Perfect Tips About Estimated Liability For Damages In Balance Sheet Reports Prepared Financial Accounting Are General

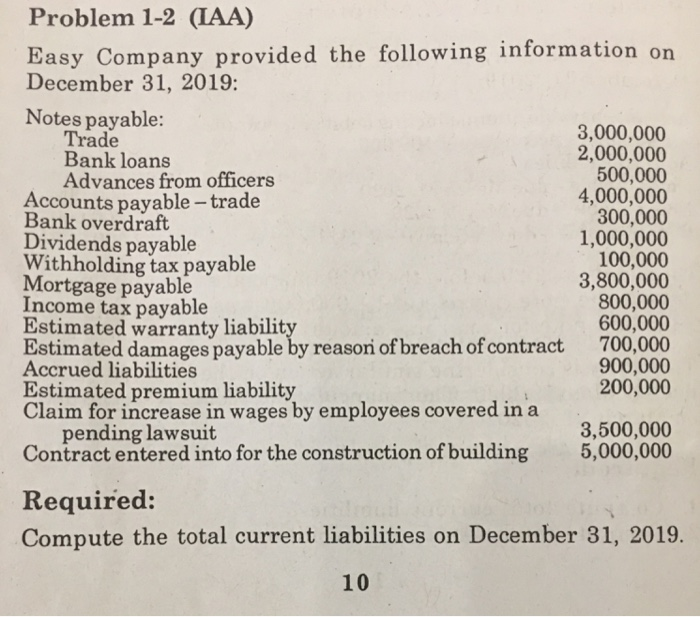

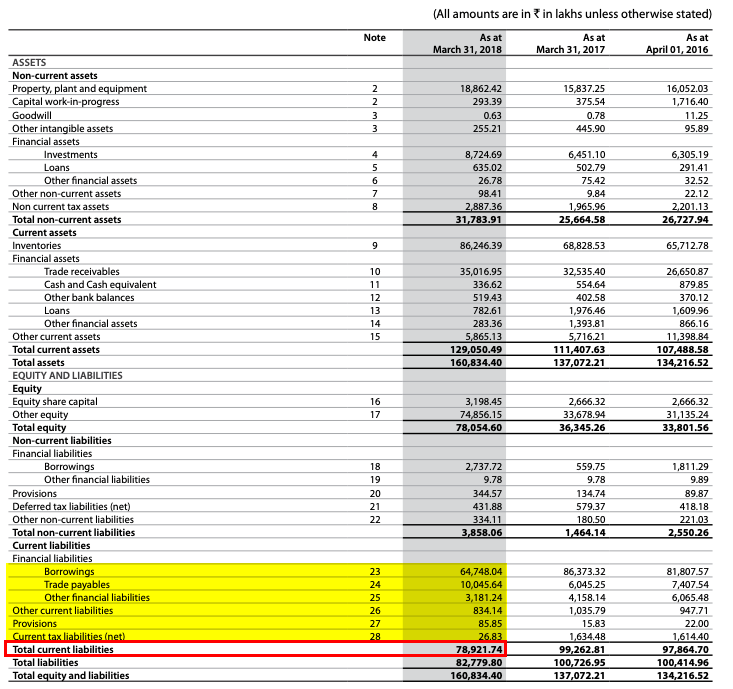

So, for example, it will include the total of.

