Unique Tips About Pro Forma Net Income Formula The Cutoff Assertion For Accounts Payable Includes

$80,945 (6) (7) depreciation expense:

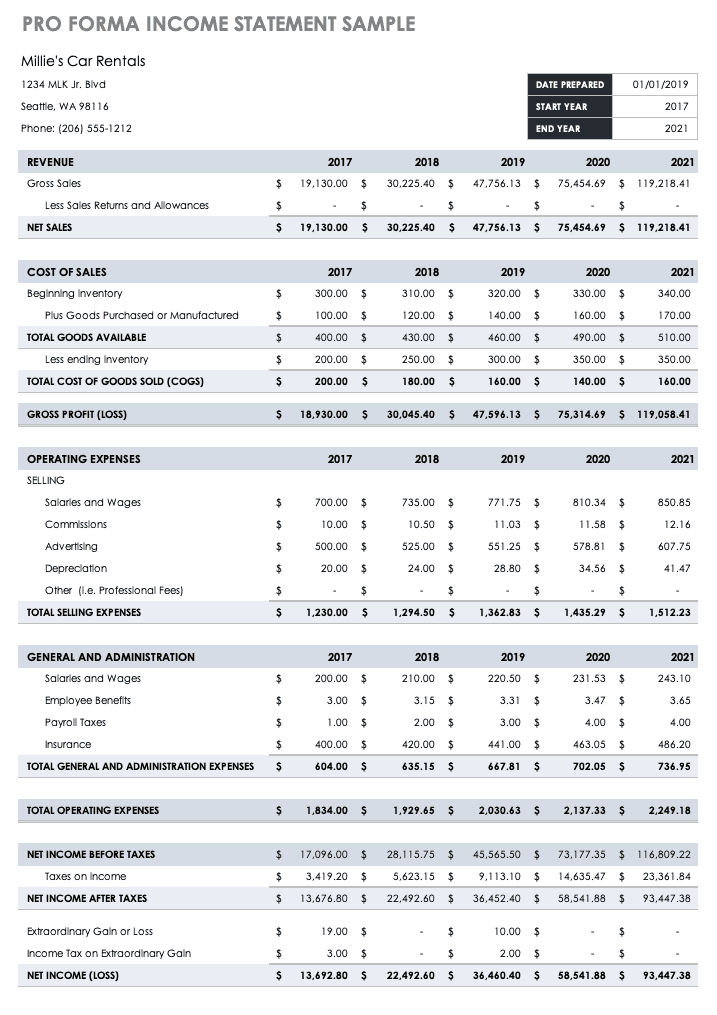

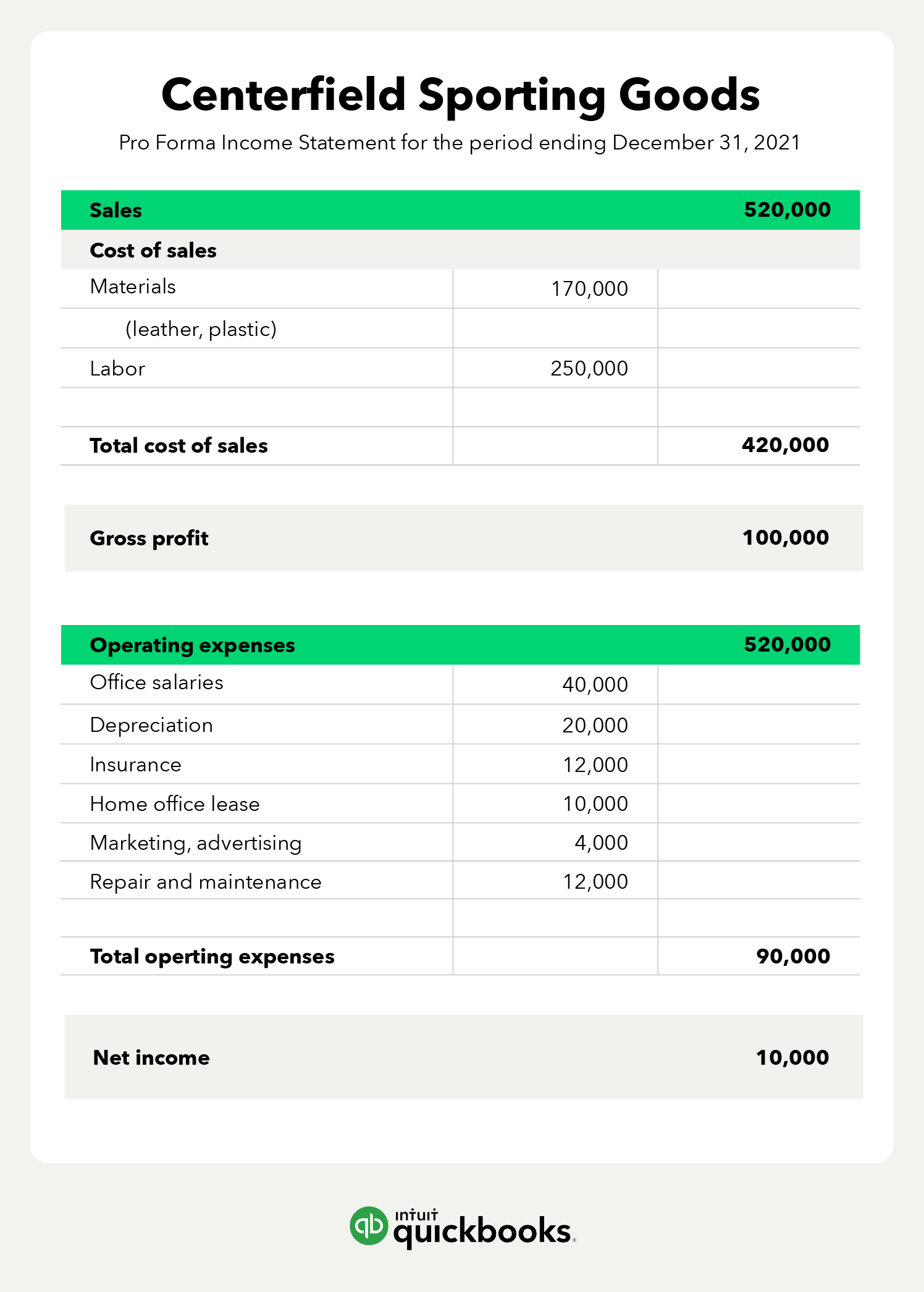

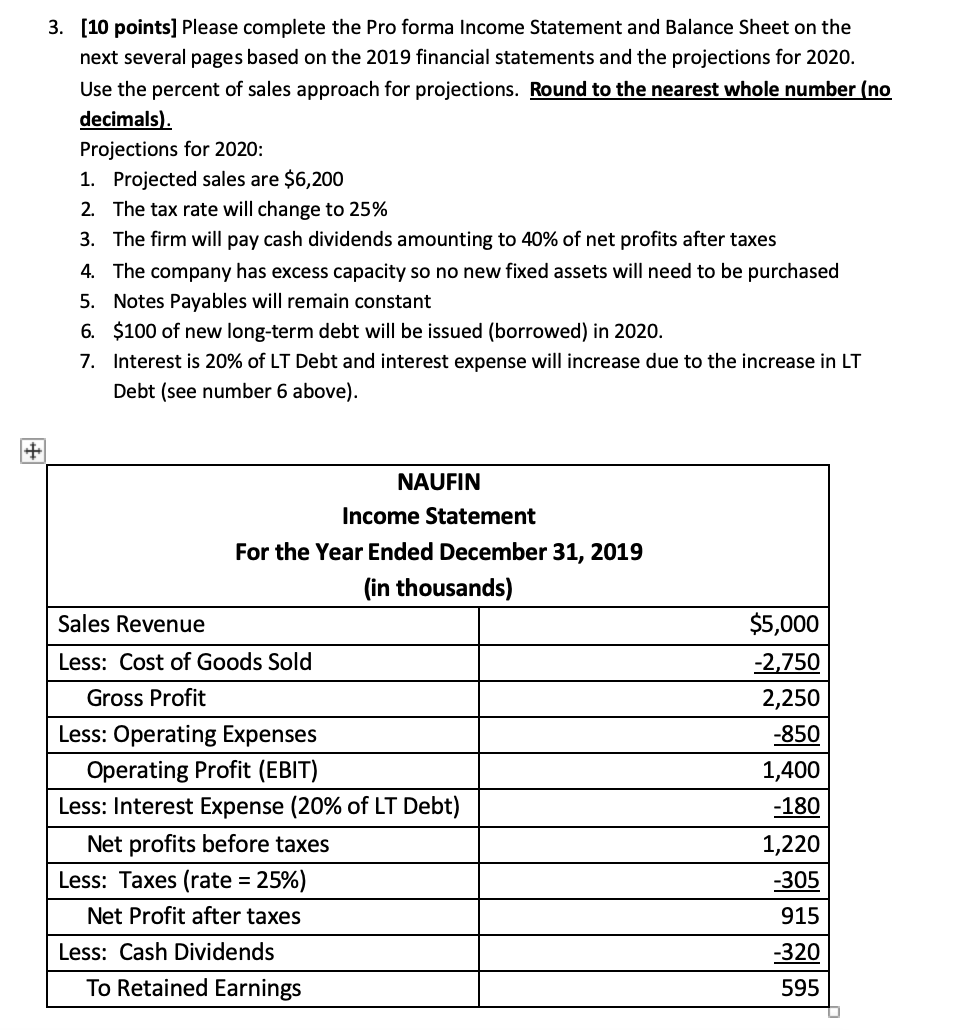

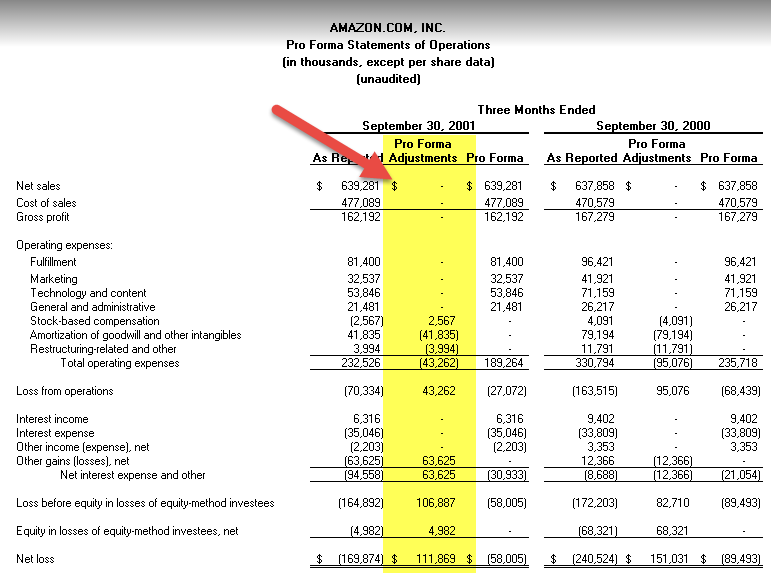

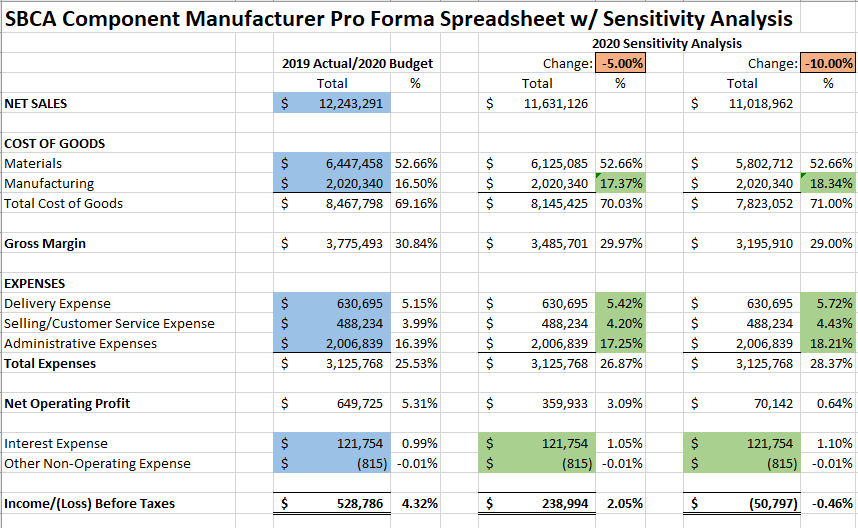

Pro forma net income formula. So put another way, the net income formula is: Pro forma statements are useful with regard to tracking future financial direction and occurrences, often including some historical numbers to help account for what the projected outcomes should look like. Calculate pro forma net income before taxes.

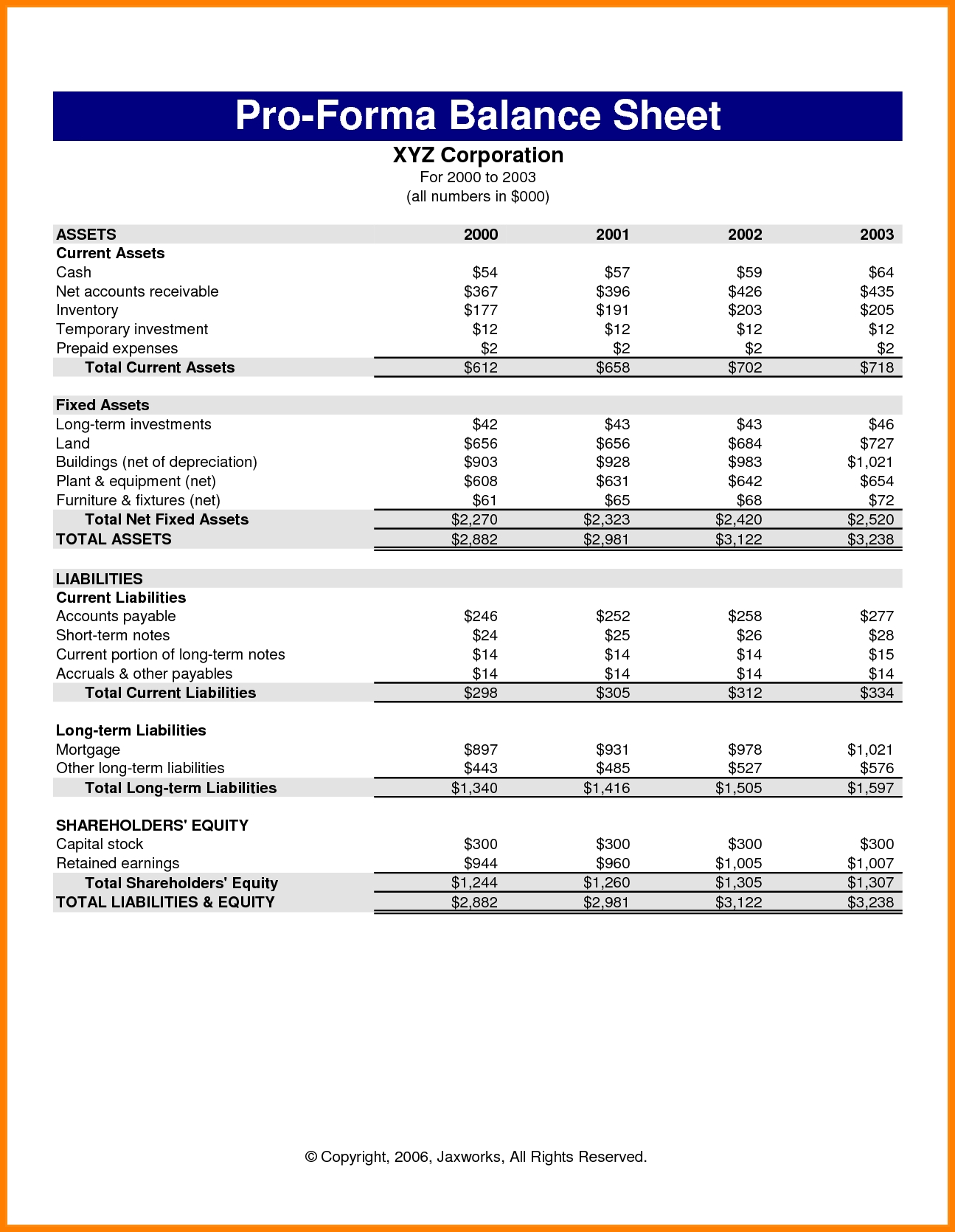

Assets = liabilities + owner’s equity assets: Here is the formula for proforma earnings per share: Calculate your pro forma profit before taxes by finding the difference between the pro forma gross profit and the pro forma total expenses.

You may be wondering, what does “pro forma” mean? A pro forma income statement shows what potential sales revenue, expenses, taxes and depreciation might look like. Assets can be categorized into many types.

Why prepare pro forma statements The pro forma income statement is a document that is a way to show your company's income if you exclude some costs. It can be of two types:

$75,675 $(87,168) $8,945 (10) (11) taxes: Or, if you really want to simplify things, you can express the net income formula as: Creating a pro forma income statement.

Pro forma eps = (acquirer’s net income + target’s net income)/(acquirer’s shares outstanding + new shares issued) = (6,000+3,000)/(3,000+700) Pro forma income statement allows startups to create a hypothetical projection of your income and expenses. Potential gross income (pgi) = monthly rent per unit × total number of units × 12 months vacancy loss = potential gross income (pgi) × vacancy rate (% of pgi) credit loss = potential gross income (pgi) × bad debt (% of pgi)

Proforma earnings per share eps formula: Let’s say you want to increase your income by $18,000 over the course of one year. Pro forma net income is the net income shown as a result of these assumptions and projections.

Basically, it is a fancy word for “future” or “projected.” sometimes, however, it is used to restate financial books in an unofficial way. Historical pro forma income statement. Pro forma is the sum of all earnings divided by all shares outstanding to get pro forma eps.

Analyze a pro forma income statement and its purpose. Market value = net operating income (noi) ÷ market capitalization rate where: In the event that the projected numbers show that profits are likely to drop, the pro forma statement allows a.

When a company plans to apply some changes in its income statements retrospectively, then the pro forma statement is prepared to adjust line items historically. Types of pro forma income statement. Key takeaways pro forma, latin for “as a matter of form” or “for the sake of form”, is a method of calculating financial results using certain projections or presumptions.