Beautiful Tips About Increase In Accounts Receivable On Cash Flow Statement Balance Sheet Of A Startup

It affects both the cash inflows and cash outflows, ultimately influencing the overall financial health and stability of the company.

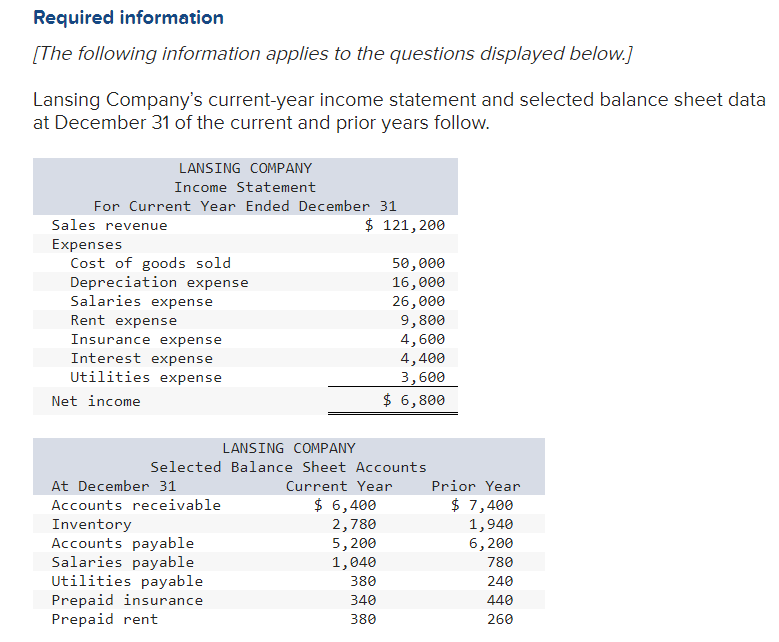

Increase in accounts receivable on cash flow statement. More specifically, how does an increase in accounts receivable affect cash flow? Days sales outstanding (dso) the standard modeling convention is to tie ar to revenue to forecast accounts receivable, given how they are closely associated. The increase in accounts receivables is deducted from net profit and the decrease in accounts receivables is added to net profit.

Then we’ll discuss why businesses need a cfs, how changes in ar affect the cfs, and how to calculate cash flow. The cash flow statement for the month of april reports that there was no change in the cash account from march 31 through april 30. An increase to accounts receivable can have a range of implications for your business, affecting everything from cash flow to overall financial health.

