Beautiful Info About Debt To Equity Ratio Calculation Example Tri Balance Sheet

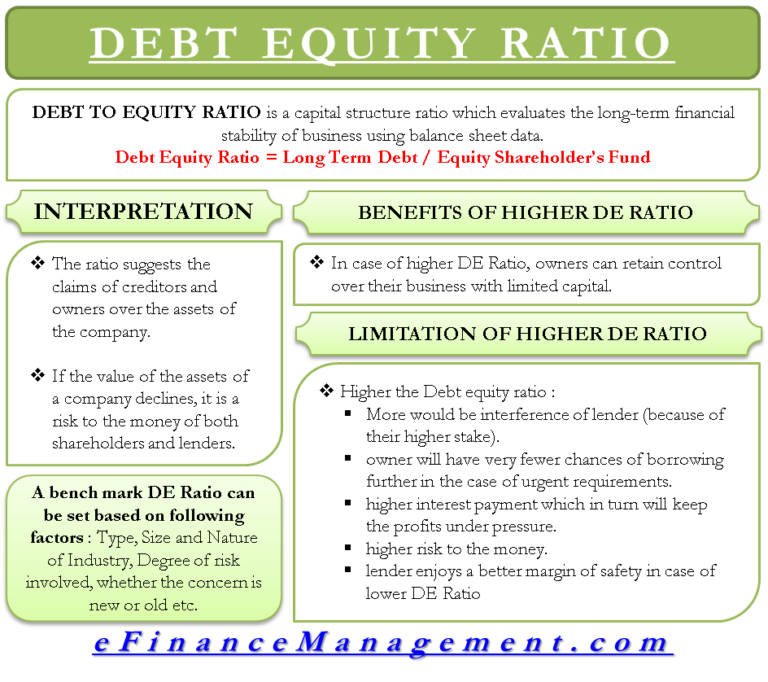

The debt to equity ratio shows the percentage of company financing that comes from creditors and investors.

Debt to equity ratio calculation example. Here, all the liabilities that a company owes are taken into consideration. Shareholders’ equity = $100 million. Suppose company def has $230,000 in assets.

