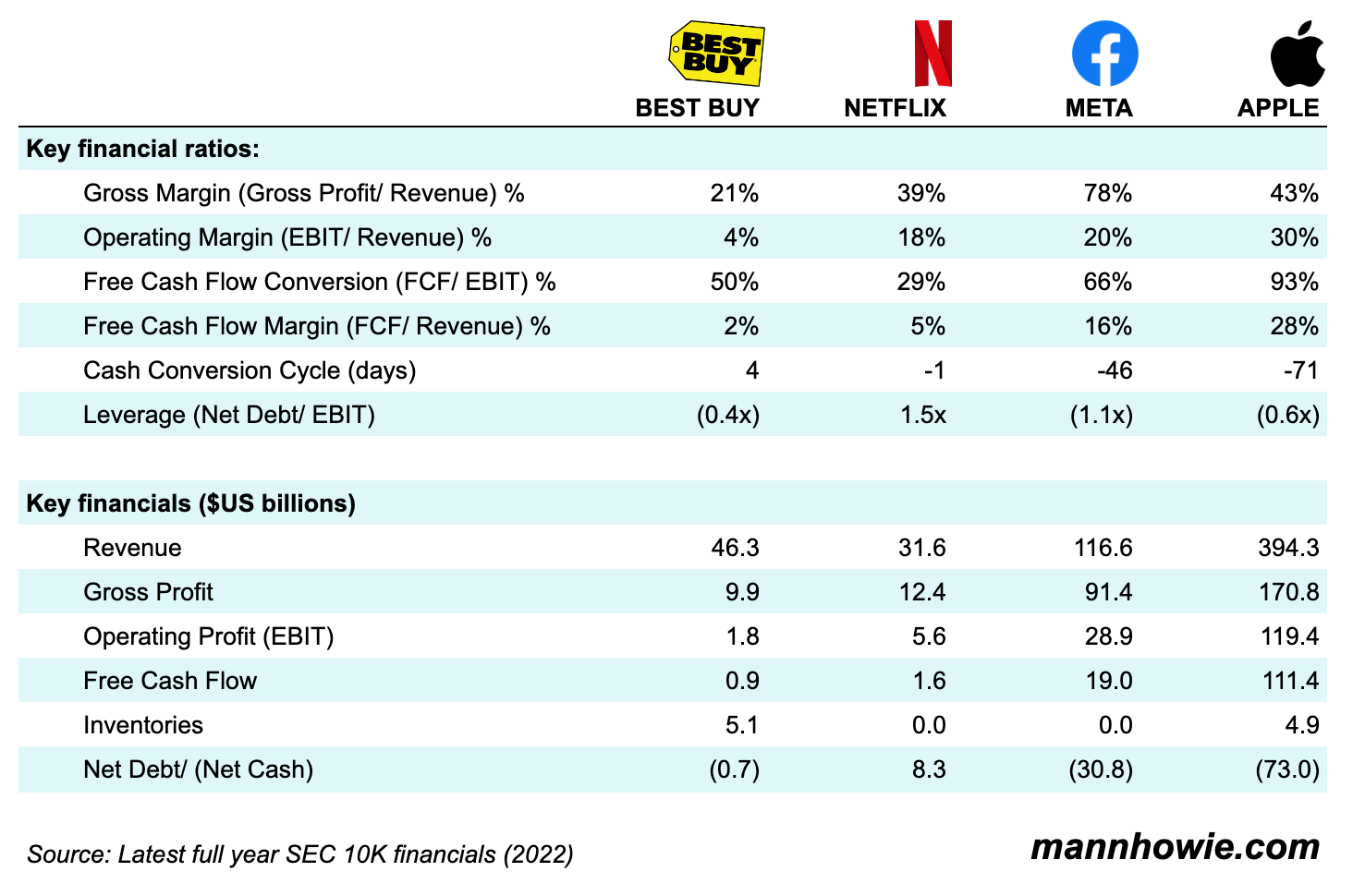

Apple inc financial ratios. Apple inc key financial stats and ratios. The ev/ebitda ntm ratio of apple inc. 30), or 58% of the.

