Who Else Wants Tips About Gaap To Stat Adjustments Nonprofit Balance Sheet

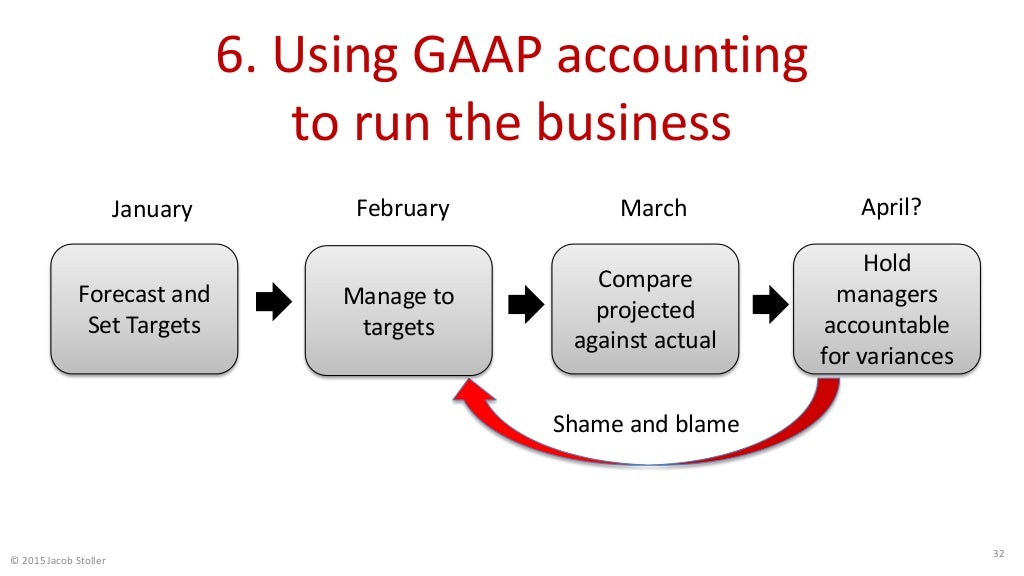

Awards classified as liabilities require ongoing valuation adjustments through earnings each reporting period, leading to greater earnings volatility.