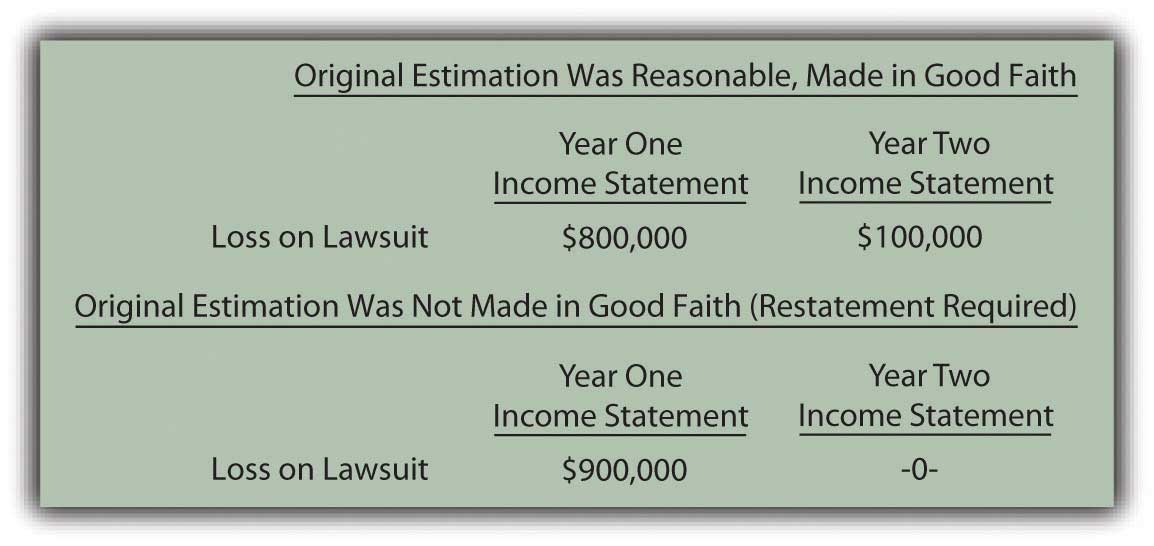

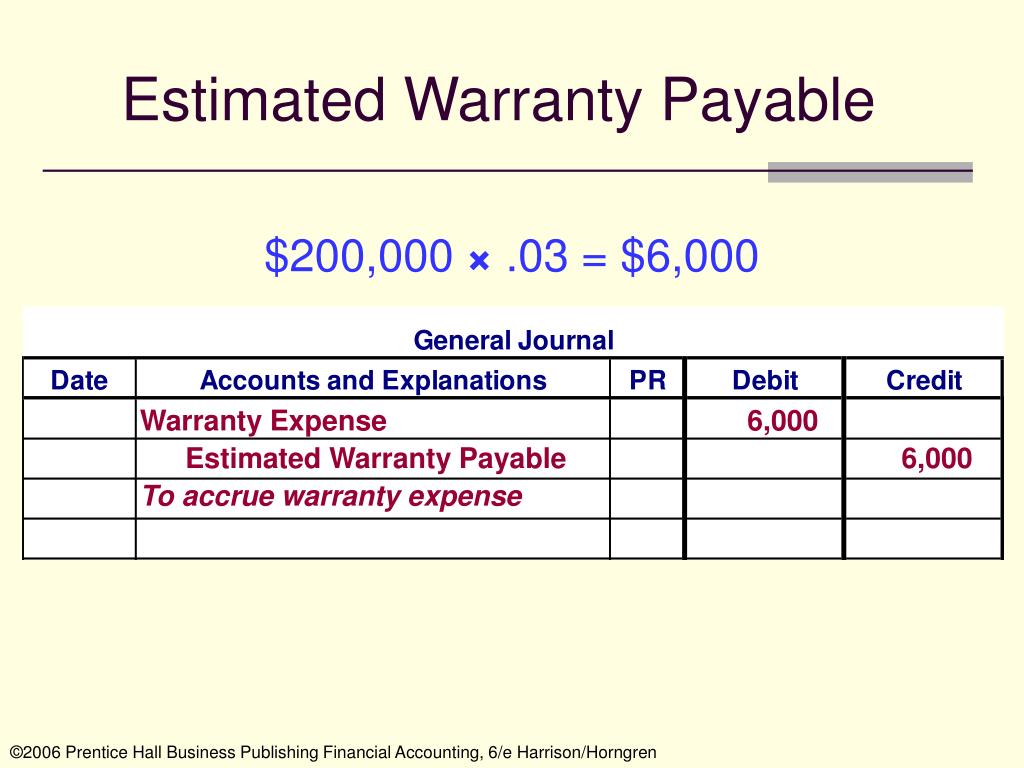

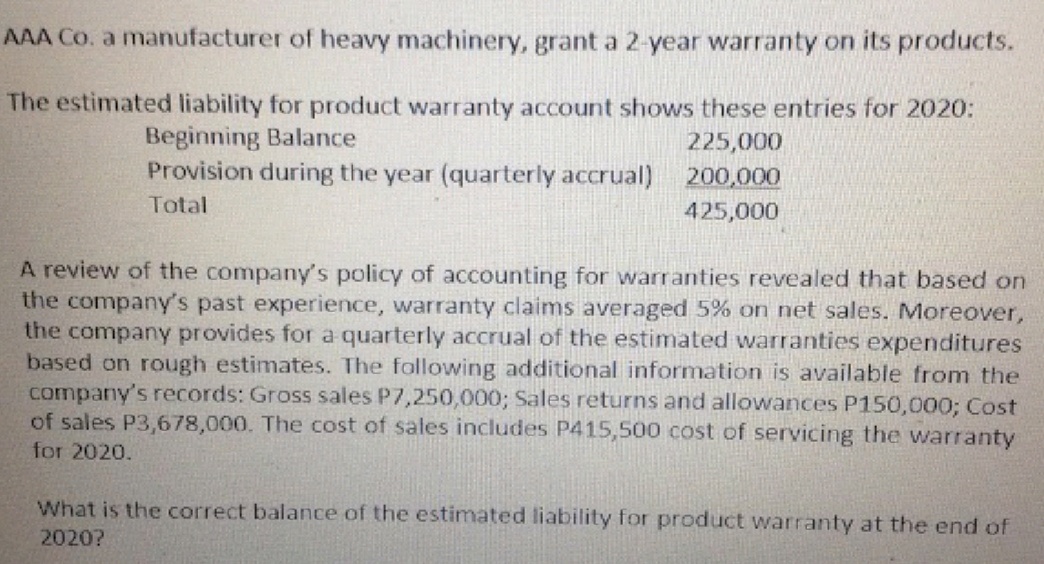

Estimated liability for damages in balance sheet. Right, this is a liability that's going on to our balance sheet in the amount of 80,000. Generally accepted accounting principles (gaap) require contingent liabilities that can be. Okay, so