Fun Tips About Revenue In Profit And Loss Account Is The Same As Income Statement

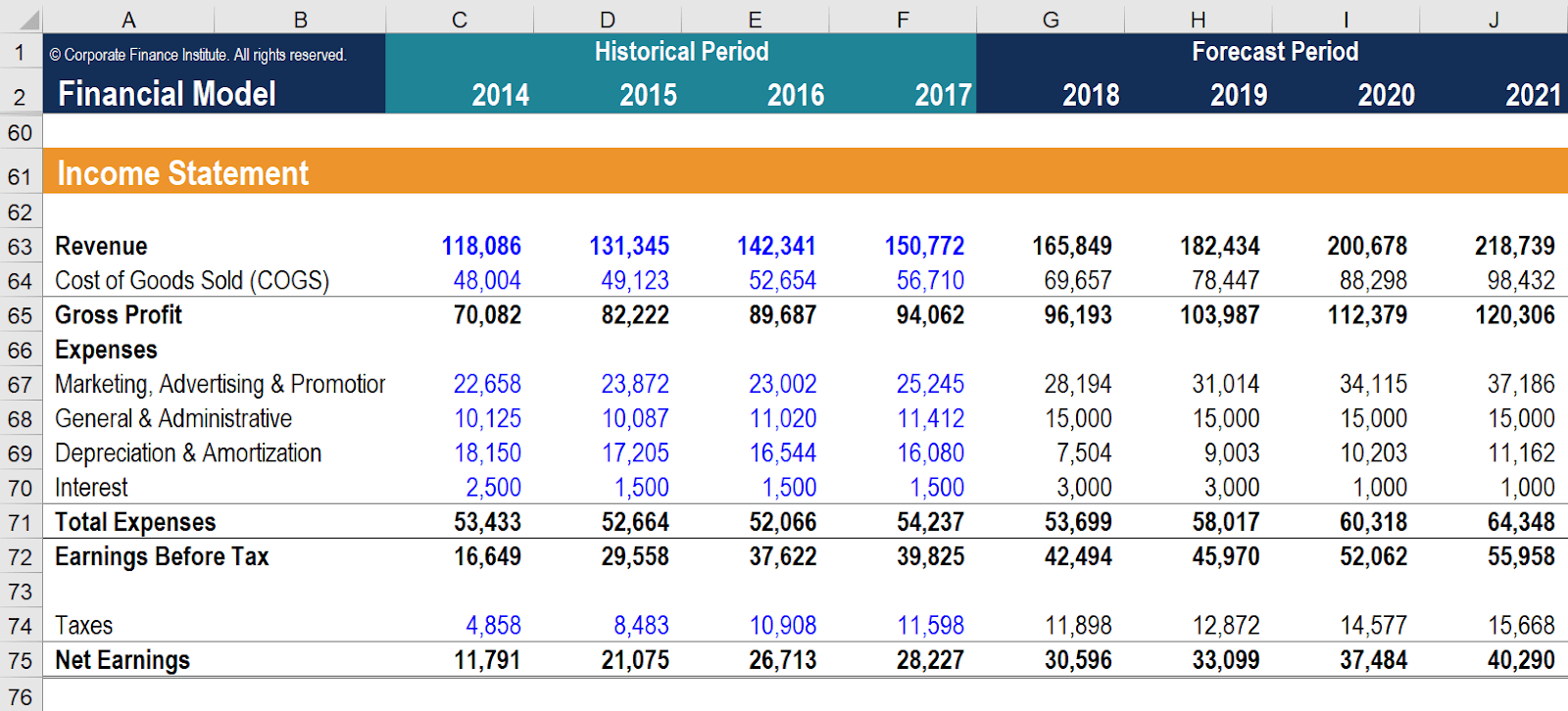

The report helps companies track their financial performance and make informed decisions about their operations.

