Smart Info About Difference Between Income Statement And Profit Loss New Balance Sheet Format 2019 In Excel

A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364 million in a civil fraud case, handing a win to.

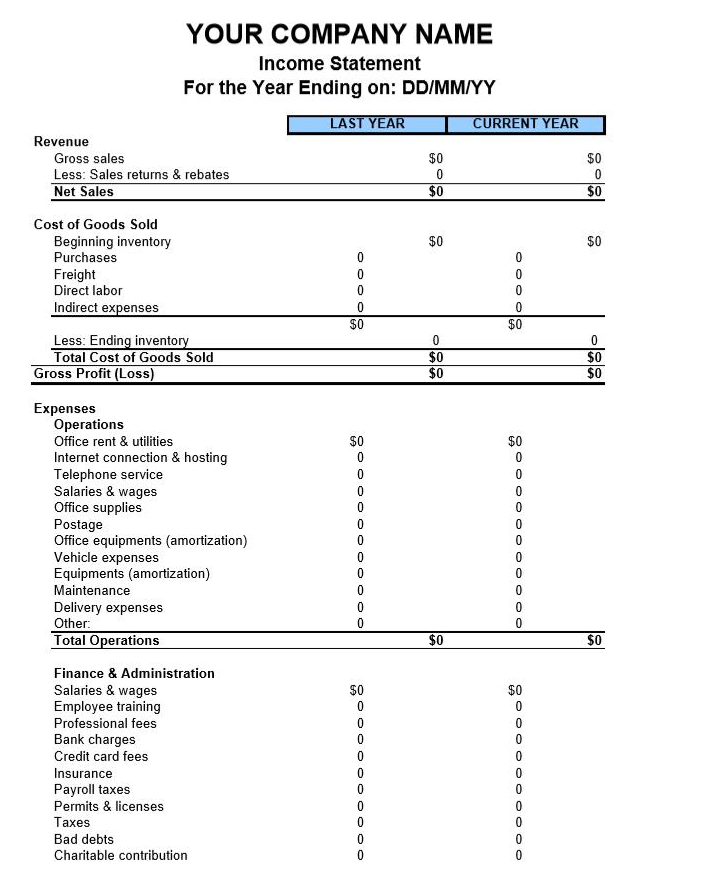

Difference between income statement and profit and loss. The main difference between the two is that an income statement is more comprehensive than a profit and loss statement. The formats of the annual balance sheet and the profit and loss account of the ecb are set out in annexes ii and. In this article, we explain the meanings of income statement vs profit and loss, compare them to one another.

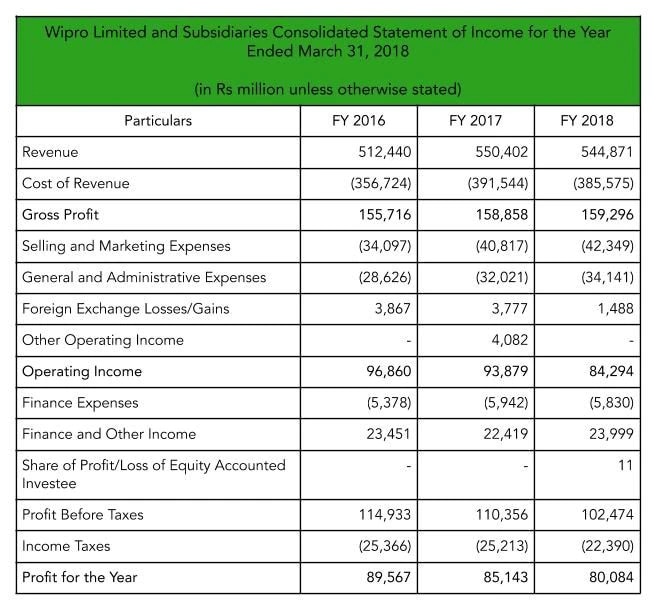

On the contrary, a profit and loss account displays the income realized and costs incurred by the firm throughout the course of operations in a fiscal year. The income statement, also known as the profit and loss statement or p&l for short, is a financial document that summarizes a company’s revenue, expenses, and net income. Net profit could also mean a corporation's net income after income tax.