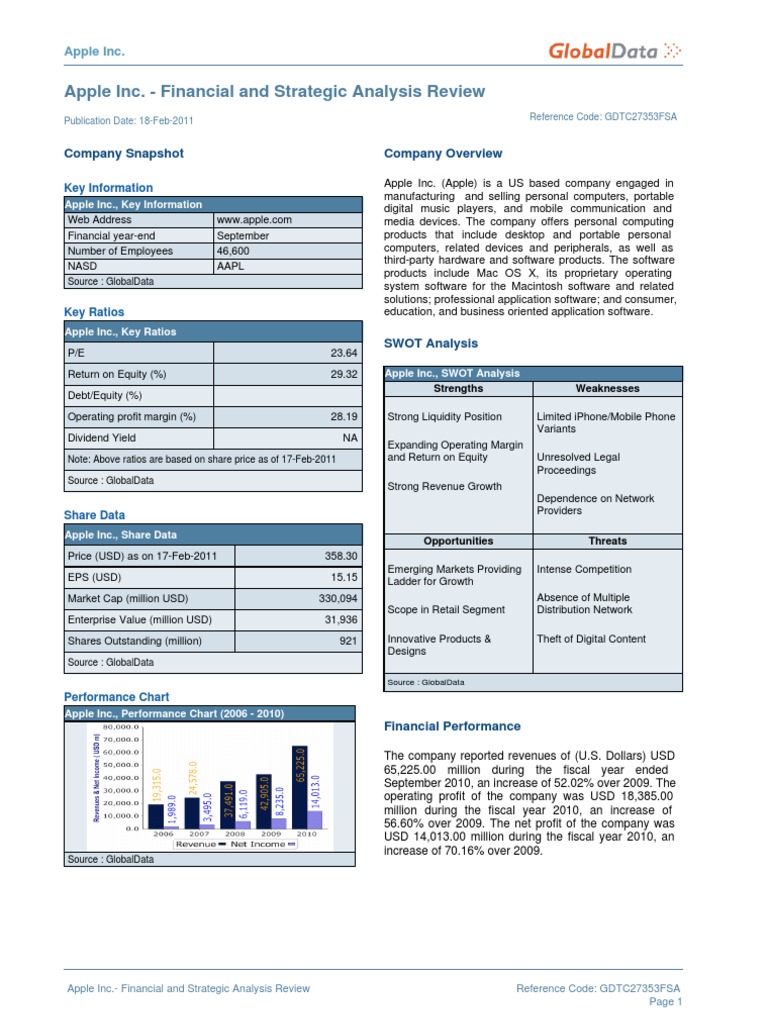

View the latest aapl income statement, balance sheet, and financial ratios. As of 2023 they employed 161.00 k. According to these financial ratios apple inc.'s valuation is way.

October 28th, 2022 pdf generated by stocklight.com united states securities and exchange. Apple is presently reporting on over. Annual data quarterly data apple inc., profitability ratios based on:

Find out all the key statistics for apple inc. 2024 annual meeting of shareholders. 61 rows current and historical current ratio for apple (aapl) from 2010 to 2023.

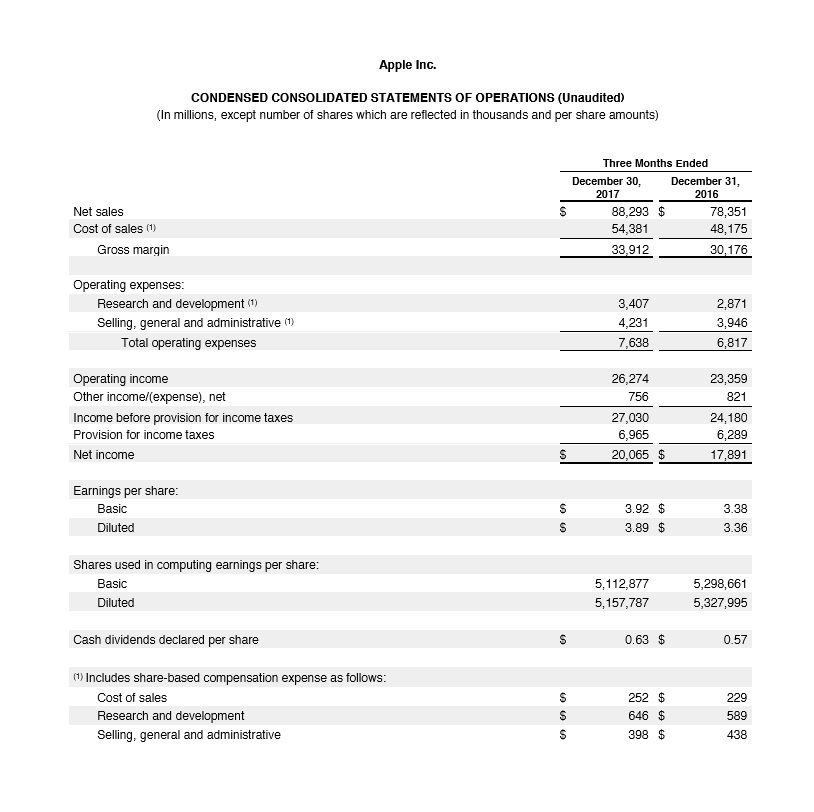

Trending find the latest apple inc. Current ratio can be defined as a liquidity ratio that measures a company's ability to pay short. Even today, the iphone is apple's biggest moneymaker, generating $69.7 billion of revenue in the latest fiscal quarter (q1 2024 ended dec.

The company has an enterprise value to ebitda ratio of 21.91. Apple historical financial ratios. (aapl), including valuation measures, fiscal year financial statistics, trading record, share statistics and more.

Common stock (aapl) annual income statements, balance sheets, financial statements, ratios, and cash flow data at nasdaq.com. The firm trades with high earnings multiples: 29 rows financial ratios and metrics for apple inc (aapl).

Includes annual, quarterly and trailing numbers with full history and charts. Fundamentals trends premiums profitability ownership competition. Apple will host the 2024 annual meeting of shareholders on february.

Is significantly higher than the median of its peer group: Ten years of annual and quarterly financial ratios and margins for analysis of apple (aapl). According to these financial ratios apple inc.'s valuation is way above the market valuation of its peer group.

The company has an enterprise value to ebitda ratio of 22.12. As of 2023 they employed 161.00 k. Technical forum financial summary income statement balance sheet cash flow ratios dividends earnings aapl ratios advanced ratios ttm = trailing twelve months 5ya.