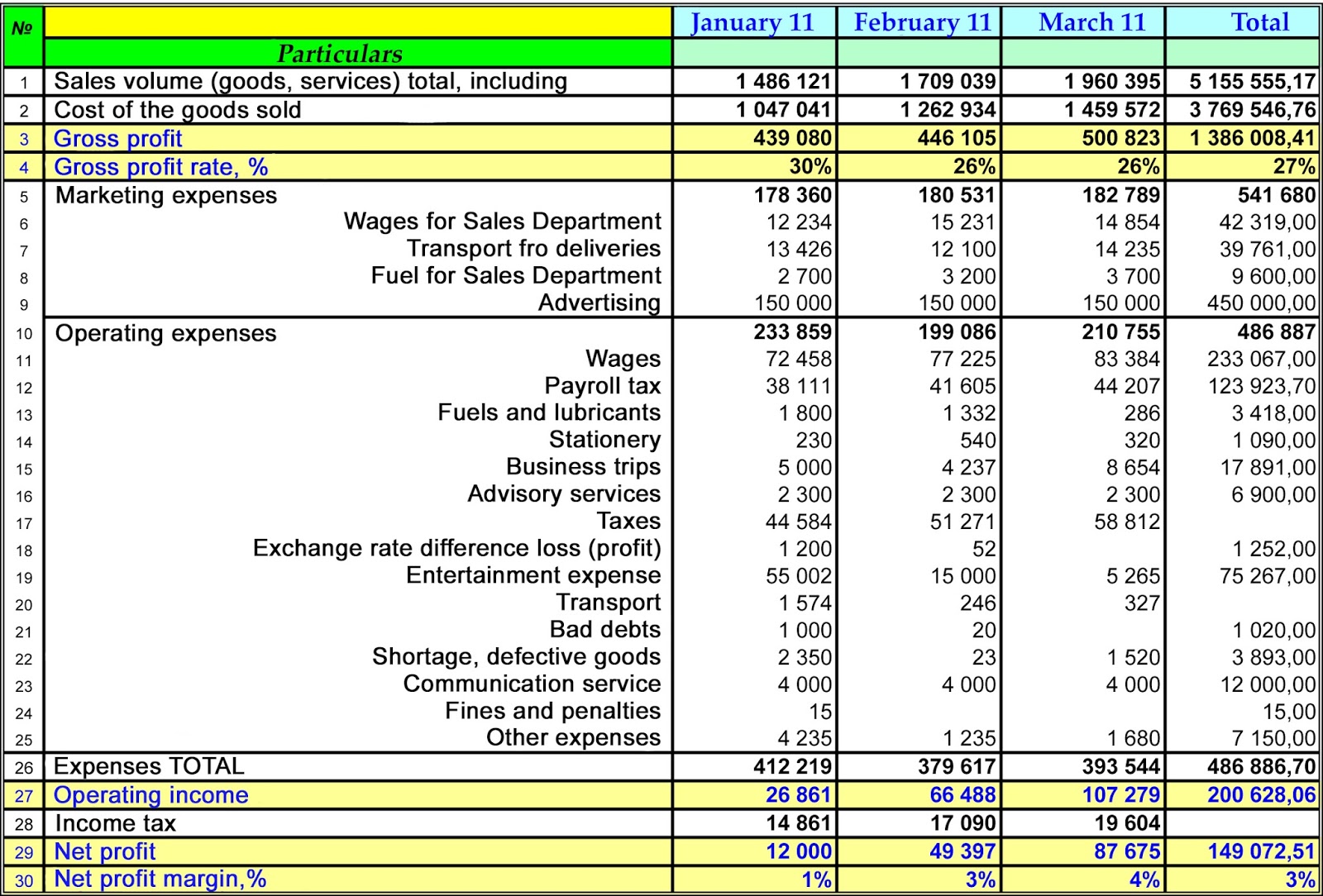

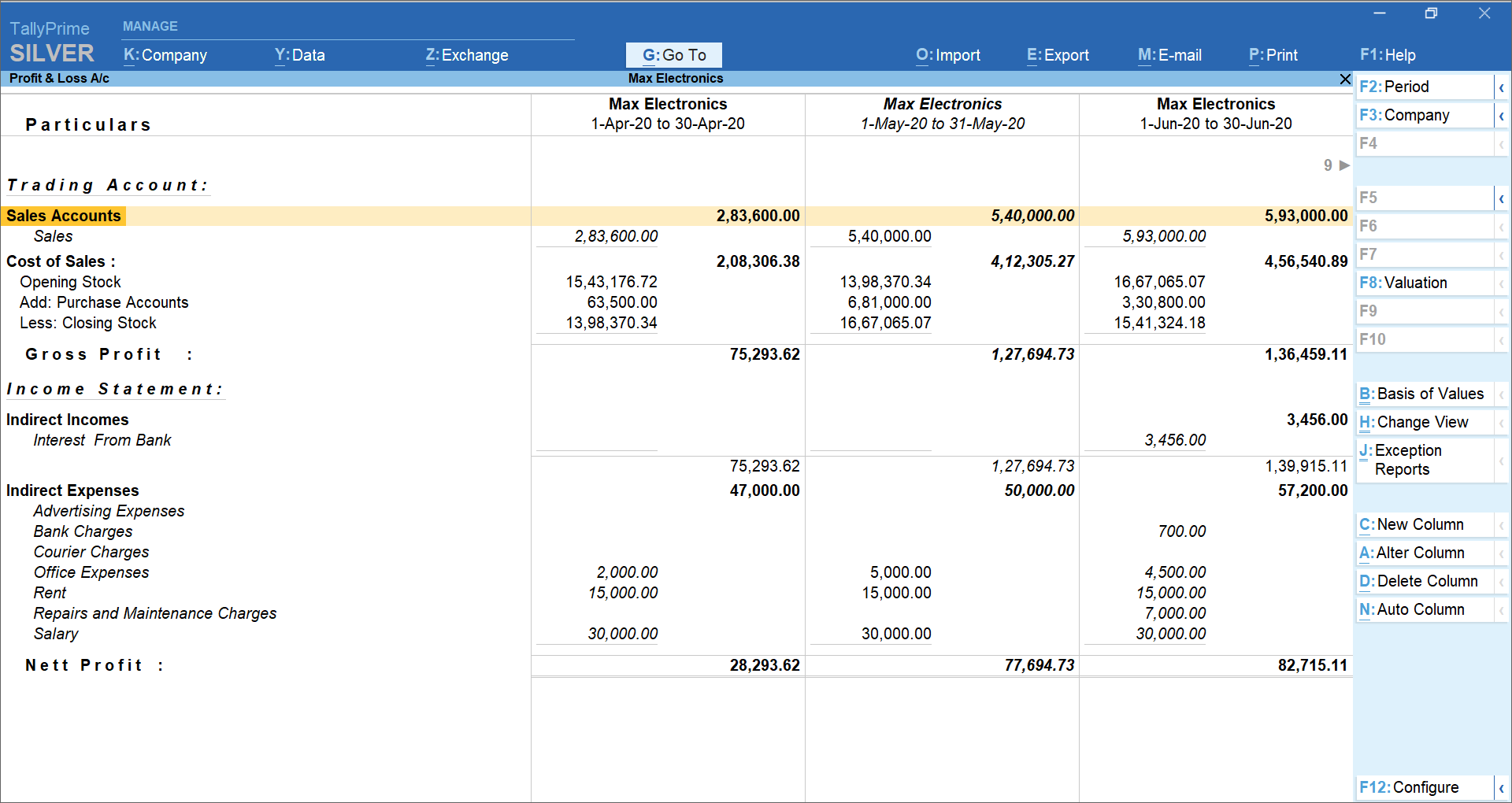

Revenue in profit and loss account. The two parts of the account are: A profit and loss (p&l) statement is a financial report that summarizes a company’s revenues, costs, and expenses over a specific period. Qtrly revenue 949.9 million rgt versus 677.7 million rgt.