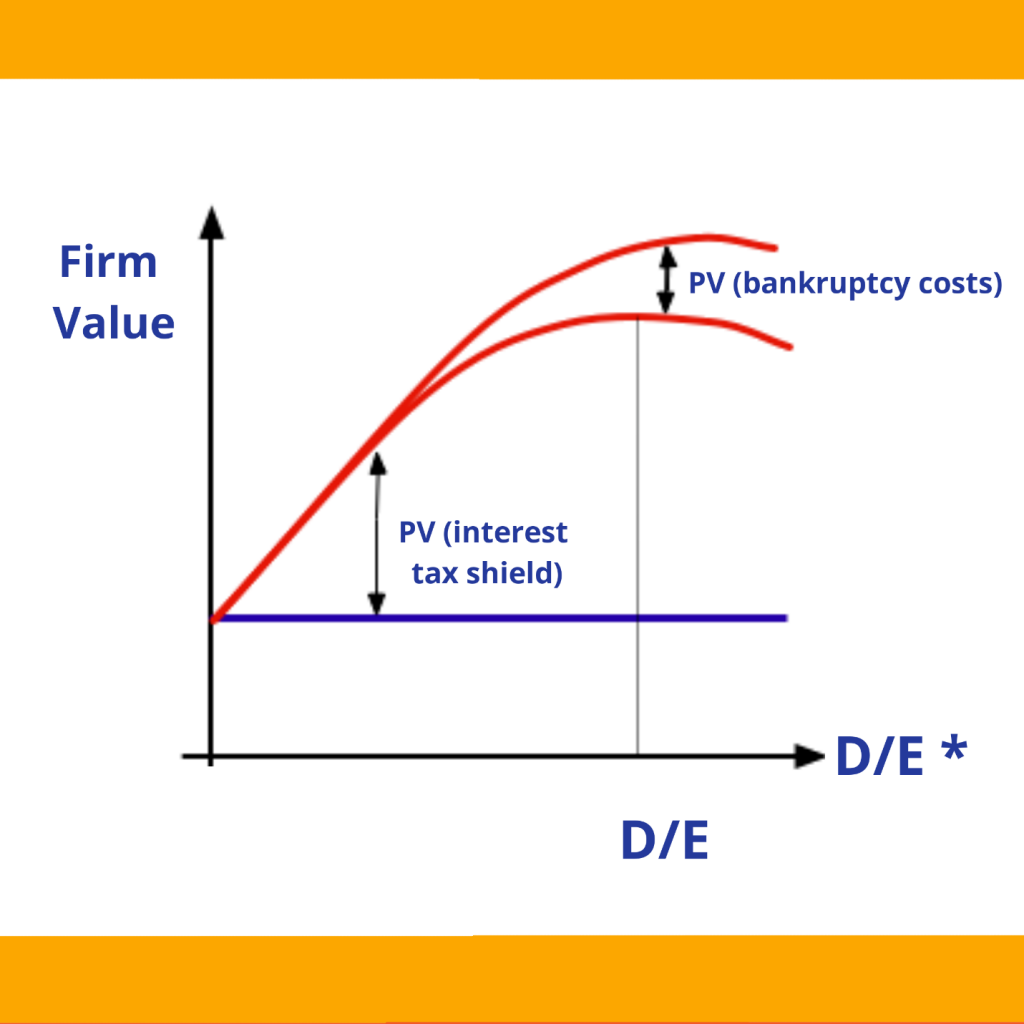

Ready to find out how much you can afford for your dream home? The optimal d/e ratio varies by industry, but it should not be above a level of. A higher debt to equity ratio indicates that more creditor financing (bank loans) is used than investor financing (shareholders).