notice we made two journal entries here, one for our revenue, whoops.

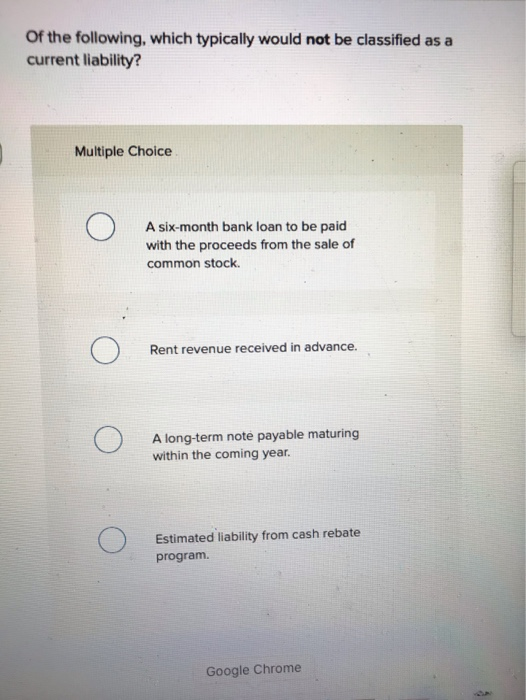

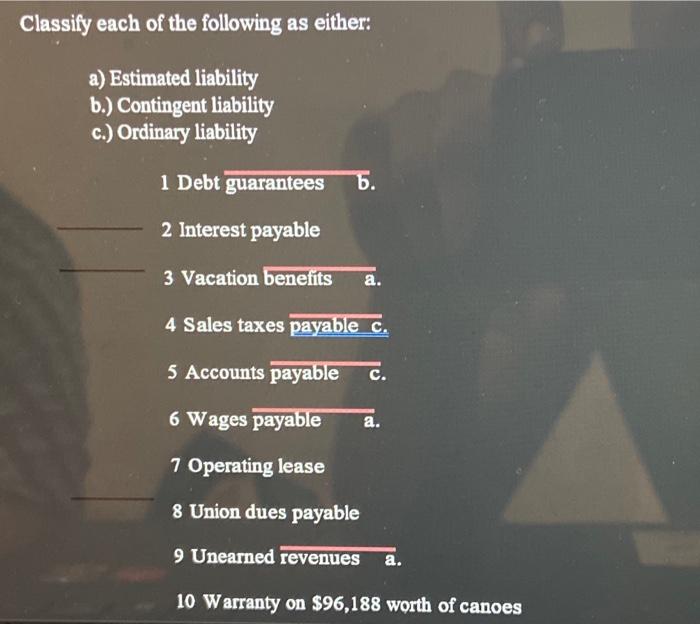

In may 2020 the board issued. An estimated liability is an obligation for which there is no definitive amount. Contingent liabilities are those that are likely to be realized if specific events occur.

