Ideal Info About Other Comprehensive Income Examples Oasis Petroleum Balance Sheet

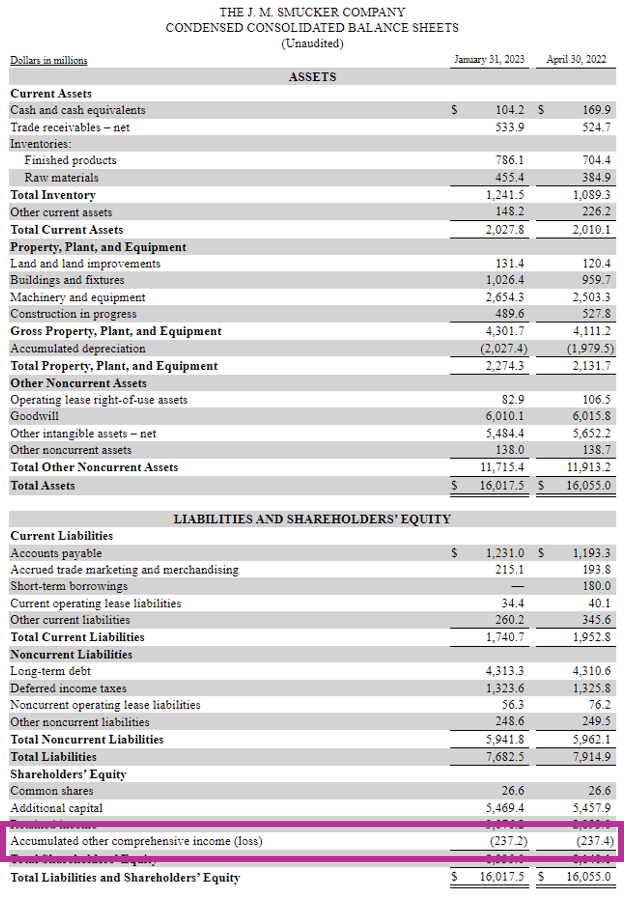