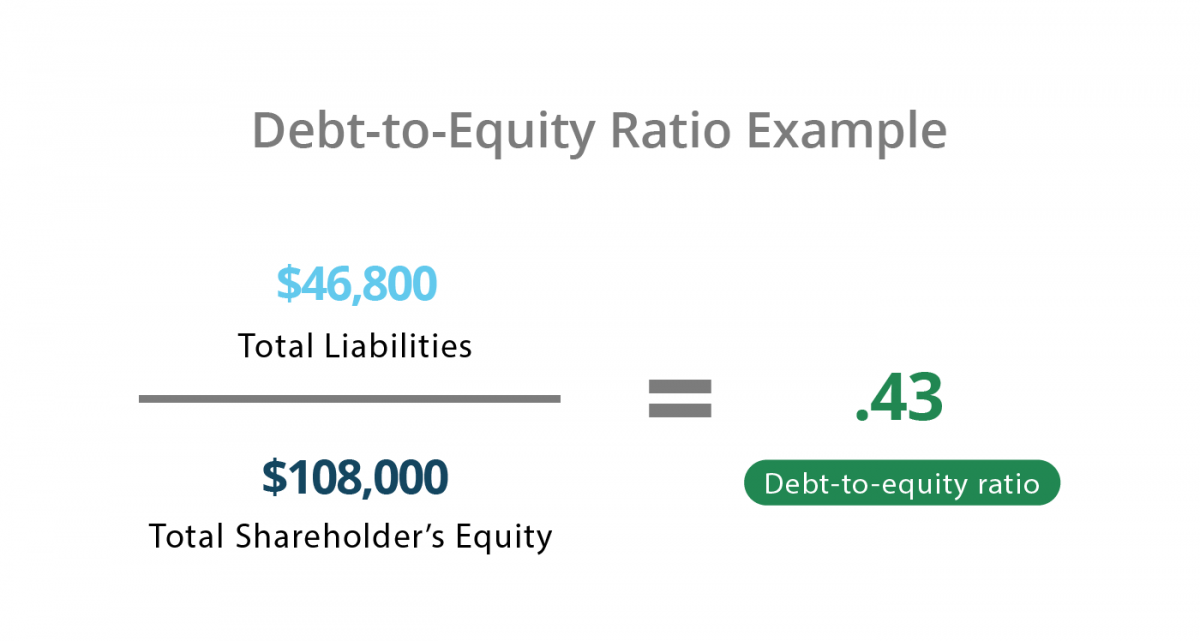

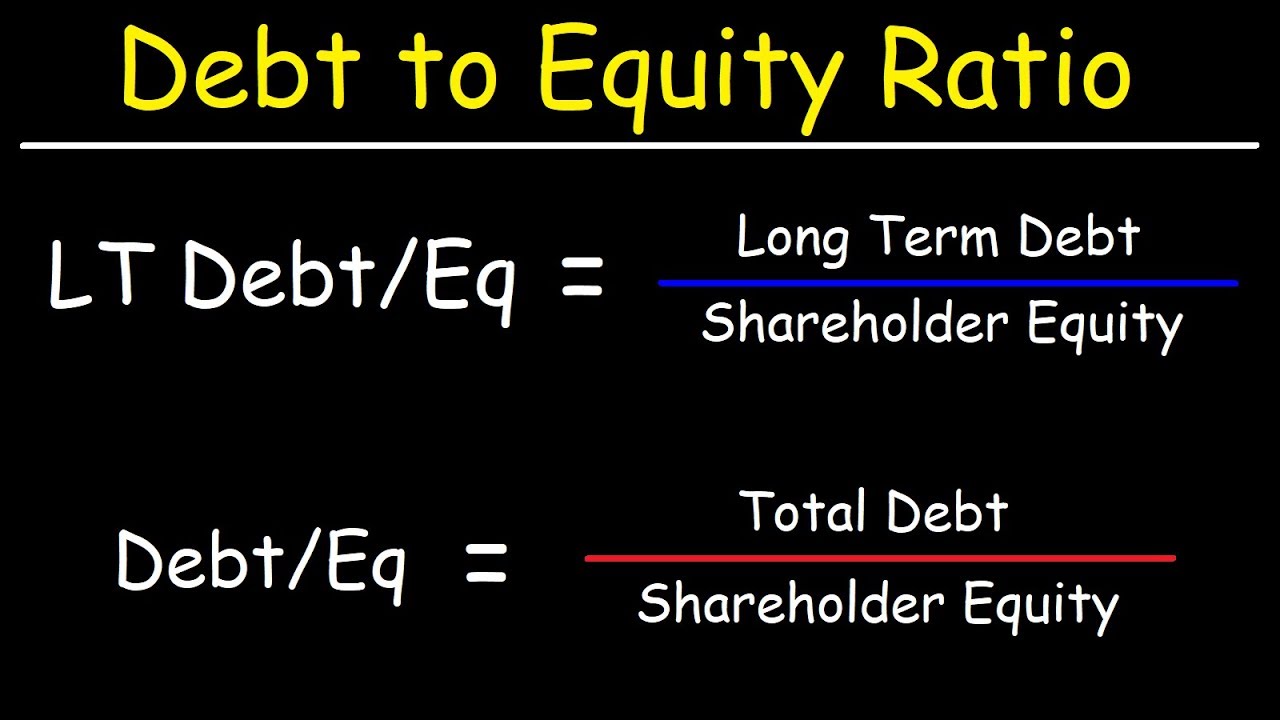

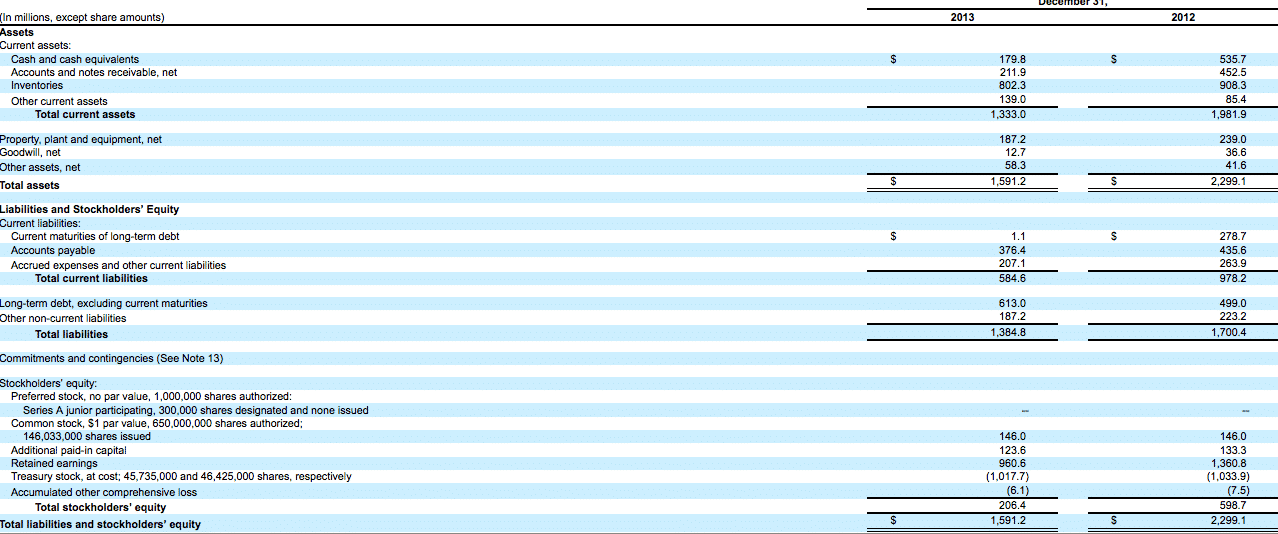

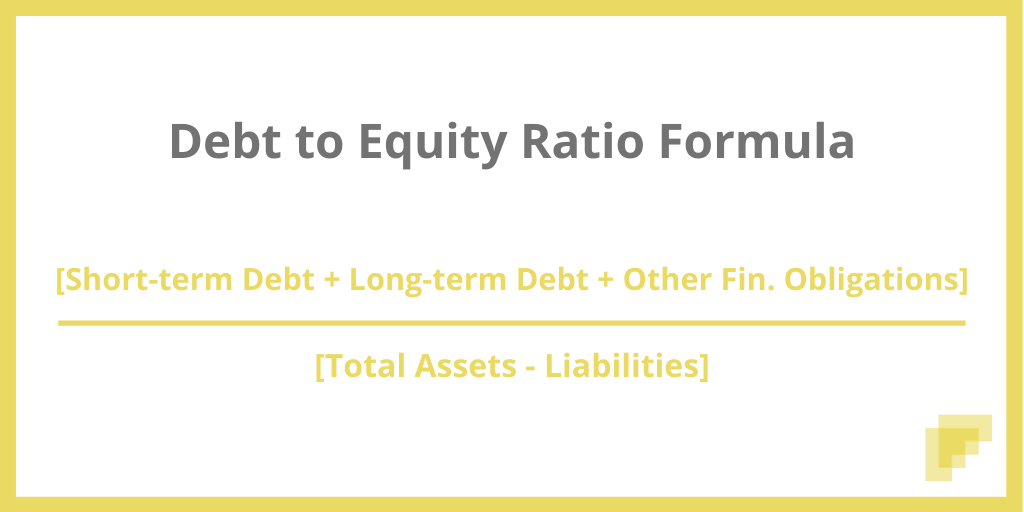

Debt to equity ratio formula is calculated by dividing a company’s total liabilities by shareholders’ equity. Canva d/e ratio formula d/e = total liabilities / shareholders’ equity What was the total liabilities of the corporation?

