Nice Info About Cash Flow Activities Abn Amro Financial Statements

Financing activities include transactions involving issuing debt.

Cash flow activities. Cash flows from financing (cff), or financing cash flow, shows the net flows of cash used to fund the company and its capital. The direct method or the indirect method. Free cash flow (fcf) is defined as what a company has left over accounting for maintenance and operational expenses and it’s a revered investing metric for a simple reason:

Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a. What is cash flow from investing activities?

It is how much money is generated by making, selling, or providing services or products to your customers. Docs free cash flow data by ycharts; There are three types of cash flows:

Operating activities include generating revenue, paying expenses, and funding working capital.it is. Financing activities detail cash flow from both debt and equity financing. Costs incurred in connection with a restructuring program or other organizational transformation activities planned and controlled by management, and.

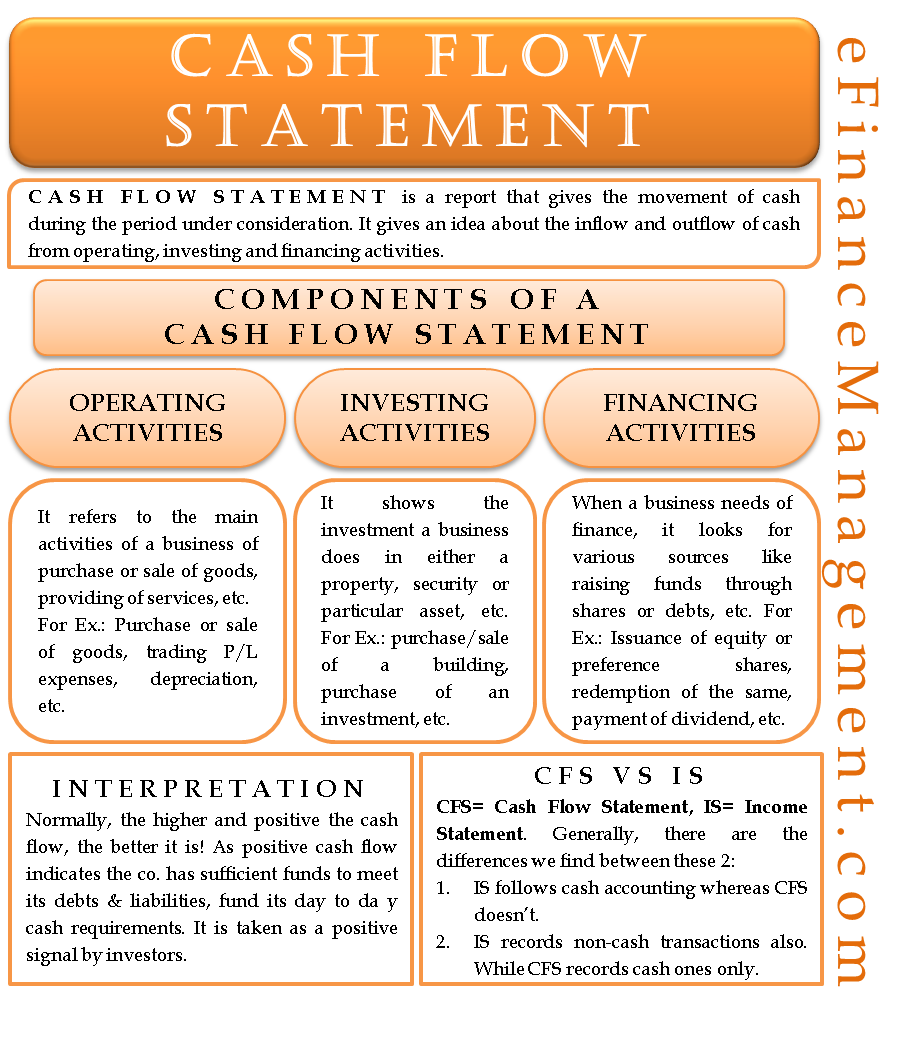

A healthy operating cash flow indicates that a company is doing a good job turning its profits into cash. Cash flow (cf) is the increase or decrease in the amount of money a business, institution, or individual has. There are many types of cf, with various important uses for running a business and performing financial analysis.

Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments during a specific time period. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities.

Ttm = trailing 12 months. Including cash inflows a business gains from its continuing progress and external financing sources, as well as all cash outflows that pay for trading activities and finances during a delivered time. Cash flow from operations is the section of a company’s cash flow statement that represents the amount of cash a company generates (or consumes) from carrying out its operating activities over a period of time.