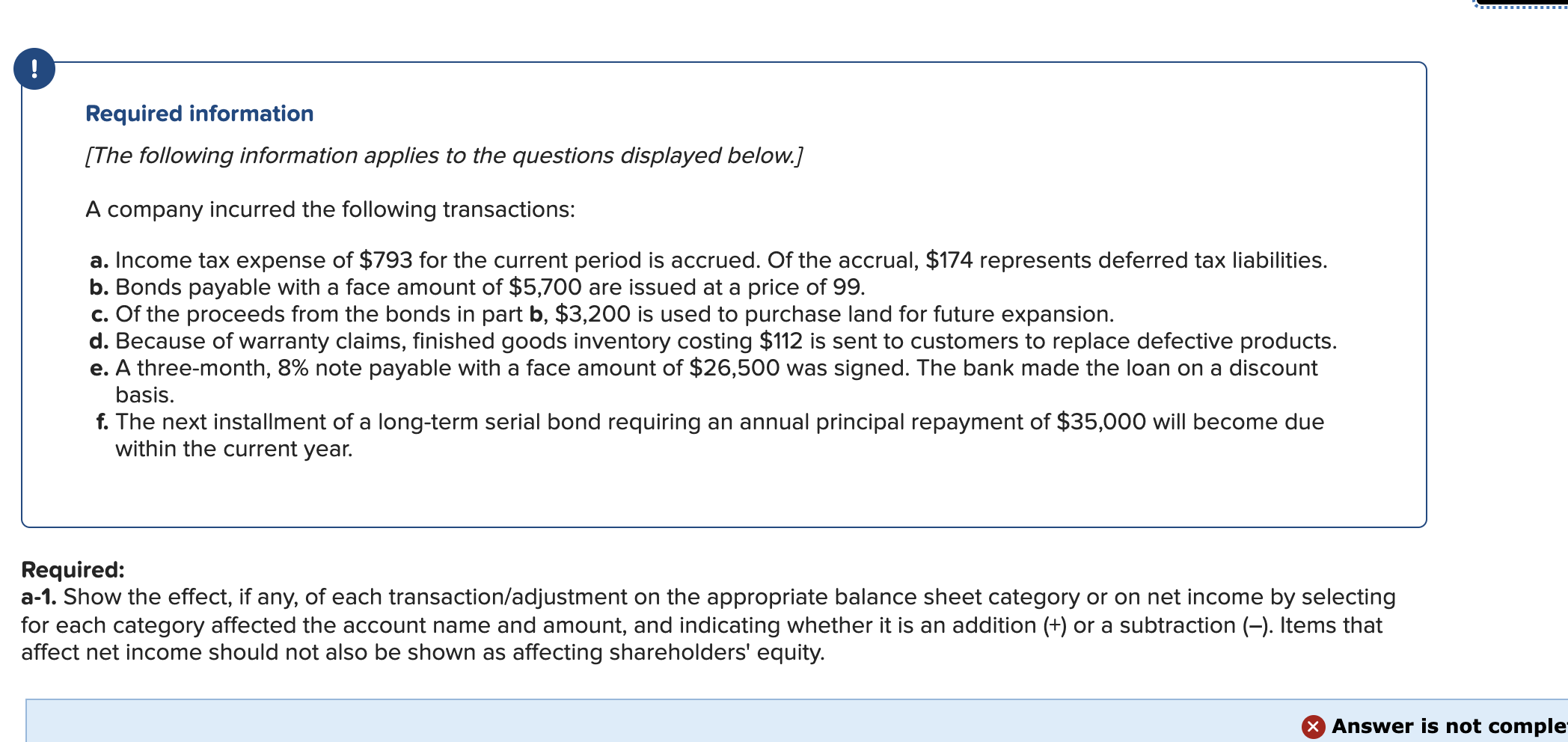

Ias 37 outlines the accounting for provisions (liabilities of uncertain timing or amount), together with contingent assets (possible assets) and contingent liabilities (possible. From the trial balance, a company prepares its financial statements, which comprise a profit and loss account, a balance sheet, a cash flow statement and. According to the fasb, if there is a probable liability determination before the preparation of financial statements has occurred, there is a likelihood of occurrence, and the liability.

These liabilities are categorized as being likely to occur and estimable, likely to occur but not estimable, or not likely to occur. Without a defective product, there can be no liability; No one gets hurt, no property is damaged, and no claims are filed.