For example, let’s say a company carries $200 million in total debt and $100 million in shareholders’ equity per its balance sheet. Total debt = $200 million. Debt/equity ratio example:

D/e = total liabilities / shareholders' equity nick hillier via unsplash; Suppose a company xyz ltd. It shows the proportion to which a company is able to finance its operations via debt rather than its own resources.

Now, let’s take a closer look at how the debt to equity ratio affects company xyz’s financial performance and your returns: Using this ratio, the investors can understand how the firm performs in capital structure;

Debt to equity ratio calculations: Debt to equity ratio = total liabilities / shareholders' equity De ratio = ₹1,50,000 / ₹1,00,000 = 1.5.

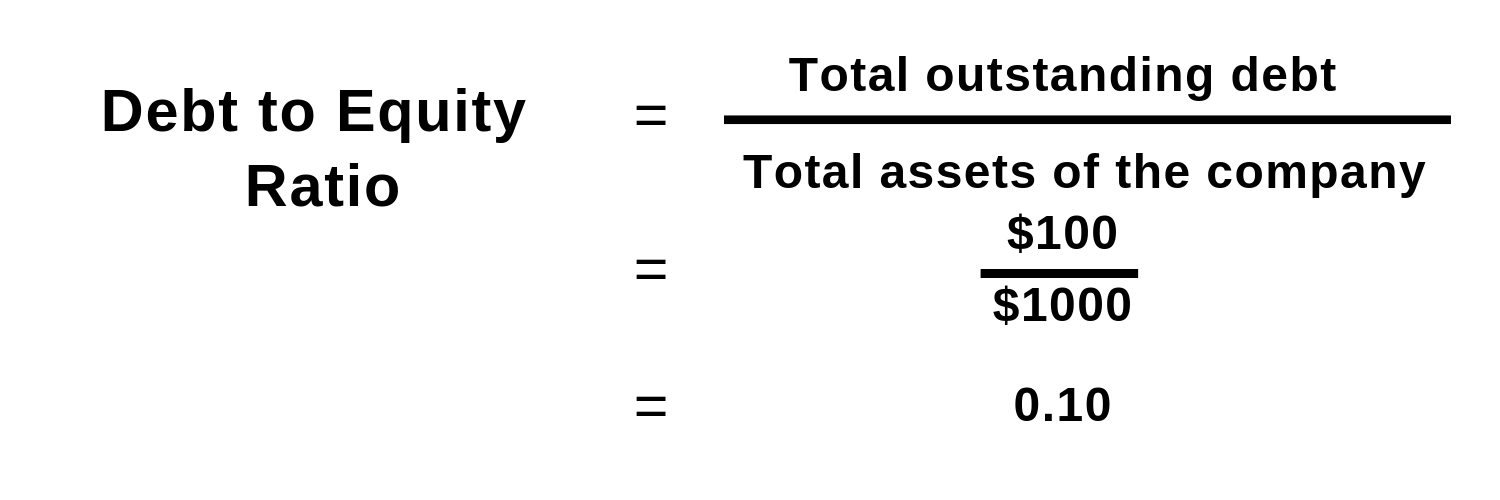

Debt to equity ratio formula & example formula: A ratio of 1 means that debt and equity are on even. Solution debt to equity ratio = total liabilities/total stockholder’s equity or total stockholder’s equity = total liabilities/debt to equity ratio = $937,500/1.25 = $750,000 example 3 steward corporation’s debt to equity ratio for the last year was 0.75 and stockholders’ equity was $750,000.

This means that for every $1 the firm has in equity; Shareholder’s equity represents the net assets that a company owns. Debt to equity ratio formula example:

De ratio= total liabilities / shareholder’s equity liabilities: It has $0.33 in leverage. To illustrate the d/e ratio better, here is an example calculation.