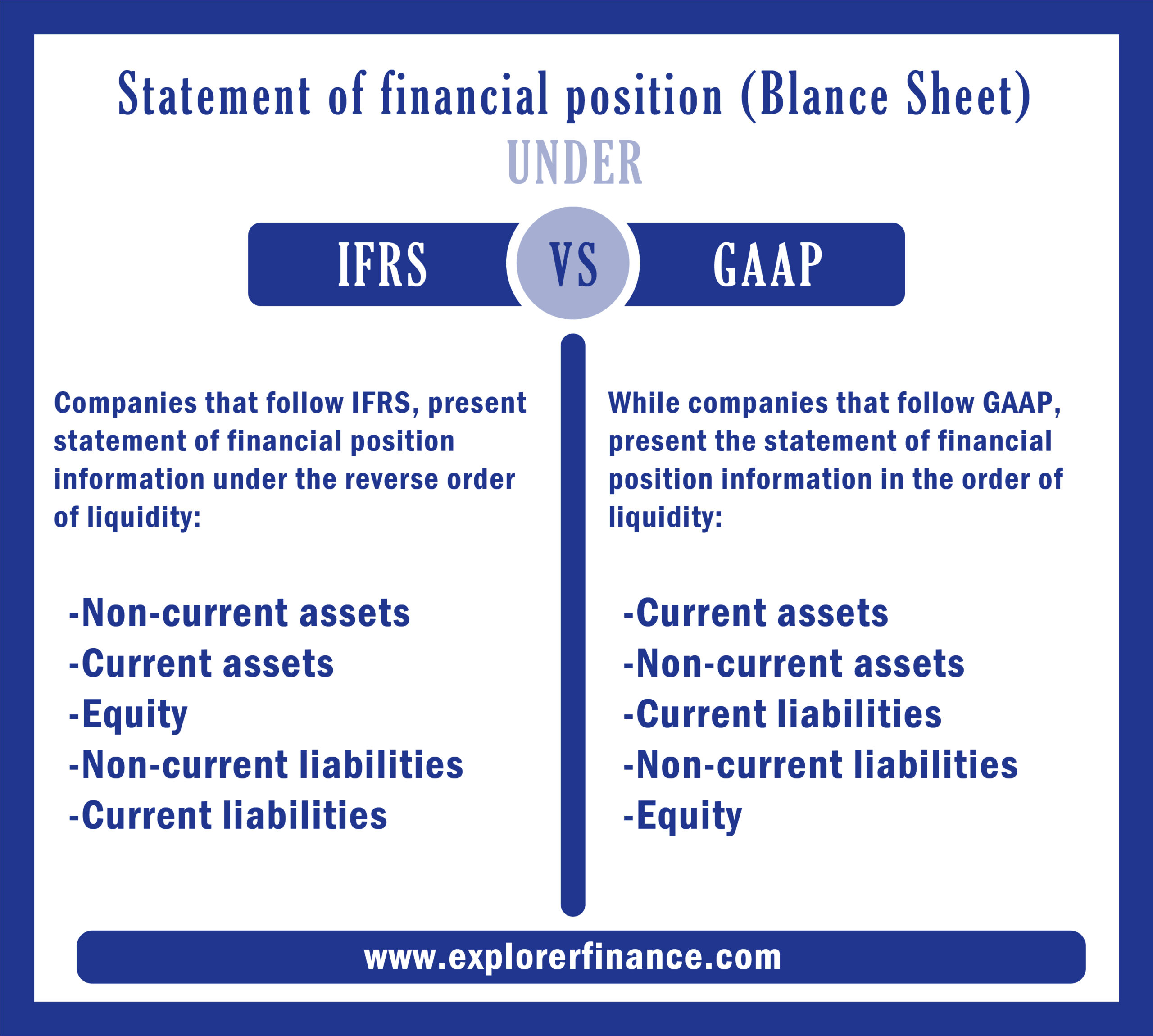

Gaap to stat adjustments. This may result in a lower taxable income for federal tax reporting purposes. While both ifrs and us gaap employ a current and deferred tax model for income tax reporting, differences might exist with respect to the tax rate (s) used to. In an academic study of gaap financial statements prepared by multinational corporations, susan borkowski and mary anne gaffney (“fin 48, uncertainty and transfer pricing:.

Tax benefit related to the irs audit: Nvda) today reported revenue for the fourth quarter ended january 28,. They concluded that as this trend continues, analysts and.