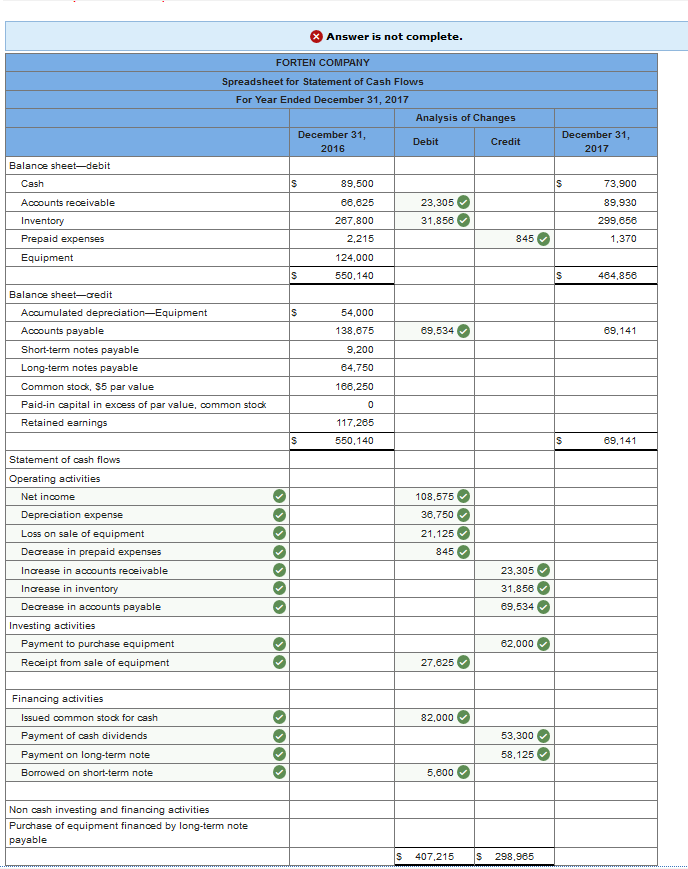

Conversely, a negative number indicates a cash flow increase of the same amount. How accounts payable affects cash flow. The statement of cash flows is prepared by following these steps:

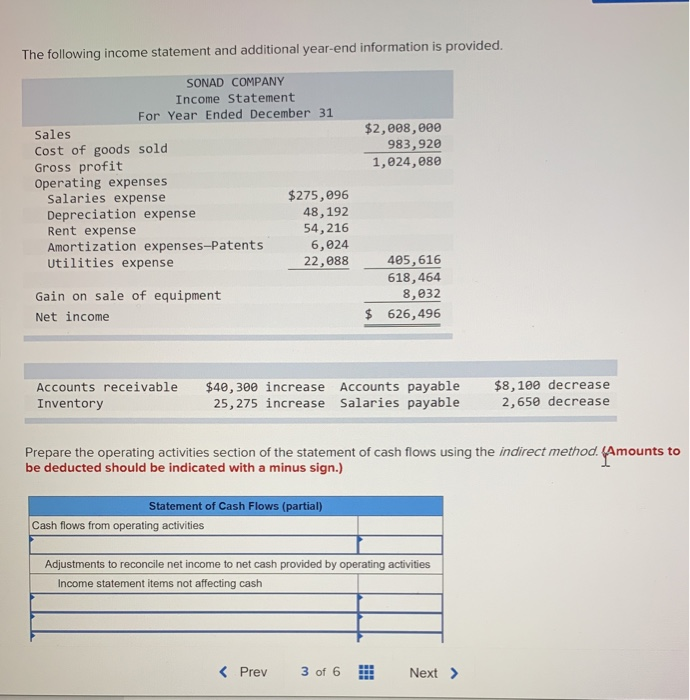

An increase in inventory may be because there have not been enough sales in the current year to cycle the inventory from a current asset to sales/profit and ultimately into cash. There are two methods for cash flow statement preparation: An increase in accounts receivable means that the customers purchasing on credit did not yet pay for all the credits sales the company reported on the income statement.

So, we can summarize the adjustments for the increase or decrease in accounts receivable on cash flow statement as below: We’ll begin by defining ar, cash flow, and the cash flow statement. Since this amount is in parentheses, it communicates that the company collected less cash than.

A positive difference shows an accounts receivable increase, signifying cash usage and indicating a cash flow decline by the same amount. Increase in accounts receivable (21,000). The operating activities section reports the increase in supplies and the resulting negative adjustment to the amount of net income.

Transactions that show a decrease in assets result in an increase in cash flow. The amount due from the customer is called accounts receivables. A cash flow statement consists of three sections:

Operating activities are also referred to as company operations. A huge increase and a considerable decrease in accounts payable is not good for a company's finances. If accounts receivable increased from one year to the next, the implication is that more people paid on credit during the year, which represents a drain on cash for the company, as some of the revenues that came in during the year increased the accounts receivable balance instead of cash.

Increase in accounts receivable => deduct the increased amount from net income. To reiterate, an increase in receivables represents a reduction in cash on the cash flow statement, and a decrease in it reflects an increase in cash. It did not increase its percentage ownership of its equity investee (affiliate.

If you're carrying balances that charge you monthly interest, paying them off is an opportunity for better to reduce your expenses long term. Debt and equity issuances: It is popularly called trade receivables and it is a current asset.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)