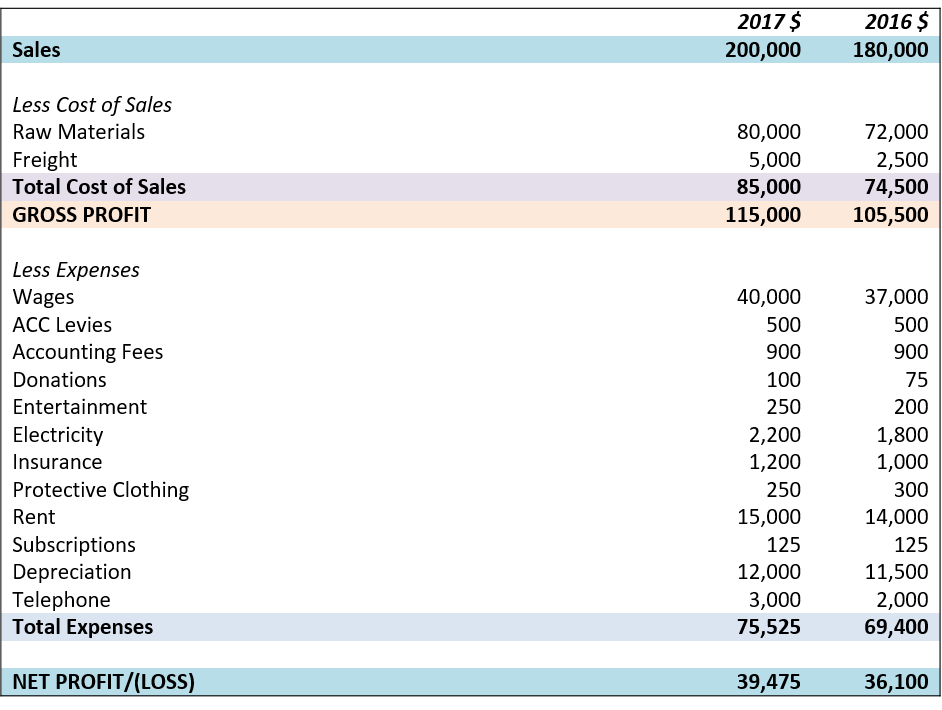

Qtrly profit attributable 42.9 million rgt versus loss 44.2 million rgt. The outcome is either your final profit or loss. A profit and loss statement is calculated by totaling all of a business’s revenue sources and subtracting from that all the business’s expenses that are related to revenue.

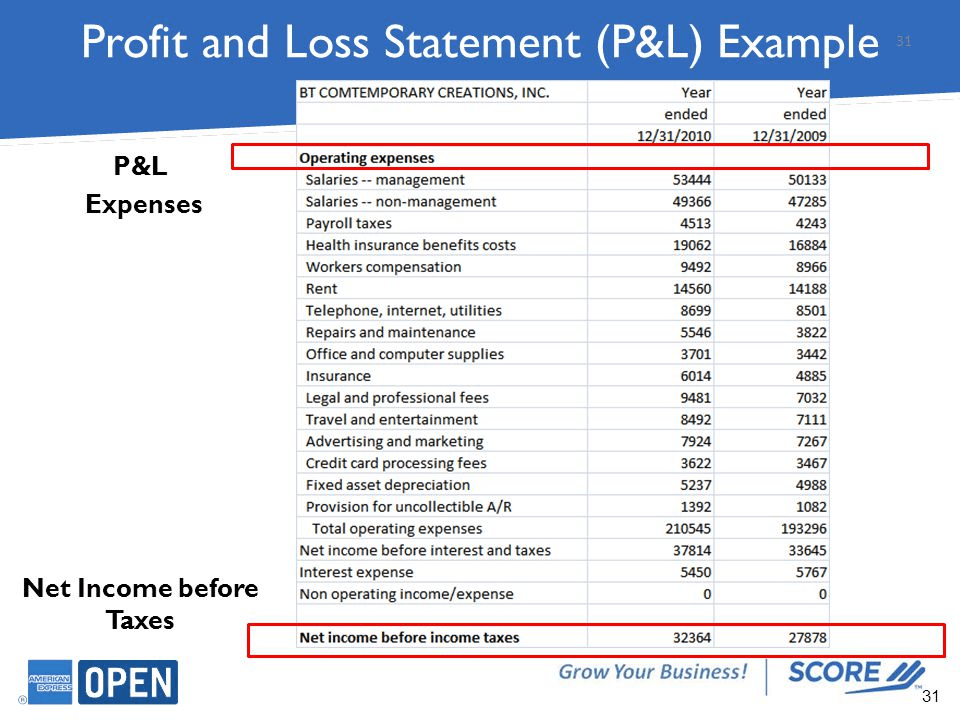

This is the money made from selling your goods. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year. Then, it subtracts the costs of making those goods or providing those services, like.

A company reports net profits when its total revenues exceed its total expenses. Eatclub, which owns and operates several popular cloud kitchen brands such as box8 and mojo pizza, has demonstrated strong recovery after the pandemic. The trading and profit and loss account are two different accounts that are formed within the general ledger.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. To provide an example, first comes the sales, or revenue. Following are some of the incomes/expenditures which are not considered while calculating revenue from operations.

The result is either your final profit (if. A profit and loss statement is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year.it captures how money flows in and out of your business. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services.

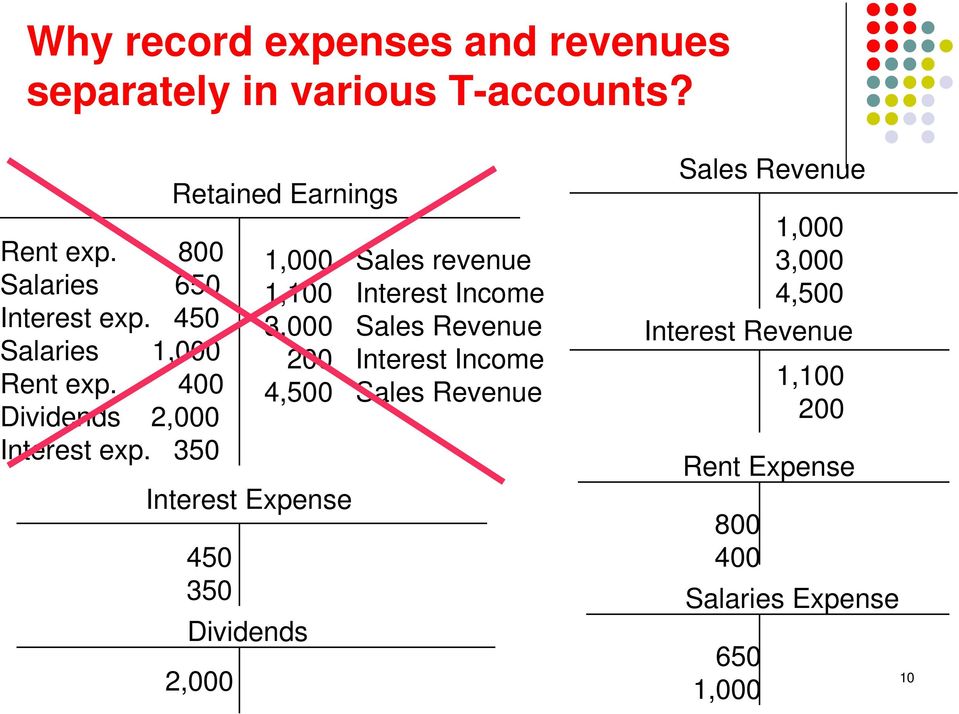

The resulting balance at the bottom of a profit and loss account (see below) represents either a net profit or net loss that will be transferred to the capital account. Understand the concept of trading account here in detail. Only the revenue or expenses related to the current year are debited or credited to profit and loss account.

What is a profit and loss statement? Air canada shares were down as much as 6.5 per cent on friday as investors digested the carrier’s latest earnings report. The profit and loss account starts with gross profit at the credit side and if there is a gross loss, it is shown on the debit side.

Understand that a profit and loss (p&l) account is a financial statement that summarises the revenues, costs, and expenses incurred during a specific period. Login or create a forever free account to read this news. It summarises the trading results of a business over a period of time (typically one year) showing both the revenue and expenses.

Rs 315 crore in fy23 from rs 107 crore in fy21. The profit & loss account reports the incomes and expenses directly related to an organisation to measure the performance in terms of profit or loss. It shows your revenue, minus expenses and losses.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)