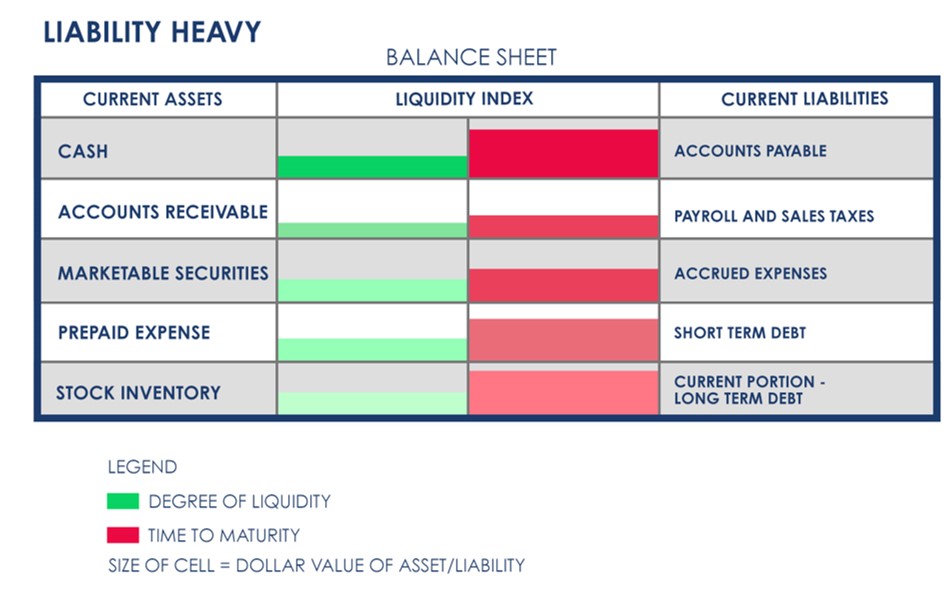

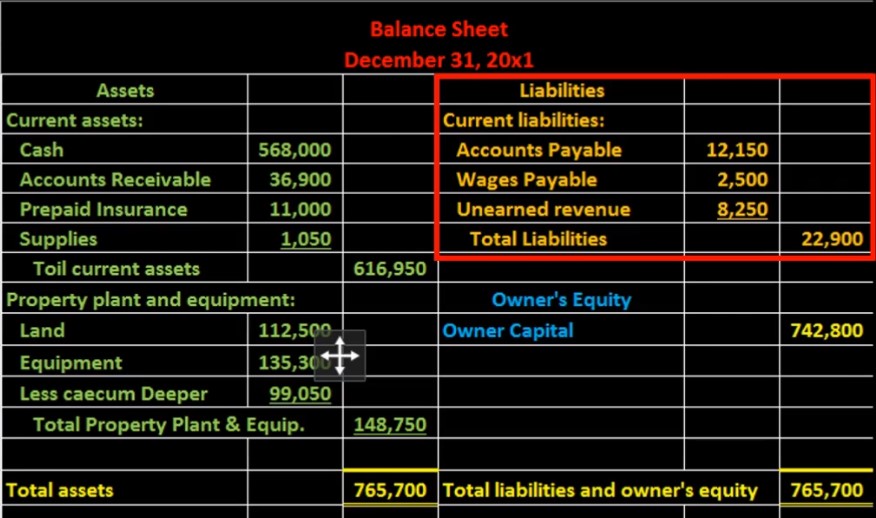

Reviewing liabilities on the balance sheet by michael schmidt updated december 20, 2023 reviewed by david kindness of all the financial statements issued. Assets = liabilities + equity. Probable recoveries should be reflected separately as an asset in the balance sheet and not netted against the remediation liability, consistent with asc 210.

Replaced parts of ias 10 contingencies and events occurring after the balance sheet date that was issued in 1978 and that dealt with contingencies. Liabilities are settled over time through the. If the contingency is probable and estimable, it is likely to occur and can be reasonably estimated.

Cfi’s financial analysis course as such, the balance sheet is divided into two. However, even with good risk. The balance sheet is based on the fundamental equation:

In other words, it’s a known liability that management knows. An estimated liability is a debt or obligation of an unknown amount that can be reasonably estimated. The trial balance lists the total value of items debited or credited to each particular accounting category in the year;

Since the outcome of contingent liabilities cannot be known for certain, the probability of the occurrence of the contingent event is estimated and, if it is greater than 50%, then a. In this case, the liability and associated expense must be journalized and. A liability is a company's financial debt or obligations that arise during the course of its business operations.

Instead, the accountant must make an estimate based on the available data.

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)