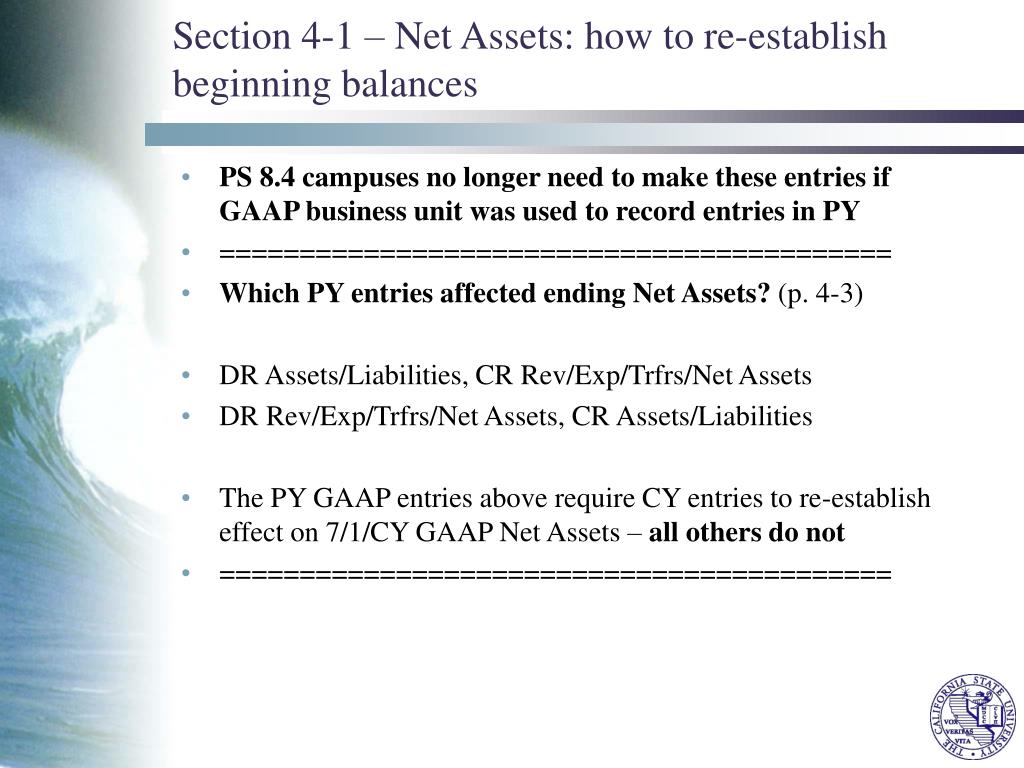

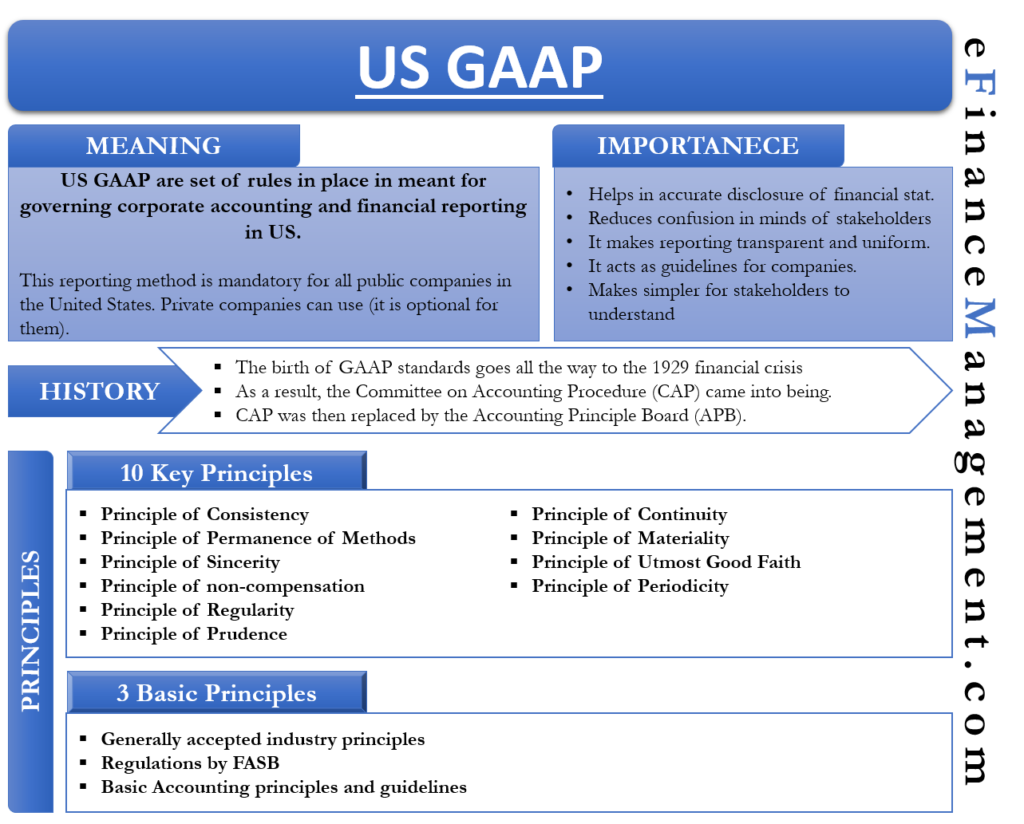

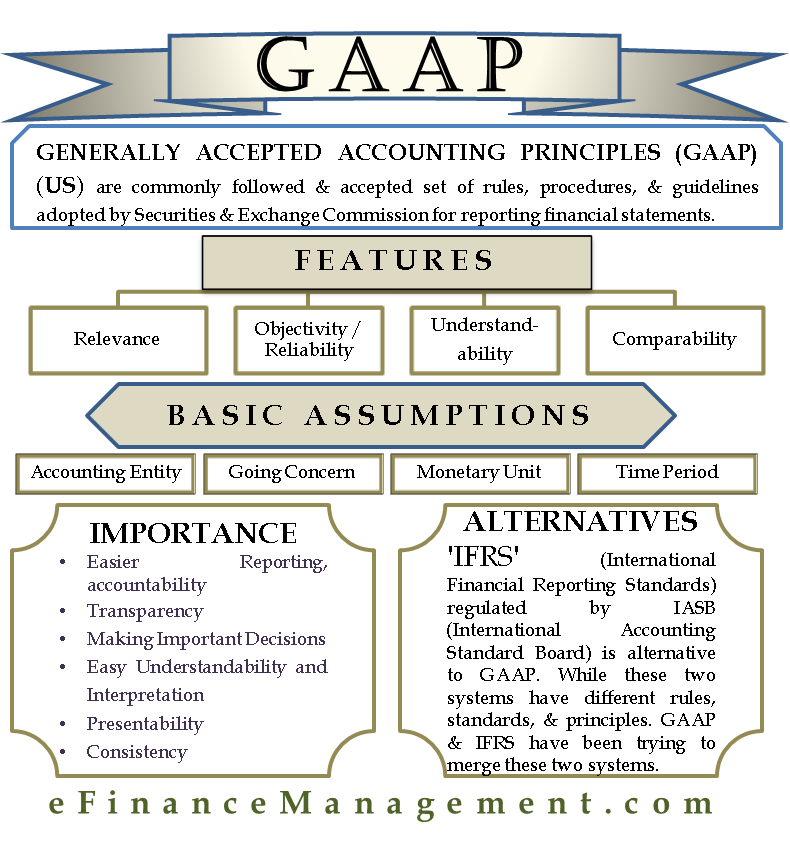

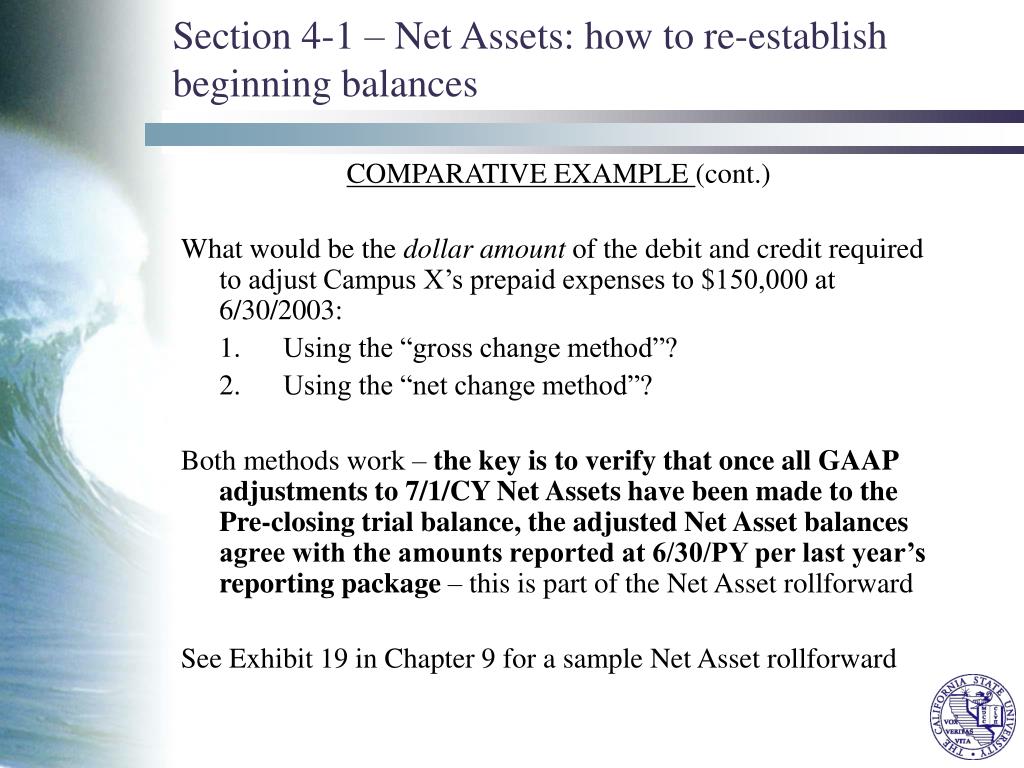

Your gaap to stat adjustments on a more frequent basis will allow you to identify any accounting problems or deal with accounting complexities early on, as they occur,. To adjust a balance sheet from gaap to stat, an accountant must identify and remove the assets that stat principles would consider nonadmitted, such as furniture, office equipment, unsecured. The core of gaap revolves around a list of ten principles.