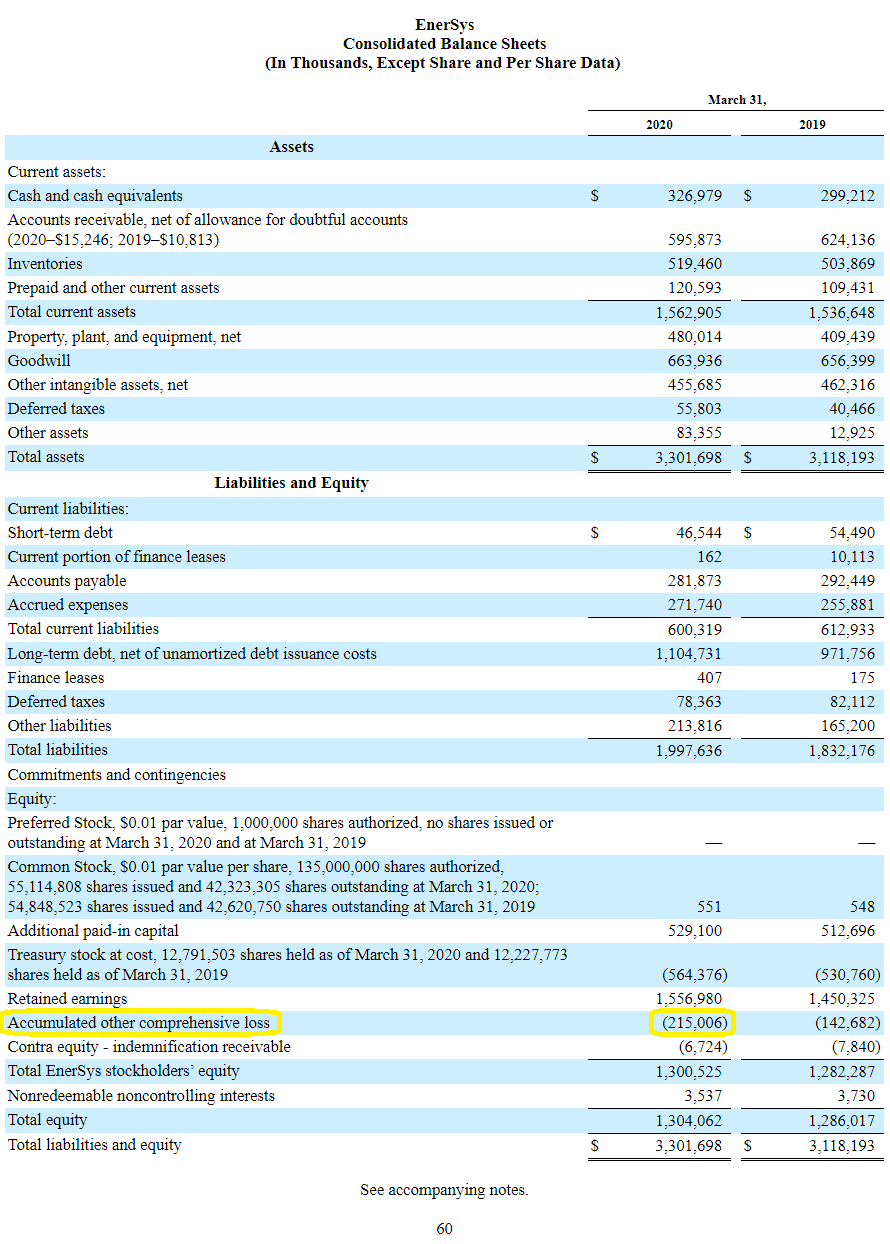

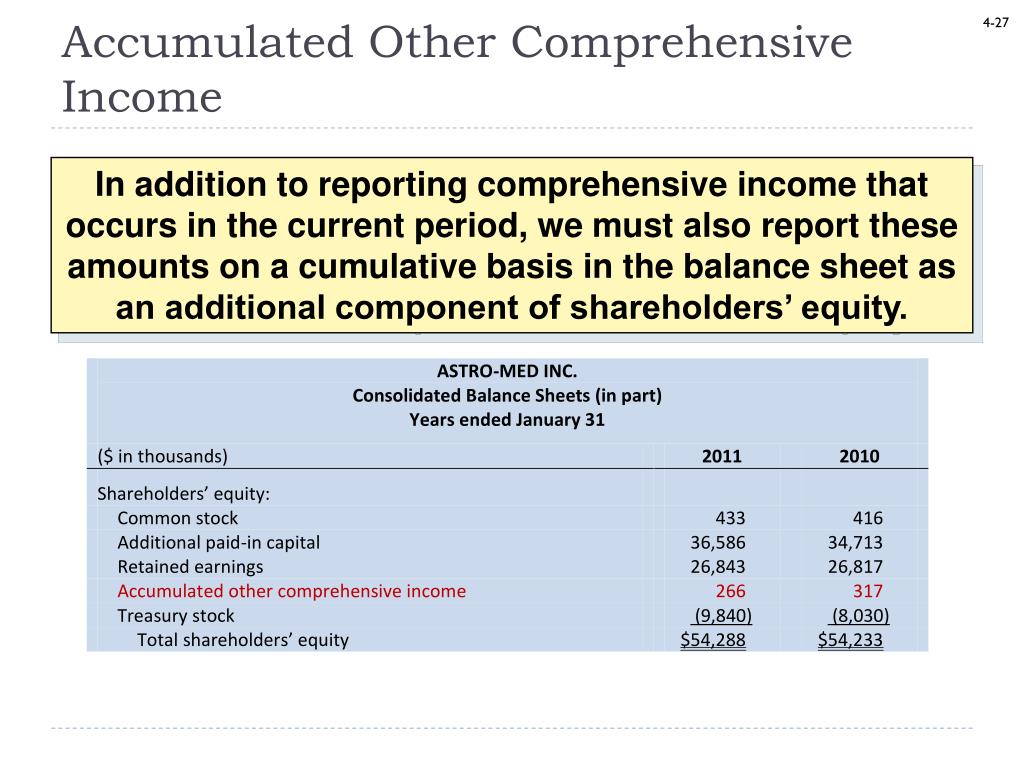

Examples of accumulated other comprehensive income.