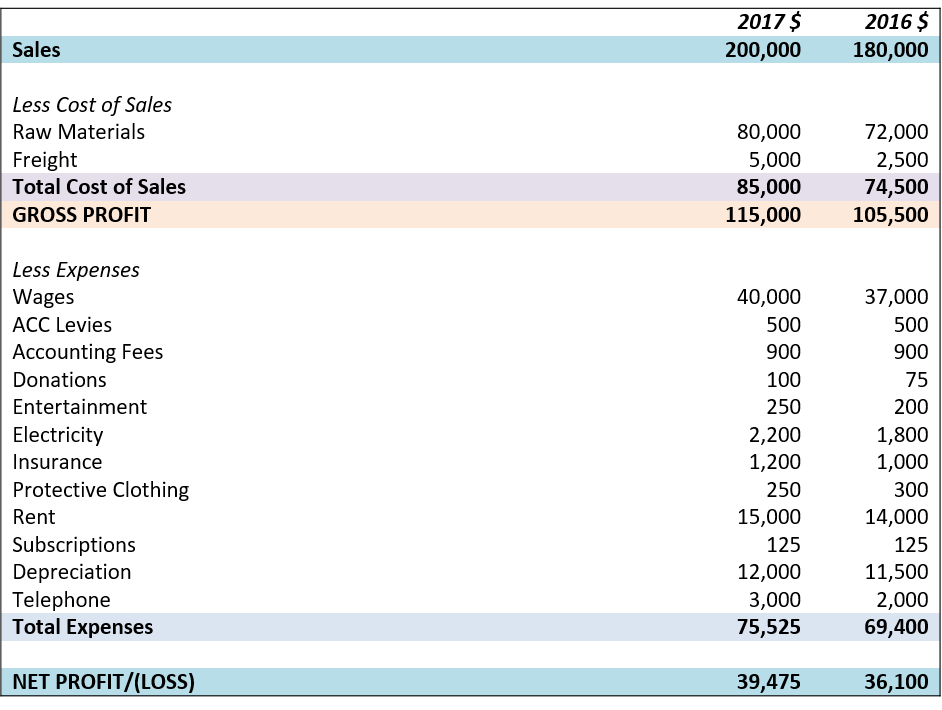

Differences there are also a few differences between income statements and profit and loss accounts. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. Understanding an income statement vs profit and loss can help you determine a business's performance and how you can improve it.

Gross profit represents the income or profit remaining after production costs have been subtracted from revenue. An income statement shows all of a. A profit and loss (p&l) statement is the same as an income statement.

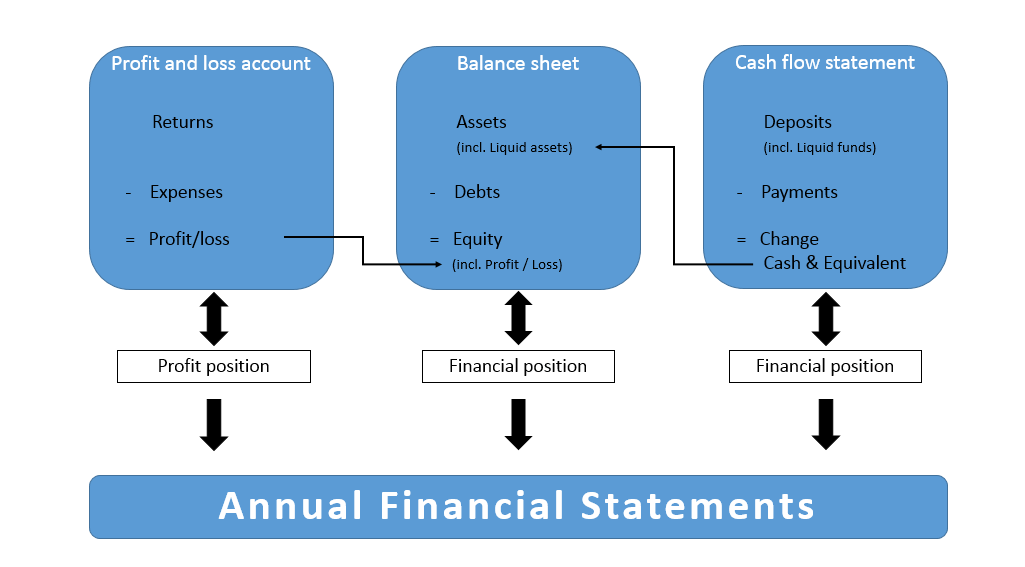

The income statement is a statement (a report) which forms part of all the financial reports, called the financial statements. Profit and loss accounts only show the gross profit of a. It’s a financial document that includes the revenues and expenses of a company.

The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of. For example, a company's sales minus its cost of goods sold is referred to as the company's gross profit. The cash flow statement is linked to the income statement by net profit or net burn, which is the first line item of the cash flow statement.

The income statement is a financial document that shows how much money a company has earned over a specific period of time, while the profit and loss statement is focused. Net income is the profit that remains after all. The main difference is that the balance sheet yields information regarding a company’s assets, liabilities, and shareholders’ equity, while the profit and loss.

A profit and loss statement shows a company’s total income, summing up revenue and business costs in order to find their net profit for a given period of time. The profit and loss statement, or p&l, is sometimes used to mean a company's income statement, statement of income, statement of operations, or statement of earnings. The profit or loss on the.

The purpose of the statement of profit or loss and other comprehensive income (ploci) is to show an entity’s financial performance in a way that is useful to a wide range of.

![[Latest] Difference Between Accounting Profit and Taxable Profit (With](https://i.pinimg.com/originals/2d/ce/c3/2dcec3c1fe0257e856e45cc040816433.png)

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)