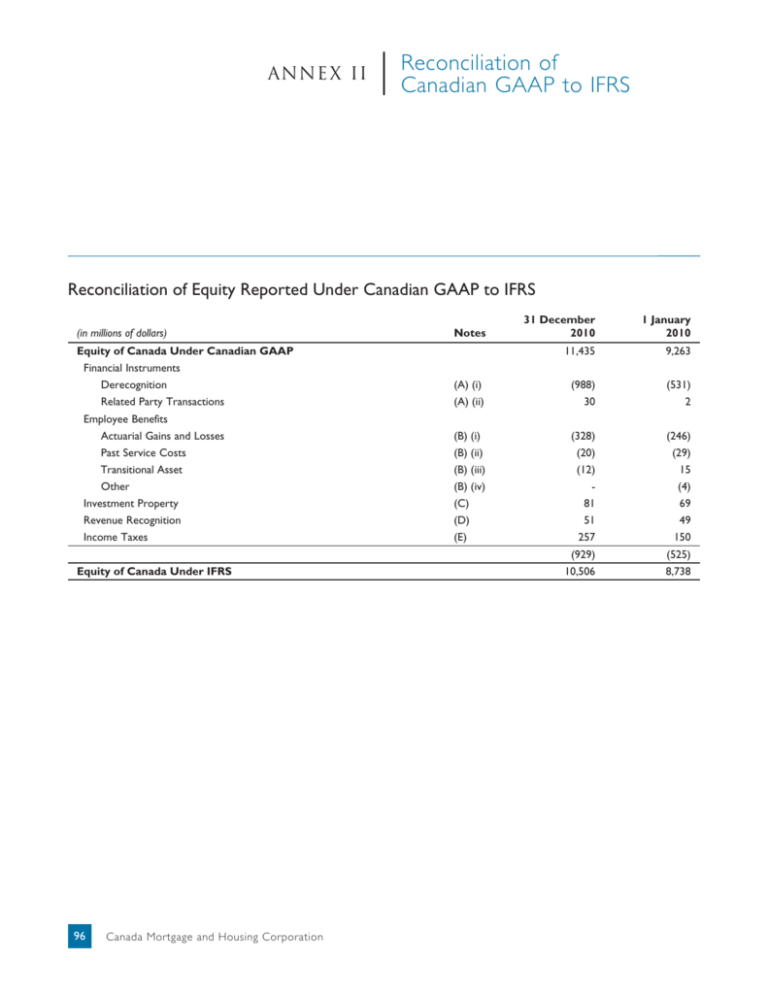

How to account for insurance proceeds The results indicate that 36% of member companies maintain a parallel set of local gaap accounting books and records to meet local requirements. Gaap to statutory adjustments —legal entities for which the local tax regulations require a different basis of accounting from those of the parent use gaap to stat adjustments.

Displays available underlying detail of gaap to stat and stat to tax adjustments. Ajustările de la gaap la stat sunt necesare deoarece normele gaap permit societăților de asigurare să utilizeze metode contabile și ipoteze mai liberale decât normele stat. (2) for mexican frs, the ifrs.

1 gaap to stat adjustments ; Gaap to stat adjustments ;