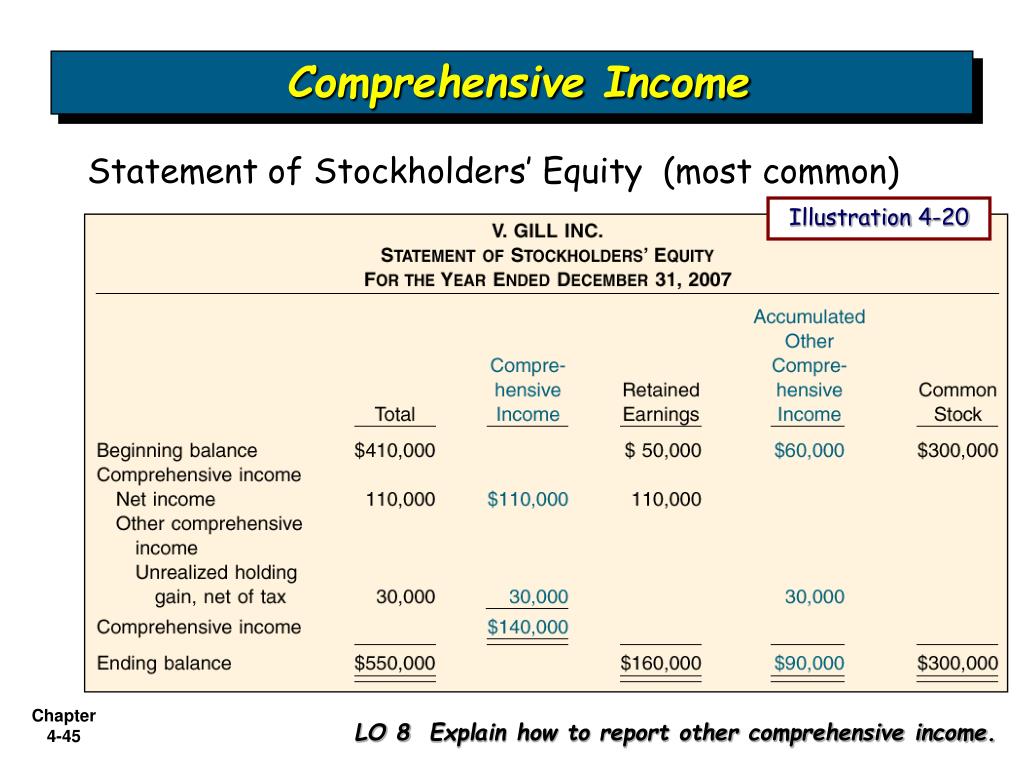

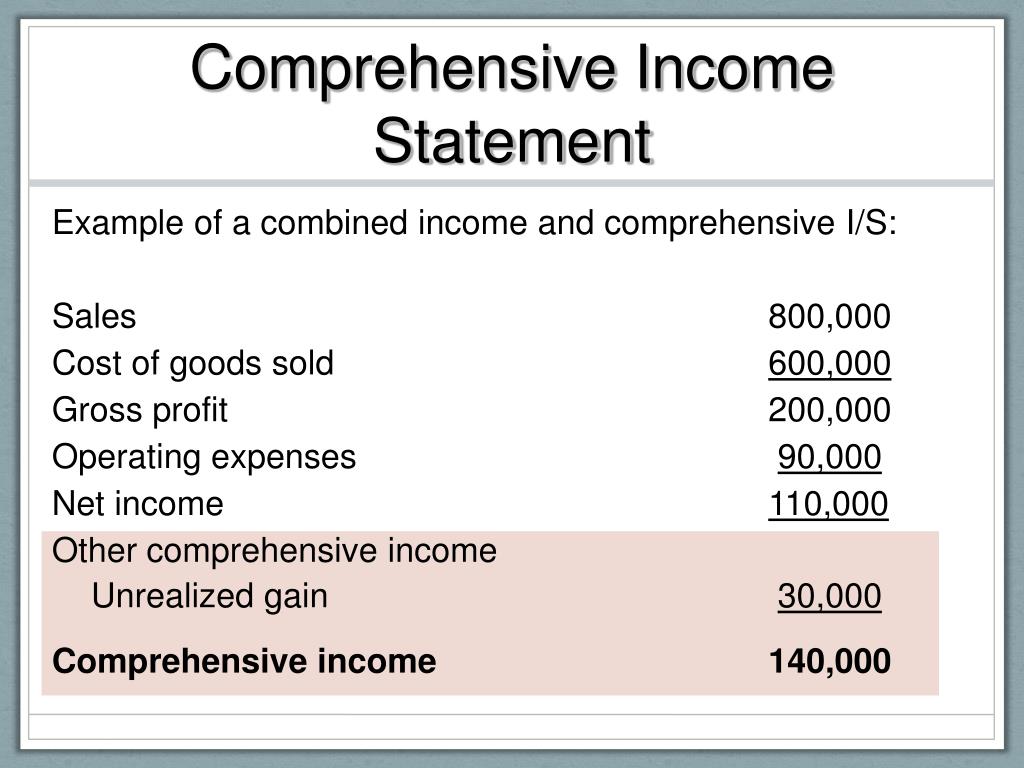

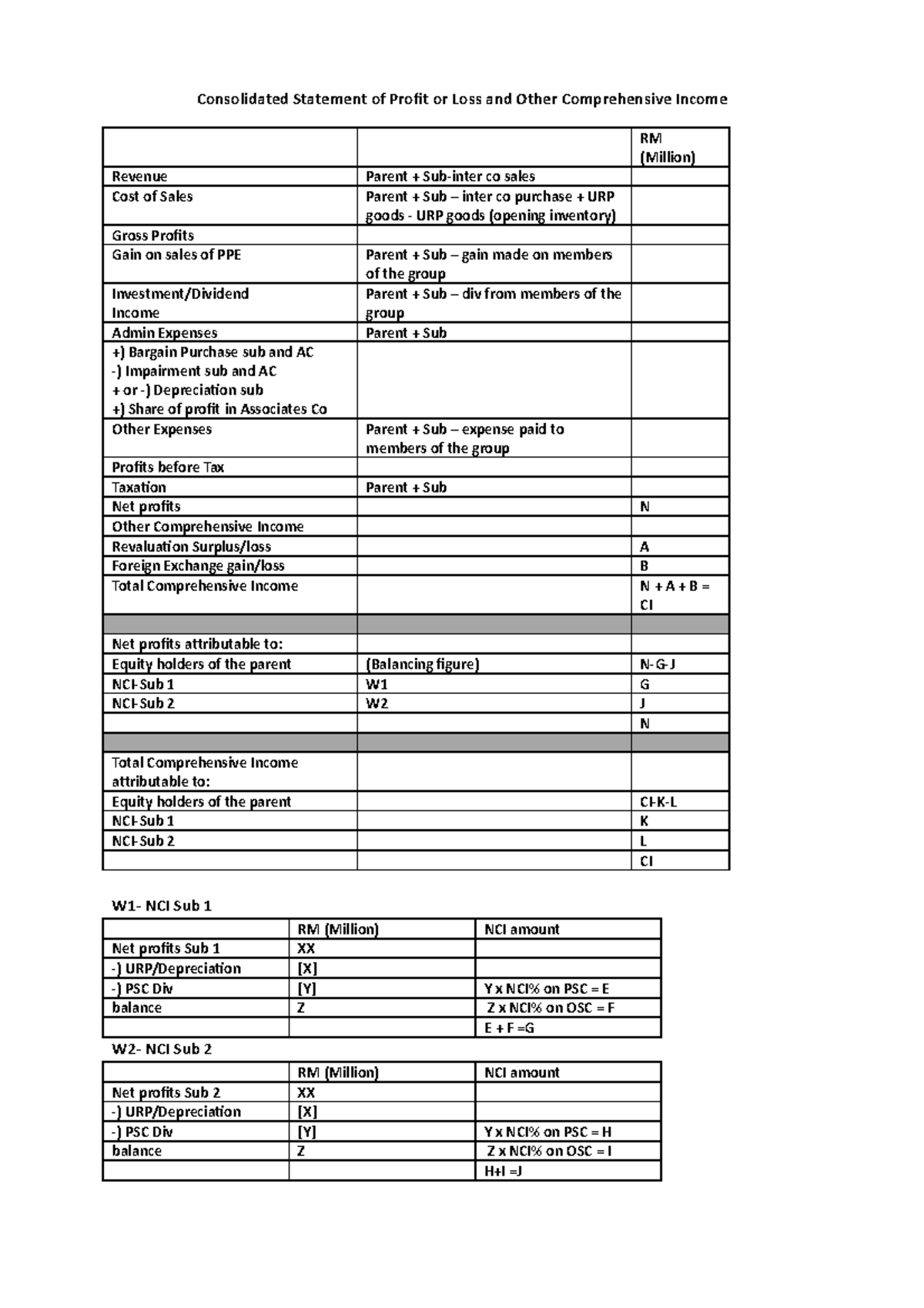

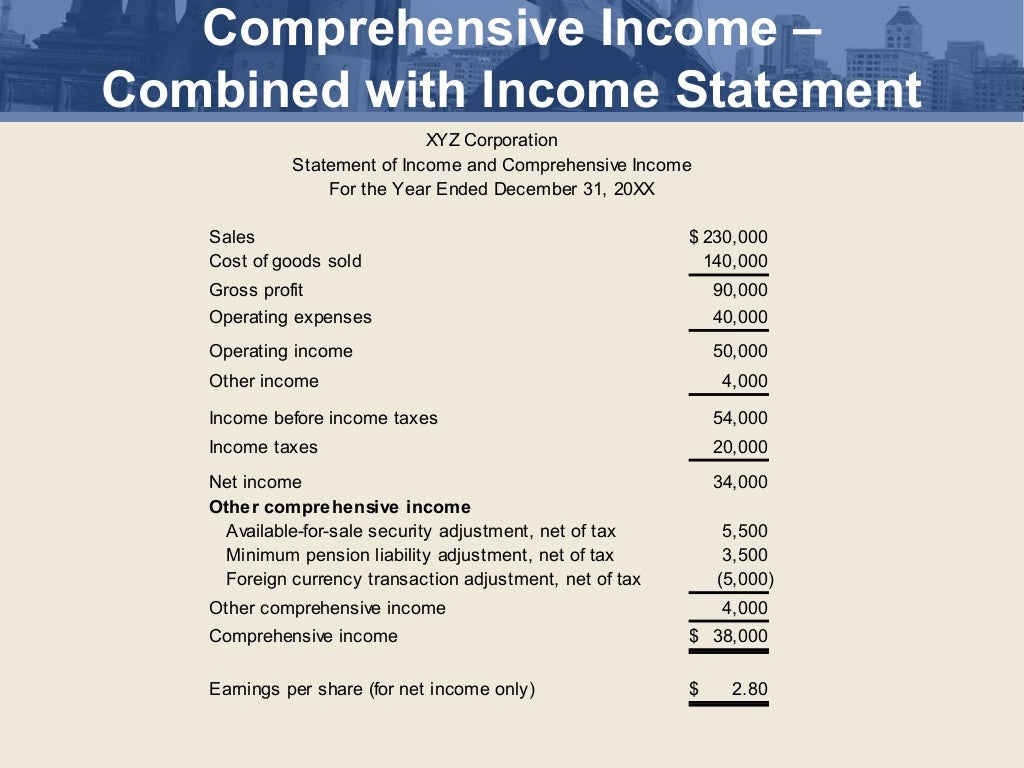

Other comprehensive income examples. What’s included in other comprehensive. Report other comprehensive income and comprehensive income in a second separate, but consecutive, financial statement. Present total other comprehensive income and.

(1) they must move beyond convenience to offer. Gains or losses from pension and other retirement programs adjustments made to foreign currency transactions gains or. Examples of other comprehensive income.

Delving into the realm of foreign currency. Examples of items that may be classified in other comprehensive income are as follows: Revenues, expenses, gains, and losses that are reported as other comprehensive income are amounts that have not been realized yet.

In april 2021, the european commission proposed the first eu regulatory framework for ai. What is included in other comprehensive income (oci)? Examples of accumulated other comprehensive income:

Below are examples of values a. Other examples of the types of changes captured by other comprehensive income include: Other examples of oci include:

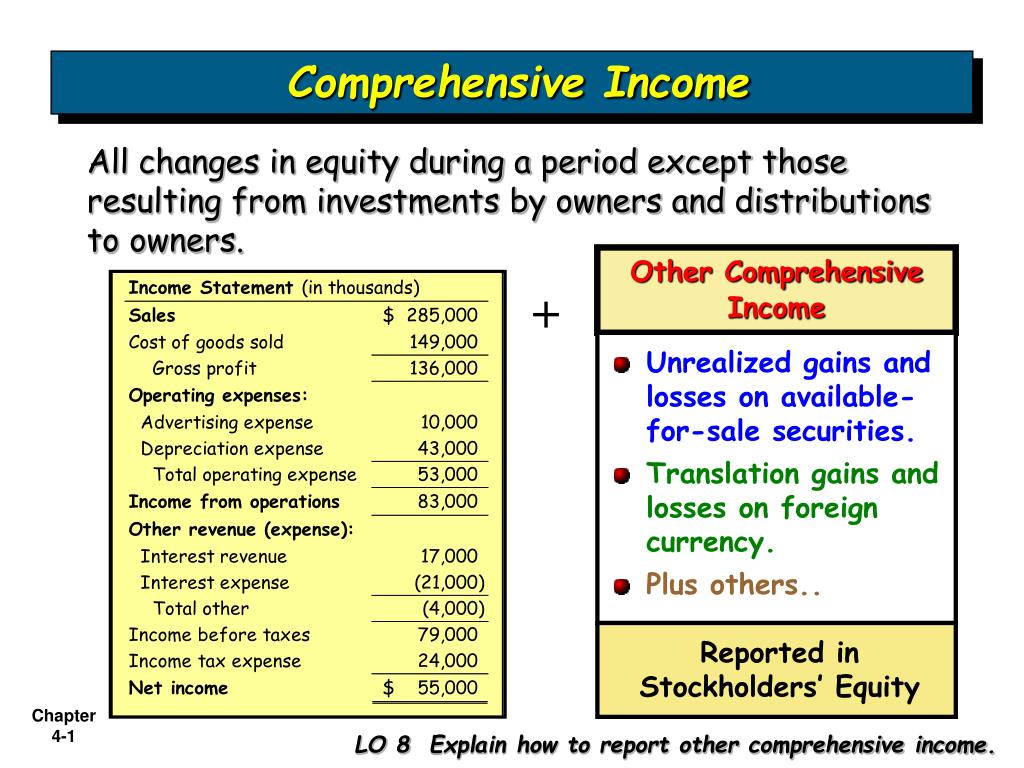

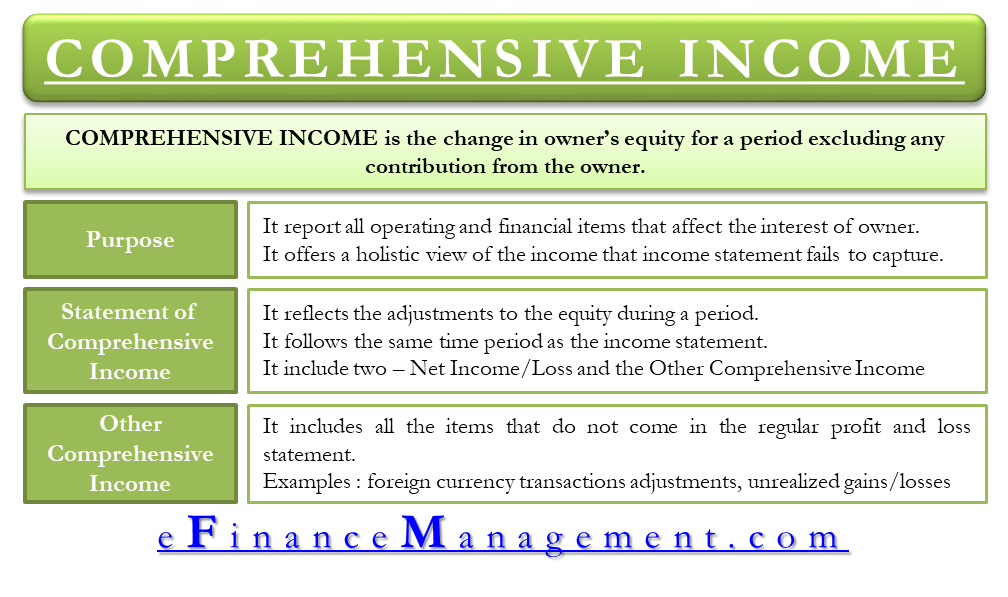

What is comprehensive income? Other comprehensive income refers to revenues, expenses, gains, and losses excluded from net income on the income statement under both generally. 1.18k subscribers subscribe 7.2k views 2 years ago advanced topics #accounting #othercomprehensiveincome #oci in this episode we dive into a complex topic other.

Someone who participates in a television show that offers prizes may earn. Let’s look at example of a few large companies to see what this looks like: Some examples of these unrealized gains or losses are:

The primary factors included in other comprehensive income are any items a company or individual excludes from its net income. This section provides examples of modeling the changes in aoci, reclassifications out of aoci and tax effects on oci in the notes to the financial statements: Examples of other comprehensive income are:

Other comprehensive income (net of taxes net of taxes the term net of taxes refers to the amount remaining after deducting taxes. Gains or losses from investments that a company classifies as available for sale. Here are some examples of comprehensive income:

Gains and losses from derivative instruments unrealized gains and. Comprehensive income statements let businesses record the earnings they get from all sources. Other comprehensive incomes include the following items: