Recommendation Info About Impairment Charge Example Cash Inflow And Outflow Examples

Company bb acquires the assets of company cc for $15m, valuing its assets at $10m and recognizing goodwill of $5m on its balance sheet.

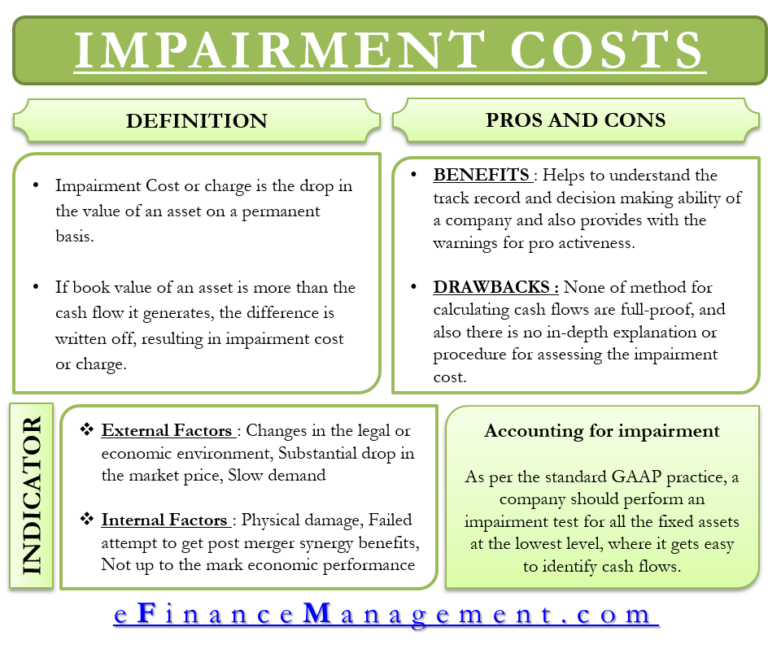

Impairment charge example. Impairment charge explained (with example) december 30, 2022 robby. Goodwill asset value (year 0) $4,000,000 impairment test results value (year 1) $3,000,000 income statement impact/ impairment charge $1,000,000 why does impairment matter? Impairment charges are an accounting term used to describe the expenses incurred when the value of an asset has decreased significantly.

Example of a charge of impairment in accounting. At the date of the acquisition, the book value of the net assets of investee totaled $50 million and the fair value of the net assets totaled $62.5 million. An impairment charge is a relatively new term used to describe for writing off worthless goodwill.

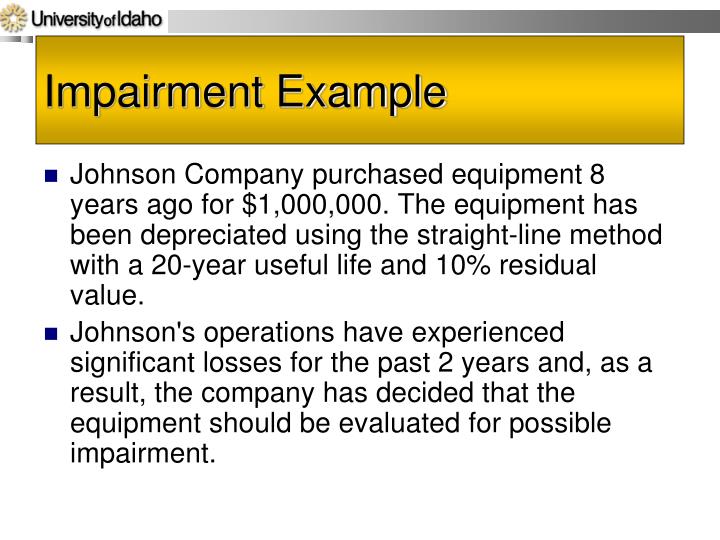

As businesses evolve, it becomes necessary to evaluate and update the value of certain assets, such as inventory,. That standard consolidated all the requirements on how to assess for recoverability of an asset. Do not underestimate how long the impairment testing process takes.

It decided to evaluate its assets' charge of impairment, especially concerning goodwill. For example, a video game company may experience factory impairment during a natural disaster. Impairment charge is an expense that reflects a reduction in the carrying value of an asset on the balance sheet.

Perhaps the most famous goodwill impairment charge was the $54.2 billion reported in 2002 for the aol time warner, inc. While any asset can suffer impairment, the most commonly impaired assets are inventory, pp&e, intangible assets and goodwill. In this article, we explain what an impairment charge is and the pros and cons of impairments and provide an example of an impairment in accounting.

Bhp group will record another $3.2 billion impairment in relation to its brazilian samarco dam failure, and a $2.5 billion impairment charge for its western australia nickel business, the world's. Example of a goodwill impairment. Hsbc’s earnings sink on $3 billion impairment on chinese bank.

An entity acquires 60 per cent of a subsidiary, which is a cgu. Asset impairment occurs when the net carrying amount, or book value, cannot be recovered by the owner. The battery metal producer said it recorded an impairment charge of a$171.8 million for its cosmos and forrestania assets in western.

Impairment of assets in april 2001 the international accounting standards board (board) adopted ias 36 impairment of assets, which had originally been issued by the international accounting standards committee in june 1998. Impact on cash flow statement. Is a canadian oil and gas drilling company.

The amount at which an asset is recognised in the balance sheet after deducting accumulated depreciation and accumulated impairment losses It includes identifying impairment indicators, assessing or reassessing the cash flows, determining the discount rates, testing the reasonableness of the assumptions and benchmarking the assumptions with the market. Here is an example of goodwill impairment and its impact on the balance sheet, income statement, and cash flow statement.

When comparing the book value and the reported value, the reported value drops significantly because of this impairment. An impairment charge is a cost that shows a reduction in the carrying value of a specific asset on a balance sheet. Updated april 17, 2022 reviewed by natalya yashina what is an impairment charge?

)

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)