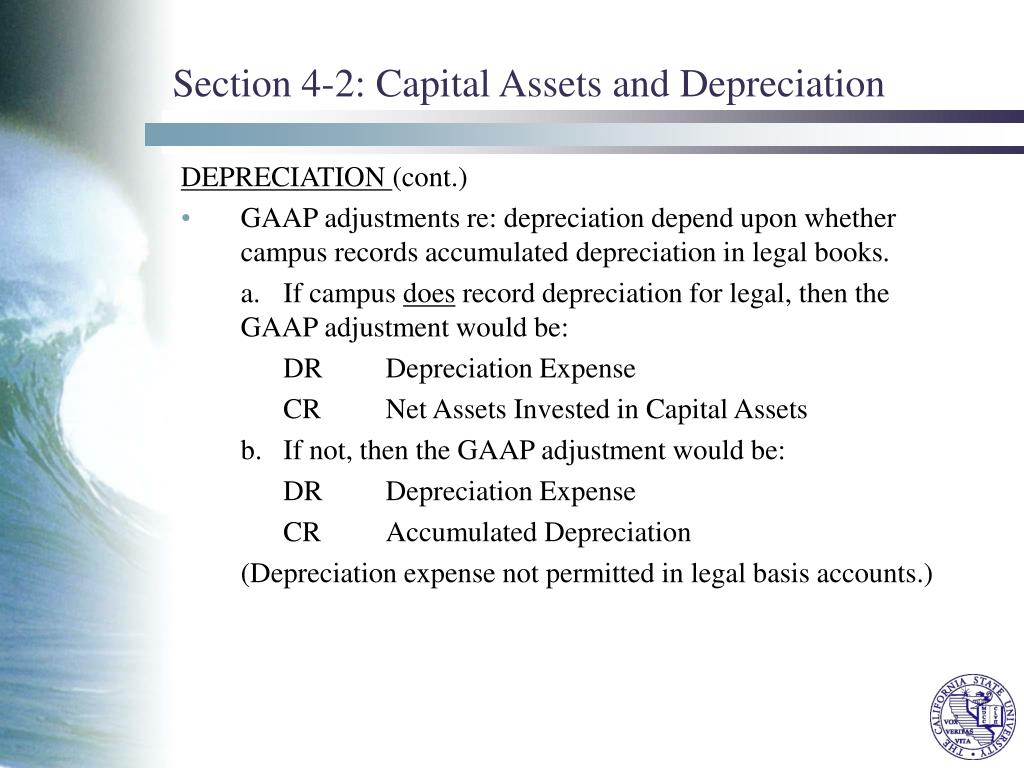

Kamakura advantage stat/gaap/tax accounting treatments. Gaap allows reporting 100 percent of the loss reserves as a liability. 10 key principles of gaap.

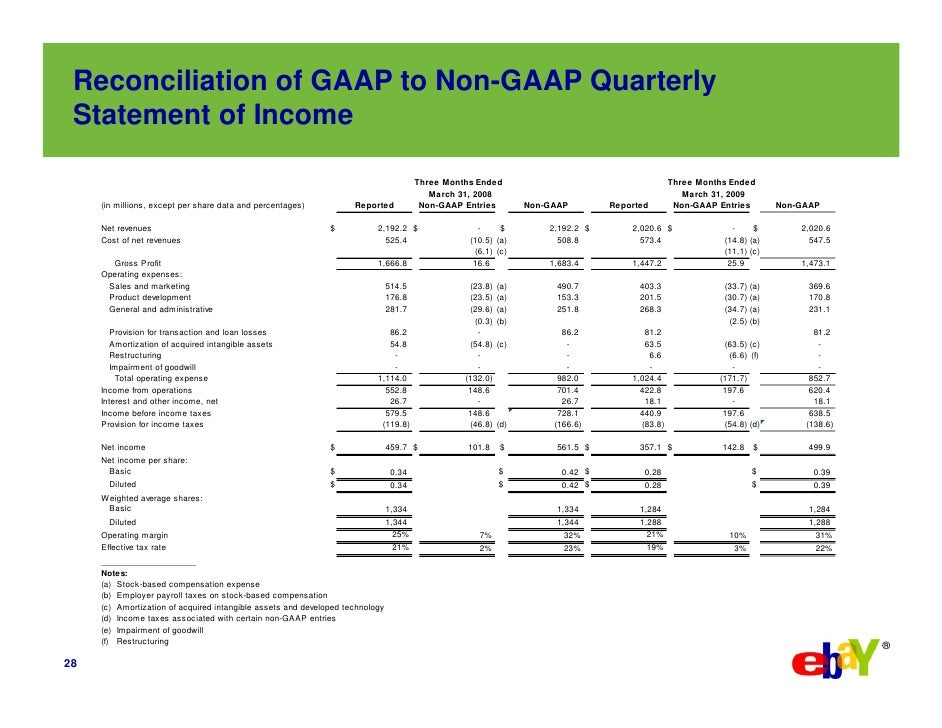

2 the difference between statutory expense ratio & gaap expense ratio ; Adjustments made to gaap statements to create pro forma statements include litigation costs, restructuring charges, and other nonrecurring items. Santa clara, calif., feb.

Displays available underlying detail of gaap to stat and. O adjusting reported liabilities to current estimates (e.g., eliminating explicit risk margins and margins in assumptions,. Together, these principles are meant to clearly define, standardize and.