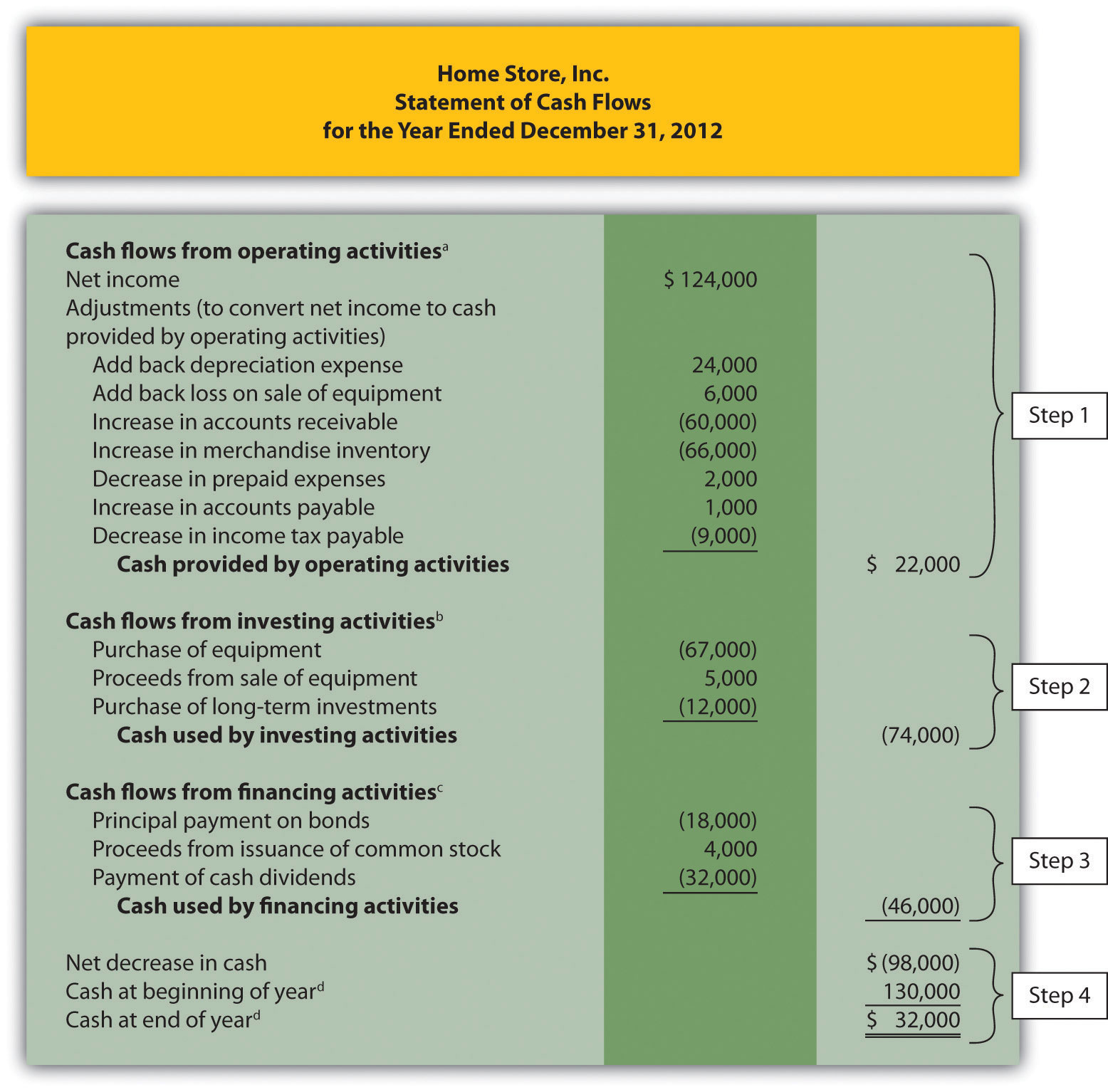

How to create a cash flow statement 1. The main components of the cash flow statement are: Begin with net income from the income statement.

The three sections of the cash flow statement are: Describe the three classifications of cash flows, and provide examples of activities that would appear in each classification. A cash flow statement is a financial statement that presents total data.

Deal activity in saudi arabia is set to accelerate this year as the kingdom’s sovereign wealth fund looks to raise money for its ambitious projects, according to a top banker at the. Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. Cash flow from investing, cash flow from financing, and cash flow from operating activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)